Neuralink Corporation is an American neurotechnology company developing implantable brain-machine interfaces.

You would think this is straight out of science fiction, but mark my word that in our lifetime, we could all be operating digital devices from our heads if Musk gets his way.

And he often does get his way.

Scary as it seems now, this will probably be the first of many artificial intelligence procedures to infuse humans with layers of artificial intelligence.

Musk believes humans will go the way of robot hybrid in the future because the natural development of competition is trending in that way and sadly, this direction in humanity is ultimately existential for every one of us.

Improvements in technology will periodically be announced and iterations will need to be adopted because software is upgraded.

As for today and now, testing on pigs has segued into testing on monkeys.

Musk has told us the monkey testing has gone “well.”

Pending FDA approval, Musk hopes to start testing humans with severe spinal-cord injuries like tetraplegics, quadriplegics in 2022 which would represent a monumental step in this technology.

Earlier this year, a 20-person biotech firm called Synchron secured approval from the FDA to start human testing, so the stakes are high and imminent.

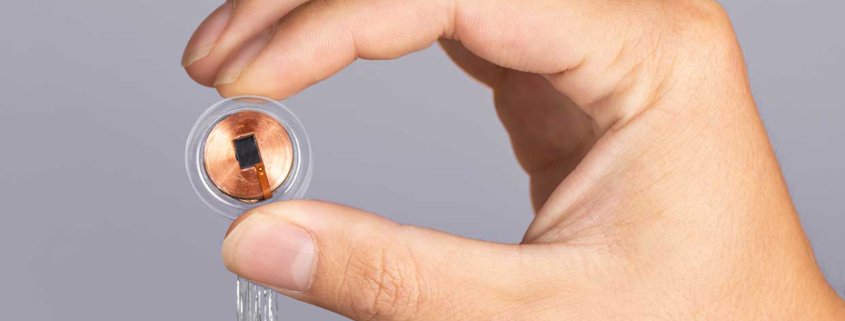

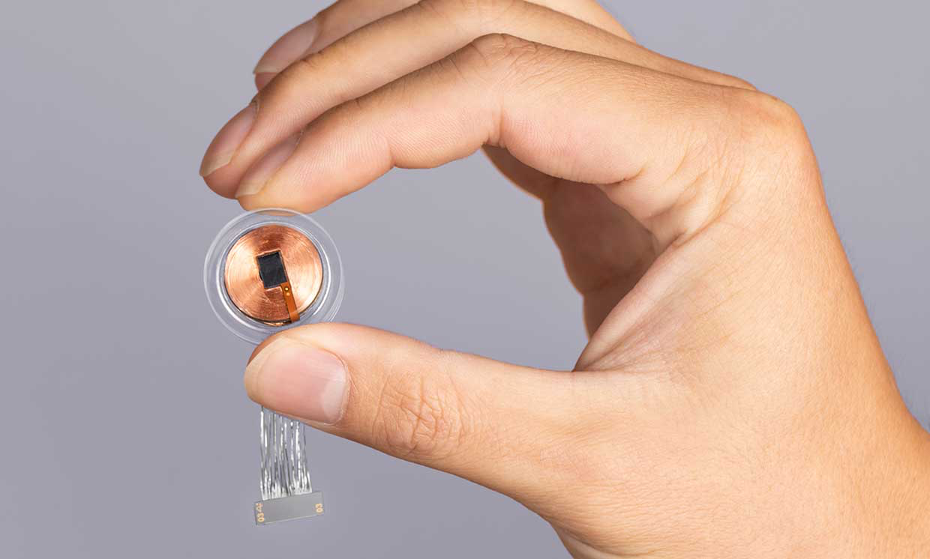

Neuralink’s dramatically simplified design for an implant that hopes to create brain-to-machine interfaces is a big deal and partly because of the star power backing the project that can literally move mountains.

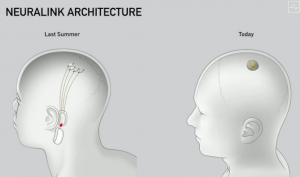

The previous design consisted of a bean-shaped device that would sit behind the ear, but now it is the size of a large coin, and it goes in your skull.

I expect the final iteration to be a millimeter wide.

The in-brain device could enable humans with neurological conditions to control technology, such as phones or computers, with mere thoughts.

The other use case is solving neurological disorders from memory, hearing loss, and blindness to paralysis, depression, and brain damage which is a tad more altruistic.

The current prototype – referred to as version 0.9 – measures 23 millimeters by eight millimeters and has 1024 electrode "threads" attached to it that are implanted into the brain.

It is designed to replace a coin-sized portion of the skull and sit flush so it would be physically unnoticeable. It would be inductively charged the same way you would wirelessly charge a smartwatch or a phone.

The surgical robot, which is programmed to insert the neural threads safely into the brain, was done by US design company Woke Studios.

Woke Studio’s robot would be able to insert the link in under an hour without general anesthesia, with the patient able to leave the hospital right away.

The robot will eventually do the entire surgery – so everything from the incision, removing the skull, inserting electrodes, placing the device, and then closing things up.

It will be completely automated.

If this technology is green-lighted by the U.S. Federal Government, I envision a free for all into this technology from the likes of Facebook, Google, Apple, and Microsoft, and so on.

If you thought website “cookie tracking” is bad now, then once tech firms are granted access to consumers’ brains, it could open up a pandora's box of moral conflicts of interest, an avalanche of revenue opportunities, and lawsuits galore.

Look at the hesitation and disgruntlement of the health industry hoping to convince Americans to take two jabs of an mRNA vaccine in the arm and now think about trying to convince humans to implant a chip in their head for the sake of competing.

Will American society really get to the point where Facebook is selling your “thoughts” to neural advertisers?

It’s scary to think about but that is the direction we are headed down for better or worse.

If you view this through the lens of big tech, battering down the hatches to get access to consumers’ “thoughts” is the holy grail of access points and revenue flow.

In 2021, humans still need to digest thoughts and carry out functions through actionable fingers into a phone interface.

We have also allowed big tech into our home feeding them data through smart devices and virtual assistants like Amazon Alexa.

Getting rid of all that “fluff” and extracting data and behavioral results from the original source is potentially worth over 20 trillion dollars along with a recurring revenue source to infinity.

Not only will physical devices be useless at that point, but they will also spawn a mega cloud storage business that is hooked straight to the mind.

An economic analyst can digest how cloud companies like Amazon and Google would rake in the trillions by storing libraries of data that a mind can tap in at any time.

It really is a gigantic step that will digitize, even if marginally ethical, and computerize humans - big tech is first in line to reap the profits and literally control our brains.

This is the future – a future where we coexist with artificial intelligence and brain chips.