“The right moral compass is trying hard to think about what customers want.” – Said CEO of Google Sundar Pichai

Mad Hedge Technology Letter

October 15, 2021

Fiat Lux

Featured Trade:

(DEATH OF THE SPORTS GYM)

(PTON), (NLS), (GRMN), (LULU), (PLNT)

I hope for your sake that you don’t own a gym! — because one area that will certainly experience transformation into mainly smart products is fitness.

In the long term, this would be classified as a terrible investment, and I will tell you why.

The global digitally connected gym equipment market is projected to separate itself from the equipment of the past.

No more bench presses and barbells.

When I say smart fitness products, I am not just talking about Peloton (PTON) — though they are the trailblazer of the group.

Rising technological advancements in the fitness and gym equipment market are happening at warp speed.

Rapid digitalization of the health and fitness industry along with the increased utilization of smart machines is making products better and more efficient.

There are advantages for the consumers like storage, monitoring, and analysis of their fitness performances and the ability to log these details for future references.

New platforms will start popping up that integrate gym equipment and sports equipment along with the training and coaching software.

My personal favorite is Tonal.

This machine is ingenious and uses its smart cable machine to perform strength training exercises.

It’s essentially a 24-inch iPad plastered on the wall with cables and is the Tesla of the smart gym industry with onscreen coaches that guide you through your workout.

Tonal’s AI automatically adjusts weight based on a user’s strength during workouts. Rather than physical weights, Tonal uses electromagnetic force to produce up to 200 pounds of resistance.

Artificial intelligence (AI) is there to track everything you do, analyze it, and decide what you're going to do next, so you end up getting a much better workout, in a shorter amount of time, in the convenience of your home.

With precise data measurement, Tonal can measure the quality of every single repetition, decide how much weight one should lift, and adjust weight in one-pound increments.

To visit their website, click here. (https://www.tonal.com/)

Treadmills are anticipated to hold the largest revenue shares of the market and dominate the market segment on the account of rising instances of cardiovascular diseases.

Strength training equipment is expected to rapidly increase sales by the consumers as well as the increasing inclination of regular fitness enthusiasts over bodybuilding and strength building.

As for specific smart gym stocks, Peloton (PTON) and Nautilus, Inc. (NLS) had huge run-ups in 2020 as business boomed during the health crisis.

These two stocks have come back to life during the “reopening trade.” They after going through a consolidation phase in 2021, but I do believe it is a good time to buy during a low patch.

Conversely, a gym franchise stock Planet Fitness, Inc. (PLNT) had a terrible 2020 because of the mandated closures but has followed up a bad year with a sensational year as in-person gym activity has reversed.

However, I believe the situation will be quite grim in the long haul for in-person gym aficionados, as Tonal proves, gyms will migrate into the confines of our homes simply because the technology now is TOO GOOD to justify getting in a car to drive 30 minutes to the gym, spending 15 minutes changing in the locker rooms, only to then start a workout.

Tonal can almost fit in a kitchen pantry — it’s an iPad with attached cables and nothing more than that.

Its compact nature will attract many gym enthusiasts and one doesn’t need to allocate a whole room for a home gym, even a hallway can suffice with Tonal.

Tonal can get better, but I specifically thought the programmed training dialogue from the A.I. trainers were cheesy.

But it’s good enough that it lays down the marker for in-home smart gyms to gain market share in the future, which is why I believe franchise gyms will be made redundant.

Unfortunately, Tonal is a private company and Lebron James just made a big investment to buy a piece of it.

Alternatively, a direct play that I like for the smart gym is Garmin Ltd. (GRMN) who produces a variety of smart fitness products and specializes in navigation. This stock is immune to the in-person or at-home gym question because their products will get used no matter what.

A second derivative play of the smart gym is the clothes that are needed to work out.

Although not a tech stock, workout apparel stock Lululemon Athletica Inc. (LULU) made hay last year and their stock has basically moved from the lower left to the upper right for the past 10 years with minimal volatility.

So does this mean the end of the sports gym as we know it?

I am not calling for the death of gyms yet, but we have definitely started down that path albeit it incrementally and once Tonal lookalike products become a little more affordable, kiss goodbye to many people going to the gym.

“Technology's always taken jobs out of the system, and what you hope is that technology's going to put those jobs back in, too. That's what we call productivity.” – Said CEO of Salesforce Marc Benioff

Mad Hedge Technology Letter

October 13, 2021

Fiat Lux

Featured Trade:

(AMERICA’S NEW SOCIAL CREDIT SYSTEM IS HERE)

(ABNB), (PYPL), (FB), (GOOLG), (AMZN)

Several external events have prompted Silicon Valley giants to unveil a predecessor to what effectively could become a de facto social credit system by the end of this decade.

I would argue that it is already here, and we are just blind to it.

Take short-term housing agent Airbnb (ABNB) and their business model.

Try searching for a specific listing in any city with a certain date, number of guests.

If you ask other friends and family around the world to input the same data into the same listing, prices will vary greatly.

This is intentionally done because pricing depends on the profile of a certain customer.

If it is $80 per night for me, it could be $100 for the next person.

Why?

Airbnb has an embedded algorithm that conjures up a de facto social credit score, applies it to the situation, and bam — you get your price.

Through my rough research, I have found that males tend to get charged less and especially males wielding a financial profile from a rich country.

I honestly am not sure what data Airbnb is privy to, whether it is only based on a customer’s prior internal Airbnb history, or if it is pieced together from other “sources.”

I am not sure, but if they somehow have access to alternative sources to understand their client better, they might already know that this 47-year-old John Doe booking a 3-night stay in Chicago, Illinois earns $300,000 per year, 1 out of his 5 credit cards is American Express among others, he reported $300,000 of Bitcoin profits in 2020 to the IRS and he owns 3 mansions in Miami, Florida.

It would almost be safe to say that this John Doe would get a better daily rate on the same Airbnb listing than if a 19-year-old student from Albania with no credit card, no assets, and no income tried to book the same listing.

Of course, this also goes for a hardworking single mother trying to take her kids on vacation. So, in the end wealthy men get benefited by a system with discounts that other customers could probably use. But, I guess that's just business in corporate America.

This is just the beginning of the race to pad a soft social credit system so tech companies and others can charge different prices to different people, or maybe not sell some customers services at all.

Relying on an indirect boost from D.C., corporate America will attempt to force the most profound changes our society has seen during the internet era.

Last week, PayPal (PYPL) announced they would start to crack down on users that did not use their platform responsibly.

This group could potentially lose access to PayPal’s services.

PayPal says the collected information will be shared with other financial firms and politicians.

Facebook (FB) is adopting similar practices, recently introducing messages that ask users to snitch on their potentially “extremist” friends.

At the same time, Facebook and Microsoft are working with several other web giants and the United Nations on a database to block potential extremist content.

Some banking platforms already have announced a ban on certain legal purchases, such as firearms.

The growth of such restrictions will accelerate to every part of the business world.

The potential scope of the soft social credit system under construction is enormous and the data exchange practices could have all tech companies swapping customer info in some type of private network that is only accessible to them.

A creation of a “Digital Dollar” would put the tools in place to make sure customer data and flow of money are followed to the very kilobyte.

Working in conjunction with major tech companies, citizens convicted of a crime could lose their ability to transact any business as well.

On a business level, this is great for all the big Silicon Valley companies involved because they would be more efficient at deploying the business intelligence at hand to make money.

I won’t go through the Rolodex of tech companies that are in the data business, but anything involving the cloud and anything in the cloud making great margins, will go gangbusters if this is allowed to happen, which it's looking like it will.

Imagine how conversion rates at Facebook, Google (GOOGL), and Amazon (AMZN) will skyrocket because they already know how to sell stuff to the end guy.

Imagine how Airbnb could ban guests before they even had a chance to destroy somebody’s residence or give generous rates to big spenders that would encourage even more big spending.

This is essentially the dream of Silicon Valley, not for only ad tech like Roku, The Trade Desk, Snapchat, and so on, but the software companies too.

Accurate and voluminous data means better decisions and a super-charged business model.

"Software is like Lego. You can make anything with it, but it may not be appropriate." - CEO of IMC Worldwide Stuart Sherman

Inflation is everywhere — at your grocer, coffee shop and the bad news is — it’s likely to stay transitory for quite a while as it transits into even higher prices.

This isn’t the Mad Hedge Agricultural Letter so I will stay in my lane — this letter is about one of the building blocks of technology and specifically Electric Vehicles (EVs) — Lithium Batteries.

Lithium-ion batteries are the most popular type of batteries used in electric cars.

This kind of battery may sound familiar — these batteries are also used in most portable electronics, including cell phones and computers. Lithium-ion batteries have a high power-to-weight ratio, high energy efficiency and good high-temperature performance.

In practice, this means that the batteries hold a lot of energy for their weight, which is vital for electric cars — less weight means the car can travel further on a single charge.

The cost of Lithium-ion batteries is critical to EVs because it comprises about 50% of the total cost of producing an EV.

So what’s the deal with Lithium-ion batteries?

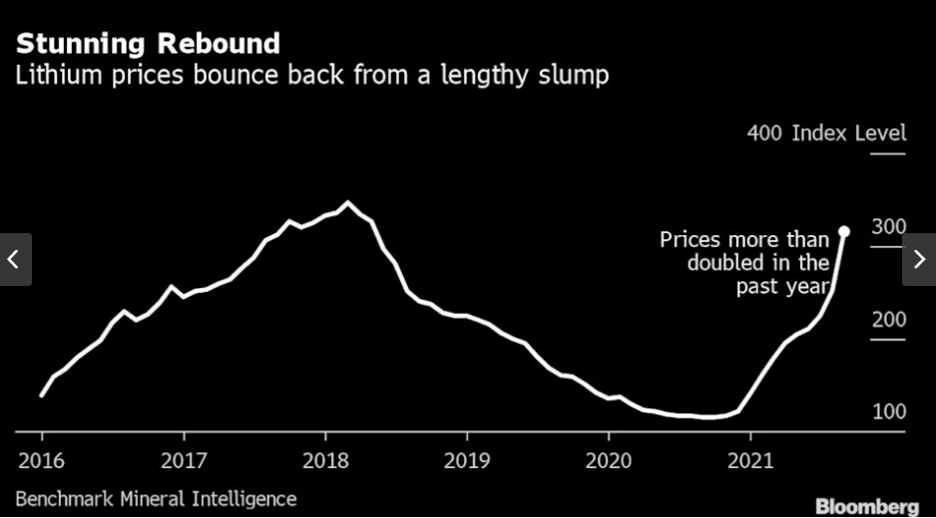

Prices have more than doubled in the past year because demand for the materials used in electric cars and renewable-energy storage has gone bonkers.

Miners cannot issue the supply to satisfy the current demand.

Instead of getting more into the weeds — I will tell you that your new Tesla (TSLA) you’re about to buy will become more expensive, so start budgeting wisely!

Increased costs will be passed onto electric vehicle (EV) manufacturers and not necessarily battery cell manufacturers, thereby potentially leading to a cost increase in EVs in the near future.

The price inflation from lithium is actually derailing a decades-long trend of a fall in lithium-ion battery prices.

Then coupled with a persisting semiconductor shortage (impacting microchip availability) — supply shortages could lead to EV demand destruction as EVs simply fail to come to market in significant quantities or do so at higher prices in limited availability.

Demand destruction is highly likely to accelerate if new lithium projects do not come to market relatively quickly, or miners might simply choose to collude together to keep prices high.

On the supply side, it’s just not guaranteed that miners can keep their costs of exploration, mining, engineering, and executing as low as they did before.

Hiring the proper talent to execute a new mine is facing headwinds like many other businesses in terms of spiking salary costs and lack of engineering talent.

For the EV industry, price points are a sore point because many consumers are on the fence about whether to buy an EV or not.

Simply put, if EVs are too expensive, consumers will just go with a gas guzzler because that’s what they know and they don’t need to deal with waiting hours at a charging station to charge their EV with a gas station across the street.

It’s true that the quality of EVs from Tesla to Mercedes has improved leaps and bounds in the past few years so the quality issue is a non-issue today.

To have a circular and sustainable bull market, EV uptake would need to surpass 50%. Until then, it’s a war of price points.

There’s also a strong possibility that not enough lithium can be mined, and this will keep EV prices high.

Battery makers are also facing higher prices for other key inputs like cobalt and copper.

Instead of doing risky things like short Tesla, which is a dangerous strategy, I would buy a lithium ETF.

The one I recommend is Global X Lithium & Battery Tech ETF (LIT).

The stock is up over 300% in the last 2 years and if this lithium inflation narrative persists, which I highly believe it will, then any substantial drawdowns should be bought.

Mad Hedge Technology Letter

October 8, 2021

Fiat Lux

Featured Trade:

(THE EASY WAY TO PLAY THE CLOUD)

(WCLD), (EMCLOUD), (QQQ)

Overperformance is mainly about the art of taking complicated data and finding perfect solutions for it. Trading in technology stocks is no different.

Investing in software-based cloud stocks has been one of the seminal themes I have promulgated since the launch of the Mad Hedge Technology Letter way back in February 2018.

I hit the nail on the head and many of you have prospered from my early calls on AMD, Micron to growth stocks like Square, PayPal, and Roku. I’ve hit on many of the cutting-edge themes.

Well, if you STILL thought every tech letter until now has been useless, this is the one that should whet your appetite.

Instead of racking your brain to find the optimal cloud stock to invest in, I have a quick fix for you and your friends.

Invest in The WisdomTree Cloud Computing Fund (WCLD) which aims to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index (EMCLOUD).

What Is Cloud Computing?

The “cloud” refers to the aggregation of information online that can be accessed from anywhere, on any device remotely.

Yes, something like this does exist and we have been chronicling the development of the cloud since this tech letter’s launch.

The cloud was the concept powering the “shelter-at-home” trade.

Cloud companies provide on-demand services to a centralized pool of information technology (IT) resources via a network connection.

Even though cloud computing already touches a significant portion of our everyday lives, the adoption is on the verge of overwhelming the rest of the business world due to advancements in artificial intelligence and the Internet of Things (IoT) hyper-improving efficiencies.

The Cloud Software Advantage

Cloud computing has particularly transformed the software industry.

Over the last decade, cloud Software-as-a-Service (SaaS) businesses have dominated traditional software companies as the new industry standard for deploying and updating software. Cloud-based SaaS companies provide software applications and services via a network connection from a remote location, whereas traditional software is delivered and supported on-premise and often manually. I will give you a list of differences to several distinct fundamental advantages for cloud versus traditional software.

Product Advantages

Speed, Ease, and Low Cost of Implementation – cloud software is installed via a network connection; it doesn’t require the higher cost of on-premise infrastructure setup maintenance, and installation.

Efficient Software Updates – upgrades and support are deployed via a network connection, which shifts the burden of software maintenance from the client to the software provider.

Easily Scalable – deployment via a network connection allows cloud SaaS businesses to grow as their units increase, with the ability to expand services to more users or add product enhancements with ease. Client acquisition can happen 24/7 and cloud SaaS companies can easily expand into international markets.

Business Model Advantages

High Recurring Revenue – cloud SaaS companies enjoy a subscription-based revenue model with smaller and more frequent transactions, while traditional software businesses rely on a single, large, upfront transaction. This model can result in a more predictable, annuity-like revenue stream making it easy for CFOs to solve long-term financial solutions.

High Client Retention with Longer Revenue Periods – cloud software becomes embedded in client workflow, resulting in higher switching costs and client retention. Importantly, many clients prefer the pay-as-you-go transaction model, which can lead to longer periods of recurring revenue as upselling product enhancements does not require an additional sales cycle.

Lower Expenses – cloud SaaS companies can have lower R&D costs because they don’t need to support various types of networking infrastructure at each client location.

I believe the product and business model advantages of cloud SaaS companies have historically led to higher margins, growth, higher free cash flow, and efficiency characteristics as compared to non-cloud software companies.

How does the WCLD ETF select its indexed cloud companies?

Each company must satisfy critical criteria such as they must derive the majority of revenue from business-oriented software products, as determined by the following checklist.

+ Provided to customers through a cloud delivery model – e.g., hosted on remote and multi-tenant server architecture, accessed through a web browser or mobile device, or consumed as an application programming interface (API).

+ Provided to customers through a cloud economic model – e.g., as a subscription-based, volume-based, or transaction-based offering Annual revenue growth, of at least:

+ 15% in each of the last two years for new additions

+ 7% for current securities in at least one of the last two years

With ETF funds like WCLD, you're going to see a portfolio that's going to have a little bit more sort of explosive nature to it, names with a little more mojo, a little bit more chutzpah, because you're focusing on smaller names that have the possibility to go parabolic and gift you a 10-bagger precisely because they take advantage of the law of small numbers.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.