Mad Hedge Technology Letter

January 10, 2025

Fiat Lux

Featured Trade:

(NVIDIA GETS PUT IN PLACE)

(NVDA)

Mad Hedge Technology Letter

January 10, 2025

Fiat Lux

Featured Trade:

(NVIDIA GETS PUT IN PLACE)

(NVDA)

It is uncommon when private tech companies lash out at the government like they are some kind of whipping boy.

Silicon Valley is so successful - they don’t need to target government policy.

Anger comes in many forms but openly criticizing the government could get you in some hot water in places like China.

Just look at Alibaba founder Jack Ma who was taken out to pasture by the Chinese communist party.

Criticism is usually reserved in Silicon Valley because subsidies and relationships are preserved to fight another day.

Nvidia finally felt it was time to let loose on the disastrous Biden Administration as the chip company gets dragged into politics just like almost everything else in American society.

Nvidia viciously criticized new chip export restrictions that are expected to be announced soon, saying the White House was trying to undercut the incoming Trump administration by imposing last-minute rules.

It’s is arguable that many strategic moves the current administration executes are to stymy the next administration.

Private tech companies are just collateral damage and Nvidia is finding that out the hard way.

The looming changes would cap the sale of US artificial intelligence chips on both a country and company basis — a move that would more tightly limit exports to most of the world.

The extreme ‘country cap’ policy will affect mainstream computers in countries around the world, doing nothing to promote national security but rather pushing the world to alternative technologies.

Nvidia has been the biggest beneficiary of a surge in AI spending over the past two years, helping turn the once-niche company into the world’s most valuable chipmaker. Its shares nearly tripled last year, following a 239% gain in 2023.

Speaking at the CES conference in Las Vegas this week, Huang said he expected Trump to bring less regulation.

I can now say with more certainty that tech stocks appear to be in a bubble and it doesn’t help that an obstructionist government is putting in limits to how much they can sell abroad.

Globalization has accelerated to some extreme that many people and businesses are still having a tough time wrapping their minds around what happened.

Putting a cap on the number of AI chips Nvidia can export will just gift the advantage to another competitor.

The Chinese have never played by the rules with their state subsidies and stealing of intellectual property.

These are several hallmarks of their national heavyweights.

Hamstringing Nvidia is the worst thing the US government could do minus shutting them down completely.

In general, the amount of bureaucratic nonsense, dysfunction, red tape, and needless saber-rattling is starting to hit the bottom line of Silicon Valley.

This could all bring forward a selloff from this tech bubble we are currently in.

Granted, I will acknowledge that the federal government isn’t only targeting the tech sector and the inefficiencies run across a wide swath of the U.S. economy system.

But that doesn’t make it better.

We are priced to the point where AI is guaranteed to become our savior and I would say to hold on because we are nowhere near certainty and there are very few use cases of all this AI data center investment.

We are trading at highs and the government going after Silicon Valley will hasten a sharp selloff in expensive tech stocks.

Don’t play with fire or you’ll be burned.

Mad Hedge Technology Letter

January 8, 2025

Fiat Lux

Featured Trade:

(BUY THE MICROSOFT DIP)

(MSFT)

How will Microsoft grow their stock in 2025?

In short, MSFT are building what the market wants, and what the market wants are AI data centers.

The stock price should be rewarded if they can deliver these new AI data centers to the market.

The data center increase shows no signs of slowing down and I do believe this puts a floor under tech stocks.

To be honest, there has been a lot of bad energy surrounding the current tech business models because many of them are getting stale.

Why upgrade to the next iPhone when there isn’t much of an upgrade?

The refresh cycle data shows people are standing pat and using their own tech longer and that is bad news for tech software and hardware companies.

So instead of trying to squeeze the remaining juice out of a stale model, beefy balance sheet tech companies are driving full force into AI investment even though this investment doesn’t reciprocate with any sort of revenue stream.

It’s a little bit of a build it and it will come mentality which I do believe is quite risky and at some point, we are due for a heavy selloff.

That selloff could get triggered if the US 10-year interest rate blows past 5.5%, then all bets are off.

Microsoft says it plans to spend $80 billion on building AI data centers this year.

Microsoft has poured billions of dollars over the last two years into Anthropic, as well as Elon Musk’s startup xAI.

Advances by these firms would not have been possible without new partnerships founded on large-scale infrastructure investments that serve as the essential foundation of AI innovation and use.

The $80 billion would reflect a significant increase on the $53 billion capex spend Microsoft made in 2023.

Documents leaked last April revealed it had more than 5GW of capacity at its disposal, with plans to add an additional 1.5GW in the first half of 2025. It is possible this has since been revised upwards as it looks to provide compute power to OpenAI to run ChatGPT and its other AI services, as well as supporting its own Azure public cloud platform.

Part of this is definitely the management at OpenAI namely CEO Sam Altman. He is seen as the avant-garde of AI and the leader of the whole movement. He is demanding a massive build out and investors have largely taken him at this word. Nobody has really questioned him and that stems partly from no one really knows where this AI thing is headed in the future, but we are convinced that buckets of data space are needed for whatever comes next.

My issue is what if the thing that comes next is a cataclysmic letdown, then where do tech stocks head?

Most likely they would head for the gutter.

So we give the benefit of the doubt to this gargantuan AI infrastructure build-out and it feels like we are flying blind in a snowstorm, but that is what the market is telling us and the market is always right until it is not.

Sometimes tech does figure it out, and we are really hoping there is something of great value at the end of the build-out.

Buy the dip in MSFT until the AI infrastructure story is killed off.

Mad Hedge Technology Letter

January 6, 2025

Fiat Lux

Featured Trade:

(DIGITAL SPORTS CONTENT RISES TO THE TOP)

(FUBO), (DIS)

It isn’t a shocker that the first deal to go through in 2025 is in digital sports streaming.

This sub-sector is scorching hot.

It was only just a few days ago when Netflix rolled out its debut in streaming NFL during Christmas when they broadcasted 2 games.

Live American football – not the European variant - is the holy grail of digital content and the beefiest of marketers with the deepest of pockets will cough up to place their ads in these commercial slots.

Disney (DIS) will combine its Hulu + Live TV business with sports streamer FuboTV (FUBO) in the first major media dealmaking move of 2025.

Disney will control 70% of Fubo. Shareholders of the sports streamer will own the remaining 30% of the combined business, which will operate under the Fubo publicly traded company name.

Disney is struggling in many parts of their business, for example, is underperforming in their theme parks.

Their movies also suck.

Pro football is the last bastion of premium content and even the woke employees at Disney understand that.

Disney stock has essentially halved since 2021 with shareholders furious about their lack of strategic vision.

The acquisition of Fubo gives Disney a chance to restart in a sub-sector that has a glowing future.

Cord cutters are exploding and since last year’s Presidential election, the trust in legacy media has never been at such a low ebb, and rightly so with the poor level of content quality.

The combination of the two businesses will form one of the largest digital pay-TV providers as consumers search for cable alternatives amid increased cord-cutting.

Fubo, which offers users access to live TV channels over the internet, has primarily focused on sports.

Hulu + Live TV, categorized as a cable replacement option — similar to YouTube TV — allows users to stream from about 100 live TV channels across sports, news, and entertainment.

As a much smaller player, Fubo struggled with high content costs and the ability to curb subscriber churn and adequately compete in the marketplace — hence the lawsuit's inception.

The three companies first announced the joint venture last year, with an expected price point of $42.99 a month. The service will bring together their respective slates of sports rights and comes as media companies face pressure from investors to scale their streaming services and achieve profitability.

I’m not saying that digital streaming of pro sports is easy.

We aren’t in the early innings.

Content costs are astronomically high and subscriber churn can be a problem in the offseason.

The nightmare could end up like the NBA.

Look at sports like pro basketball (NBA, viewership is down 50% this season as subscribers flee the sinking ship.

The basketball commissioner created a model where most teams make the playoffs meaning the 82 game schedule has been deemed irrelevant causing their best stars to sit out games.

It’s just one example of the management of pro sports going down the drain and pro football isn’t immune to bad management too.

As it stands, I highly support Disney’s foray into Fubo and Fubo would be a great stock to pick up and hold at $4.80.

The stock is up from $1.44 this morning.

Live pro sports still fetches a premium and I don’t believe that will change any time soon.

Jump into tech stocks that have big investments planned in American football.

Much of the big growth opportunities have been saturated and I do believe the tech market will become more of a zig-zag trading market in 2025.

Mad Hedge Technology Letter

January 3, 2025

Fiat Lux

Featured Trade:

(THE EYEWEAR PIVOT NOBODY SAW COMING)

(META), (ESSILORLUXOTTICA)

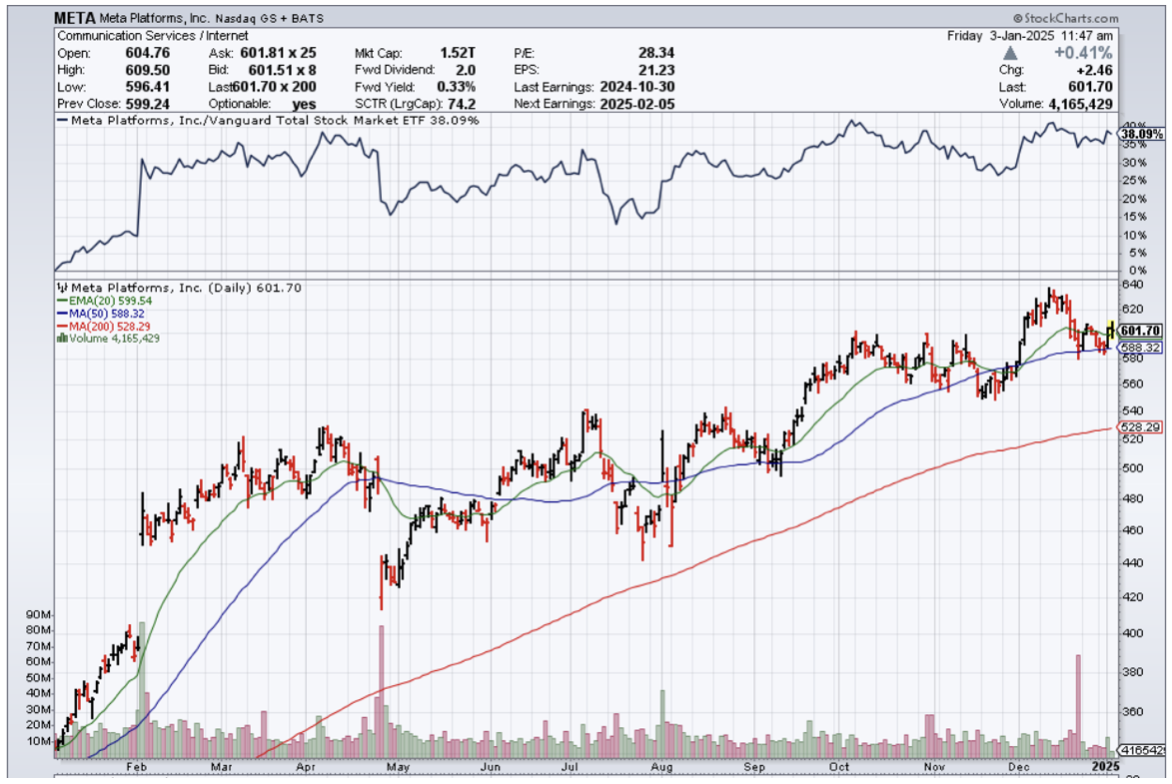

Meta (META) migration into the eyewear business is a little bit of a head-scratcher until peeling back the layers and really understanding what is going on.

EssilorLuxottica’s agreement to prolong its long-term collaboration with Meta Platforms for the development of smart eyewear over the upcoming 10 years is a massive victory for Meta CEO Mark Zuckerberg.

This milestone offers meaningful insight into the direction of where the business model is heading.

Many have expected that Meta would start to branch out into other venues once their core businesses start to stagnate.

The digital ad game and social media platforms only go so far in terms of growth these days, and shareholders are waiting for the next big thing.

Short-term prospects are what drives the stock movement, and Meta is looking for that pixie dust.

EssilorLuxottica is the largest maker of eyewear in the world and the owner of many eyewear brands and retailers, including Ray-Ban, LensCrafters, and Pearle Vision in the U.S.

EssilorLuxottica also acquired Heidelberg Engineering, a maker of imaging and healthcare machinery and technology, largely for the ophthalmic and eyecare markets worldwide.

Prescription glasses are not cheap, ranging into the thousands of dollars for designer frames and lenses.

If Meta can figure out how to do this all online without going to the optician, imagine the juicy margins they could extract from this sort of venture.

Meta and EssilorLuxottica have a relationship for the production of the Ray-Ban smart glasses. The glasses’ latest version gives consumer’s video, camera, and Bluetooth headset capability in a stylish eyewear frame with a cool brand on it.

Heidelberg Engineering makes complex, sophisticated, expensive equipment that you may be exposed to if you’re examined in an ophthalmologist’s office. Buying Heidelberg makes EssilorLuxottica more entrenched in the industry where it is the established leader.

The tie-up with EssilorLuxottica is the perfect onboarding situation to understand how to perfect the optimal glasses and lenses and then transfer it into an online experience.

Remember, even if this investment is for VR purposes, the application revolves around virtual eyewear as well.

Meta now understands they need to secure a monopoly on eyewear, and it is a conscious decision to make that a launching point for more of their products.

In the future, Meta wants consumers to access Instagram, Whatsapp, and Facebook through EssilorLuxottica eyewear products.

Meta also hopes to secure the first mover advantage while other big tech firms lack the deep knowledge of eyewear. There have already been numerous failed attempts at smart glasses, and so Meta founder Mark Zuckerberg is doubling down with a relationship with Europe’s most deeply entrenched premium eyewear firm.

Although the boost to the bottom and top line won’t happen quickly with a possible relationship with EssilorLuxottica, this could anoint Meta as the gatekeeper to the new virtual world through this new eyewear tech.

It’s becoming clear that Meta is running up to certain upper limits in regards to the growth of their 3 platforms, and they are looking for another super booster to prop up profits.

I don’t believe that Meta will be allowed to acquire this eyewear company because of anti-competitive laws, but adopting its best product practices and hiring their best talent seems a lot more on brand from Meta.

Meta has never been shy at poaching outside talent and rewarding them handsomely.

On the flip side, EssilorLuxottica would be smart to adopt some tech now by hiring the right people and trying to digitize the experience further otherwise, Meta will get what they are coming for.

Meta pushing the envelope is one of the big reasons why they have stayed ahead of other big tech companies and why the stock has done so well the past few years.

Meta stock is a great short-term and long-term proposition for patient and impatient investors.

Mad Hedge Technology Letter

December 30, 2024

Fiat Lux

Featured Trade:

(THE UNBEATABLE PARTNERSHIP)

(EMR), (GRMN), (AMBA), (NVDA), (DXCM), (CSCO), (INTC), (QCOM)

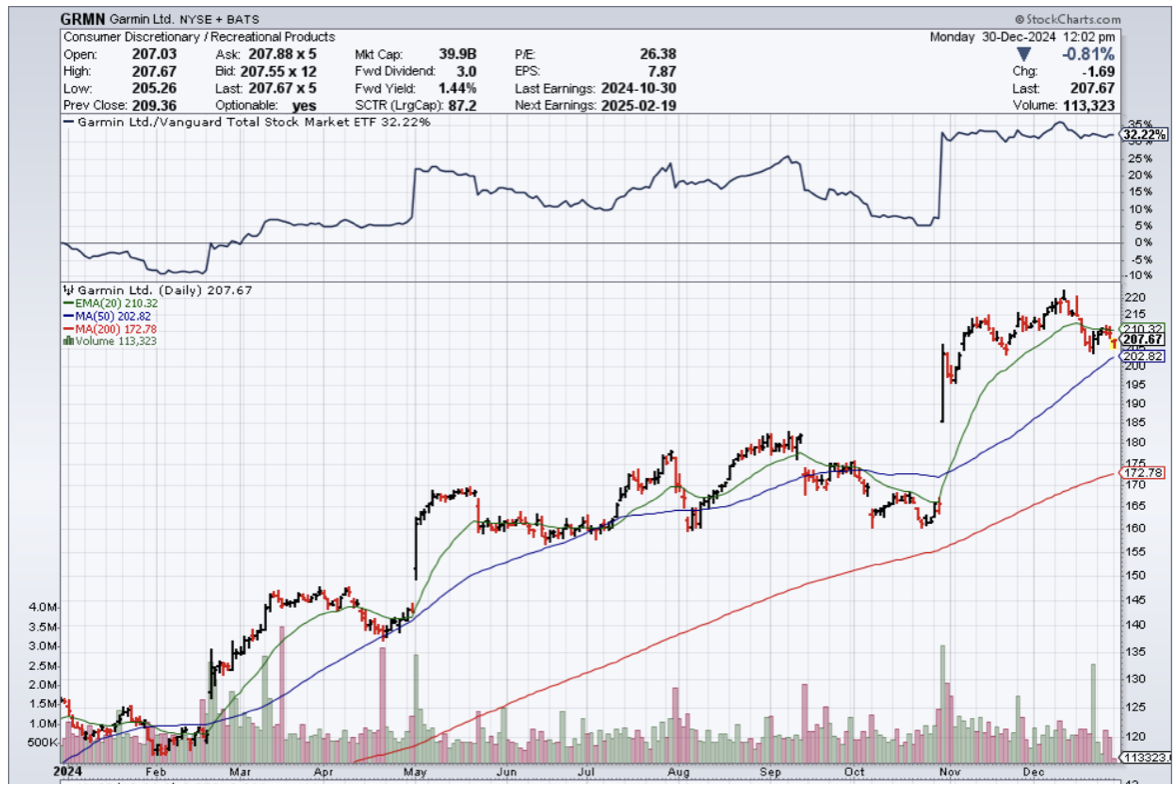

Let me introduce to you one of the hottest trends in tech.

It has been on the tip of everyone's tongue for years, and that might be an understatement, but the interaction of the Internet of Things (IoT) and artificial intelligence (AI) offers companies a wide range of advantages.

In order to get the most out of IoT systems and to be able to interpret data, the symbiosis with AI is almost a must.

If the Internet of Things is merged with data analysis based on artificial intelligence, this is referred to as AIoT.

Moving forward, expect this to be the hot new phrase in an industry backdrop where investors love these hot catchphrases and monikers.

What is this used for?

Lower operating costs, shorter response times through automated processes, and helpful insights for business development are just a few of the notable advantages of the Internet of Things.

AI also offers a variety of business benefits: it reduces errors, automates tasks, and supports relevant business decisions. Machine learning as a sub-area of AI also ensures that models – such as neural networks – are adapted to data. Based on the models, predictions and decisions can be made. For example, if sensors deliver new data, they can be integrated into the existing modules.

The Statista Research Institute assumes that there will be 200 billion networked devices by 2026.

This is exactly where AI comes into play, which generates predictions based on the sensor values received.

However, many companies are still unable to properly benefit from the potential of connecting IoT and AI, or AIoT for short.

They are often skeptical about outsourcing their data - especially in terms of security and communication.

In part because the increased number of networked devices, which requires the connection of IoT and AI, increases the security requirements for infrastructure and communication structure enormously.

It is not surprising that companies are unsettled: Industrial infrastructures have grown historically due to constantly increasing requirements and present companies with completely new challenges, which manifest themselves, for example, in an increasing number of networked devices. With the combination of IoT and AI, many companies are venturing into relatively new territory.

By connecting IoT and AI, a continuous cycle of data collection and analysis is developing.

But, companies can no longer deny the advantages of AIoT because this technical combination makes networked devices and objects even more useful.

Based on the insights generated by the models, those responsible can make decisions more easily and reliably predict future events. In this way, a continuous cycle of data collection and analysis develops. With predictive maintenance, for example, production companies can forecast device failures and thus prevent them.

The combination of the two technologies also makes sense from the safety point of view: continuous monitoring and pattern recognition help to identify failure probabilities and possible malfunctions at an early stage – potential gateways can thus be better identified and closed in good time.

The result: companies optimize their processes, avoid costly machine failures, and at the same time reduce maintenance costs and thus increase their operational efficiency.

In this way, IoT and AI represent a profitable fusion: While AI increases the benefit of existing IoT solutions, AI needs IoT data in order to be able to draw any conclusions at all.

AIoT is, therefore, a real gain for companies of all sizes. They thus optimize processes, are less prone to errors, improve their products, and thus ensure their competitiveness in the long term.

Some hardware, software, and semiconductor stocks that will offer exposure into AIoT are Emerson Electric Co. (EMR), Garmin (GRMN), Ambarella (AMBA), Nvidia (NVDA), DexCom (DXCM), Cisco (CSCO), Intel (INTC), and Qualcomm (QCOM).

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.