Mad Hedge Technology Letter

December 13, 2024

Fiat Lux

Featured Trade:

(THE AI TRAIN KEEPS CHUGGING)

(DELL), (AAPL), (NVDA)

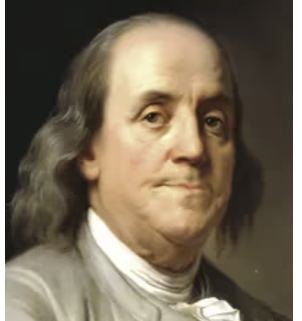

If anyone needs another AI data point, the tech market just delivered us a juicy one with an outstanding earnings call with Broadcom (AVGO) and its CEO Hock Tan.

The AI enterprise build-out has been developing in full-force and investors are pouring money into the foundation of the AI future.

That is currently where the AI profits currently lie.

The software companies have missed out on that profit in the short-term, but since many are also involved in the AI infrastructure spend, they can turn to their investors and ask for a mark-up in owned shares.

This won’t always be the case, and I do believe we are fast reaching an inflection point where shareholders will demand more from their capital and not just more AI data centers and more modern AI semiconductor chips.

I am talking about meaningful revenue growth directly tied to AI spend – we don’t have that yet.

At some point, there needs to be an application from all of this money spent and return on capital.

In the meantime, Mr. Market is cheering the success of AVGO and the stock is up 25% today at the time of this writing signaling investors will continue to back this AI infrastructure spend into 2025 and possibly beyond.

Broadcom CEO Hock Tan said the company expects its custom AI chips will generate between $60 billion and $90 billion in revenue over the next three years from its three existing hyperscaler customers, whom the company did not name. Tan reiterated his belief that each of the three hyperscalers will deploy 1 million clusters of its custom AI chips called XPUs by 2025.

Apple is reportedly working with Broadcom to develop an AI server chip. The move by tech giants to make their own server chips is meant to cut costs and scale back their reliance on Nvidia’s (NVDA) GPUs (graphics processing units).

That trend is reflected in the industry at large. The AI chip market is set to grow 74% in 2025, while the semiconductor market overall is projected to grow just 12% next year.

We are seeing this type of binary divergence in tech firms like Dell and Oracle.

Many of these legacy tech companies are attempting to wean themselves from a legacy business that is expanding in the low single digits.

From a technical perspective, any dip to the $200 level will be a strong buy for AVGO.

I believe they continue to pivot into the AI infrastructure build while partnering with companies that can aid this type of success.

They will continue to invest in products related to AI, mainly chips, which will be installed in a wide array of businesses like data centers, consumer electronics like smartphones and laptops, and electric vehicles.

AVGO has been a hot company for quite a while, and even though not quite an Nvidia, I do believe AVGO stock is a solid backup option for tech investors looking for some diversification.

Mad Hedge Technology Letter

December 11, 2024

Fiat Lux

Featured Trade:

(OPTIMISTIC FUTURE FOR GOOGLE)

(GOOGL), (AAPL)

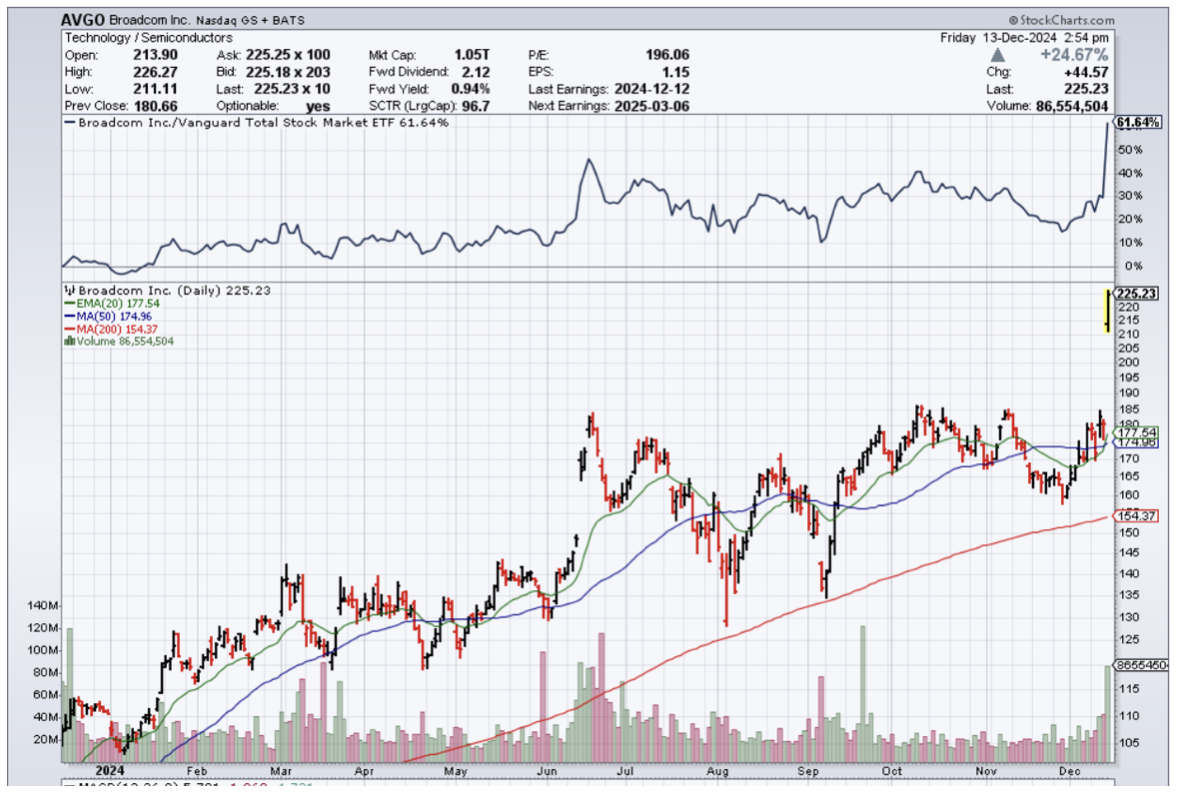

It isn’t a surprise that the Department of Justice is going after Google (GOOGL) to divest its Chrome browser following a ruling in August that the company holds a monopoly in the search market.

I don’t believe this will tank the cash cow business of Google Search, and let’s not forget the most likely outcome is that Chrome is retained as a division of Google.

At worst, if it does get divested, the appeal process takes many years.

Although I do believe it will become harder for Google Search to track and monitor user behavior without Google Chrome, this is by no means a deal breaker.

Plenty of traffic comes from completely different operating systems like Apple (AAPL) iOS that don’t employ the Chrome browser.

In fact, spinning out its browser would result in a massive windfall because the current setup hides the aggregate value and synergies within a larger corporation.

Once Google Chrome is spun out, animal spirits could take hold, and the value could skyrocket.

Google will naturally profit from this as well.

Chrome, which Google launched in 2008, provides the search giant with data it then uses for targeting ads. The DOJ said in a filing that forcing the company to get rid of Chrome would create a more equal playing field for search.

The DOJ said that Google will be prevented from entering into exclusionary agreements with third parties like Apple and Samsung. The department also said that Google be prohibited from giving its search service preference within its other products.

Search advertising accounted for $49.4 billion in revenue, representing three-quarters of total ad sales in the most recent period.

The DOJ’s request represents the agency’s most aggressive attempt to break up a tech company since its antitrust case against Microsoft, which reached a settlement in 2001.

In August, a federal judge ruled that Google holds a monopoly in the search market.

Also, the DOJ suggested limiting or prohibiting default agreements and “other revenue-sharing arrangements related to search and search-related products.”

The most likely outcome is that Google will be legally forced to do away with certain exclusive agreements, like its deal with Apple. I also don’t believe that Google will be forced to divest from the Android operating system, and the chances of that happening are almost zero.

Even without an exclusivity agreement, most Apple users use Google Chrome because it is still the most useful search engine.

Will that be the case in the future?

With AI changing business models left and right, it is hard to say, but in the interim, it is hard to believe that a lack of exclusivity agreement will cause any meaningful change to the bottom or top line in the next few years.

Breaking up parts of Google would result in a massive windfall for shareholders, strengthen the tech ecosystem, and make Google and its spinoff entities more competitive.

However, high-up executives are wary about voluntarily dumping revenue from the mothership because it hurts negotiating leverage when agreeing on future compensation, and that is what usually standalone corporate executives care about.

I believe spinning out some of these businesses, like Waymo, Google devices, Google Maps, and YouTube, would be great for America and give an opportunity for investors to jump into great tech companies before they skyrocket.

“You want to be the pebble in the pond that creates the ripple for change.” – Said CEO of Apple Tim Cook

Mad Hedge Technology Letter

December 9, 2024

Fiat Lux

Featured Trade:

(CHINA AND NVIDIA AT LOGGERHEADS)

($COMPQ), (NVDA)

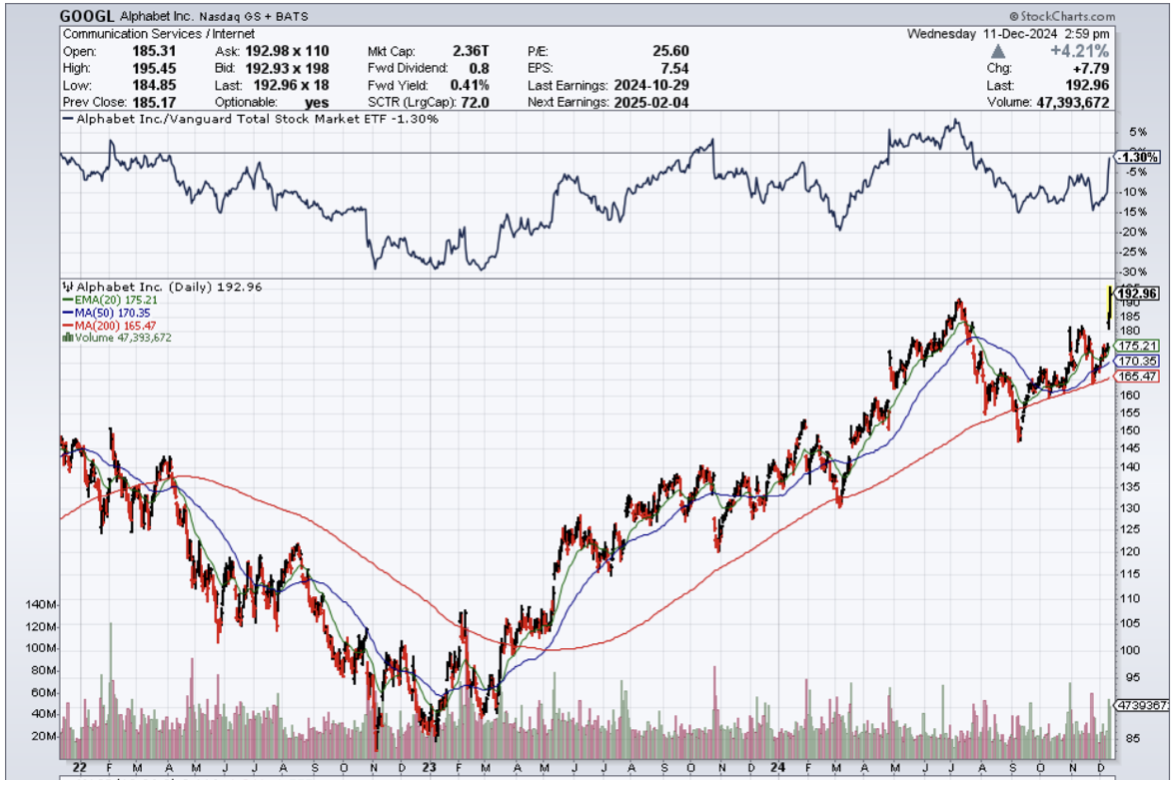

Claiming Nvidia (NVDA) is stunting competition is just the beginning of the end as the tech war between China and the United States heats up again as we get prepared for a new administration to take over the White House.

This appears like a strategic shot across the bow and instead of just talking tough, China is throwing up a pre-emptive attack to counter whatever is in store for them past 2024.

Technology has been a national issue for some time and the follow through has been quite robust as China has bulldozed their way to corner the EV market with national champion BYD.

China is doing well in tech, but understands their tech sector cannot co-exist with Silicon Valley in the long term.

The probe is aimed at Nvidia's practices regarding possible anti-monopoly violations. It is also set to examine its 2020 acquisition of Mellanox, a purchase that was approved by China's State Administration for Market Regulation under the condition that the chipmaker would avoid discriminating against Chinese companies.

According to a Chinese media report, the government believes Nvidia’s $7 billion purchase of the Israeli computer networking equipment maker may have violated Beijing's anti-monopoly rules.

The U.S. has amped up restrictions on chip sales to China in recent years, barring Nvidia and other key semiconductor manufacturers from selling their most-advanced artificial intelligence chips in an effort to limit China from strengthening its military. The company has worked to create new products to sell in China that abide by the U.S. regulations.

I remember the golden years in China where growth was unwavering and every recent American college graduate would jump at the chance to make a career in China.

China, along with many other rich Western countries, have hit a wall with growth models that are delivering diminishing returns.

Asia is struggling and there is no other way to describe it.

The United States continues to power through with the top income bracket and enterprise money propping up the rest of the market and minting millionaires through higher tech stocks.

Nvidia is the jewel of America’s recent success and they promise to bolster Americas claim as the flag bearer of the AI movement. The loser would be zero sum and that loser would be China.

Threatening the best in show of American tech is a bold move by China and it smells of desperation.

There have been whispers of a major currency devaluation to the Chinese yuan in the pipeline which would hurt the economy similar to how the Japanese yen crash has crippled the Japanese.

Then, over the weekend, Syria being overthrown and Russia being able to pull back resources indicates that Russia plans to wind down its operation in Eastern Europe and America could set the stage for conflict in China.

Pulling military resources in Eastern Europe and allocating it further east to China would make sense since the upcoming administration views China as a bigger threat than Russia.

China’s political move to name Nvidia as anti-competitive could be the new beginning of a nasty pernicious relationship for the next 4 years between the 2 governments.

What does that mean for tech stocks?

Buy the dip in Nvidia on news like this.

Stepping back and looking at the Nasdaq ($COMPQ), this won’t take down the index.

Nvidia shares grew around 200% in 2024 and although I don’t expect a repeat performance in 2025, capital is pouring in from the sidelines from abroad and at home.

One thing I can tell you is that money from nowhere is pouring into China, especially the foreign type, because the hostile government means investing there is impossible and idiotic for outsiders.

I am bearish China’s economy and optimistic that U.S. tech stocks can muscle through the China headwinds.

Mad Hedge Technology Letter

December 6, 2024

Fiat Lux

Featured Trade:

(A SHORT TERM TRADE)

(UBER), (GOOGL), (TSLA), (WRD)

Uber’s (UBER) stock is almost 30% down from all-time high’s, and the stock was on a nice run from the lows of 2023 when the stock was trading around $25 per share.

There has been great optimism around the business, with revenge travel stoking a huge growth bump in the ride-sharing business.

Uber once burned through money like there was no tomorrow, but now it is a profitable business.

However, there are outsized risks just around the corner, and the stock has pulled back because the next risk might be existential.

They are running into one of the greatest innovators the world has ever seen.

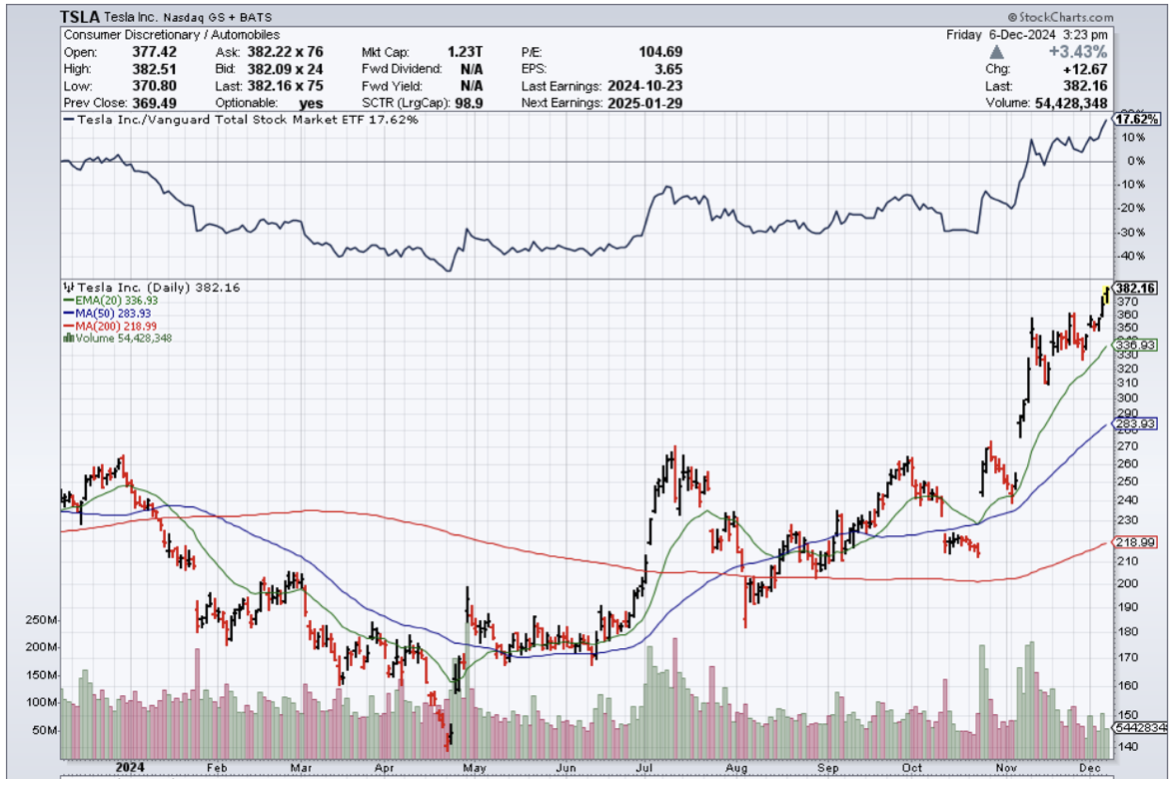

Tesla (TSLA) and Elon Musk have made a lot of noise lately about self-driving robotaxis, and they do have their proprietary software with billions of driving hours of data.

Uber has nothing like this, and the more Elon Musk elbows out the competition about the self-driving technology, the more Uber’s share price sinks.

Uber is the tech company most affected if Musk successfully implements robo taxis as a main part of Tesla’s business.

By now, it is becoming quite apparent that EVs aren’t the holy grail of technology Musk is chasing after. It is merely a placeholder until he goes onto greater projects and technologies.

Sure, first, it would be rockets and space, but on Earth, Musk is after artificial intelligence through robots, and one of those applications would be self-driving automobiles.

Google’s Waymo is another long-term investors in self-driving tech that will destroy Uber’s business model as well.

Uber just said it would partner with robotaxi maker WeRide (WRD) to launch ride-hailing in Abu Dhabi. Uber said it would be the first time AVs are available on the Uber platform outside of the US and that Abu Dhabi would be the largest commercial robotaxi service outside the US and China when it launches in 2025.

Waymo (GOOGL) lately said it would expand its robotaxi service to Miami, Florida.

Waymo has previously tested vehicles in Miami, the company said, a city that provided “challenging rainy conditions” for its driverless vehicles, and Uber’s stock crashed 10% on this news itself.

Waymo said it is already providing 150,000 trips per week in Phoenix, Los Angeles, San Francisco, and Austin.

Uber still has to pay for over 160 million month active riders to get shuttled around on its app, and when they are muscled out of the technology by Google and Tesla, it is not guaranteed they will be able to license this high level of proprietary technology from these big tech stalwarts.

If you are Google or Tesla, why ever involve Uber when you could pick up their riders for pennies on the dollar after Uber bankrupts itself because of the high cost of employing human drivers?

Long term looks quite grim for Uber, and I don’t believe there is a magical elixir for the self-driving software. They are too far behind.

The one hunch I have is that over the past year, Waymo and Tesla have made the concept of the masses taking self-driving technology as a real service closer and closer.

Each day, we inch closer, and the day of full implementation will be a death knell for Uber.

However, in the short term, I do believe Uber’s stock is oversold, and it could stage a bounce back in the short to mid-term.

Any dive into the high $50 range would be a great buying opportunity for a quick trade in Uber. I wouldn’t buy and hold for the long haul, there are better options.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.