Here we go again.

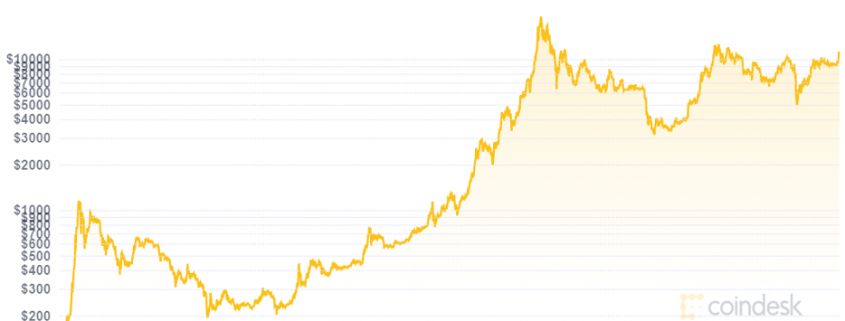

The Bitcoin bulls have crashed the party and they have good reason to celebrate as the so-called digital gold surged from its nadir of $3,715 in January 2019 to over the $11,000 mark today.

The currency was in the doldrums after the crash from $20,000 with many investors left holding the bag.

The Mad Technology Letter doesn’t often foray into the speculation of Bitcoin, predominantly because the asset is untethered to fundamentals, but the price action of late has made us take notice.

There has been resistance at the $10,000 mark and $10,500 mark. Blowing through this resistance signals that Bitcoin could be in for a sustained rally.

What is moving the digital gold?

The gyrations in the digital currency come as gold prices have surged amid a mad migration for assets that are considered alternatives to cash and stocks fueled by the COVID-19 pandemic that has driven much of the developed world into a deep recession.

Gold hasn’t been this high since 9/11 and it’s on the verge of surging past the $2,000 mark.

Prices for gold and bitcoin have climbed as a gauge of the U.S. dollar hit its weakest level since 2018 and the dollar is at a 9-month low.

Not only has the virus dampened sentiment around the global economy, but the insane spending by governments to help prop up economies battered by pandemic has supported bullion prices.

U.S. Treasury Secretary Steve Mnuchin and the GOP are in the works to push through yet another massive stimulus and who knows what is after that.

Bitcoin has benefited from the knock-on effects of gold being a safe haven trade.

The fact is that Bitcoin shares gold’s key characteristics of being a store of value and scarcity— and could potentially knock gold off from its perch in the future as the world becomes ever more tech-driven.

Bitcoin is also thriving as it updates itself.

Bitcoin has much more intrinsic value today than it did a year ago just from an infrastructure perspective.

The Lightning network is working, sidechains are working. The currency is just a lot more rock-solid foundationally that it has ever been.

Security has always been a black eye for this asset class and rightly so as who would want their digital fortune pickpocketed by a hacker.

The Lightning network is a second-layer technology for bitcoin that scales the blockchain’s ability to conduct transactions and it is facilitating the ability to operate the network smoothly.

It’s more than just increasing capacity driving the surge in investor interest and prices.

The supply of available bitcoin continues to shrink — a function of the halving of coins in circulation which happened earlier this year.

Another x-factor will be the continuing adoption of financial institutions using bitcoin.

This offers investors more confidence in the security and fungibility of the assets.

Many experts forecasted the digital currency to surge in the third quarter or early fourth quarter solely based on the enhanced infrastructure to support transactions and activity on the blockchain.

A reaction to the halving of currency in circulation was also another inflator.

The coronavirus was just the supercharger to the equation.

With legitimate institutions holding bitcoin for customers, the average person will begin to feel more secure dabbling in Bitcoin, and this will support wide-scale adoption and acceptance of the digital gold.

No doubt that the concept of Bitcoin is hampered by this cult of life characters that go on air to try to bid up the currency saying their yearend targets are $30,000.

The overhyping of Bitcoin is something of an eyesore, but I can definitely vouch for the increasing relative legitimacy of Bitcoin and this asset class is not going away.

There certainly is a case for Bitcoin to go to $15,000 and $20,000 if a much predicted “second wave” hits this fall in large swaths of the world forcing developed governments into yet another stimulus package.

Once Brazilians, Russians, and Americans take their late European summer vacations, it’s hard to not see another lockdown in Europe.

Many investors can observe numerous governments just not having their act together feeding into the Bitcoin narrative and honestly contributing to its legitimacy as well.

It’s hard to remember when faith in certain governments was lower.

I don’t advocate pouring one’s life savings into Bitcoin though, it’s just too untested and needs to prove itself more as a financial asset.

If technology and the digital revolution is the story to believe in, then invest in a Nasdaq exchange listed fintech company.

These platforms offer Bitcoin to customers for purchase as well and are the growth companies that many tech investors dream of.