The genie is out of the bottle and life will never go back to pre-Covid ways.

Excuse me for dashing your hopes if you assumed the economy, society, and travel rules would do a 180 on a dime.

They certainly will not.

The messiness of distributing the vaccine is already rearing its ugly head with Germany botching the BioNTech-Pfizer vaccine delivery, deploying refrigerators that weren’t cold enough.

Moving on to tomorrow’s tech and the decisive trends that will power your tech portfolio, you can’t help but think about what will happen to the American university system.

A bachelor’s degree has already been devalued as traditional academics trumped by the digital economy invading its turf.

Another unstoppable trend that shows no signs of abating is the “winner take all” mentality of the tech industry.

Tech giants will apply their huge relative gains to gut different industries and have set academics and the buildings they operate from as one of their next prey.

Recently, we got clarity on big-box malls becoming the new tech fulfillment centers with the largest mall operator in the United States, Simon Property Group (SPG), signaling they are willing to convert space leftover in malls from Sears and J.C. Penny.

The next bombshell would hit sooner rather than later.

College campuses will become the newest of the new Amazon (AMZN), Walmart (WMT), or Target (TGT) eCommerce fulfillment centers, and let me explain to you why.

When the California state college system shut down its campuses and moved classes online due to the coronavirus in March, rising sophomore Jose Antonio returned home to Vallejo, California where he expected to finish his classes and “chill” with friends and family.

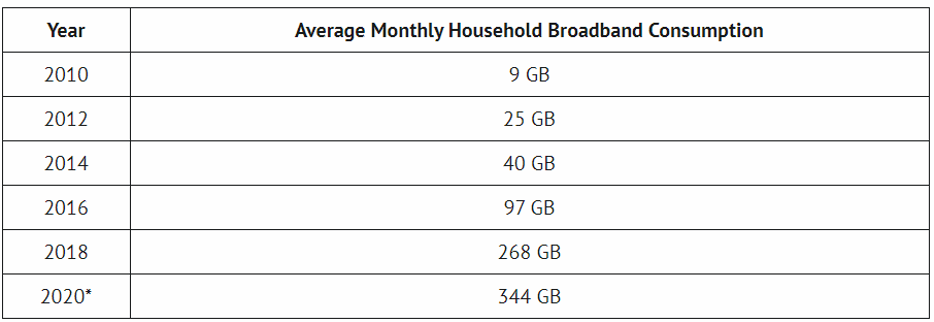

Then Amazon announced plans to fill 100,000 positions across the U.S at fulfillment and distribution centers to handle the surge of online orders. A month later, the company said it needed another 75,000 positions just to keep up with demand. More than 1,000 of those jobs were added at the five local fulfillment centers. Amazon also announced it would raise the minimum wage from $15 to $17 per hour through the end of April.

Antonio, a marketing and communications major, jumped at the chance and was hired right away to work in the fulfillment center near Vacaville that mostly services the greater Bay Area. He was thrilled to earn extra spending money while he was home and doing his schoolwork online.

This was just the first wave of hiring for these fulfillment center jobs, and there will be a second, third, and fourth wave as eCommerce volumes spike.

Even college students desperate for the cash might quit academics to focus on starting from the bottom at Amazon.

Even though many of these jobs at Amazon fulfillment centers aren’t those corner office job that Ivy League graduates covet, in an economy that has had the bottom fall out from underneath, any job will do.

Chronic unemployment will be around for a while and jobs will be in short supply.

Not only is surging unemployment a problem now, but a snapshot assessment led by the U.S. Census Bureau and designed to offer less comprehensive but more immediate information on the social and economic impacts of Covid showed that as recently as the period between November 25 and December 7 (including Thanksgiving), some 27 million adults—13 percent of all adults in the country—reported their household sometimes or often didn’t have enough to eat.

Yes, it’s that bad out there right now.

When you marry that up with the boom in ecommerce, then there is an obvious need for more ecommerce fulfillment centers and college campuses would serve as the perfect launching spot for this endeavor.

The rise of ecommerce has happened at a time when the cost of a college education has risen by 250% and more often than not, doesn’t live up to the hype it sells.

Many fresh graduates are mired in $100,000 plus debt burdens that prevent them from getting a foothold on the property ladder and delay household formation.

Then consider that many of the 1000s of colleges that dot America have borrowed capital to the hills building glitzy business schools, $100 million football locker rooms, and rewarding the entrenched bureaucrats at the school management level outrageous compensation packages.

The cost of tuition has risen by 250% in a generation, but has the quality of education risen 250% during the same time as well?

The answer is a resounding no, and there is a huge reckoning about to happen in the world of college finances.

America will be saddled with scores of colleges and universities shuttering because they can’t meet their debt obligations.

The financial profiles of the prospective students have dipped by 50% or more in the short-term with their parents unable to find the money to send their kids back to college, not to mention the health risks.

Then there is the international element here with the lucrative Chinese student that added up to 500,000 total students attending American universities in the past.

They won’t come back after observing how America basically ignored the pandemic and the U.S. public health system couldn’t get out of the way of themselves after the virus was heavily politicized on a national level.

The college campuses will be carcasses with lots of meat on the bones that will let Jeff Bezos choose the prime cuts.

This will happen as Covid’s resurgence spills over into a second academic calendar and schools realize they have no pathway forward and look to liquidate their assets.

There will be a meaningful level of these college campuses that are repurposed as eCommerce delivery centers with the best candidates being near big metropolitan cities that have protected white-collar jobs the best.

The coronavirus has exposed the American college system, as university administrators assumed that tuition would never go down.

The best case is that many administrators will need to drop tuition by 50% to attract future students who will be more price-sensitive and acknowledge the diminishing returns of the diploma.

Not every college has a $40 billion endowment fund like Harvard to withstand today’s financial apocalypse.

It’s common for colleges to have too many administrators and many on multimillion-dollar packages.

These school administrators made a bet that American families would forever burden themselves with the rise in tuition prices just as the importance of a college degree has never been at a lower ebb.

Like many precarious industries such as nursing homes, commercial real estate, hospitality, and suburban malls, college campuses are now next on the chopping block.

Big tech not only will make these campuses optimized for delivery centers but also gradually dive deep into the realm of digital educational revenue, hellbent on hijacking it from the schools themselves as curriculum has essentially been digitized.

Just how Apple has announced their foray into cars, these same companies will go after education.

Colleges will now have to compete with the likes of Google (GOOGL), Facebook (FB), Amazon (AMZN), Apple (AAPL), and Microsoft (MSFT) directly in terms of quality of digital content since they have lost their physical presence advantage now that students are away from campus.

Tech companies already have an army of programmers that in an instance could be rapidly deployed against the snail-like monolith that is the U.S. university system.

The only two industries now big enough to quench big tech’s insatiable appetite for devouring revenue are health care and education.

We are seeing this play out quickly, and once tech gets a foothold literally and physically on campus, the rest of the colleges will be thrust into an existential crisis of epic proportions with the only survivors being the ones with large endowment funds and a global brand name.

It’s scary, isn’t it?

This is how tech has evolved in 2020, and the tech iteration of 2021 could be scarier and even more powerful than this year’s. Imagine that!

AMAZON PACKAGES COULD BE DELIVERED FROM HERE SOON!