“We could use technology to help achieve universal health care, to reach for a clean energy future, and to ensure that young Americans can compete -- and win -- in the global economy.” – Said Former U.S. President Barrack Obama

Mad Hedge Technology Letter

May 5, 2021

Fiat Lux

Featured Trade:

(THE BOOMING SUB-SECTOR OF ECOMMERCE FURNITURE)

(OSTK)

Growth has been pummeled the last few days as the U.S. government has sent mixed signals from Fed Chair Jerome Powell and Treasury Secretary Janet Yellen.

On one hand, Powell has been steadfast, saying he will not even think about raising rates for years, but Yellen came out yesterday admitting the turbo-charged US economy might need a rate hike.

Growth companies get penalized the most for the perception of rising rates while banks get rewarded.

Rising rates mean that loss-making tech firms will need to bear a higher cost of financing while needing more things to go their way to become profitable.

They also need more time because theoretically, exorbitant financing raises the bar to becoming profitable.

For the real speculative tech firms in nascent sub-sectors, this is the last thing you want to hear.

We have seen this concept run amok in the SPAC market with many of these newly listed vehicles down big over this consolidation move.

One ecommerce firm on the brink of profitability that I might consider taking a look at if it drops to $50 from the current $78 is volatile furniture seller Overstock.com (OSTK).

Remember it's typical of OSTK to drop 7% on down days and surge 7% on up days.

Enter into this stock with caution.

Why do I ultimately like OSTK at $50?

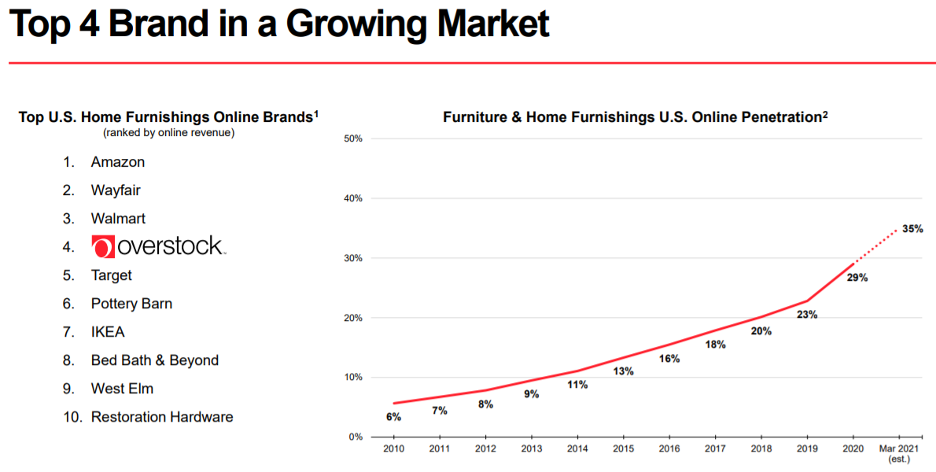

OSTK is now a top four brand in the large and growing U.S. online home furnishings market, this up from the 5th spot.

The total addressable market is growing and now estimated at $325 billion, up from $300 billion last year.

A true secular shift in consumer behavior is underway and not going away.

Permanent moves from cities to suburbs feel like a lasting structural shift in American life, one of the impactful themes to come out of the public health crisis.

Consumers have become accustomed to buying home furnishings online, just like they do so many other products.

It’s not a question of whether consumers will buy furniture and home furnishings.

It’s a question of where: online or in-store? As you know, housing starts surged in March, growing 37% versus March 2020, to the highest level since June 2006, exceeding economists' forecasts.

As the great reshuffling persists and home buying continues to increase, so too will demand for home furnishings.

Consumers will increasingly migrate to optionality, looking to marry up the best selection with high value and convenience of buying online.

Overstock’s motto is “where style and quality cost less.”

They hope to capture the smart value customers of home furnishings.

OSTK offers a value proposition that resonates with a particular subset of the market. The firm only specializes in furniture and home furnishings.

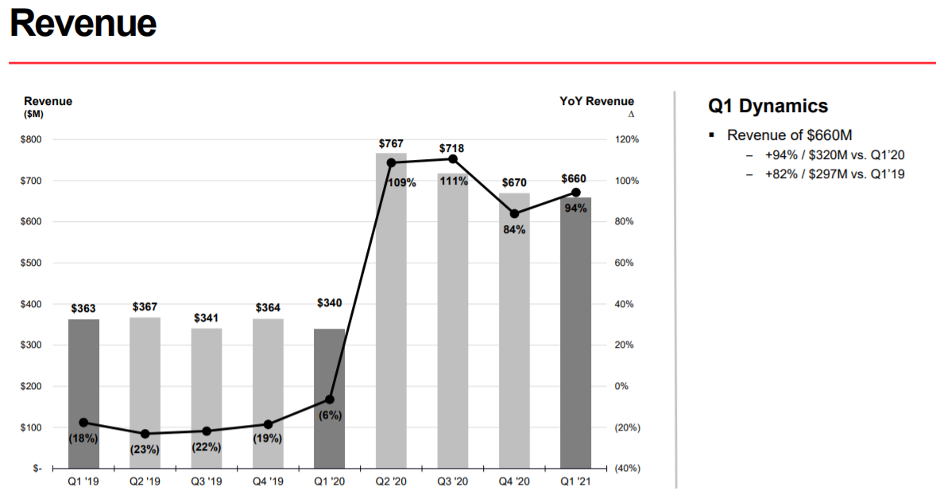

They posted revenue of $660 million in the first quarter, an increase of 94% year over year or 82% versus 2019.

This increase was primarily driven by a 66% increase in pandemic customer orders and a 17% increase in average order size.

Increased order activity was largely driven by new customer growth and strong repeat behavior catalyzed by work-from-home dynamics.

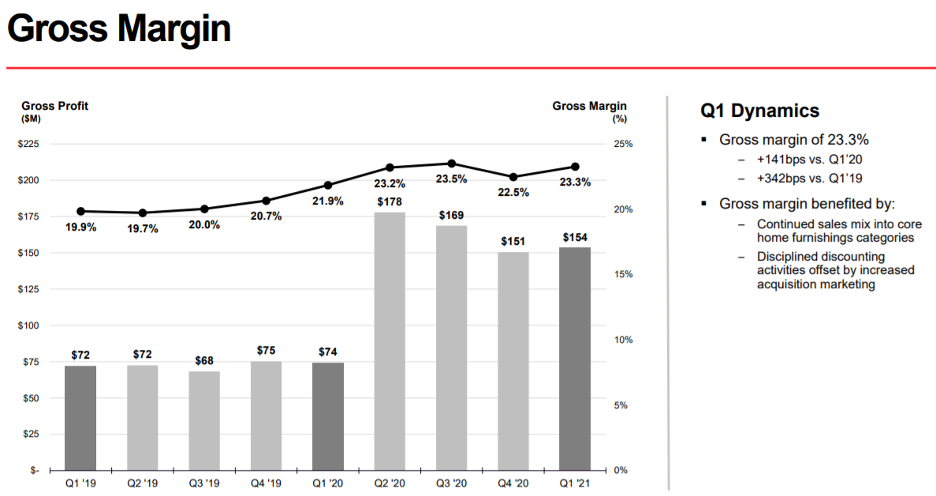

OSTKs gross profit came in at $154 million in the first quarter, an increase of $79 million year over year and an increase of $82 million versus Q1 of 2019.

Gross margin came in at 23.3%, which is an improvement of 141 basis points, compared to a year ago and 342 basis points compared to two years ago.

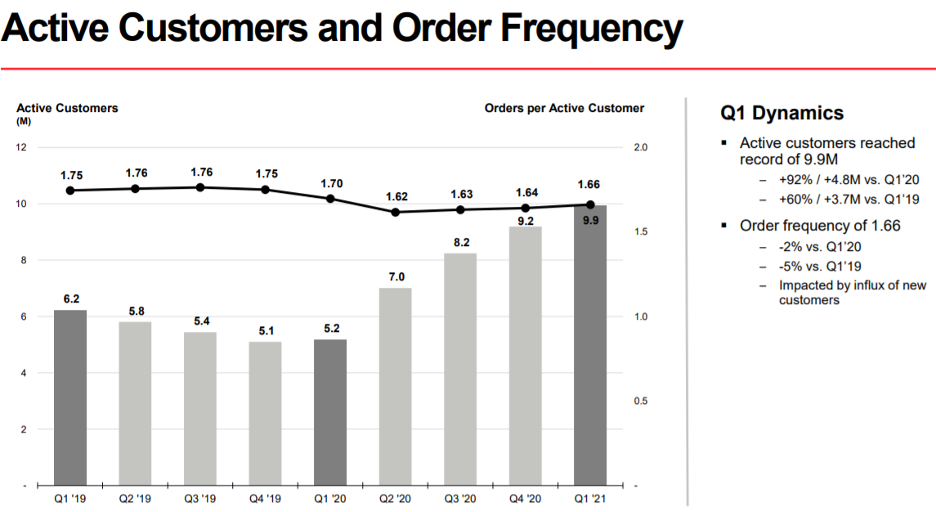

Active customers, meaning the total number of customers who made at least one purchase over the prior 12-month period, as of March 31, grew to 9.9 million.

This is the highest in OSTK’s operating history and represents an increase of 92% or 4.8 million active customers, compared to the first quarter of 2020 and a 60% increase versus 2019.

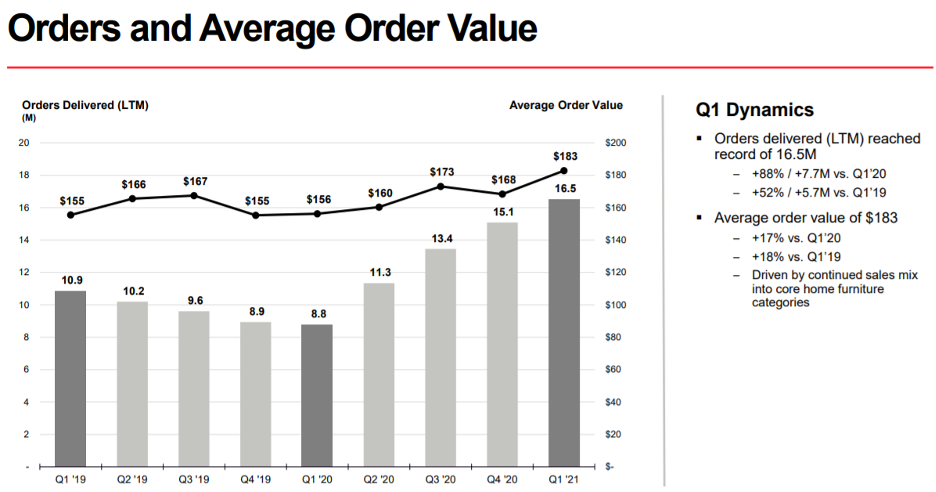

On a trailing 12-month basis, orders delivered reached a record 16.5 million as of March 31.

This is an increase of 88% compared to the prior year or 7.7 million orders and a 52% increase versus 2019.

Average order value increased by $27 or 17% versus the first quarter of 2020. This is mainly driven by a successful sales mix shift into core furniture and home furnishings.

Another key point I would like to touch on is the logistic solutions.

Free shipping is a key component of smart value. It also happens to be a top purchase driver, particularly for OSTK’s target customers.

OSTK has permanently launched free shipping on everything in 2020.

The word is out, at least with their existing customer base, which continues to rate OSTK favorably on shipping charges.

Pricing is also a key element to OSTK’s success.

Because savvy shoppers seek value, OSTK product pricing must be competitive.

One of their 2020 strategic initiatives was to clarify promotional messaging and refine the pricing model.

This meant ensuring OSTK’s products are optimally priced compared to the competition: not too low; and post promotion, certainly not higher.

As a result, 85% of OSTKs product is competitively priced in March 2021 compared to 55% in December 2019.

Lastly, unfortunately, the company does not provide guidance which doesn’t help quell the extreme volatility in the stock.

However, management did say that they face an imminent “difficult year-over-year second quarter comparison” which is the case for many tech firms that went gangbusters in Q2 2020.

Home furnishing revenue represents 93% of total revenue and the tough comparable data leave me no choice but to recommend waiting for this stock to drop to $50.

In the future, the company plans to expand into Canada and enter into government business, and these two planks of growth could help extract the incremental dollar.

However, I believe $70 is too high for OSTK and as many tech firms impossible benchmarks from 2020 to beat, I do believe a sell-off is more than likely in high growth names like OSTK.

In the end, I do believe $50 is a fair price for OSTK and should be bought and held if it comes down to that level.

“Artists work best alone.” – Said Co-Founder of Apple Steve Wozniak

Mad Hedge Technology Letter

May 3, 2021

Fiat Lux

Featured Trade:

(BUY FACEBOOK ON THE DIP?)

(FB), (APPL)

A company such as Facebook (FB) simply must be on investors’ radar all the time because of the profitability element to it.

In a truncated period where growth stocks are out of favor, these bottom-line tech behemoths can weather the storm.

This tech firm doesn’t produce any real products because the user is the product.

A favorable expense layout is why net income this past quarter was $9.5 billion on $26.17 billion revenue.

Even a grossly profitable company such as Apple (AAPL) does a lot worse per dollar generated.

For every $3.79 billion in revenue at Apple, they only profit $1 billion, which is great compared to the status quo except Facebook.

Yes, it costs money to source raw materials and supplies to construct iPhones, iPads, and iMacs, which makes Apple’s operation much more impressive than Facebook.

Strip the hassle of making stuff like iPhones and iMacs and you have Facebook, an online portal to post stuff and serves no real purpose but to display ads to people.

Their attempts to get into the device and ecosystem games have utterly fizzled because users simply have no trust in Facebook management and how they fumble around personal data.

Why buy a Facebook Portal, the firms’ microphone video tablet, when there are trustful options out there without sacrificing the quality?

Before releasing the Portal, during the product announcement, Facebook initially claimed that data obtained from Portal devices would not be used for targeted advertising.

One week after the announcement, Facebook changed its position and stated that “usage data such as length of calls, frequency of calls” and “general usage data, such as aggregate usage of data will also feed into the information that we use to serve ads”.

So Facebook is quite stuck with what they have now, which is a blossoming Instagram and legacy Facebook portal both of which are cash cows.

They aren’t able to do M&A because of fear of anticompetitive legislation and their debauchery of privacy has locked them out of the hardware market.

Facebook wants to monetize WhatsApp, Facebook’s wildly popular chat app, but is finding resistance in funneling user data with an updated user agreement being criticized heavily worldwide with users deleting the app and downloading an alternative mainly the app Telegram.

Facebook rescinded the user agreement and has delayed their WhatsApp targeting ad division until they can ram the updated agreement down WhatsApp users’ throats.

I will say that “what they have” has been working out extremely well for the company when Facebook reported daily active users reaching 1.88 billion, up 8% or 144 million compared to last year.

Q1 total revenue was $26.2 billion, up 48% and this is attributed to growth in advertising revenue largely driven by continued strength in product verticals such as online commerce.

If investors don’t remember, Facebook was dragged down to the 20% revenue growth level just a few quarters ago on all the privacy hullabaloo.

To reaccelerate revenues is a major win for Facebook that can’t be understated.

Growth was broad-based across all advertiser sizes, with particular strength from small- and medium-sized advertisers.

Facebook’s year-over-year ad revenue growth also benefited from lapping pandemic-related demand headwinds experienced during March of last year. On a user geography basis, ad revenue growth accelerated in all regions.

Facebook’s bread and butter are the strength of their advertising revenue growth in the first quarter of 2021, which was driven by a 30% year-over-year increase in the average price per ad and a 12% increase in the number of ads delivered.

What is Facebook doing to branch out revenue channels?

They haven’t quit the hardware game with their Virtual Reality (VR) headset product called Oculus Quest 2 and management only played it down by saying they saw “sustained strength” without busting out any specific metrics.

I read the tea leaves as this isn’t doing enough for management to offer real data on it.

When I analyze the Oculus Quest 2 VR headset, the $299 retail price, it practically means they are losing money on it by a wide margin.

There is no premium in the pricing because the price is one of the few ways that consumers can overlook data privacy issues.

The $299 gets you a robust virtual reality headset with 6GB of RAM, a Qualcomm Snapdragon XR2 CPU, 64GB of storage, 1832x1920 per eye display, and a pair of controllers.

The jury is out whether the stickiness of VR will actually continue and if it does, how long full-scale adoption will take.

But it is painfully clear that Facebook will be losing money even on Oculus Quest products until there’s a 5th or 6th or even 7th iteration or even further.

There is nothing to suggest that VR is on the verge of full-scale adoption.

CEO and Founder Mark Zuckerberg must be tearing his hair out about how he has effectively been locked out of hardware products since the inception of his empire.

And no, data centers, their largest expense along with remunerations, to hold the data you give him don’t count as hardware.

A few headwinds to take note of, in the third and fourth quarters of 2021, Facebook expects year-over-year total revenue growth rates to significantly decelerate sequentially as they are facing tough comparable data from the prior year.

Lastly, Facebook will continue to expect increased ad targeting headwinds in 2021 from regulatory and platform changes, notably the recently launched Apple iOS 14.5 update, which will have an impact in the second quarter.

As the global economy and US economy open back up in a roaring fashion, it’s hard not to like this stock.

Ad budgets are on the verge of exploding and Facebook is still one of a nicely forged duopoly.

Even if they haven’t been able to branch out, they are incredibly proficient at what they do, and serving ads to a 2 billion plus user base will become more voluminous and expensive as the year advances.

No surprise the stock is at $325, another all-time high, and even if I personally hate the company, the stock is a viable candidate to buy on any dip.

As we move into the next part of the year, I do believe the buyback story will accelerate for big tech and cash cows like Facebook, and its stock will hit $400 by the year-end.

At the end of the day, this a story of the big getting bigger.

OCULUS QUEST 2 – THE NEXT DISASTROUS FACEBOOK HARDWARE?

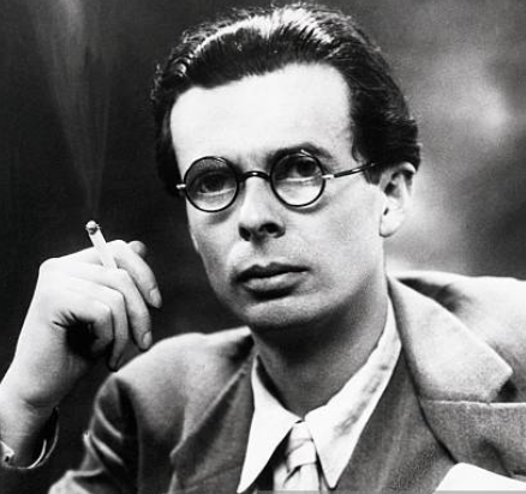

“Technological progress has merely provided us with more efficient means for going backwards.” – Said English writer and philosopher Aldous Leonard Huxley

Mad Hedge Technology Letter

April 30, 2021

Fiat Lux

Featured Trade:

(A QUARTER TO REMEMBER FOR TIM COOK)

(AMZN), (AAPL)

Investors looking to park their cash in an emerging tech stock have to reckon with the earnings’ strength of a company like Apple (AAPL).

Eventually, any artisanal tech company hoping to deliver you a 10 bagger will need to adjust their sights that at some point in their future, they will need to directly compete with an Apple or Amazon (AMZN).

That is what is so scary for the little guys.

There were bountiful eye-popping numbers serving as ironclad proof to investors that sticking with the Goliaths is the sure-fire approach to grind your way up to more wealth.

A tech company Apple’s size expanding quarterly revenue to almost $90 billion last quarter representing a 54% year-over-year growth rate is stuff of legends.

A 54% growth rate is what us analysts give a green light for regardless of the size of the company.

Many analysts like to resort to explaining the upcoming stifling of growth in big tech as the law of large numbers.

Apple has shown they can overcome almost anything.

And this was supposed to be the company in which they have a China issue.

The consensus is that Apple is a brilliant business with an even better operational model.

Three reasons why Apple is firing on all cylinders.

First, Apple’s installed base growth has accelerated and reached an all-time high across each major product category.

Second, the number of both transacting and paid accounts on Apple’s digital content stores reached a new all-time high during the March quarter, with paid accounts increasing double digits in each of our geographic segments.

Lastly, Apple’s paid subscriptions continued to show strong growth.

This trifecta of outperformance was why revenue in the March quarter broke a record of $89.6 billion an increase of over $31 billion or 54% from a year ago.

Management saw strong double digits in each product category, with all-time records for Mac and for services and March quarter records for iPhone and for wearables, home, and accessories.

Products revenue was a March quarter record of $72.7 billion, up 62% over a year ago.

Company gross margin was 42.5%, up 2.7% from last quarter driven by cost savings, a strong product mix and favorable foreign exchange.

iPhone revenues had a March quarter record of $47.9 billion, growing 66% year over year as the iPhone 12 family continued to be in high demand.

With unmatched 5G capability, the best camera system ever in an iPhone, and advanced durability from Ceramic Shield, this family of devices is popular with both upgraders and new customers alike.

In the US, the latest survey of consumers from 451 Research indicates customer satisfaction of over 99% for the iPhone 12 family.

Turning to services. Another all-time revenue record of $16.9 billion with all-time records for the App Store, cloud services, music, video, advertising, and payment services.

Apple’s new service offerings, Apple TV+, Apple Arcade, Apple News+, Apple Card, Apple Fitness+, as well as the Apple One bundle, continue to scale across users, content, and features and are contributing to overall services growth.

It was a quarter of sustained strength for wearables, homes, and accessories, which grew by 25% year over year.

Apple Watch is a global success story, and the category set March quarter records in each geographic segment, thanks to strong performance from both Apple Watch Series 6 and Apple Watch SE.

The Mac broke an all-time revenue record of $9.1 billion, up 70% over last year, and grew very strongly in each geographic segment.

This impressive performance was driven by the customer approval to new Macs powered by the M1 chip.

iPad performance was also outstanding with revenue of $7.8 billion, up 79%.

Where does Apple go from here?

First, hiring warm bodies and lots of them to try to meet all the extra incremental demand the company needs to satisfy in the near future.

Over the next five years, Apple will invest $430 billion, creating 20,000 jobs in the process.

The investments will support American innovation and drive economic benefits in every state, including a new North Carolina campus and job-creating investments in innovative fields like silicon engineering and 5G technology.

After hiring, Apple is laser-focused on shareholder return.

They were able to return nearly $23 billion to shareholders during the March quarter. This included 3.4 billion in dividends and equivalents and $19 billion through open market repurchases of 147 million Apple shares.

Apple’s board has authorized an additional $90 billion for share repurchases. They are also raising their dividend by 7% to $0.22 per share, and continue to plan for annual increases in the dividend going forward.

Lastly, management threw a damp towel on the feeling of success by removing guidance and talking about headwinds.

Management said that coming up, they would not offer specific financial guidance because of “continued uncertainty around the world in the near term.”

They also said that the sequential revenue decline from the March quarter to the June quarter will be greater than in prior years.

Second, supply constraints will have a revenue impact of 3 to $4 billion in the June quarter meaning a lack of chips.

All in all, hard to be happier if you are an Apple long-term holder. This is a no-brainer buy and hold forever. Any substantial dip should be bought.

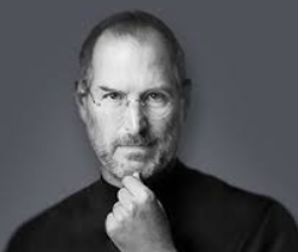

“Being the richest man in the cemetery doesn't matter to me. Going to bed at night saying we've done something wonderful, that's what matters to me.” – Said Co-Founder of Apple Steve Jobs

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.