“If you're gonna make connections which are innovative... you have to not have the same bag of experiences as everyone else does.” – Said Co-Founder of Apple Steve Jobs

Mad Hedge Technology Letter

March 24, 2021

Fiat Lux

Featured Trade:

(THE METAVERSE HAS ARRIVED)

(RBLX)

The saga of Roblox (RBLX) began in 1989 when founders David Baszucki and Erik Cassel programmed a 2D simulated physics lab called Interactive Physics, which would later go on to influence their approach to constructing the foundations of Roblox.

Students across the world used Interactive Physics to see how two cars would crash, or how they could build destructible houses.

In starting Roblox in 2004, the founding team desired to replicate the inspiration of imagination and creativity we saw in Interactive Physics on a much more extreme scale by ushering in a new category of human interaction that did not exist at the time.

People from around the world come to Roblox every day to connect with friends and together they play, learn, communicate, and explore in 3D digital worlds that are entirely user-generated, built by Roblox’s community of nearly 8 million active developers.

This is a new cyber world which humans are very much a part of.

I call this emerging category “human co-experience,” which is considered to be the new form of social interaction that was envisioned back in 2004.

Roblox’s platform is powered by user-generated content and draws inspiration from gaming, entertainment, social media, and even toys.

Some refer to this world as the “metaverse”, a term often used to describe the concept of persistent, shared, 3D virtual spaces in a virtual universe.

The idea of a metaverse has been written about by science fiction authors now for over 30 years.

With the advent of robust consumer computing devices, cloud computing, and high bandwidth internet connections, the concept of the metaverse is coming to fruition.

The Roblox human co-experience platform consists of the Roblox Client, the Roblox Studio, and the Roblox Cloud.

Roblox Client is the application that allows users to explore 3D digital worlds.

Roblox Studio is the toolset that allows developers and creators to build, publish, and operate 3D experiences and other content accessed with the Roblox Client.

Roblox Cloud includes the services and infrastructure that power human co-experience platform.

The company’s mission is to build a human co-experience platform and now investors can buy the stock betting on the value appreciation and monetization of this metaverse.

The hybrid experience is spurring a wave of new popularity and running through the Roblox numbers, it’s easy to understand why this stock that just went public through a SPAC will certainly explode higher.

The numbers are a classic roadmap of how tech growth numbers should behave and dream to behave.

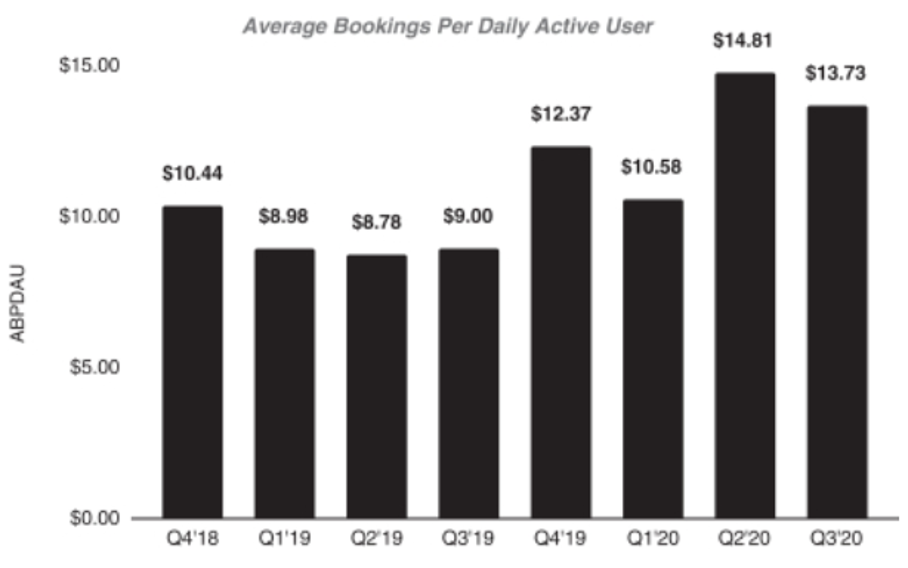

They combine significant bookings and revenue with strong unit economics, free cash flow generation, and high daily active user (DAU) growth.

What are a few tantalizing growth metrics that whet investor’s appetite?

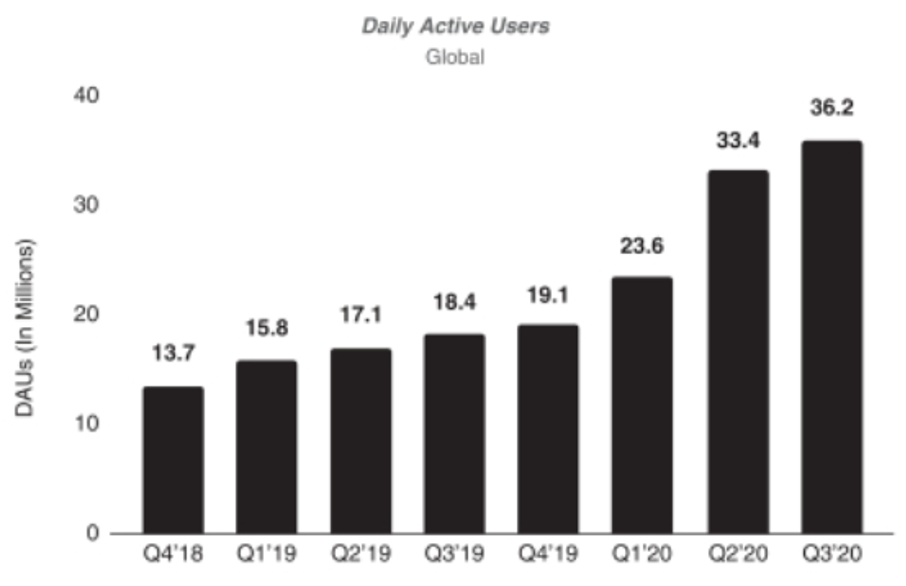

DAUs on Roblox grew 47%, from 12.0 million DAUs in 2018 to 17.6 million in 2019, and grew 82%, from 17.1 million in the nine months that ended September 30, 2019 to 31.1 million in the nine months the ended September 30, 2020.

Hours engaged on Roblox grew 45%, from 9.4 billion in 2018 to 13.7 billion in 2019, and grew 122%, from 10.0 billion in the nine months that ended September 30, 2019 to 22.2 billion in the nine months that ended September 30, 2020.

Revenue grew 56% from $312.8 million in 2018 to $488.2 million in 2019 and grew 68% from $349.9 million in the nine months that ended September 30, 2019 to $588.7 million in the nine months that ended September 30, 2020.

The latest revenue performance shows 2020 revenue expanding at 82% year over year to almost $1 billion in annual sales and 2021 is slated to be the year where annual revenue hits around the $3 billion mark at year-end.

How is Roblox planning to outperform in 2021?

Platform Extension: Significant investments in high fidelity avatars, more realistic experiences, 3D spatial audio technology, and other social features. These investments should enable Roblox to support human co-experience.

Age Demographic Expansion: As a result of platform extension, developers and creators are now able to build higher quality experiences and content that appeal to an older age demographic.

International Reach: I believe there is significant runway in unsaturated markets in the world for Roblox to grow by the same organic, word-of-mouth user and developer growth that U.S., Canada, and the United Kingdom experienced.

Monetization: I predict that there is significant potential to increase monetization by actively working with developer and creator community to help them improve their monetization methods. Second, Roblox recently introduced a subscription service, Roblox Premium, which will increase conversion of free users to paying users and encourage the retention of paying users. Third, digital marketing could be a monetization tool that could attract many marketing budgets as the platform matures.

Jump on the bandwagon before others find out about this company. We are still in the early innings of Roblox’s trajectory, and this is the ultimate stay-at-home economy buy and hold stock.

“Build something 100 people love, not something 1 million people kind of like.” – Said Co-Founder and CEO of Airbnb Brian Chesky

Mad Hedge Technology Letter

March 22, 2021

Fiat Lux

Featured Trade:

(WHAT’S THE DEAL WITH SPOTIFY?)

(SPOT)

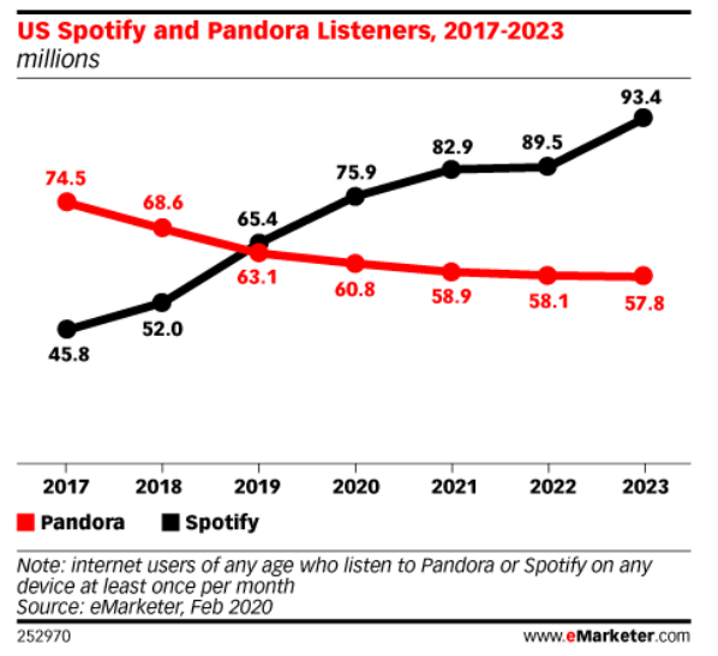

Many would believe that ad-based music streaming and the free streaming of it would represent a massive windfall in this new work-from-home economy.

And that is exactly what happened when Spotify’s (SPOT) stock rose from $121 on March 1st, 2020 and elevated to $365 just in February 2021.

The close to tripling of SPOT's shares came on the heels of a new annual year-end report by America’s Recording Industry Association showing that overall recorded music revenue increased by roughly 9.2% in 2020 to $12.2 billion.

This overperformance in music streaming was a relatively significant increase compared to 2019’s reported $8.9 billion, but the big takeaway was that two tech companies have seized the bulk of the revenue.

Both Spotify and Apple Music were the two most dominating streaming platforms, raising approximately $7 billion amongst the two, while subscriptions rose from 60.4 million to 75.5 million.

Even more unthinkable, the figures show 83% of the music industry’s revenue came as a result of streaming.

Why did 2020 work out so well for SPOT?

More time at home resulted in more people getting hooked on streaming and turning to SPOTs platform, but it also created disruption in listening habits, consumption hours and the release of new music and podcasts.

The new dynamics of music streaming is cause for belief that subscribers have been pulled forward from the back half of 2020, which could translate into underperformance for subscriber growth in the year ahead.

Long term, the trend lines are healthy as streaming from a shift from linear to on-demand has clearly accelerated and will continue to remain as a massive multi-billion user opportunity.

SPOTs stock has consolidated from highs of $365 and now trade around $270 after investors got scared hearing management’s lukewarm optimism for 2021.

The hesitation culminated when management admitted that the “full-year 2021 plan will have a higher variance than prior years.”

Uncertainty is always killer in tech and SPOTs response is to shift to more aggressive revenue growth where they know pricing power will enable SPOT to increase ARPU.

SPOT is flirting with price increases across a number of markets even if in the world’s largest music market, the company’s $10-a-month subscription cost has remained fixed for years even as Spotify added millions of podcasts and songs to the platform.

Spotify announced at the investor day that it would double the number of countries where its services are available and roll out dozens of new podcast shows from the likes of Barack Obama and Ava DuVernay.

The ultimate problem that SPOT still confronts is if music streaming can be a profitable business and I believe launching SPOT in 85 new territories across Africa, Asia, and Latin America, such as Ghana, Sri Lanka and Pakistan, will deteriorate SPOTs average revenue per user (ARPU).

ARPU has been declining steadily as the company offered promotional discounts and expanded into countries such as India, where it charges subscribers a lower price. ARPU dropped 8% in the fourth quarter from a year ago, to only €4.26.

At a broader level, the overall number of total ears is saving them but the reckoning with profitability problem could turn out to be 2021 which is inherently terrible for the underlying stock.

In the last year alone, SPOT tripled the number of podcasts on their platform, moving from about 700,000 in Q4 2019 to 2.2 million podcasts today.

Investments in originals and exclusives are creating more and more reasons for listeners to choose Spotify, and exclusive programming is already proving to be an essential part of differentiation.

But how long will they be able to burn through cash before they can scale a profit?

Even if we are in the early days of seeing the long-term evolvement of how we can monetize audio on the Internet, tech will have all business models, and that's the future for all media companies that first will have ad-supported subscription and a la carte sort of in the same space of all media companies in the future, and you should definitely expect Spotify to follow that strategy in that pattern.

Even with that tidal wave of secular positivity, Spotify’s management is modeling ARPU to be “roughly flattish” for 2021 and that’s a red flag.

The crop has already been harvested for 2020 because last year was the year that investors gave tech and all corporates a free pass to write off performance with investors only focusing on low rates, liquidity, and the overarching secular trends.

As 2021 plays out, the tech market is grappling with an undermining bond scare along with tough quarterly comparisons to last year.

It won’t be surprising to see tech growth consolidating and absorbing the higher rates and optimistic re-opening expectations.

After this dip, I expect SPOT to reaccelerate its growth contingent on increasing the ARPU that is beginning to become a sensitive spot for the company’s metrics.

“Artists work best alone.” – Said Co-Founder of Apple Steve Wozniak

Mad Hedge Technology Letter

March 19, 2021

Fiat Lux

Featured Trade:

(TAKE A PASS ON THE NEWEST TECH SPAC eTORO)

(FTCVU)

The spike in retail investing has been a boon for online brokerage platform eToro.

The Israeli-headquartered company went public through an SPAC (special purpose acquisition company).

Shares of FinTech Acquisition Corp V (FTCVU), which eToro will trade under, rose over 30% on the news.

Let’s look into the investment thesis of eToro.

The secular trends are highly supportive with a confluence of circumstances — the acceleration of digital technologies, commission-free stock investing, and low-interest rates — increasing retail engagement in the capital markets.

In a way, this brokerage celebrates the rise of the retail investor.

How do eToro’s numbers look?

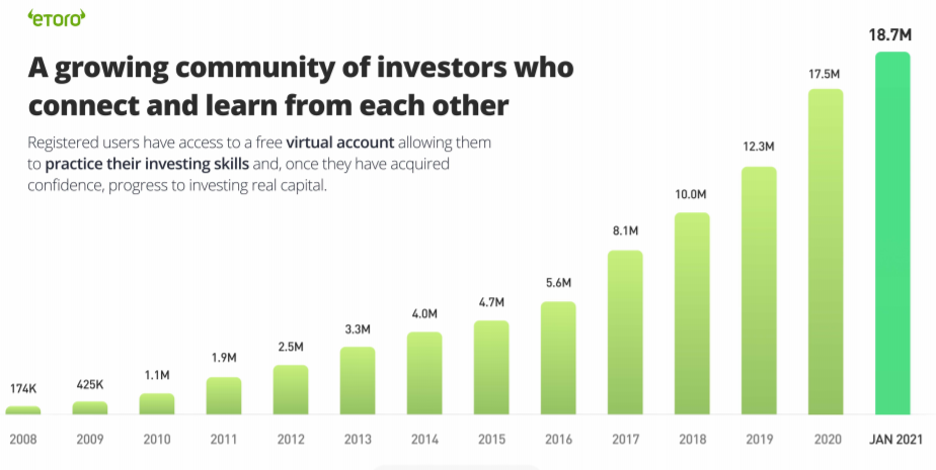

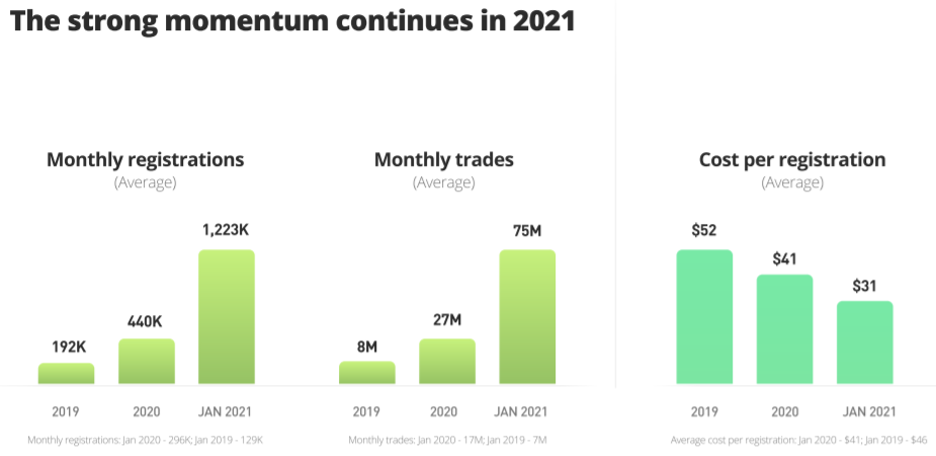

eToro had 147% annual revenue growth from 2019 to 2020 indicating that the surge of voluminous trading was real.

That spike coincided with the shelter-at-home economy.

People were just sat at home with nothing to do with even sports betting offline and online trading became the new sports betting.

The platform boasts over 20 million registered users from more than 100 countries.

Five million of those were added last year alone as retail engagement rose worldwide.

eToro already offers crypto services in the U.S. and plans to launch stock investing in the second half of 2021.

From 2016 to the end of 2020, revenue rose 1,000% highlighting the astronomical growth in its products.

eToro’s projections are ambitious predicting a rise of revenue of 150% from the start of 2020 to 2025.

To reach their 2025 targets, the tech company would need to grow around 30% per year.

So what are the key takeaways from this “social investment network” trading business?

Well, I love that total revenue grew 147% in the past year, but I hate the -34% annual revenue growth the year prior to that in 2018.

That is a massive red flag.

Another overwhelming ding against them is that eToro has minimal business in the lucrative U.S. market, and most of its revenue is procured from Asia and Europe.

They just announced their foray into U.S. equities, and I must ask, why didn’t they do this years ago?

In an interview with a major television network, eToro CEO Yoni Assia, when asked if there is potential in the US market, he began his answer with eToro’s exploits of creating a cryptocurrency platform for the U.S. market and claimed the North American revenue grew “triple digits” last year but failed to offer any real numbers.

This is another red flag.

His first inclination should not be hyping up a North American cryptocurrency platform, and instead should have focused his intentions on building a stable business on the equity, bonds, and mutual fund side which has more stable cash flow.

Claiming a “triple-digit” growth rate, to me, means that eToro’s North American business is so minimal that the puniest of growth translates into a quadrupling or quintupling of growth or whatever you want to call it.

Another overstep is that the company claims it’s a “social trading network” hoping to hype itself up by attaching it to a branch of social media which is really a step too far.

eToro is grasping at many straws because they are more of an imposter than the real deal.

Another worrying sign that this trading platform is targeting the wrong revenue stream is if you browse eToro’s official American website by clicking (https://www.etoro.com/en-us/), visitors are met with an oversized graphic of Hollywood actor Alec Baldwin pointing to a phone that has the bitcoin logo on it.

A serious trading platform would never, in a million or trillion years, decide to post Baldwin as the first graphic potential customers would see visiting their homepage, forcing me to believe that the company is eyeing the high churn rate but short-term pump and dump of a customer type of strategy.

This strategy is very high risk and EXTREMELY LOW QUALITY.

Usually, the strategy coalesces around an underlying thesis of selling it before the wheels fall off but reaching for any type of growth in the short term.

I cannot in good faith recommend eToro as a sound tech investment.

There are better tech companies out there to invest in for the long haul and any short-term appreciation in eToro will be temporary.

I admit this is a legitimate tech company, but the way they do business is off-putting.

Selling the idea that a trading platform can be buoyed by crypto is beggar’s belief.

It’s still only a small sliver of the real money out there.

Don’t get thrown off by the glitzy marketing, hyped-up numbers, and vague rhetoric from upper management.

Oh yeah, lastly, why invest in eToro when its stronger competitor with a large footprint in the U.S. is planning to go public themselves?

Take a pass on eToro for the betterment of your wallet.

“We've arranged a civilization in which most crucial elements profoundly depend on science and technology.” – Said American astronomer and cosmologist Carl Sagan

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.