E-commerce is now happening absolutely everywhere except the pipes in your house, and Shopify’s (SHOP) plan is to ensure that merchants using Shopify can sell pretty much everywhere.

That’s just how it is these days.

The internet town squares of modern day are social media and that corresponds to everywhere as people take social media to the streets in droves.

And so, it's important that wherever consumers could be potentially looking to purchase that Shopify merchants continue to show up there.

And from a merchant perspective, that it all neatly feeds back into a centralized back office where they can run their business.

So whether it's Google Search or it's on Instagram or it's on all the other channel integrations Spotify has, that is essential.

Now, again, over time, you are going to see more of these surfaces show up where commerce is happening, and Shopify is also integrating there to make sure that merchants can access those customers.

It’s SHOP’s job to stay one step ahead and that’s what they are exactly doing.

And of course, as more of those services come to life, that increases the complexity of commerce and running a business, a modern-day business, and that also increased the value Shopify provides to their customers.

Shopify and its platform do internet selling at a world-class level.

And yes, there are sometimes where it's faster, better, and more effective for them to partner with another technology company. They’ve developed a solid reputation for being a company that builds incredible software and particularly are renowned for having trustful partners.

But there are other times where SPOT needs to build it themselves because it's just mission-critical, and I have full confidence in them that they can actually deliver the best product on the planet.

This story and numbers are backed up by the latest short-term performance showing that SHOP is turning into an e-commerce juggernaut.

The latest earnings showed that year-over-year GMV growth in the rest of the world actually outpaced North America in Q2 2021.

We are seeing more international merchants that are joining and are succeeding on Shopify.

And fortunately, SHOP is stepping up its growth marketing, sales, and support efforts in places like Brazil and all over the world.

It isn't necessarily any particular focus on Brazil per se, but there are merchants around the world who are looking for a retail operating system and Shopify certainly is the priority.

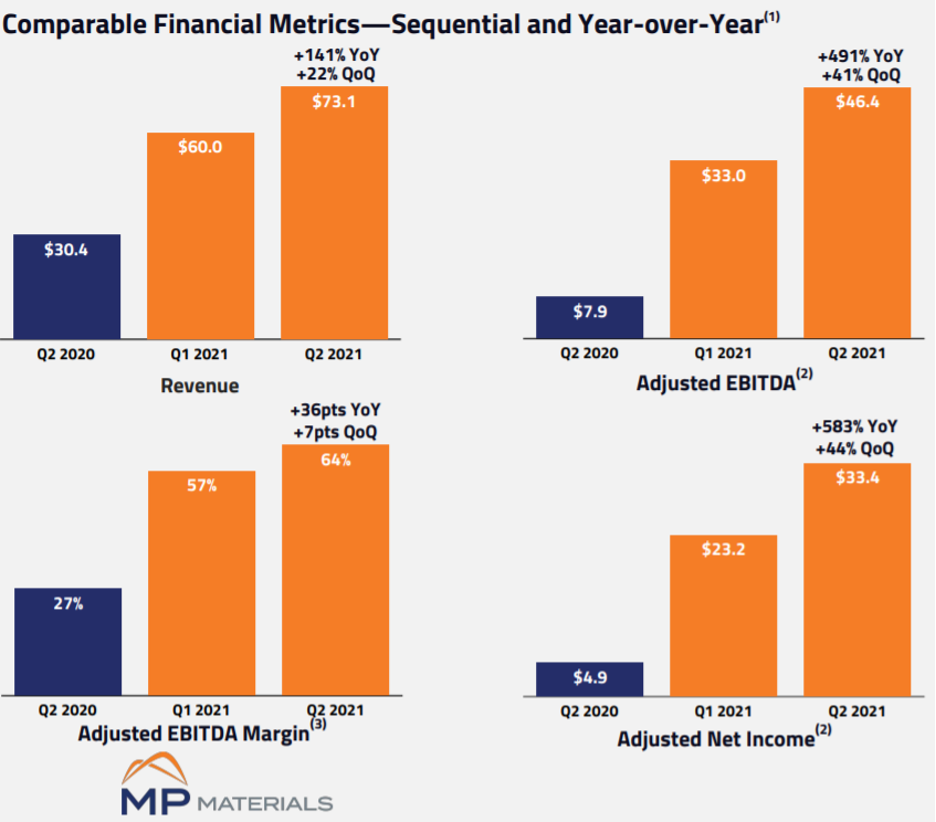

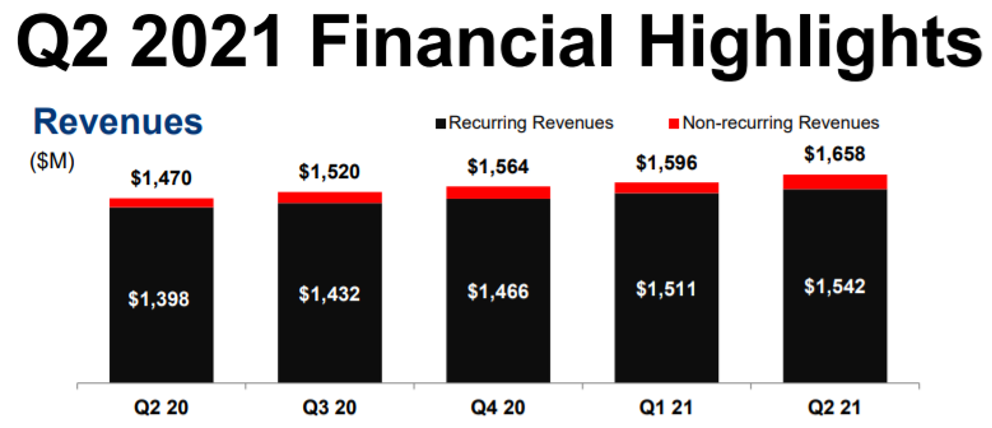

Revenue in the second quarter was up 57% year over year to $1.1 billion, marking the first time Shopify exceeded $1 billion in a single quarter.

This was driven by strong performance from subscription solutions and merchant solutions segments.

The combined strength in revenue, improved margin profile, and lower overall opex spend as a percent of revenue contributed to strong adjusted operating earnings in Q2 compared to the same period last year.

Adjusted operating income was $236.8 million in the second quarter compared with adjusted operating income of $113.7 million in the second quarter of 2020, as revenue growth outpaced growth in spend.

Echoing the bit I said about social media being the townhall of ecommerce — this is something management takes personally, which is why they announced a partnership with TikTok to launch new in-app shopping features.

The deal will allow a select group of Shopify merchants to add a shopping tab to TikTok profiles and link directly to their online stores for checkout.

The understanding of buying things is now transforming shopping into an experience that's rooted in discovery, connection, and entertainment, creating unparalleled opportunities for brands to capture consumers' attention.

TikTok is uniquely placed at the center of content and commerce, and these new solutions make it even easier for businesses of all sizes to create engaging content that drives consumers directly to the digital point of purchase.

Social commerce is a rapidly booming market.

Sales on social media apps will surge 34.8% to more than $36 billion in 2021, according to eMarketer.

Partnering with the wildly popular short form video platform TikTok is a brilliant move for Shopify — one that’s likely to pay off quite quickly.

Back to the stock market — the stock today sits at $1,450 and has gone through a time correction shifting sideways for the past 3 months.

These levels still mean that SHOP is trading at PE levels around 75, but they are a growth stock so who cares about PE levels!

The past quarter’s sensational performance translated into expanding revenue by 57%.

No doubt that beating the comparable data from a covid year is turning out to be arduous with almost the effect of turning 2021 into a consolidation year.

That has certainly been the case for Zoom Video (ZM) and Teledoc (TDOC).

Management indicated that revenue won’t be growing at the same pace as last year, but readers shouldn’t stress because this lack of pace doesn’t suggest anything is wrong with the business model.

As long as Shopify sustains a growth rate of over 40% for the next few years which is easily attainable for a company accruing only $3 billion of revenue per year, the stock will go up.

That will surely happen, and I am guessing they can maintain a 50% growth rate.

Once the lower growth rates are digested, I envision this stock turning the corner and will rise to $1,800 by the middle of 2022.