“Once things start moving, Uber will, too.” – Said Current CEO of Uber Dara Khosrowshahi when asked about the fallout from the coronavirus

Mad Hedge Technology Letter

November 24, 2021

Fiat Lux

Featured Trade:

(ONE OF THE BEST METAVERSE STOCKS)

(RBLX), (FB)

There aren’t that many metaverse stocks out there as of now, but I do feel that is about to change in the next few years.

The same thing happened with cryptocurrencies, and now not only do we have single stocks that offer pure crypto exposure, but we also even have crypto ETFs.

The natural path the metaverse will take is to enter through video gaming because of the ease of transition it will facilitate once the real thing is up and running.

There’s a fit right there because video gaming already possesses the parameters of a world set up for virtual activity; and yes, even though one could call Facebook a “world,” much of that is done through logging onto a webpage.

Populating a webpage is out of date technology and the new internet version 3.0 will be vastly different.

Enter Roblox.

Roblox (RBLX) is what Facebook (FB) would have wanted to already become but spent most of their time developing Instagram — essentially a juiced-up version of Facebook with historical videos and old photos.

That’s old news and old tech.

It won’t cut it as the metaverse guarantees a real-time, on-demand experience in virtual 3D form with humans controlling avatars that guarantees to become a more immersive experience with our 5 senses.

In short, it’s better than opening a web page. A lot better.

Roblox already relies on computer graphics and programmed virtual experiences. And with 49% of users under the age of 13, its demographics are a massive competitive moat because young people embrace new technologies quickly and are more prone to relying on digital tools to facilitate all parts of their lives.

The company is already building on its expertise in creating virtual reality experiences.

Last year, the platform hosted a virtual performance by rapper Lil Nas X that was attended 33 million times.

In November, it announced a collaboration with apparel company Nike to create Nikeland, a virtual space allowing gamers to play Nike-themed games and try on products.

Nike is preparing to hawk its products in the metaverse, which could open up revenue opportunities for platforms like Roblox.

What takes my breath away about Roblox is not the long-term vision of the company, although I have no complaints, but its short-term metrics which are blistering hot as revenue increased 102% over Q3 2020 to $509.3 million.

Find me a company of this type of magnitude expanding by over 100% per quarter and one will soon realize that they are few and far between.

To expound more on their overperformance — Average Daily Active Users (DAUs) were 47.3 million, an increase of 31% year over year

Roblox’s 3Q results highlight its early leadership in the metaverse and continued innovation to capitalize on materially higher long-term monetization opportunities.

Its premium is appropriate given the advertising optionality on top of their existing in-app purchase revenue streams.

Long term, the vision for brands is the exact same as games or play experiences in that I imagine an ecosystem where there are thousands and thousands of these personal hands-on experiences. They are created in concert between brands and possibly creators and developer communities.

It was 16 years ago, games and play experiences were new on Roblox. That has all led us to the beginning stages of the metaverse.

The high-level vision Roblox has is just as print and just as video have been and continue to be interesting ways for brands to interact with their audience.

Let’s look at the example of Vans World, which had over 40 million visits on Roblox, people who visited Vans World were able to wear Vans, go skateboarding, check out the shop, see what new items Vans had for sale.

It’s a deep way for brands to connect with their fans and is essentially the precursor before the metaverse exists but through a video game platform.

The bear case for Roblox until now has involved its primary reliance on a younger demographic, as there have been questions on its post-lockdown growth prospects, in an environment where it could be arduous to match the covid era success. But that is an argument that doesn’t hold water, as the userbase is aging up, with 17-24 year-olds currently the fastest-growing age group.

Strategically, Roblox has positioned itself as the tech firm at the forefront of the metaverse and we all know how first-mover advantage is critical in holding off competition with firms with stronger balance sheets and an army full of agile developers.

Roblox’s inroads with kids spending time in the virtual 3D worlds the gaming platform offers is a firm lock on future cash flow if the company can do its part to develop the metaverse and make sure its revenue becomes sticky.

The stock will grow 10X if the metaverse is a moderate success, and if it is not, investors will only gain about 200% in share appreciation. Not too bad.

“If the Starbucks secret is a smile when you get your latte... ours is that the Web site adapts to the individual's taste.” – Said Founder and CEO of Netflix Reed Hastings

Mad Hedge Technology Letter

November 22, 2021

Fiat Lux

Featured Trade:

(RENOMINATION BOOSTS BIG TECH)

(FB), (GOOGL), (AMZN), (MSFT), (AAPL)

U.S. President Joe Biden is doing all he can do to make sure that the US Central Bank stays accommodative to big tech investors.

He let the doves back in the driving seat which is highly positive for corporate America and terrible for penny-pinching savers.

Biden’s decision to re-elect incumbent Fed Chair Jerome Powell was cheered by the market locking in his ultra-low interest rate policies for yet another term.

Even more brazen was the appointment of Vice Chair, an even more pronounced dove Dr. Lael Brainard.

The second in command often helps signal Fed policy and gives it a dovish twist and clears the way for all systems go in 2022.

Any inclination that interest rates would rise faster than expected is now a non-starter, and the Fed will push its "lower for longer" mantra in the face of surging inflation for as long as they can make excuses for it.

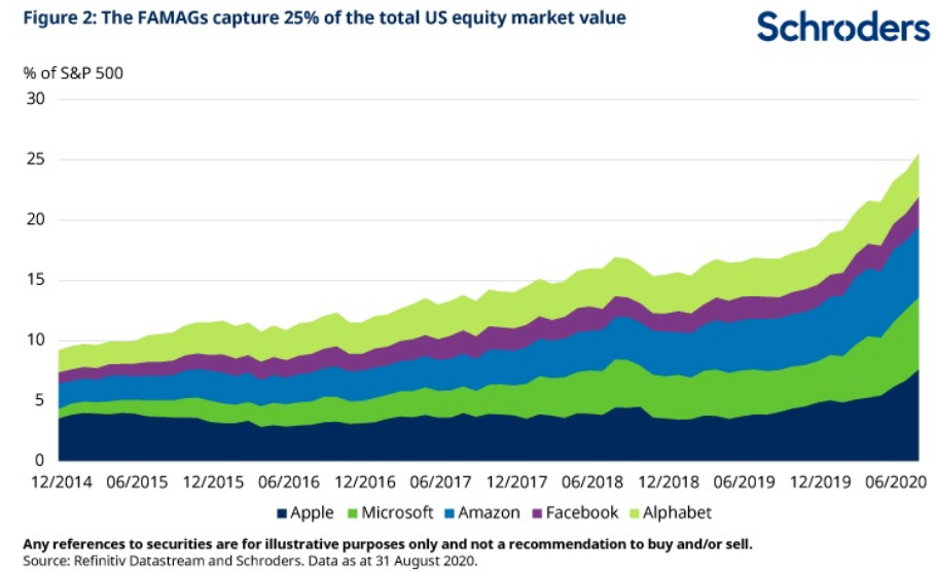

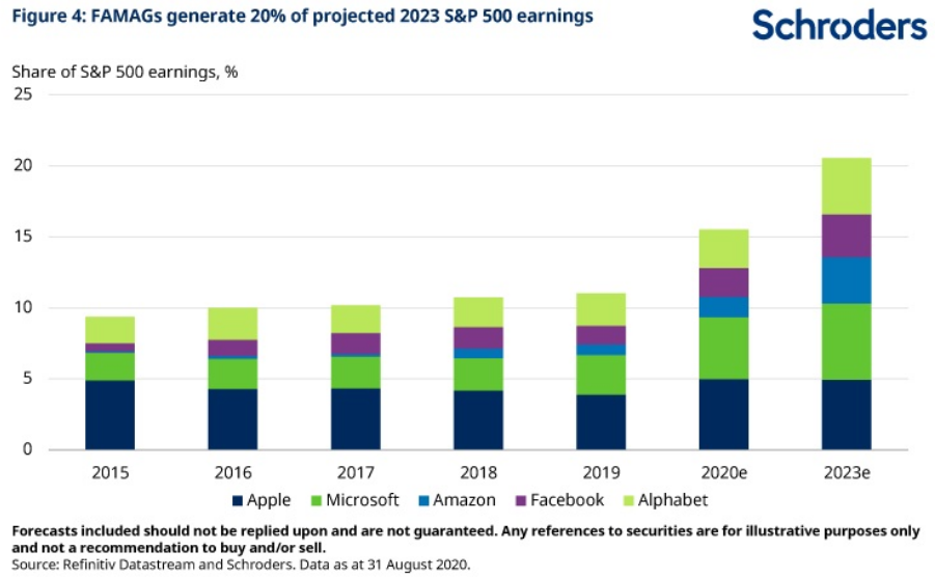

Ostensibly, the path of easiest conjecture leads me to say that the five biggest stocks in the S&P 500 – Facebook, Apple, Amazon, Microsoft, and Google, which are around 30% of the market and growing, will do well in 2022.

Long-term, they have comprised an average of about 14% of the entire stock market, and 2022 should be the year they knock on the 35% threshold.

This essentially means that the stock market is techs to win or lose and everyone else is just a footnote.

And yeah I know…it’s been like that for quite a while now; but it’s more prevalent than ever.

We are rolling into a year where big tech will weaponize their cash horde to issue low-interest corporate bonds of their own company debt and then spin those cash harvests into higher rate corporate bonds that cheapen their cost of doing business because they pocket the higher interest payments as profits.

Industry leaders are able to borrow more cheaply and in greater quantities, and the size of their balance sheets also offers incredible optionality.

This also means they can buy back more shares and also leverage up their balance sheets.

Preferential access to cheap money also cheapens the process of expansion, or in buying rivals, more easily. In effect, lower rates give leading companies an unfair set of tools to accelerate their dominance and which no regulator dares to prevent.

What does this mean in practice for investors? If falling rates have spiced up valuations of the biggest tech stocks on the way up, it implies they may struggle if rates rise, particularly as this would mean investors place less of a premium on future earnings.

But since the expectations are lower for longer, the market will be comfortable with the nominal rate even in the face of surging inflation, meaning it’s a net positive for tech stocks in 2022.

Powell and Baird will move as slow as needed and anything faster than that will shock the tech market and we will get a 5% drop which will be a golden buying opportunity.

I have read many experts’ take on tech preaching that regulation is here and coming fast to take down big tech.

However, I am in the camp that Congress will do hardly anything, and any investigation will end with a slap on the wrist which is fine.

I don’t subscribe to this ridiculous idea that superstars eventually tend to fall to earth.

I believe the current climate has set up big tech to gain an even bigger market share, crush the little guy faster, and trigger EPS to grow uncontrollably.

That’s what I am seeing on the ground with my own eyes, as opposed to baseless claims that big tech will revert back to the mean.

This sets the stage for big tech to benefit from such elevated rates of profitability next year, they will be happy to overpay for smaller companies to whom they will give an ultimatum to either sell up or get killed by them.

Numerous signs point to a devastatingly profitable and comically successful 2022 for the most recognizable and biggest tech firms who will refine their tech and harness their balance sheets in a systematically lethal way.

Unprofitable startups have a mountain climb as it relates to competing in their industries and they can thank President Joe Biden for that; they will be unduly penalized as a group that will result in lower share prices that force them to crawl on their knees to venture capitalists for capital injections.

“By giving people the power to share, we're making the world more transparent.” – Said Mark Zuckerberg

Mad Hedge Technology Letter

November 19, 2021

Fiat Lux

Featured Trade:

(THE TECH FIRM RESPONSIBLE FOR THE METAVERSE AVATAR)

(NVDA)

Nvidia (NVDA) is one of those tech companies you elevate to the top pantheon of tech companies and readers can’t take a glimpse into the future just by getting to know the chip company better.

Bluntly speaking, it’s a can’t miss tech company that every reader should have as part of their portfolio.

How are they part of the avant-garde of tech?

They are flagbearers of accelerated computing and will contribute part of the groundwork upon which the metaverse and its future business opportunities will be constructed upon.

Sounds sexy, right?

Nvidia deals in chips — chips are enablers, but chips don't create markets, software creates market.

At this point, accelerated computing is very different than general-purpose computing, it’s just at another level with the amount of data these need to be processed and the functionality of it.

Artificial intelligence, robotics, and most of the cutting-edge applications in the world need support from accelerated computing because GPUs run out of steam and that people are saying that not because it's not true, it is abundantly clear that the amount of instruction in parallel that you can squeeze out of a system is although not zero, is incredibly hard.

Accelerated computing delivers great benefits and does not require a lot of work and yet the work basically says for every domain, for every application — to have a whole stack.

What is a stack?

A stack is a linear data structure that follows a particular order in which the operations are performed.

And so whenever you want to open a new market by accelerating those applications or that domain of applications, you have to come up with a new stack, and the new stack is hard because you have to understand the application, you have to understand the algorithms, the mathematics, you have to understand computer science to distribute it across, to take something that was single-threaded and make it multi-threaded and make something that computer specialists have done sequentially and make it process in parallel.

You break everything, you break storage, you break networking, you break everything.

And so it takes a fair amount of expertise and that's why over the course of 30 years Nvidia has become a full-stack company because they solve complex problems consistently practically through decades basically integrating and connecting all that needs to be connected in a fluid type of way.

The ultimate benefit, once you have the ability, then you can open new markets and Nvidia has played a really large role in democratizing artificial intelligence and making it possible for anybody to be able to do it.

Democratized scientific computing is one of Nvidia’s biggest achievements so that researchers and scientists, computer scientists, data scientists, scientists of all kinds can get access to this incredibly powerful tool that we call computers to do advanced research.

This brilliant, advanced computing is thrusting Nvidia to the forefront of the metaverse where they have been working on perfecting the technology to populate a high-quality 3D avatar.

They call this business division the Omniverse and it took half a decade to start building Omniverse, but its largely built on a quarter century of work.

Nvidia is developing an AI to be able to speak in a human way so that people feel more comfortable and more engaged with the AI.

They are being built in pieces and will be integrated to create what is called Omniverse Avatar.

How quickly will they deploy this?

I believe Omniverse Avatar will be in drive-throughs and restaurants, fast food restaurants, check out with restaurants, in retail stores, all over the world within less than five years.

And we're going to need it in all kinds of different applications because there is such a great shortage of labor and there is such a wonderful way that you can now engage with a 3D Avatar.

This 3D avatar doesn't get tired and it's always on and it will certainly be cloud-native.

This revenue and growth essentially are generated by accelerated computing and is a full-stack challenge.

So I am not focusing on the 50% quarterly revenue growth or the 83% in quarterly EPS growth, because that will all fall into place naturally if they keep their lead in accelerated computing refining their full-stack capabilities.

It takes software to open new markets. Chips can't open new markets. If you build another chip, you can steal somebody's share, but you can't open a new market and it takes software to open new markets.

Lastly, the Omniverse opportunity is a great opportunity for Nvidia who could be responsible for creating the avatars in the metaverse.

They are ostensibly one of the foundational companies of the Metaverse.

Nvidia are one of our favorite tech companies at the Mad Hedge Technology Letter.

Mad Hedge Technology Letter

November 17, 2021

Fiat Lux

Featured Trade:

(THE TESLA OF PICK-UP TRUCKS)

(RIVN), (AMZN), (TSLA)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.