Softbank’s (SFTBY) Masayoshi Son has been heralded as the consensus aficionado on all things artificial intelligence and a venture capitalist who has effectively bet the ranch on transformational technology.

It also sounds like a page out of the Cathy Woods ARK funds (ARKK) fiasco to be honest with you.

Leveraging a portfolio with borrowed money works well during good times, but Son is finding out that it isn’t all rosy on the downside.

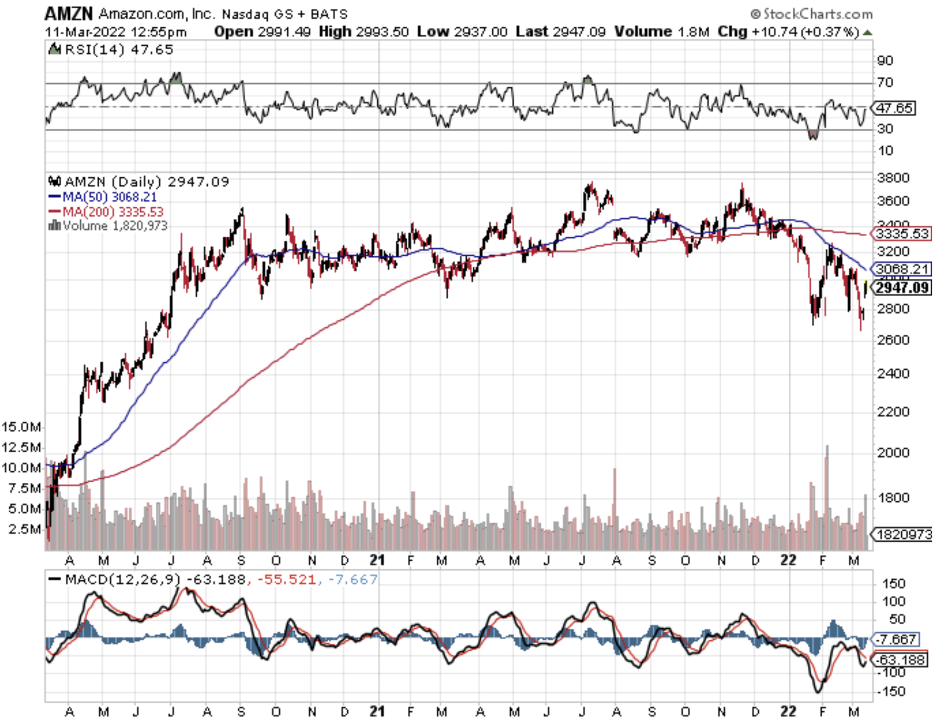

His vast fortune has crumbled along with the performance of the Nasdaq index, and it’s Son who owns many of the low-quality tech names.

His wealth has cratered, going from $25 billion last year to around $14 billion today.

Body bags are starting to pile up, such as the fiascos at German’s Wirecard AG and Greensill Capital.

Investments that go to zero aren’t the hallmark of a stock market picking genius.

Then what about Son’s China bet, Alibaba (BABA), that, has been taken back behind the woodshed and beaten to a pulp.

Then the Russia/Ukraine conflict happened, giving the flight to safety bid more life and inflation hedged assets even more time in the sun.

This has been the worse environment to invest in technology companies since the dot com bust of 2001.

Softbank’s parent stock in Japan is also down 60% and questions have arisen whether at some point soon there will be margin calls.

At the very minimum, Son is lurching towards a liquidity crisis of epic proportions.

If Son thought somebody will come in to swoop him out of his troubles, then I would love to hear the escape plan.

There just isn’t that much bright news ahead if we consider that the international conflict has brought forward a chance of recession at the same time the Fed plans to hike rates.

These 2 macro events are highly negative for tech valuations.

Son has also presided over more disasters like Chinese ride sharer DiDi (DIDI) which sold off 44% in just one day last week and South Korean ecommerce company Coupang (CPNG) whose stock has more than halved since its IPO.

The Japanese firm depends on financing to maintain its investment pace and support its share buyback program. It will need as much as $45 billion in cash this year.

The onerous funding is now a problem when the sails aren’t with Softbank’s back and he will need to cut losses just to pay off debt.

Serious red flags of Son overextending could eventually take the whole company down.

Son also has personal loans tied to company stock after pledging shares worth $5.7 billion to 18 lenders including Bank Julius Baer & Co., Mizuho Bank Ltd., and Daiwa Securities Group Inc.

More importantly, the IPO market is now morbid making it impossible for Softbank to capitalize on exciting new offerings because there are none.

I hiatus of new IPOs makes Son’s high growth strategy null and void.

There simply is no appetite now for high-growth stocks amid this poor macro backdrop.

Whispers of stagflation are cropping up all over the place and it could easily become a self-fulfilling prophecy.

Son’s image has also taken a massive hit as his poor investment decisions make him look like a novice investor.

It’s plausible to believe he won’t get that sort of leash to lock and load in the future with other people’s money.

The Saudis have already soured on a second $100 billion vision fund, and one might question why Son didn’t take profits in an Alibaba position when he could have.

Son might be so stubborn that he believes all his investments will become successful through hell or high water.

I don’t believe investors want that type of defiant attitude with their hard-earned money.

The Mad Hedge Technology Letter saw this upcoming weakness a mile away, and the fact that Son has buried his head in the sand makes us question who his trusted advisors are.

Volatile markets need more tacticians to get out of potential catastrophes.

The sad takeaway is that while Masayoshi Son might believe he is always the smartest guy in the room, he is just surrounded by "yes men" who provide a unique echo chamber that helps him execute disastrous investment decisions.

Low-quality tech is being penalized by the bucket load and Son is the poster child for owning overhyped tech that sometimes isn’t even tech--like the office sharing company, WeWork.

Avoid Son’s investment monologues because the proof is in the pudding at the point; and when it comes down to it, he doesn’t know more than the next guy.