Artificial Intelligence is something we as a society, economy, and individual simply don’t talk enough about.

The point we find ourselves at today is disappointing.

Artificial intelligence is mainly controlled by the big corporations and big governments.

How is it being applied?

Largely through spying, surveillance, and digital marketing.

Digital marketing is the only one that really hits home because we are constantly bombarded with predatory ads that manipulate consumers into buying goods we don’t need.

As artificial intelligence becomes more widespread and cheaper to apply to everyday microeconomic situations, our workforce will transform into something that we could have never fathomed.

What does that mean?

Job losses and a tidal wave of automated jobs will come to the fore.

With the pandemic ravaging job prospects, white-collar professionals have lucked out being able to loaf around the office, stroke a few keys, and get paid.

Well, massive job displacement won’t come for these professionals yet, but once artificial intelligence improves by a factor of 10X,100X, 1000X, 10000X than the average human, then job losses will reach higher up the job chain and arrive like an avalanche.

There are few hideouts from the robots, examples can be found everywhere such as accountants have a 95% chance of losing jobs in 20 years and 35% of legal sector jobs could be automated in 10 years.

Intelligent agents and robots could replace 30% of the world’s current human labor.

AI systems are already replacing human stock pickers, turning banks into human-less cloud centers running on algorithms that can analyze information from markets, social media, corporate filings, and economic conditions to quickly decipher trades. These systems can trade better than any human.

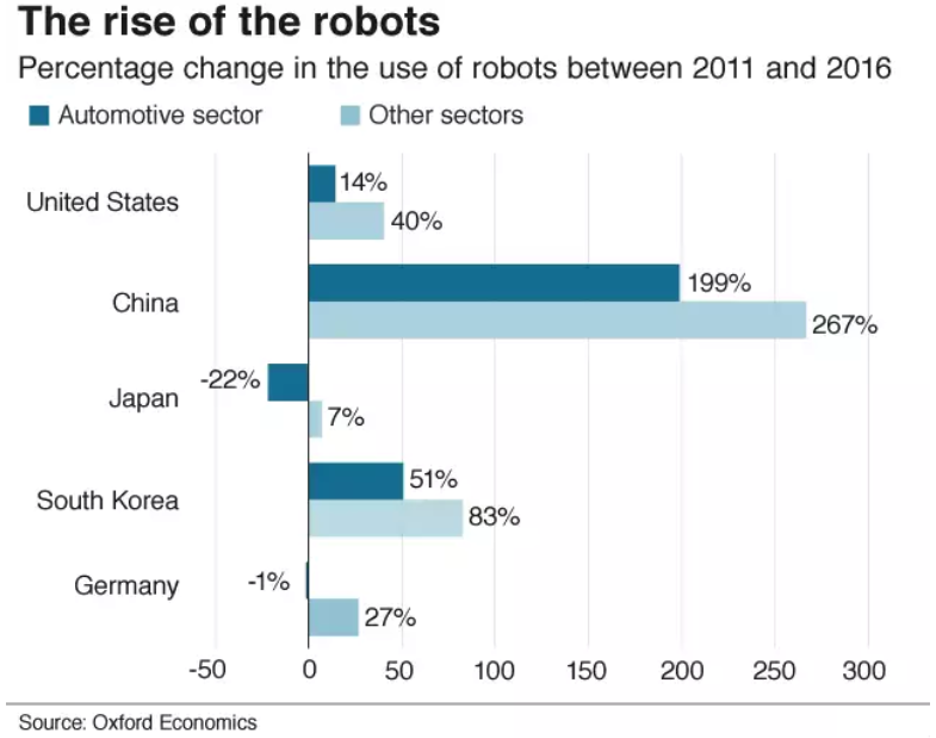

A London School of Economics study showed that 40 million manufacturing jobs around the world could be replaced with robots by 2030. Each robot impacts 1.6 jobs, with lower-skilled regions seeing a higher impact.

The only way humans will be able to get a foothold in the future job market is to merge with robots and become a super worker being able to tap into the deep reservoir of knowledge that artificial intelligence pools together.

“Augmenting humans” is a scary thought in 2020 but in 10 or 20 years, it could become the only means to survive or the only way to be competitive.

Enhanced productivity leads to economic growth, which in turn can fund new job creation opportunities and this enhanced productivity will be led and influenced by AI.

A University of Tokyo study involving 1,500 companies shows that significant performance improvement is experienced by firms which combine the forces of human and robot.

Man and AI can collaborate to enhance each other’s complementary strengths: leadership, team spirit, creativity, and social skills of the former, and speed, scalability, and data crunching techniques.

Also, technological advancements are propping up new areas which did not exist before like big data analysis, data security, decision support analysis, predictive analysis.

Data scientist was a job that didn’t exist 10 years ago, but today almost every business, from consumer brands to online pharmacies, needs data scientists to interpret customer data to design product and marketing strategies.

Around 50% of surgeons will be replaced in 20 years substituted by robots who are precise to the millimeter removing any remnants of human error.

Technology is being increasingly used to support doctors – whether it is retrieving digital records or using data analysis for diagnosis.

The “human touch” could almost become completely erased in healthcare giving way to robots being the brains of the operation and humans as assistants to lend a face to the business.

Then as AI develops, it could fork into different types of AI.

At some point, AI might be able to think for themselves, achieve consciousness, conceptualize, and do complex strategic planning or make decisions based on emotional intelligence (EQ).

Robots will eventually deal with situations where there is an absence of data and feel or interact with empathy and compassion.

Granted, we are nowhere near this last developmental stage of AI but it's food for thought while humans battle the first wave of job losses with primitive AI robots who can’t understand how you feel.

The ultimate decision that humans will need to make is if they are willing to eventually become part robot to survive.

I believe young people will jump at the chance to forge ahead a new career and ride a wave of momentum to get a leg up on the competition because they have the rest of their lives ahead of them.

Pensioners might be averse to joining the youth because they rather enjoy their last years instead of hooking up to a network of infinite data.

Do not forget that when AI is finally fused with the human brains, these humans will be able to creatively think, problem-solve, collaborate on a level that the prior collection of humans together could not compete with.

In the short-term, job losses will deepen as the world becomes overpopulated and AI isn’t mature enough to offer legitimate meaningful solutions yet.

Sometimes the economy has to go 1 step backward to go 2 steps forward.

In the next few years, we will experience the full force of digital marketing as the industry milks the last drops of what it can before that industry finally changes.

The same goes for devices like smartphones and iPads, they won’t exist in 10 years because they will be replaced.

Investors need to keep in touch with the developments of AI because seismic shifts could mean certain tech companies are deemed obsolete going forward.

In either case, software is the future, and AI and whatever framework replaces physical devices will need more software and better-quality software.

Therefore, I recommended finding the best software companies and just buying and holding because they will be part of any new tech revolution and most likely an oversized participant.