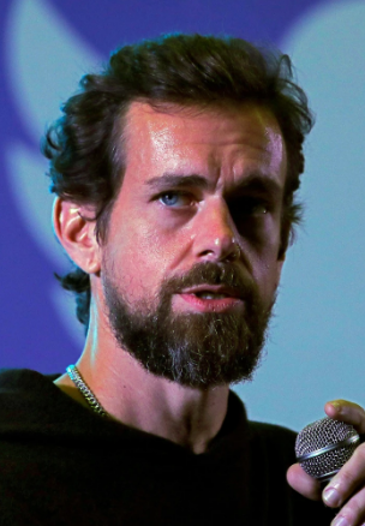

“You don't have to start from scratch to do something interesting.” – Said Co-Founder and CEO of Twitter Jack Dorsey

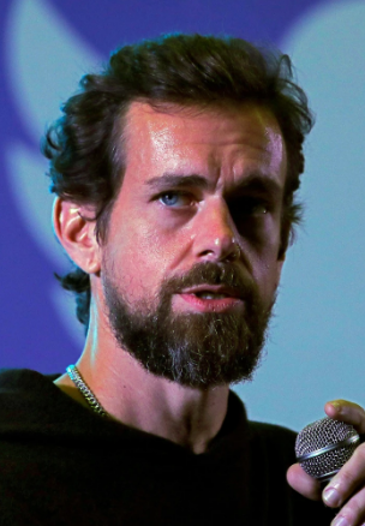

“You don't have to start from scratch to do something interesting.” – Said Co-Founder and CEO of Twitter Jack Dorsey

Mad Hedge Technology Letter

September 1, 2021

Fiat Lux

Featured Trade:

(DOOM AND GLOOM FOR THE PANDEMIC TECH DARLINGS)

(ZM), (TDOC), (DOCU), (FSLY)

Zoom (ZM) shares are getting crushed today — down around 17%.

This tanking might even signal the event that as a society, we are done with this public health crisis, at least the shelter-at-home darling tech stocks are and will be down in the dumps for the short-term.

I have to give it to the company that Eric Yuan built.

He simply had better video technology than others at the time and was ready to roll it out when everything closed down — a perfect intersection of opportunity and preparation.

The first-mover advantage meant something, but that didn’t mean it was going to be the x-factor, and this massive sell-off has a little bit of the feeling that Yuan has given that advantage all back in one go.

This first-mover effect gives management time to figure out how to stay ahead of the game whether that means moving in a different direction or doubling down on the thing that got them there in the first place.

Zoom failed.

The tepid forecasts are also bad news for the other tech darlings of 2020 like DocuSign (DOCU), Teladoc (TDOC) and I would even lump Fastly, Inc. (FSLY) in there too.

It’s highly likely that these companies have peaked and will never see a conflation of bullish tailwinds that supercharges their business models ever again like in 2020.

They will just need to ride the solo secular tailwind of the pivot to digital migration which is ok, but not a supercharger.

I mean come on! Zoom is a video conferencing software company and that’s all they had going for them; they are still a video conferencing software company.

There is only so much that can do for them.

They would have had to move mountains to reboot its growth rates.

History will likely agree with me that Zoom was just a one-hit wonder and there’s no second hit coming from any album in the future.

That’s not a bad thing if you own the company, that one great year made the founder Yuan massively rich. Well done to him.

However, buying Zoom at the peak of the pandemonium at $560 will prove to be an expensive mistake.

If it ever does rise above $560 again from the $290 today, it will take 3-5 years and that opportunity cost incurred will be painful when there are so many other alternative tech stocks besides Zoom shares.

Revenue increased by 54% year over year in the quarter and in the previous quarter revenue had grown 191%.

Next quarter, Zoom is guiding to 31% growth.

The company has stuck with what it does best — video conferencing software while many other companies have raced to deploy their own Zoom copies.

The earnings weren’t all that bad with gross margin widened to 74.4% from 72.3% in the previous quarter.

Also in the quarter Zoom announced the availability of Zoom Events, which gives organizations the ability to hold premium online meetings. And Zoom said it invested in event software maker Cvent as Cvent sought to go public through a merger with a special purpose acquisition company.

Zoom now has 2 million seats for the Zoom Phone cloud-based phone service, up from 1.5 million three months earlier.

The company increased its forecast for the year as coronavirus case counts have increased, including from the Covid delta variant, and some companies delayed plans to reopen offices.

“What we’re seeing ... is headwinds in our mass markets, so these are individual consumers and small businesses. And, as you say, they are now moving around the world. People are taking vacations again, they’re going to happy hours in person,” Said Zoom CFO Kelly Steckelberg.

This roughly translates into an admission that Zoom will never do as well as it did during the pandemic.

And if you want to create a tier of “premium” meetings, they are still meetings with a glossier title — it doesn’t move the needle one millimeter.

Acquiring an events software maker is incredibly underwhelming — sounds like a niche company becoming even more niche and what investor wants to hear that?

Why not go for a cocktail party events software platform next?

We are just in the early innings of people taking vacations around the world and that will accelerate as overseas gets its handle over the delta variant which is looking like this winter to next spring.

I am also planning my Vietnam on a motorbike vacation when they finally open back up like many others.

I would also like to point out that tough comparable numbers are an issue faced by almost every tech company, not just Zoom, but tech companies like all the FANGs.

The key here is that FANGs have more than just a shelter-in-place business and have hit the ball out of the park on earnings plus more.

In fact, the re-opening of the US economy has shown that other tech companies can’t compete with the behemoths, they might as well get acquired by them.

Even with a massive first-mover advantage, the speed at which the likes of Microsoft and Apple move to smother anything like a DocuSign is lightning quick.

The fact that the likes of Zoom are one-trick ponies is really the death knell to them and why I advocate selling themselves to a tech company that can do more with them.

The little time they had to move in a different direction was wasted in just buying a few more data centers, a marginal events software company, adding “premium” meetings, and by and large, accepting the status quo which is just not good enough when there are a bunch of 800-pound gorillas in the room.

Ultimately, Zoom forecasting 31% of revenue growth next year is pitiful and a massive let down, it honestly might as well have been -31% growth.

This stock is going to have to solve itself out in the short-term and is it worth getting into Zoom long term when others can figure out video conferencing so easily?

The moat around the castle has been removed and the enemy is at the gate.

Zoom had a chance to run with the momentum but their stagnant ideas are coming back to haunt them where it hurts — the stock price.

I would put this one on the backburner even if there is a good chance for a dead cat bounce or 2 in this stock short-term and that goes for the rest of the shelter-in-place tech stocks.

“In business, speed is everything.” – Said Founder and CEO of Zoom Video Eric Yuan

Mad Hedge Technology Letter

August 30, 2021

Fiat Lux

Featured Trade:

(A GREAT ALTERNATIVE IN THE AD TECH SPACE)

(SNAP), (AMZN), (FB), (GOOGL), (SDC)

I know many readers gripe about certain tech stocks being too expensive like Google (GOOGL), Facebook (FB), or even Amazon (AMZN), but that’s not the case for all high-quality tech names out there.

There are still deals to be had.

An undervalued tech name in the same industry, albeit more diminutive than the three I just mentioned, is ad revenue platform Snap Inc. (SNAP).

Their story is a good one and their revenue model appears to be maturing at an optimal time while still exhibiting many elements of explosive growth.

To see what I mean — Snap grew both revenue and daily active users at the highest rates they have achieved in the last four years.

Daily active users grew 23% year-over-year to 293 million — expanding revenue by 116% year-over-year to $982 million.

This outperformance reflects the momentum in SNAP's core advertising business and the positive results of their team serving ad partners helping them to generate a return on investment.

SNAP benefited from a favorable operating environment and continued success with both direct response and large brand advertisers — continue to leverage performant ad products to grow an advertiser base globally.

Adjusted EBITDA improved by $213 million compared to last year, marking the third adjusted EBITDA profitable quarter in the last 12 months as SNAP continues to demonstrate the leverage in their business as they scale.

They are also fully absorbed in making progress against revenue and Average Revenue Per User (ARPU) opportunities, which I believe will be driven by three key priorities.

First, driving ROI through measurement, ranking, and optimization.

Second, investing in aggressive sales and marketing functions by continuing to train, hire, and build for scale.

And third, building innovative ad experiences around video and augmented reality, with a focus on shopping and commerce.

The commitment to these three priorities, along with a unique reach and large, engaged community, allows SNAP to drive performance at scale for businesses around the world.

They have proven through results in North America that with a robust team, surrounding resources, and a local focus, they can accelerate revenue.

They are now taking that model and replicating it in several markets that they have identified as having a large digital advertising market and significant levels of existing Snapchat adoption.

It’s true to say they still have a lot of room to grow in some of the world's most established ad markets outside of North America, especially in Europe.

For example, in the UK, France, and the Netherlands, SNAP reaches over 90% of 13- to 24-year-olds — 75% of 13- to 34-year-olds.

SNAP continues to invest heavily in video advertising, with the goal of driving results for advertising partners and connecting them to the Snapchat Generation.

For example, SNAP worked with Nielsen to help U.S. advertisers understand how to more efficiently reach their target audiences via Snap Ads.

The Total Ad Ratings study analyzed how over 30 cross-platform advertising campaigns reached people on both Snapchat and television.

The analysis showed that Snapchat campaigns contributed an average of 16% incremental reach to advertisers' target audiences, and over 70% of the Gen Z audience that was reached by Snapchat was not reached by TV-only campaigns.

This is especially important as people are increasingly cutting the cord, and mobile content consumption continues to grow, presenting SNAP with a large opportunity to help advertisers reach the Snapchat Generation at scale.

Augmented reality advertising is delivering a return on investment that is measurable and repeatable, which is encouraging the incremental businesses to invest in AR.

For example, Smile Direct Club (SDC) leveraged a Goal-Based Bidding Click optimization for Augmented Reality (AR), which drove 49% of Snap customer leads in Q2 and was the most effective ad unit at driving traffic for their business compared to other social channels.

The success of the Lens ultimately encouraged Smile Direct Club to include AR Lenses as part of their long-term business strategy.

SNAP is betting the ranch on efforts to help advertisers improve conversions and ROI, and recently launched optimization for AR, which allows advertisers to optimize their AR campaigns for down-funnel purchases and fits well into the broader shopping strategy.

SNAPs bread and butter region of North America is hitting on all cylinders with revenue growing 129% year-over-year in Q2, while ARPU grew 116% year-over-year as they continue to benefit from significant investments made in sales teams and sales support in the prior year.

At a 30-thousand-foot level, the global internet services market was valued at over $450 billion in 2020, the year in which the pandemic fundamentally altered how society functions, accelerating a push towards digital offerings.

The internet market is expected to grow at a compound annual growth rate of 5% through 2027 and reach a value of $652 billion. US-based equities presently control close to 30% of the total global market share in the industry.

My takeaway from this is that even though there is GOOGL and FB in this space, the pie is growing so fast that there is easily room for others like SNAP.

One must believe that if SNAP keeps operating anywhere close to its pandemic performance relative to other companies, they are surely guaranteed to be a buy-the-dip company.

In terms of price action, that’s exactly what we have witnessed as the price has zig-zagged up by 300% — the stock price goes two levels up and retraces back one — rinse and repeat.

Just view the big down days as optimal entry points into a burgeoning social media platform and deploy capital.

In the short term, on the monetization side, I have to note that the fiscal comparisons will be more challenging in the second half as SNAP begins to lap the acceleration in top-line growth that they experienced in the prior year.

Once that sell-off gets baked into the equation via a 3-5% sell-off, readers should jump back into SNAP.

“It's not about working harder; it's about working the system.” – Said Co-founder and CEO of the American social media company Snap Evan Spiegel

Mad Hedge Technology Letter

August 27, 2021

Fiat Lux

Featured Trade:

(THE NEW NORMAL)

(QQQ)

So now it’s gonna be 2 years — that’s right — the work from home world is here to stay!

And I’m not talking about just Asia being in the early innings of a disastrous delta variant explosion.

Many managers had 1 year baked into the pie, but have we come to terms with the expectations that this work from home thing is here to stay?

Ostensibly, companies will never be able to get workers to come back to the office, then after 2 years, we will be too far down this road to make a U-turn.

Then as the delta variant breathes down our neck, will this turn into year three or four and so on with all the different variants down the pipeline.

Just in the last few years, several European offices allow heat days in the summer which offer workers remote working possibilities when cities sound off official heat warnings.

Some European cities usually deliver excess heat warnings if the mercury surpasses 95 degrees which is usually in June and July and the amount of these days are rising.

Japan might have to start giving mudslide, typhoon, or torrential flooding remote work days if we really want to go deeper in the weeds.

This is just where nature stands today versus how we work from a computer.

Many tech companies might see a 99% attrition rate if the managers move boldly and recall staff for in-person 5 days per week toiling and sharing the same oxygen within the same four walls as their coworkers.

One of the biggest takeaways from the pandemic after the initial uncertainty is the handoff of power back to labor which hasn’t happened in American capitalism for 50 years.

American capitalism has been crushing labor laws as long as I can remember from lacking of maternity and paternity leave to destroying unions and the list goes on.

If you’re a simple worker, you know you finally have options!

That is raising concerns among executives who have historically ruled with an iron fist and aren’t used to workers acquiring negotiating clout.

Remember in Europe, many companies require a 3-month resignation notice after 5 years of work instead of the quick 2 weeks in the U.S.

In France, it’s almost impossible to get yourself fired.

Return dates have been postponed repeatedly. Tech companies such as Amazon and Facebook have pushed them to early next year.

Lyft said it would call employees back to its San Francisco headquarters in February, about 23 months after the ride-sharing company first closed its offices.

Already, many employees are “bombarded” with messages from recruiters and friends, attempting to lure them elsewhere, and there are jobs galore!

10 million to be precise.

Managers want workers back in the office because they say there is a broader sense of connection and familiarity to the platform, to the culture of the organization—to me, this means they love controlling workers, period.

Many surveys have shown that productivity of working remotely is significantly higher than working in the office where introverted workers are bombarded with uncomfortable office politics and extroverted colleagues’ bravado. Not to mention that many companies like to have meetings to plan the next meeting and the hours of commuting that exhaust workers.

Even if 40% of workers are introverted, it would make sense to rollout a full remote workforce because the totality of the remote work is a net benefit over in-person work for the entire staff.

Perceptions of remote work have shifted as the pandemic spiraled out of control.

When professional services giant PricewaterhouseCoopers LLP surveyed employers across the U.S. in June 2020, 73% of respondents said they deemed remote work successful. By January 2021, when PwC released updated data, that figure rose to 83%. Now, more workers also say they want to stay at home full time. In new data released by PwC on Thursday, 41% of workers said they wished to remain fully remote, up from 29% in the January survey.

That doesn’t mean offices can’t have a once per quarter team bonding activity, but the verdict is clear, workers like waking up never to leave their house and get paid for that lifestyle.

The bigger deal now is workers are busy brainstorming how to upgrade or upsize their remote offices to become even more efficient.

They are even thinking how to upgrade their coffee and tea game, personally, I love my Made in Italy Bialetti stovetop espresso maker.

It hits the spot with high quality Arabica coffee beans.

On a personal level, if a company does commit to the in-person faux pas, I am in favor of only in-person every other month and the in-person portion should only be a maximum of 2 days per week that aren’t Monday or Friday.

That’s how little negotiating leverage managers and bosses have these days — I just don’t see how they can push the narrative more than that.

Also, if they want 5 days per week of in-person work, they will have to pay extra to get what they want and that’s not including the hike in salaries that have happened because of the recent inflationary pressures.

Ultimately, there is possibly no way to justify full in-person work in 2021 for a company that can function without it.

And think about it, any company searching to expand a workforce with 100% in-person work will be viewed as a company that has more red flags than a Chinese communist parade.

And I haven’t even talked about the disgust for people ditching their business casual clothing to work in their pajamas, then forcing them to clothe up again.

What a kick in the teeth!

There’s a whole host of reasons we haven’t even mentioned yet like young mothers who must consider a young child and proper child’s care or a worker who is tending to an elderly relative daily.

We can’t just sweep all this under the rug like we used to — these are real issues we must grapple with.

What does this mean for the Nasdaq index that the Mad Hedge Technology Letter predominately follows?

It goes higher.

It means we are fully reliant on tech for longer and this will seep into the share prices.

A broad swath of companies will benefit from this, and the bigger will get bigger because of the network effect.

Another year of this will solidify tech ecosystems and digital infrastructure will become better and stickier.

Companies like Google, Apple, Microsoft will bask in the glory of being highly desirable companies with earning accelerated revenues while stationed at the avant-garde of the U.S. economy.

And in the winner-takes-all tech economy, everyone else is second.

THIS IS THE NEW NORMAL!

“When something is important enough, you do it even if the odds are not in your favor.” – Said Founder and CEO of Tesla and Neuralink Elon Musk

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.