Higher inflation is something this tech bull cycle hasn’t dealt with, and it’s starting to rear its ugly head in the form of volatility and spades of it.

The Fed will have to increase interest rates or face runaway inflation that will crash the economy, but increasing interest rates will also make lives harder for tech companies.

As we try to understand the pace of interest hikes, certain tech companies will fare much better in this inflationary environment than others. To deduce the winners from the losers, investors should understand exactly how inflation affects each particular tech company.

Talk has gone from the Fed moving early to raise short-term rates, to the Fed moving even in early spring which in turn is spooking risk markets from cryptocurrencies, the S&P, and the Nasdaq.

Fed Chair Jerome Fed has done a poor job communicating his sudden hawkish tone and the market has had to quickly reprice risk assets because of the surprising nature of the hawkishness.

In the short-term, tech stocks will need some time to digest this new expectation, which I see as quite healthy, but short-term tough to swallow.

Fed Cleveland President Loretta Mester told the media she is “very open” to scaling back the Fed’s asset purchases at a faster pace so it can raise interest rates a couple of times next year if needed so this isn’t just one guy in Powell trying to move the needle.

Clearly, the Fed is moving in unison, and they threaten to become a major force in moving markets which is all we care about.

All that pressure is causing component and labor costs to rise. Companies that don't have enough pricing power to pass those costs on to their customers will likely see their gross and operating margins shrink.

This matters because tech companies offer some of the most generous salaries in the U.S. and substantial increases in pay hurts them the most.

Higher interest rates attract more consumers and businesses to put more money in higher-yield bonds and savings accounts.

There are 3 ways that higher rates are actually a gut punch to tech growth companies.

First, they increase the costs of borrowing incremental capital to expand a business. In more cases than not, tech growth companies rely on borrowed money because their operation is not yet sustainably profitable. That's bad news for high-growth tech companies, which are burning cash with widening losses.

Second, it reduces the long-term estimates for a company's earnings and free cash flow (FCF) growth meaning their underlying stock price is rerated downwards in the anticipation of this new reality.

Loss accruing tech companies commonly suffer an exodus as their underlying shares are repriced to reflect higher costs.

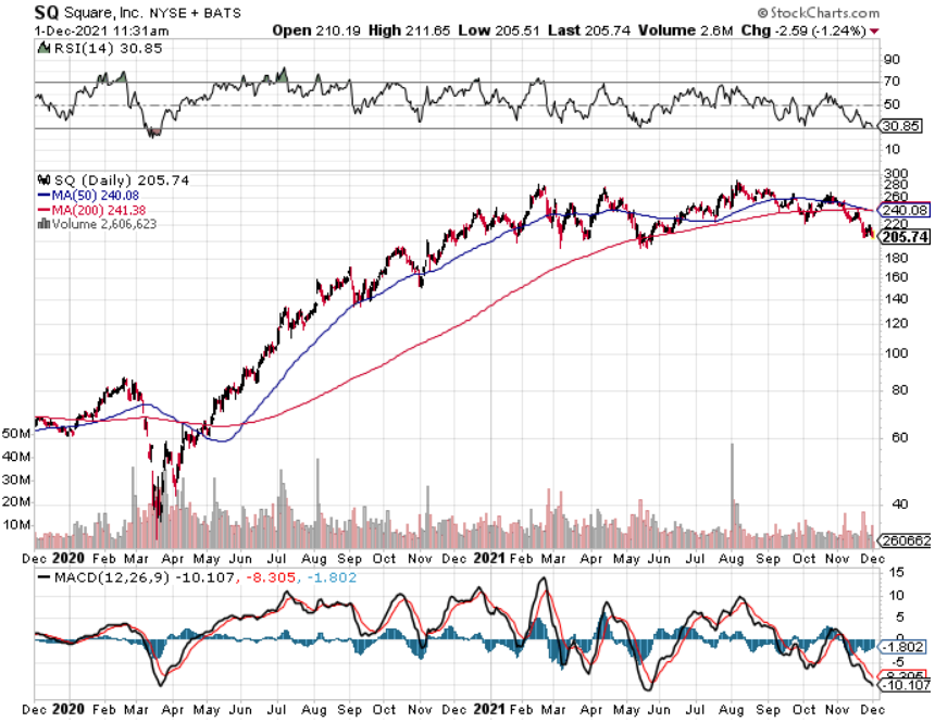

Just this morning we saw Roku (ROKU), Zoom Video Communications (ZM), Snap (SNAP), Twilio (TWLO), Square (SQ) breach 52-week lows.

The breadth of the market has been hollowed and the goalposts have indeed narrowed because of the hawkish tone at the Fed.

Lastly, higher interest rates drive institutional money into fixed income.

They do this largely by taking profits from crypto, tech stocks, or moving their stash on the sidelines then resurfacing the money into “safer” assets that anticipate weakening bond yields at the longer end of the curve.

So I won’t sit here and say sell all and every tech stock, it’s more nuanced than that.

I executed one position in December and that was Microsoft (MSFT) and it got pulled down with the broader market.

More importantly, I didn’t bet the ranch.

Ultimately, we still bask in the ideology that the tech bull market isn’t over yet because it isn’t, but this aggressiveness out of the blue has forced the overall tech market to temporarily rest with growth tech suffering major drawdowns.

In doing that, the ceiling for a Santa Claus rally is somewhat capped to the upside.

The Fed could have waited until January.

Sure, there will still be winners in tech and the odds of these winners are driven firmly behind the biggest and best like Microsoft, Amazon, Google, and Apple.

These are the type of companies that have the pricing power to raise prices and get away with it because consumers will be willing to pay it.

Other potential winners include cloud service giants like Salesforce (CRM) and Adobe (ADBE). These again are top-quality software stocks that can pass up higher enterprise software costs to the firms that can pay for it.

It’s entirely possible that the Fed could end up walking back some of these aggressive stances in the interest-raising process next year.

Don’t fight the Fed and don’t expect tech growth stocks to reverse until we receive more clarity with interest rate policy, if a reverse is triggered, it will play out with Apple, Amazon, Google, and Facebook, and Microsoft leading the way higher.