U.S. tech is about to hit a 10-bagger when TikTok is set to choose between the Microsoft (MSFT)-Walmart hybrid offer or one from Oracle (ORCL) in the next 48 hours.

The network effect that will result from this purchase will be staggering and still underhyped in the mainstream media.

I am on record saying that Walmart is the new Fang, and their ambitions prove it.

Walmart (WMT) wanted to be the majority owner of TikTok, but the U.S. government wanted a technology company to be the lead investor.

I am not sure how that makes sense in an age where every company is a tech company.

Walmart was originally in a consortium with Google (GOOGL) before moving over in recent days to partner with Microsoft (MSFT) when it became clear the retailer would not be able to lead the deal.

Walmart is validating my thesis that it is a hybrid ecommerce company with its last earnings report 2 weeks ago.

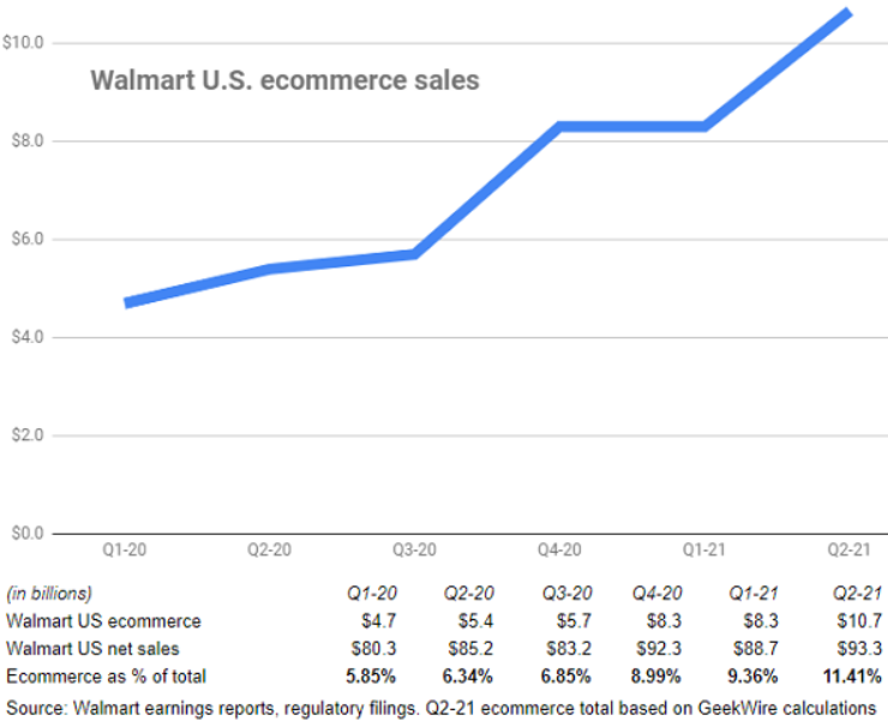

In the company’s Q2 earnings, Walmart reported its U.S. ecommerce sales were up 97% — an increase attributed to more customers shopping online during the pandemic, stocking up on household supplies and shopping for grocery items online.

The TikTok deal first started with Walmart negotiating with SoftBank Chief Operating Officer Marcelo Claure.

SoftBank’s Claure believed Walmart’s all-American image and Google’s cloud computing infrastructure backbone could be a way in for the Japanese technology company.

The deal structure would have had Walmart as the lead buyer, with SoftBank and Alphabet acquiring minority stakes. One or two other minority holders held talks to join too but this ultimately was nixed by the U.S. government.

Walmart’s goal is to become the exclusive e-commerce and payments provider for TikTok and have access to user data to enhance those capabilities.

U.S. national security hawks need to save face by having a thoroughbred U.S. tech company lead the deal to show that this isn’t just about underhanded economic mercantilism.

Google could face significant antitrust opposition if it acquired TikTok’s U.S. assets.

Amazon is out of the picture too for anti-trust worries.

These concerns caused the consortium to crumble last week and led Walmart, which had become increasingly convinced that TikTok fits into its strategy, to partner with Microsoft on a bid instead.

TikTok is pondering which way to go – either the Microsoft-Walmart bid or a rival offer from Oracle. A deal, which is set to value TikTok’s U.S. operations in the $20 billion to $30 billion range, could be completed in the next 48 hours.

What does this mean for Walmart?

Walmart is hellbent on directly competing with Amazon prime for that same ecommerce market.

Walmart ecommerce sales now total more than $10 billion in quarterly U.S. ecommerce sales, exceeding 11.4% of the retail giant’s overall U.S. net sales for the first time.

The achievement reflects the ongoing shift toward online shopping amid the pandemic, and the increasingly fuzzy line between online and physical retail sales. It is also an example of the pandemic accelerating the shift to digital commerce at traditional brick-and-mortar retailers.

The timing isn’t a coincidence with Walmart on the verge of rolling out its own Amazon Prime service dubbed Walmart+.

Walmart’s new membership program is expected to cost $98/year, competing with Amazon’s $119/year Prime membership.

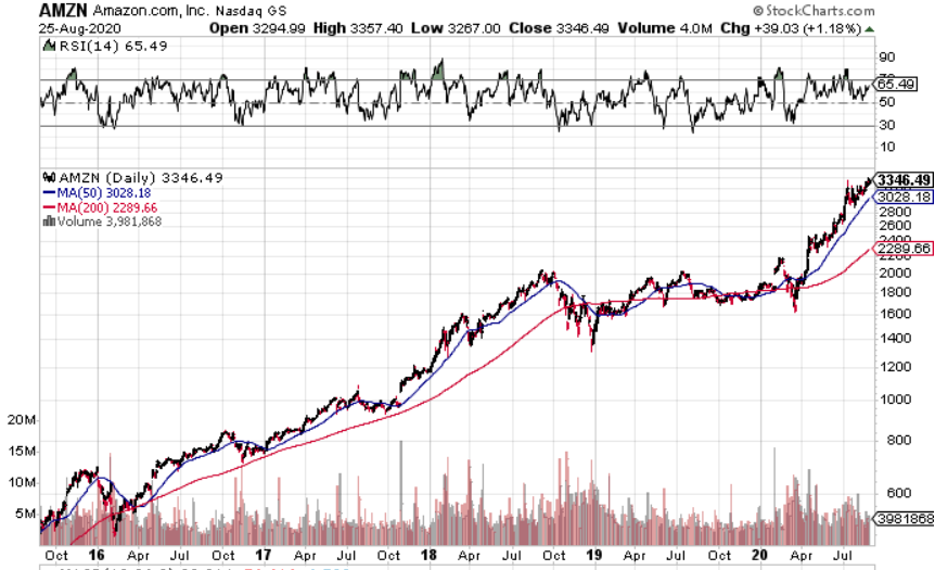

Amazon’s global online sales are 4.5X larger than Walmart’s at $45.9 billion for the quarter, up nearly 50%, and its physical retail sales were $3.8 billion, down 13% from the same period a year ago.

Walmart has significant headway to make before it comes close to Amazon Prime but there are fertile pastures in front of them, meaning I believe Walmart is a conviction buy at these levels.

At the bare minimum, this is a conspicuous sign of intent for Walmart that has successfully turned around the titanic and is a real time player in ecommerce.

They will be on the prowl for other tech purchases in the future as well as they certainly have the cash flow to pull the trigger on adding more tech talent to the lineup.

If Walmart reels in TikTok, I recommend long-term investors to buy Walmart as a tech growth asset and it is easily a $200 stock.