Snap (SNAP) is a stock that I have bashed relentlessly from the onset of the Mad Hedge Tech Letter.

But things are different now.

Recent events have made me stand back and take notice.

This company has really turned the proverbial corner.

Now I can say with conviction that Snap is a buy and hold.

The snapback in shares of more than 110% from March lows is no joke as well and could be the beginning of a roaring melt-up in share appreciation that won’t stop until the next “big” macro event.

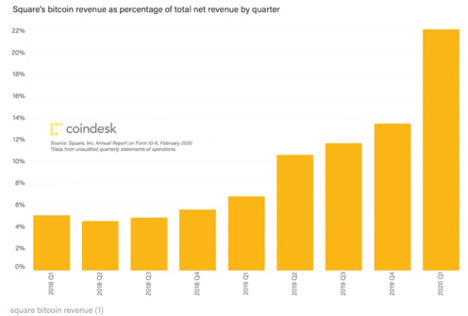

Much of this has to do with the average revenue per user climbing as they have not been able to ramp up the volume of the userbase which is a headwind that many of the social media companies are currently facing.

I fully expect annual revenue per user to jump around 22% by the end of 2020 because of Snap’s new ad technology called Dynamic Ads.

Initial data suggests that ad buyers are clamoring for this new technology.

The new design allows clients to upload their product catalogs to Snap and automatically generate ads, versus manual versions that fit Snapchat’s vertical ad format.

Snap has also delivered optimal analytic tools to better understand how effective ad dollars are.

They have also rolled out a new ad format for the map component of Snapchat that target small and medium businesses.

Digital ad delivery, design, and maintenance is really the deep core of these social media platforms and how they earn revenue, but the attractiveness of gaming to social media brought to us from the side effects of the coronavirus cannot be underestimated as well.

As lockdowns and second waves reared its ugly head, mobile gaming popularity went through the roof.

Snap didn’t hold back - they attacked this opportunity by layering themselves deeper into the gaming ecosystem.

Snap entered into a multi-game partnership with mobile game giant Zynga (ZNGA) that integrated the niche gaming asset into Snap resulting in more time spent for each Snapchat user.

Zynga has performed handsomely since the pandemic hit.

Shares have doubled since March lows and the firm stayed aggressive by acquiring gaming company Peak for $1.8 billion.

Zynga has mastered a full steam ahead acquisition strategy for the past several years that includes the purchases of Gram Games and Small Giant Games.

These two buys meant that Zynga effectively topped up with another 12 million gamers.

This strategy makes sense considering that Silicon Valley has had access to cheap capital for the last generation and is incentivized to keep users paying around in their unique walled gardens.

Zynga has also turned into quite a trendy buy call from stock analysts lately after being in the doldrums for years.

The company has parlayed its gaming machine into an ad juggernaut and expects to take in $90 million in ad sales just through one of its popular titles called Peak in 2020.

I do believe that gamers won’t bolt from the stable after the summer sun draws people out of their homes.

There is staying power in the cross-pollination of video games and social media. They complement each other quite well to the point where they are a match made in heaven for computer junkies.

I am from a different breed where I throw up ad blockers at each digital turn, but not everyone is averse to digital ads.

Social media and internet gaming had no retention problems before the pandemic, and the health crisis has exaggerated every single digital trend from cloud adoption to remote working, and social media gaming is no exception.