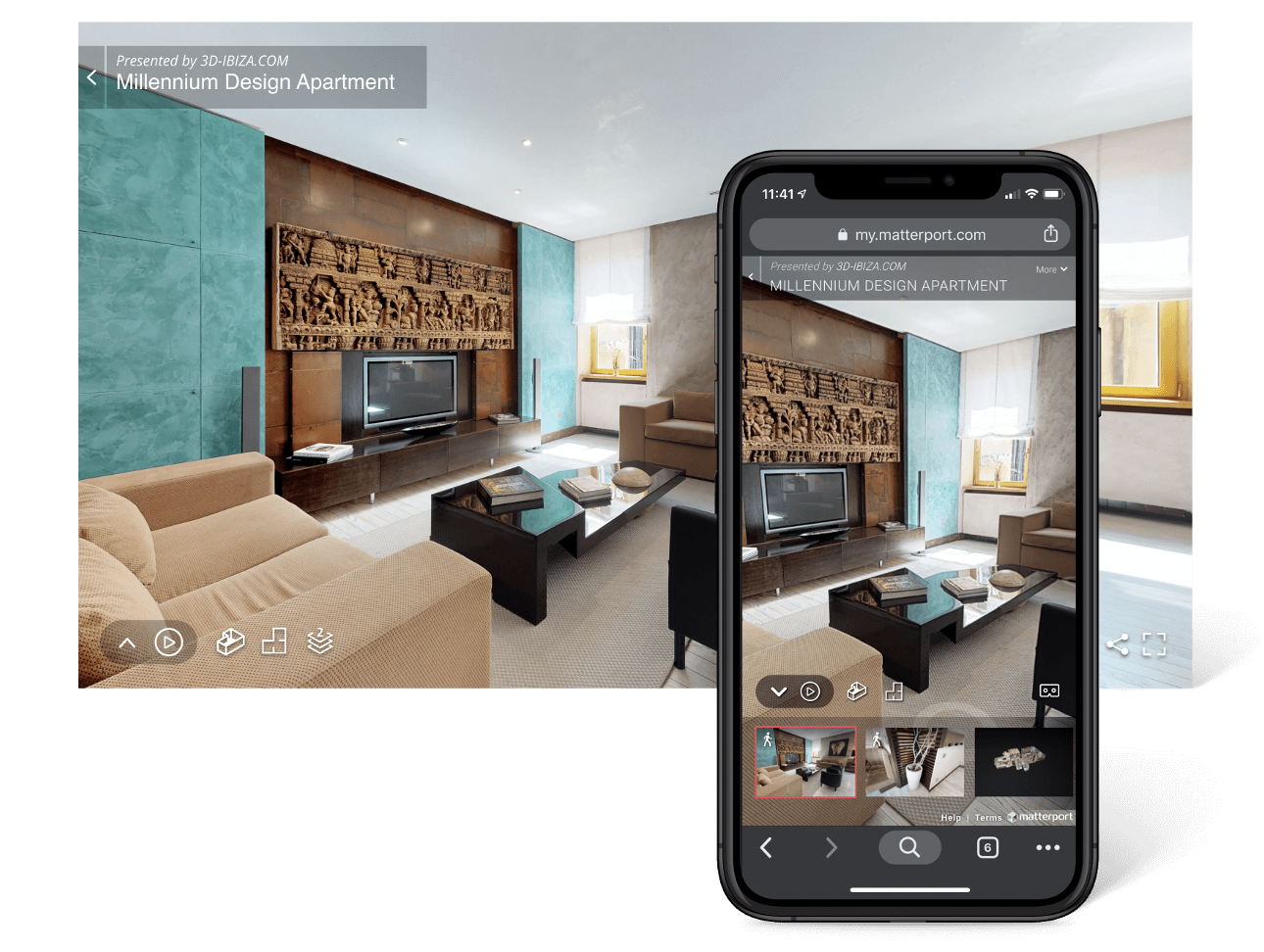

One of the more bizarre knock-on effects of the health crisis is the swaths of people doing at-home reconnaissance work on where and how to relocate via the online real estate platform Zillow (Z).

When a polar vortex hits the South of the United States causing electricity bills to spike north of $6,000 per month and folks to boil snow to flush toilets because water treatment facilities are down, you bet that internet search for relocation would explode in a heartbeat.

Well, Zillow makes this a reality and facilitates the better understanding of what type of houses are where and for what listing prices giving users access to an interactive map of properties for sale.

Not only are homes for sale listed, but Zillow has a thriving rental market function where many landlords post units for rent with contact information and details.

The pandemic has been a godsend for Zillow who was floundering before the virus.

Stuck between migrating to selling properties directly from the platform and a slow-to-move advertising business, they couldn’t get their act together.

Fast forward to today, clicks and eyeballs on Zillow have skyrocketed with some looking for larger homes.

Looking for a house during climate change is the new thing to do.

And then there are those who don't even know why they are endlessly looking at listings on the real estate site and most likely because they are bored.

Whatever the reason, the result is clear: Zillow's website traffic numbers are surging.

Some regions have felt some serious follow-through with the newfound attention like the state of Florida.

With its moderate temperature and suppression of state taxes, it's no surprise to see Miami, Tampa Bay, Palm Beach, and Fort Myers, Florida in the top 20 in terms of traffic. Broader demographic and structural shifts also lifted Pennsylvania cities like Scranton and Allentown.

The top three were Las Vegas, Stamford, Connecticut, and Austin, Texas.

Of the 100 largest metros in the country, every one of them saw an increase in traffic.

Millennials are the largest generational group in the country and they're barreling towards home-buying years. They're hitting their mid-30s. They want stability.

Zillow describes it as “the great reshuffling,” and it's leading to a lot more than just a spike in Zillow traffic.

In all four corners of the country, the property market is scolding hot and the median time that a home goes on the market and then goes to pending is 17 days as of December.

That's 25 days faster than a year ago.

How do the numbers look under the hood?

Gangbusters.

Zillow had 9.6 billion page visits to its website and to its app in 2020.

That was up 1.5 billion from 2019.

Zillow shares have been the ultimate benefactor with shares surging up around 500% since the March 2020 bottom.

The ongoing growth acceleration in the real estate macro environment, a sustainable shift in real estate activity online, and the longer-term opportunity for these companies to capture share of industry economics all bode well for the stock price.

Given the pandemic driven outperformance across the internet sector, with housing activity and buyer demand continuing to accelerate, new listings growth and velocity offsetting challenges to supply and lower mortgage rates drive a more affordable buyer environment despite meaningful home price appreciation.

I expect that the macro impact alone will lead to upward forward earnings revisions in the category as companies report results.

I believe that a tectonic shift of real-estate activity online continues.

Lastly, Zillow’s investments in technology and business model evolution which improves conversion of site visitors to home buyers and sellers, increase purchase and sale options, and enhance the experience for agents and consumers.

In the end, this will increase the number of property purchasers.

It’s hard not to see financial outperformance in the near-term future for Zillow.

The growth in the existing home sales market and home price appreciation will continue to benefit Zillow and I expect views of between 13-14 billion in 2021 which sets up the opportunity for Zillow to beat in revenue and profitability. I would also take a look at Redfin Corporation (RDFN) who has a similar business model.