“A founder is not a job, it's a role, an attitude.” – Said CEO of Twitter Jack Dorsey

Mad Hedge Technology Letter

August 16, 2021

Fiat Lux

Featured Trade:

(HOW TO BE A TECH ANGEL INVESTOR)

(FB), (PINS), (LYFT), (TWTR), (BTC)

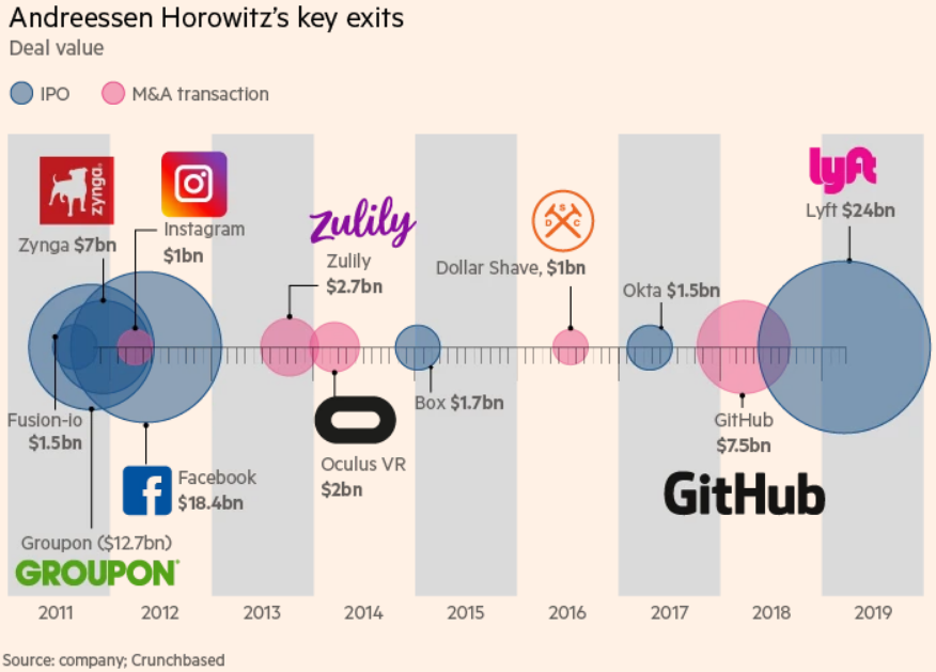

It’s not easy to be the genius who doled out early seed money to Facebook (FB), Foursquare, GitHub, Pinterest (PINS), Lyft (LYFT) and Twitter (TWTR), among others.

These investments turned out to be highly successful. If someone even miraculously hit on one of these, your grandchildren would know about it.

This person even acquired a majority stake in Skype for $2.75 billion which was considered highly risky at the time and offloaded it to Microsoft in 2011 for $8.5 billion.

Not everyone can do this like Silicon Valley tech investment maestro Marc Andreessen.

Behind the public markets is angel investing and the data says that these investments fail over 50% of the time for the best of breed like Andreesen.

There are simply too many variables that can derail these profit models which nobody can predict.

To lose over half the time and claim to be an outsized winner means relying on those 10 or 100-baggers or might I even say 1,000-baggers to drag up the portfolio performance.

These are the guys who were buying bitcoin (BTC) at 10 cents on the dollar.

Truthfully, investing in startup companies is not for everyone considering there is over a 50% chance a company will end at a 0 or pennies on the dollar.

However, it can be highly gratifying if and when the investments do pay off and investors get a front seat to the forefront of the tech innovation cycle, which you simply don’t get by trading Facebook and Google from your Fidelity account on your computer screen.

These investors can also get direct access to the chatter while creating a rich network of tech know-how; and I do believe that’s half the value in it too, since it can propel angel investors to the next super app or guy behind the next super app.

I mean who could have ever predicted a global health crisis that’s going into its 3rd year soon? And who will be able to nail the knock-on effects of climate change.

That is why risking losing one’s shirt is a real possibility if they bet the ranch on an unknown entity.

Everybody wants the next Tom Brady to quarterback their team, but who knows who the next Tom Brady is at 18 years old?

Even though Andreessen hits on less than 50% of his ideas, the industry median is around 17%, showing how superior his performance is.

He definitely has this thing figured out on relative terms.

Let’s define Angel Investor.

An angel investor is a high-net-worth individual who provides financial backing for small startups or entrepreneurs, typically in exchange for ownership equity in the company.

The funds that angel investors offer could be one-off investments to help the business get off the ground or in drip injection form to support and carry the company through its difficult early stages, which means burning cash.

Most of these companies don’t make money for the first 10-years and that time is usually a referendum on the quality of the idea; very few stand the test of time.

The potential to make 100-baggers is out there with subsectors like fintech already worth half a trillion dollars in 2020 and with a predicted annual growth rate of 35%.

Angel investors typically require a 35-40% return on the money they invest in a company minus costs and inflation to call it a winner.

But Venture Capitalists may take even more, especially if the product is still in development. For example, an investor may want 50% of the business to compensate for the high risk it is taking by investing in a startup.

Angel investors do the jobs of banks.

Traditional banks would never lend to an entity based on a half-built product or even a genius idea.

Proof of income and debt to income ratios are realities at banks.

When net profits are negative, the balance sheet is too ugly for banks to even think about doing any business with these startups.

Therefore, there are limited pathways for entrepreneurs to find capital, and many turn to Angel investors to help startups take their first steps.

Who Can Be an Angel Investor?

Angel investors are normally individuals who have gained "accredited investor" status, but this isn’t a prerequisite. The Securities and Exchange Commission (SEC) defines an "accredited investor" as one with a net worth of $1M in assets.

Essentially these individuals both have the finances and chutzpah to provide funding for startups. This is welcomed by cash-hungry startups who find angel investors to be far more appealing than other, more predatory, forms of funding.

These private funds usually draw up opportunities for a defined exit strategy, acquisitions or initial public offerings (IPOs).

Liquidity events is what makes everyone happy at the end except for the investors who missed the boat.

It’s even possible that an angel investor only sees growth in the first 5 years and unloads the “idea” to another private investor for a profit.

Private market deals are common because of the excess of liquidity brought on by the U.S. Central Bank lowering interest rates for a prolonged amount of time.

What I do know is that America is the framework within which almost all unicorns prosper, and I do not envision any monumental shift to Europe or China, these other places simply have more problems than the U.S.

How does the normal Joe get it on the action?

Andreesen has said the only way he usually does business is with a “warm” introduction which can be hard to come by if one doesn’t rotate in the same social circles as these heavy hitters.

Scoring a warm introduction also means getting boots on the ground in California which is ebbing and flowing between its colossal wildfires and public health issues like many other places.

Honestly speaking, if might be difficult to get the best of the best angel opportunities even if the gunpowder is loaded.

It’s accurate to believe that probably guys like Andreesen get the best of the best ideas in front of them and if they pass on it, the likes of Sequoia, Benchmark, and Softbank have very smart people as well who get similar type of presentations and opportunities.

Like you correctly guessed, this private group of capital is quite incestuous and tight-knit. It’s a copycat league of the ages.

The one avenue that might be of interest is a platform that has democratized angel investing who on the last count had close to 1,000 companies looking for start-up capital.

This platform is called https://angel.co/angel-investing and some are even actively hiring on the same platform.

I won’t stand here saying this is the cream of the crop because it’s not, but I will say that sometimes companies are overlooked, or the industry consensus has shifted too far in one direction offering undiscovered dark horses a chance.

Lastly, this forum of angel companies on offer does give analysts insight into where money is funneled to and the current hot sub-sector of the tech industry.

This platform even offers an Angel index fund if a reader wants to take the aggregate performance of 150-200 companies with a $50,000 minimum.

If a reader wants access to facilitate angel investing by a deal-by-deal offer from the Angel list as a professional investor, then $500,000 is required.

“In the startup world, you're either a genius or an idiot. You're never just an ordinary guy trying to get through the day.” – Said Venture Capitalist Marc Andreessen

Mad Hedge Technology Letter

August 13, 2021

Fiat Lux

Featured Trade:

(ARE THE WHEELS FALLING OFF THE CHIP INDUSTRY?)

(MU), (SK HYNIX), (NVDA)

Is the chip industry about to freeze over?

Signs are creeping in of a cyclical downturn in memory chips starting in the first quarter of 2022.

This is all brought about by cycle indicators signaling that we are shifting out of 'midcycle' to 'late-cycle' for the first time since 2019 and this phase change has historically meant a challenging backdrop for forward returns.

The investments have been pouring in from chip companies to build more foundries and to improve chip performance.

Incrementally, new supply will eventually come online to address the giant chip shortage that many industries are grappling with.

However, I will say that whispers of an imminent collapse in the chip dynamics are exaggerated at best.

I don’t believe that the next cyclical downturn begins from Q1 2022 exacerbated by inventory builds.

We are still far from that happening even if the chip environment has tensed up more so now.

Micron (MU) has said that the order-filling time for chipmakers now exceeds 20 weeks.

The order-filling time represents the period from ordering a semiconductor to receiving it. That metric added on more than eight days in July, putting the total at 20.2 weeks.

Businesses from automakers to consumer-electronics companies are suffering from the chip shortage. Carmakers are expected to miss out on $100 billion in sales due to the lack of critical components.

Another industry-wide headwind is the UK's possible blocking of Nvidia’s (NVDA) planned $40 billion acquisition of Arm Holdings over national security issues.

A possible downturn in the chip cycle would also mean heavyweight South Korean memory-chip maker SK Hynix will severely underperform as well.

There are forecasts of contract prices for memory chips used in personal computers that decline by as much as 5% in the December quarter from the September quarter.

The PC market is only 20% of the DRAM market. Smartphone DRAM accounts for 40% of the market and server DRAM is 30% of the market. Miscellaneous device markets make up the remaining 10%.

Therefore, it is safe to say that not all the eggs are in one basket.

However, an analyst downgrade has set the tone for all makers of dynamic random access memory chips and puts the onus on the entrenched to prove the supposed downturn is not the case.

A world in which all relevant companies have hoarded chips because of the fear of not be able to source the right chips would be a transitory issue.

I don’t see demand falling off a cliff.

Many of these DRAM companies have moats around their business models and the case of businesses snapping up a high volume of chips and their inventories peaking out is a problem many companies would love to have.

As we progress into 2022, companies will start to plan their next iterations of devices and gadgets, and no doubt the next generation will need at least 50% more high-performing chips compared to the last version.

The pricing pressure is almost analogous to what happened with lumber prices and builders started buying at whatever prices during the short squeeze earlier this year.

This doesn’t mean the housing industry is doomed, but I understand it more as moderating prices will be a tailwind for the overall health of the industry.

Chips are famous for that boom and bust dynamic.

The price gains in chips cannot be absorbed in the same rate and as prices moderate, companies will start to look at acquiring the next batch of chips even if inventory is high.

In the short term, chip stocks are on course for a short correction that could take around a quarter to digest, but I highly doubt this will last into next year.

The 30,000-foot view shows us that many chip firms are enjoying record demand for their best chips driven by cloud customers’ capital expenditures, and even upside from the popularity of cryptocurrency-related chip products.

Demand is everywhere to be found.

The leading-edge manufacturers will take this dip in stride and adjust for the new environment in 2022.

Lower pricing expectations is something that nobody wants to hear as a chip CEO and absorbing a more challenging pricing environment into 4Q does not beat price spikes.

It gets lost that DRAM prices increased 35% over the past two quarters, with expectations for a “further modest increase” through the end of this year.

The industry can afford a little reversion to the mean pricing and shareholders will mostly stay in these stocks long term.

I understand that this dip in chip shares like Micron caused by moderation of pricing power translates into a great entry point into the stock for new buyers.

Quite quickly will investors start to shrug off this negative element to the industry and pile back into premium names or just stick with Nvidia who doesn’t sell DRAM chips.

“A founder is not a job, it's a role, an attitude.” – Said Founder and CEO of Twitter and Square Jack Dorsey

Mad Hedge Technology Letter

August 11, 2021

Fiat Lux

Featured Trade:

(HIGHER HIGHS FOR THE NASDAQ?)

(UBER), (DIDI), (BABA), (COIN), (HOOD), (SFTBY)

The blowback from the Chinese tech crackdown has been quite tough to take for Softbank (SFTBY) because of the decision to maneuver deeply into Chinese tech shares.

It looked good at the time, as China was the center of every Wall Street analyst’s growth proposition short and long term.

However, troubles in China crystallize the massive shift of deglobalization and many investment funds are finding a new world as we turn the page.

Gone are the days when aggressive investors could just dabble in all sorts of exotic markets believing that globalized forces would be a wind at its back.

So much so that nobody ever batted an eye if you told them you had investment theses playing out in Mongolia or Brazil.

Emerging markets are blowing up and now even the passport with which you do business has never been more prominent.

Rich countries are going the way of Europe – that of intense and mind-numbing regulation to make up for a shortage of tax revenues to pay for these costly programs.

The global canary in the coal mine can be traced back to Alibaba’s founder Jack Ma effectively being muzzled by the Chinese Communist Party. This was the nail in the coffin for the China story as it relates to foreign money waterfalling in the Middle Kingdom.

That’s the end of it.

Softbank will need to go back to the drawing board and probably pluck China off the board as top dog and reset their draft board.

The pain is now being found in Softbank’s balance sheet with net profit down 40%.

Let’s look at some of Softbank’s investments which include Chinese e-commerce giant Alibaba (BABA), car-share giant Didi Global (DIDI), and short-video app TikTok owner ByteDance Ltd.

Around 35%-40% of Softbank’s investments are tied up in China and its net profit is down to 761.5 billion yen, equivalent to $6.9 billion.

The incremental buyer has dried up and Softbank is now saddled with an illiquid Chinese tech portfolio they can’t get rid of.

Softbank founder Mr. Son said that SoftBank’s shares have fallen so low that the price is now only around half of the value of the company’s assets, after subtracting debt. Given that discount, SoftBank will unveil more share buybacks at some point, and is now discussing the timing and size.

He also said that SoftBank will continue the furious pace of investment at Vision Fund 2, which has stakes in 161 companies and has been funding startups at a rate of nearly one per day in recent months.

SoftBank’s new investment in pharmaceutical company Roche Holding AG signals that the Japanese company might resort to safer stocks with stable free cash flow.

Compounding the situation might be that Softbank feels that they have been burnt by tech investment one time too many.

The ripple effect of China tech going down affects their assets as a whole and have concluded that the balance sheet needs trimming and re-upping.

Even if Softbank can find some balance sheet rejuvenation - they no longer feel they can take these extraordinary tech risks that achieve high beta which is required to satisfy investors.

Overall, we could be dealing with a dearth of real, legitimate tech opportunities in proven business models which could be a reason for Softbank rotating into sectors like pharmaceuticals.

No doubt I believe they will keep their eye out for tech opportunities, but they aren’t set on it from the beginning like the past 2 decades.

Or perhaps, this could be the segue into riskier investments than before - remember Uber (UBER) was a company that no VC wanted to touch with a 10-feet pole and Softbank took it on and made a lot of money. but where is the next Uber after Uber?

It's possible that there are no real, transformative companies in the pipeline after the Coinbase (COIN), Robinhood (HOOD) IPOs, these investments usually take 10-20 years to take profits from the initial seed funding.

It could also signal further advancements into the derivatives market with the company looking for leverage bets instead of holding vanilla equities and standard ETF index funds.

Their foray into derivate exposure gave them the nickname the “Nasdaq whale” when the company bought a torrent of call options profiting in the billions from the tech lurch up.

Even retail traders have gotten into options with their profit possibilities which are able to surpass any equity trade that only have a 2:1 leverage ratio.

Softbank could be finding tech too overvalued and looking to jump short-term into another industry almost like a day trader, although tech, for them, is something that is a long-term core objective.

We can analyze this whichever way we want but its meaning is clear – the low hanging tech fruit is gone, and it will be harder to fight for your crust of bread even much so that the Nasdaq whale is looking into morphing into the S&P whale or a different type of whale all together.

I can tell you that deep down in the weeds as a trader, I am seeing a rapidly evolving rotation that has rewarded cyclicals that are back from the dead and financials that are breaking out benefiting from the massive amount of stimulus deposits.

We need to acknowledge that the consumer is currently in the best health of our lifetime because of the free payouts, PPP loan forgiveness, and other goodies. And that doesn’t necessarily mean that tech will go up in the short-term as we skim all-time highs.

Technical charts still look positive for tech, but it is true that the sector has cooled off even if the trend will be higher long-term. It’s getting that much harder to eke out higher highs in the Nasdaq.

“Don't chase a girl, let the girl chase you.” – Said Founder and CEO of Softbank Masayoshi Son

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.