“It is only when they go wrong that machines remind you how powerful they are.” – Said Australian Writer Clive James

Mad Hedge Technology Letter

October 22, 2021

Fiat Lux

Featured Trade:

(BOMBSHELL HITS AD TECH)

(SNAP), (FB), (GOOGL), (AAPL)

So, first the good news — SNAP expanded revenue by 57% year-over-year.

It was only a few years ago that this tech company was the backwater of social media, but it’s done its bit to catch up with the crowd.

SNAP targets the 18–29-year-olds and although not minted, there are pathways for a lifetime of revenue generation from this cohort.

In a rough environment battling Google (GOOGL) and Facebook (FB) and despite these challenges, they crossed $1 billion in quarterly revenue for the first time.

That was the good news and now you might want to cover your ears so put on those earmuffs.

The reason SNAP missed guidance by $3 million was because there have been changes to advertising tracking in Apple’s iOS system.

These ongoing changes to digital advertising were introduced as part of iOS 14.5 and were announced ahead of time, and now that move is started to suppress the bottom line for the social media giants.

SNAP anticipated some degree of business disruption, and unfortunately, their provided measurement solution did not scale as expected.

Basically what’s happening is that it’s more difficult for advertising partners to measure and manage ad campaigns for iOS.

Advertisers are no longer able to understand the impact of their unique campaigns based on things like the time between viewing an ad and taking an action or the time spent viewing an ad.

Real-time campaigns and creative management are hindered by extended reporting delays and advertisers are unable to target advertising based on whether or not people have already installed an app.

Without these business analytics, SNAP’s platform is less attractive because sale conversions are a great deal lower.

This impact was compounded by the ongoing macroeconomic effects of the global pandemic with advertising partners facing a variety of supply chain interruptions and labor shortages.

The ongoing magnitude and duration of these global supply and labor disruptions are inherently unpredictable.

Also, businesses do not have the inventory or operational capacity to support incremental demand.

SNAP expect customers to cut marketing budget given the diminished need to drive incremental demand at a time when supply chains are not able to operate at peak capacity.

This in turn that reduces their short-term appetite to generate additional customer demand through advertising at a time when their businesses are already supply-constrained.

The big question is: how bad will the Apple changes impact SNAP in the future?

SNAP is down 25% in today’s trading and that’s just them.

Facebook is down around 6% and Google is also off 3%.

Apple has signaled that they aren’t willing to accommodate the tracking techniques of the social media companies.

Clearly, investors are worried about the magnitude of the drop in shares, and this does a great deal to kill the momentum in the stock.

This isn’t the end of the world because I would like to point out that these changes happened in June and July, yet SNAP was still able to grow revenue by 57% year over year.

But I will say this will crimp the growth elements in the business model and lower the ceiling.

Growth rates of high 50% could start trending towards the lower 40% and investors hate that.

The company is still quite small — less than $90 billion of market cap.

This is exactly what SNAP didn’t want because comparatively speaking, Google and Facebook will be able to absorb this better with their war chest of capital readying itself to plug in the gaps.

The stock essentially gave back a year of performance in one morning, but I do view this as a buying opportunity and readers who have a long-term view will certainly profit once SNAP work itself through this problem, but it will be closer to a crawl up than big gaps up in prices.

“In the old world, you devoted 30% of your time to building a great service and 70% of your time shouting about it. In the new world, that inverts.” – Said Founder and CEO of Amazon Jeff Bezos

Mad Hedge Technology Letter

October 20, 2021

Fiat Lux

Featured Trade:

(NETFLIX STILL ADDING VIEWERS)

(NFLX)

Netflix (NFLX) is reaching close to 1 billion TV fans globally with their content, and that can obviously generate a lot of virility for great pieces of content.

That being said, the content has to deliver. Yet that’s what Netflix has essentially done from the beginning, repeatedly offering world-class content that is consumed in nanoseconds.

If you think about the big picture, NFLX is at 213 million subscribers and that doesn’t make a dent compared to pay-TV households, ex-China.

But NFLX certainly believes they can match pay-TV households, and that aspiration signals plenty of room for growth.

Streaming is developing at a breathtaking pace, all kinds of devices and competitors helping that market grow, and it’s not just NFLX even though many of us live in a NFLX-centric world.

Then when I think about what’s out there in terms of competition — competition of content because NFLX doesn’t live in a vacuum.

Allowing to scale with this robust network and offering titles like Squid Game a chance to go viral really just signals overperformance for the NFLX business as a whole.

The most incredible part is the system that NFLX built from scratch that has turned into a highly distributed business model when it was NFLX’s Korean team two years ago that commissioned the hit show.

Just the synergy in that is great for NFLX, while really driving a narrative of a strong international audience that is digesting the Netflix content engine.

To that, I must give NFLX management credit for pushing hard into the content creation business and they have really made miracles happen up against the pandemic and all, but now with the team wrestling with the post-COVID, how do things move forward?

It all comes back to if NFLX can be that first choice in entertainment, then ultimately, that's what's driving that secular growth from linear to streaming entertainment and specifically NFLX’s platform.

The NFLX team recognized something that nobody else did and created an environment for that creator to make a great show.

They pretty much found the best content creators, handed them boatloads of cash, and said go make something kickass and they did.

Hollywood has been notorious for not only selling out but for micromanaging content creators and suffocating the creation process.

Clearly, when creative artists are not given the freedom to create, it negatively impacts the end-product, and that’s a pivotal reason linear television and Hollywood are now chasing NFLX.

NFLX is now the King of content going viral and going viral is really hard to predict, but it's super powerful when it happens, and they deliver the goods to be able to deliver that much viewing when viewers storm NFLX’s platform to consumer adjacent content that turns into binge-watching.

And you have people talk about it in ravenous terms that you can spoof it on Saturday Night Live because it's so in the zeitgeist.

Few companies in the world can accomplish that.

Now it’s not only Korea’s Squid Game, but NFLX is churning out the viral hits like with La Casa de Papel from Spain, with Lupin from France, with the film Blood Red Sky from Germany, from Sex Education in the U.K., where the stories of the world can increasingly come from anywhere in the world.

NFLX has systemized a way to build great hits.

Non-English content viewing has grown three times since NFLX started in 2008 making content.

Installing new storytellers into the world from everywhere in the world is supercharging the business model and that’s why we are experiencing a massive melt-up in NFLX shares.

“Often you have to rely on intuition.” – Said Founder and Former CEO of Microsoft Bill Gates

Mad Hedge Technology Letter

October 18, 2021

Fiat Lux

Featured Trade:

(THE BEST CLOUD SECURITY GROWTH STOCK TODAY)

(CRWD)

Today’s sophisticated hackers are going “beyond malware” to breach organizations.

These hackers are increasingly relying on hard-to-detect methods such as credential theft and tools that are already part of the victim’s environment.

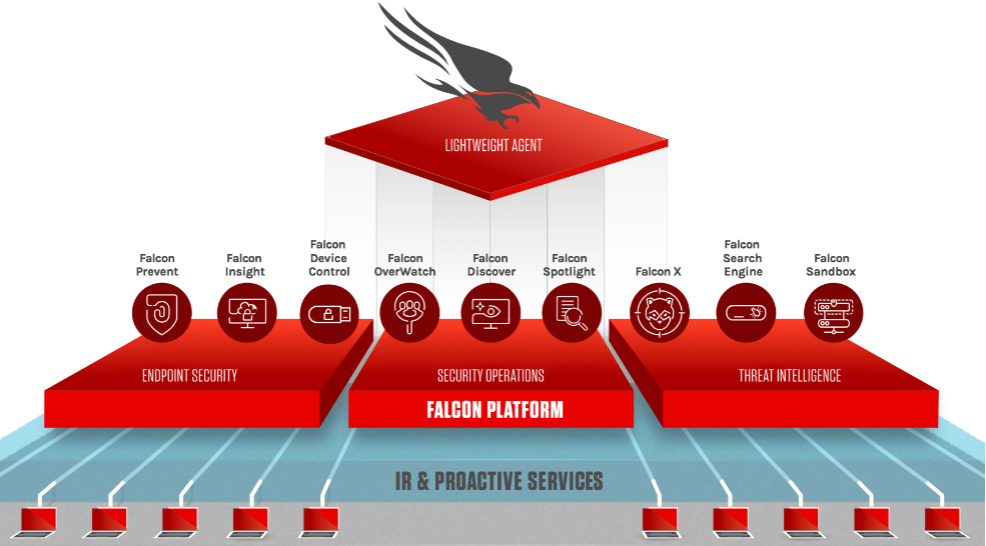

Falcon is the preeminent security platform built by CrowdStrike (CRWD) to stop breaches via a unified set of cloud-delivered technologies that prevent all types of attacks.

Falcon is the major reason why this tech stock is growing so rapidly and why many investors are jumping on the bandwagon.

The stock is up over 400% in the past 5 years, and this is just the beginning of its growth.

CrowdStrike Falcon responds to malicious challenges with a powerful yet lightweight solution.

It unifies next-generation antivirus, endpoint detection and response, cyber threat intelligence, and managed threat hunting capabilities.

Management’s approach to stopping breaches with the Falcon platform is foundational to CrowdStrike's leadership position and maintaining the overperformance which many investors have been impressed with.

Using AI, machine learning, and an intelligent lightweight agent, the Falcon platform defends against today's most sophisticated threats with unmatched speed and simplicity.

Simply put, companies need to employ a holistic breach prevention strategy rather than overly relying on malware prevention.

Nearly every breach you have ever heard of had two things in common, the victims had both a firewall and an antivirus solution, which is why management decided to build the Falcon platform from the ground up to stop breaches and not just prevent malware.

Meanwhile, competitors have fallen further behind as they continue to blindly promote a strategy that relies on malware prevention versus a comprehensive solution, focused on people, process, and technology that stops breaches.

Today, more than half of the detections analyzed were not malware-based.

Attackers are increasingly attempting to accomplish objectives without using malware.

They are exploiting the proliferation of vulnerabilities and abusing systemic weaknesses in identity architecture to get on the system and then move laterally.

This makes it more difficult for legacy and next-gen malware-focused products to be effective because they are not focused on breach prevention.

To further demonstrate my point, I'd like to share a situation with a certain unnamed company using Microsoft's legacy security products that failed to rise to the challenges of today's adversaries and ended up unnecessarily costing them.

This company experienced a long and difficult deployment process, particularly in low bandwidth environments where endpoint performance was critical.

Notably frustrated, this company began to evaluate alternatives when it was unfortunately hit by ransomware that encrypted their primary and backup data, causing weeks of business disruption and a financial impact estimated to be in the tens to hundreds of millions of dollars.

This is a typical story that is told to CrowdStrike and more will follow as the volume of companies ill-prepared is voluminous.

Many of these damaging experiences by companies are then followed by their in-house IT teams connecting with CrowdStrike’s incident response team to remediate and stabilize their IT operations — followed up with deploying Falcon Complete across their environment.

The Falcon platform processes approximately 1 trillion events per day from millions of agents, delivering unprecedented security insights.

This empowers Falcon to benefit from crowdsourcing and economies of scale unlike any other solution on the market today, which I believe enables AI algorithms to be uniquely effective.

CrowdStrike’s success hinges on growing leadership as the trusted security partner of choice and especially growing the Falcon platform.

Several outside reports have praised Falcon Complete and recognized its strength in its breach prevention warranty, fully remote automated remediation, breadth of threat hunting capabilities, and strong machine learning and artificial intelligence capabilities for detection and response.

The net result of focusing on the Falcon platform to increase revenue upside is the subscription revenue growing 71% over Q2 to reach $315.8 million.

While it’s understandable that subscription gross margin fluctuates quarter to quarter, management expects it to remain solidly within an increased target model range of 77% to 82%.

For the next quarter, CrowdStrike expects total revenue to be in the range of $358 million to $365.3 million, reflecting a year-over-year growth rate of 54% to 57%.

Management has reaffirmed that demand for their Falcon platform is still hot, but I am not thrilled that the total revenue growth is expected to drop to the mid-50% from 70%.

Even though this drop is a seasonal adjustment, it was only just in 2018 when the company was doing $100 million in total revenue, and we are talking now about reaching $2 billion per year after almost surpassing $1 billion per year in 2020.

The stock has substantially more upside and any significant drop should be bought.

We are hovering near all-time high’s so any 5-10% drops should be bought into.

I am still highly bullish on this cloud security company and believe its best days are ahead of them.

“The right moral compass is trying hard to think about what customers want.” – Said CEO of Google Sundar Pichai

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.