“Wear your failures as a badge of honor.” – Said Current CEO of Alphabet Sundar Pichai

Mad Hedge Technology Letter

October 19, 2020

Fiat Lux

Featured Trade:

(ROLL OUT THE OVERSTOCK.COM PLAYBOOK)

(OSTK), (AMZN)

As the virus engulfs the U.S. once again — I can’t help but think it’s time for the 2nd wave of Overstock.com (OSTK) going ballistic again.

Highlighting the insanity of 2020, Overstock.com shares were trading at a pitiful $2 on March 11 and then lockdowns happened, and the stock never looked the same again.

To say that underlying shares went parabolic is an understatement, the meteoric rise from $2 to $115 in a 5-month span is stuff of legends.

Remember that Overstock.com was just a middling backwater stock almost as Myanmar’s mediocre geopolitical status is to the Asian continent.

In fact, shareholders were in the process of searching for a buyer — in a way waving the white flag as a resentful ending to a half-hearted try to catch Amazon’s (AMZN) e-commerce business.

Overstock.com sells everything from baby toys to wrought iron firepit décor.

If it’s for the home or something related, they probably have it in store for you and as Covid has throttled the population’s go-to shopping places from strip malls to the shopping lanes of America, Overstock.com has become an outsized winner.

Let’s get into the weeds of their business.

With the tectonic shift to e-commerce likely permanent, shares can keep rallying specifically because the risk of another lockdown is increasing and the virus spreads again.

Multiple catalysts, both on the macro and micro level that can drive continued upside to revenue meaning high estimates for Ebitda (earnings before interest, taxes, depreciation, and amortization).

Bricks-and-mortar stores will continue to bleed market share to online competition even if the virus is handled, providing a tailwind for Overstock into 2021.

The company’s improved pricing model will shoot margins higher, while it also works to broaden its target audience and expand marketing.

Overstock has evolved in recent years, thanks to new management and a new strategy, which includes a timely focus on home goods, a retail standout during the pandemic. It also has blockchain-based ventures that bulls say the market is ignoring.

The one-sentence answer to why the stock has gone ballistic is easy — 109% revenue growth year over year.

The company ended the quarter with a healthy balance sheet that included a cash balance of over $300 million.

Overstock Retail's exceptionally strong second-quarter performance was on fire supporting a 200% increase in new customers, and profitability, as measured by adjusted EBITDA, improved by $51 million year over year.

A key takeaway here is the scalability of Overstock’s pure-play e-commerce model and efficiencies created through partner drop-ship program.

Overstock’s overarching goal is to create operating leverage by growing top line at a faster pace than operating expenses.

Overstock is profitably gaining new customers and making progress toward achieving sustainable, profitable growth long term.

Last quarter, revenue from their Retail business was a record $767 million and customers are increasingly finding and purchasing products in core home furnishings categories.

Compared to the second quarter of 2019, new customer growth increased by over 200%, and Overstock has experienced strong customer purchase repeat behavior.

Gross margin improved by almost 3.5% year over year and the margin improvements were fueled largely by operational efficiencies, as well as several onetime items unique to the second quarter of 2020.

The onetime items included lower costs from being understaffed in the customer care organization as Overstock adjusted to increased sales volumes, a benefit from fulfillment-related charges as part of the service level agreements to protect customers' experience, and lower discounting activity as they strategically balanced marketing efforts against product availability and stockouts.

Operating expenses improved 5% as management was able to leverage technology expenses, illustrating the strong operating leverage inherent in an e-commerce business.

Overstock is one of a slew of internet companies that will harvest the fallout from another spread of the virus.

I believe it’s time to roll out the Overstock playbook again and buy and hold shares.

For short time traders, this is a beast of a stock to execute short-dated trades on because of the elevated volatility, but in general, I am bullish on this company through 2021.

“Almost everything is like a machine.” – Said Hedge fund Manager Ray Dalio

Mad Hedge Technology Letter

October 16, 2020

Fiat Lux

Featured Trade:

(CELL TOWER INDUSTRY IS PRINTING MONEY)

(CCI), (SBAC), (UNIT), (VNQ), (LMRK), (VMI)

Investors who want to green light capital into this sector should consider American Tower (AMT), Crown Castle (CCI), SBA Communications (SBAC), and Uniti Group (UNIT). Cell towers are the largest property sector by market capitalization making up 18% of the broad-based Vanguard Real Estate ETF (VNQ).

Three disruptive developments started before the pandemic will remain influential from the chronic housing shortage to retail apocalypse, and the migration to digital.

The 2020s will supercharge these three trends and tech investors need to scurry into the intersection of seminal trends to profit from the appreciation taking place in the U.S. economy.

As a 10% pullback in cell tower REITs over the last quarter reared its ugly head, offering a rare entry point into this segment of the U.S. tech ecosystem.

Usage of the cell towers has mushroomed throughout the pandemic. Cellular network capacity has been pushed to the limits as businesses, schools, and individuals take their in-person life and migrate it online.

5G is circling in the skies looking for a soft landing. Phone makers are frantically upgrading their device iterations to accommodate an internet speed that is 100X faster than what we have now.

Any company that flubs the 5G smartphone will be left in the dust.

Cell tower REITs will eventually be the focal point of 5G networks, supported by a network of higher-density small cells. High-power macro towers provide the most economical mix of wide coverage and capacity.

Super-fast Wi-Fi speeds will usher in a new era of super apps that will fundamentally disrupt the telecommunications space and deliver cheaper and more efficient apps to the consumer marketplace.

These super apps will make the apps we use now on our phones seem like a waste of time.

Cell tower REITs continue to benefit from favorable competitive positioning within the telecommunication sector. Scant supply and high demand should translate into continued pricing power for cell tower REITs.

Cell tower REITs are the “landlords” to the United States' four nationwide cellular network operators: AT&T (T), Verizon (VZ), T-Mobile (TMUS), and DISH Network (DISH). These three cell tower REITs own roughly 50-80% of the 100-150k investment-grade macro cell towers in the United States. This favorable competitive positioning has given these REITs substantial pricing power over the last decade amid the roll-out of 3G and 4G networks.

5G is the fifth-generation mobile network that powers mobile broadband, promising far-faster speeds and lower latency than the prior iteration.

5G networks require up to 10 times more physical antennas per tower, and cell tower REITs typically negotiate higher revenue per tower after each incremental equipment upgrade.

Cell tower REITs continue to be one of the few remaining growth engines of the REIT sector, and the health crisis has validated the need for additional network investments.

The dearth of cell tower supply - combined with the absolute necessity of these towers for networks - has given REITs substantial pricing power even as the number of potential tenants has dwindled down to just four national carriers over the last two decades.

High barriers to entry through the local permitting process and due to the economics of mass scaling make competition irrelevant.

This is a high-margin business with significant operating leverage driven by adding additional multiple tenants to existing towers.

Cell towers aren’t going away anytime soon and there is nothing to replace it on the horizon.

Another viable infrastructure play would be Landmark Infrastructure Partners (LMRK), an MLP that owns real property interests that underlie cellular towers, rooftop wireless sites, billboards, and wind turbines.

I would throw Valmont Industries, Inc. (VMI), who manufactures communication infrastructure, into the mix as well.

“I do not fear computers. I fear lack of them.” – Said American writer and professor of biochemistry at Boston University Isaac Asimov

Mad Hedge Technology Letter

October 14, 2020

Fiat Lux

Featured Trade:

(TECH OPTION VOLUME UNHINGED)

($COMPQ), (APPL), (FB), (MSFT), (GOOGL), (NFLX)

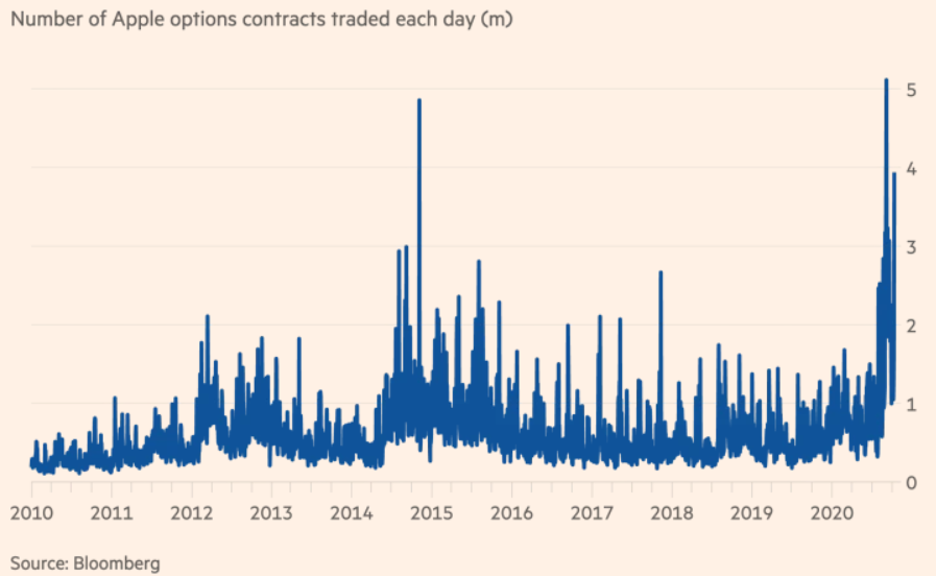

The euphoria in big cap tech shares is the catalyst moving the Nasdaq index recently.

Call option activity is taking the top off of tech shares with usual low beta stocks surging over 5% in single trading sessions.

This unfortunately is causing our options trades to experience heightened stock volatility and the knock-on effect is our strikes getting blown out.

Some of the excess volatility comes down to traders making big bets in the run-up to the election.

Remember when Trump won in 2016, the market exploded higher when many “experts” guaranteed a massive sell-off would ensue.

In the short-term, the unsustainable pace of speculation in derivatives will translate into wild price swings. Monday brought the biggest rally for the Nasdaq 100 Index since April, but measures of volatility rallied as well.

One proxy for the froth still latent in options, the percentage of overall volume represented by single-stock contracts, remains up 19% from a year ago.

Most of the action is concentrated in mega cap technology and momentum-driven shares.

A consensus is coalescing around a few big buyers coming into the options market to corner it with rumors of purchases around $300 million worth of call contracts on tech stocks in a single day.

The Nasdaq 100 Index has gained in all but two sessions this month and just notched its best week since July after last month’s sharp drop.

Whipsawing markets are also possible when liquidity remains thin.

Trading in options showed itself capable of influencing share movement in August and September when dealer hedging (demand from people who sell options for the underlying stock) created feedback loops that helped drive the Nasdaq higher.

That dynamic can also make sell-offs worse than they should be as well as sellers adjust positions.

Big trades in thin markets, especially in technology or momentum trades considered overbought or oversold, increase the potential for exacerbated stock moves as dealers hedge exposure.

Call open interest in Facebook (FB), Amazon (AMZN), Netflix (NFLX), Alphabet (GOOGL), Apple (APPL) and Microsoft (MSFT) has averaged 12.8 million contracts over the 30 days through Friday, the highest since early 2019.

The tech-heavy Nasdaq index has gyrated an average of 1.8% per day since the beginning of September, while the broader market gauge has fluctuated by 1.2% over that time period.

Recent options activity has been momentum-based, meaning that stocks tend to attract more interest in calls when it’s rallying versus when it trades lower.

Throw in structural forces that are contributing to a sustained high implied volatility environment, and election hedgers have their work cut out for them.

There are fewer short-volatility players as well in the wake of the health crisis.

There’s also less volatility selling by retail investors after the delisting of some popular VIX products earlier this year like the volatility ETF ticker symbol XIV.

It could take a few years for the imbalances to work itself through the system.

Then there’s the resurfacing of an event similar to the “Nasdaq whale” which is reported as Softbank acting like a hedge fund and buying as many big tech call options they could afford.

Softbank CEO has essentially turned his failed hedge fund named the Vision Fund from a start-up investor into a speculative hedge fund in risky option contracts solely betting on the rise of Silicon Valley tech in the age of the coronavirus.

After being burnt by Uber and WeWork, he finally decided to stay out of the messy acquisitions/seed funding and just speculative through derivatives from Tokyo.

The avalanche of options volume will no doubt cause the tech markets to become jittery and it certainly puts a floor under tech implied volatility for a while.

Retail investors have taken notice of this insane volume and largely stayed on the sideline.

At the apex of the madness, retail traders spent more than $511 billion in notional value on call options and that figure was slashed to $343 billion in the first week of October.

Retail traders tend to buy less-expensive short-dated contracts which tend to have greater convexity and ability to exacerbate share movements.

The level of risk-taking occurring in the public markets is at an all-time high.

Just look at America’s most elite university endowments who have slashed their exposure to the stock markets to the lowest levels since before the crash of 1929. And now they’re betting the ranch on secretive, illiquid, and high-risk private-equity funds and hedge funds.

A US teachers’ pension fund has sued Allianz Global Investors, accusing one of the world’s biggest asset managers of employing a “reckless strategy” that cost retirees almost $800m during this year’s market turmoil.

This is just one example of the high-risk strategies taking place with pension money.

In a lawsuit filed on Monday in New York, the Arkansas Teacher Retirement System claims that Alpha Funds, investment vehicles marketed by AllianzGI, had placed bets against an escalation of market volatility in an effort to recover losses they incurred from the same strategy in February.

So here we stand with derivative trading in tech options and general equity strategies leveraged to the hills that are betting on the system not breaking, or at least not breaking yet.

Even if the system reaches breaking point, many of these private investors are betting on governments to come rescue them perpetuating the feedback loop and offers a conundrum to savvy asset managers to miss or partake in the gaps up themselves.

“Success can cause people to unlearn the habits that made them successful in the first place.” – Said current CEO of Microsoft Satya Nadella

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.