“I know tech better than anyone.” – Said Current President of the United States Donald J. Trump on his Twitter Account in 2018

Mad Hedge Technology Letter

May 29, 2020

Fiat Lux

Featured Trade:

(TRUMP’S TWITTER ATTACK WILL GO NOWHERE),

(TWTR), (FB)

I am convinced that Facebook (FB) and Twitter and other social media platforms will suffer minimal damage as a result of the administration cracking down on social media platforms.

The executive order could make it possible for social media companies to become liable for content posted on their platform.

The issue came about after Twitter decided to fact check two of Trump’s tweets.

To read more about Twitter’s decision, click here.

Trump views the fact checks as a personal attack against him and a threat to his ambitions in the political arena.

Section 230 refers to Section 230 of Title 47 of the United States Code (47 USC § 230). It was passed as part of the controversial Communication Decency Act of 1996.

Section 230 says that “No provider or user of an interactive computer service shall be treated as the publisher or speaker of any information provided by another information content provider.”

To read more about the law from Harvard Law Review, click here.

Facebook’s CEO Mark Zuckerberg condemned Twitter’s action saying that social media companies shouldn’t be the “arbiter of truth.”

What I see is President Donald J. Trump putting a massive premium on his Twitter account as the focal point to disperse his opinions and thoughts in the run-up to the U.S. presidential election.

This could be the difference between winning or losing!

This election will be fought tooth and nail on digital platforms and in the realm of global social media, Twitter is one of the most important platforms which is why I am incredibly bullish on the stock.

U.S. Democratic nominee Joe Biden understands the role of digital media in the upcoming election the hard way by being forced to be rooted in front of a webcam instead of rallying the masses at in-person live events.

Unable to round the circuit is an outsized blow for Biden and his digital response to it will be measured up to the Republican’s controversial response to the health crisis.

Trump has Twitter at his disposal and is much more adept at wielding it for his personal and career interests than Biden.

This U.S. election could become a Twitter contest to an extreme degree.

Twitter intruding into Trump’s daily flow of tweets and the backlash resulting from it is a clear signal that Trump is adamant that he can say whatever he wants through his Twitter account and in his mind, that will springboard him to re-election.

Facebook has benefited the most from Section 230 by Zuckerberg building his tech firm into a $650 billion company. Google’s YouTube platform is another outsized winner too.

This is the very law that undergirds Facebook’s entire competitive advantage since the company doesn’t actually produce anything, not even its own content.

Remember that Facebook effectively profits off of other’s personal data by giving digital ad companies the ability to post ads to a specific audience of Facebook subscribers.

I understand that Zuckerberg doesn’t consider this selling personal data and the difference at most comes down to technical verbiage.

I believe it will not devolve to a litigious stage.

This is merely a hands-off warning by Trump who wants control over his Twitter account and destiny up until the November election without any distractions or tech firms playing boss.

Zuckerberg wants Twitter CEO Jack Dorsey to shut his mouth and continue with the status quo which would mean higher stock prices and extreme wealth generation for everyone involved.

The exorbitant costs associated with auditing content of over 2 billion people keep Zuckerberg up at night.

Artificial Intelligence cannot identify the next threat and its backdated database can only identify what was assumed malicious in the past.

There is simply no way to ensure that 100% of content flowing through these digital arteries is mainstream enough to be deemed acceptable and social media platforms would open themselves up to lawsuits.

The lead up to the 2020 U.S. presidential election will most likely experience record social media engagement and these powerful platforms like Facebook and Twitter are the last tech stocks investors should go bearish on in the short-term.

Trump’s panic at the Twitter fact check is a stamp of approval for Twitter and Facebook.

Buy them on the dip.

“A founder is not a job, it's a role, an attitude.” – Said Co-Founder and CEO of Twitter Jack Dorsey

Mad Hedge Technology Letter

May 27, 2020

Fiat Lux

Featured Trade:

(THE NEXT DIGITAL ARMS RACE IS HERE),

(SPOT), (AMZN), (AAPL), (GOOGL), (FB)

The arms race for digital content is on and the next leg of the race is all about podcasts.

Wasn’t it just a few years ago that nobody listened to podcasts but kids?

Well, the surge in popularity recently has been nothing short of unfathomable with podcast personality of the stars such as Joe Rogan raking in 190 million downloads per month.

The "off the beaten path" media vehicle has exploited holes left by legacy media and the numbers back me up.

The tech world has taken note of this growing trend with reports that Apple is preparing to double down on original podcast content, purchasing shows that would become exclusive to its Apple platforms.

Apple (AAPL) would most likely try to sync new podcasts with Apple TV+ content and eventually cross-pollinate the video-streaming service.

Nothing has been as catchy as Spotify’s deep investments into the podcast world with $700 million combined for Parcast, Gimlet, Anchor, The Ringer, and The Joe Rogan Experience exclusivity.

Investors have rewarded Spotify for their aggressive strategy and shares are now trading over $190, up from $110 just a few months ago.

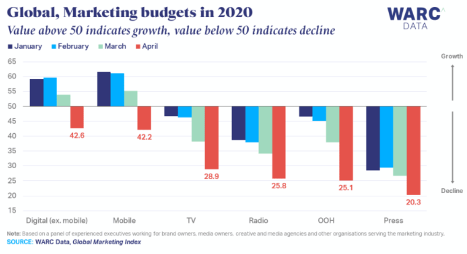

Spotify is all about the digital ad model and the coronavirus pandemic has shown us that TV ads are in a death spiral with ad companies like Facebook (FB) and Google (GOOGL) holding up the digital ad stakeholders.

I will say that the loss of Joe Rogan to YouTube is painful for Alphabet and they could likely continue to bleed big accounts until they cough on the money to buy premium content for itself.

Certain content is worth paying the premium for exclusivity or even overpaying for like a top-five NFL quarterback and podcasts are the new battleground to reach the populace who are fed up with sanitized legacy media who have been throttled by the U.S. culture wars.

“The Joe Rogan Experience” is the top podcast in America in terms of listeners and cultural influence and its over 300 million base is a massive win for Spotify (SPOT).

Rogan has leaped to great heights by interviewing guests like Tesla’s Elon Musk and smoking weed with him on set.

Amazon (AMZN) is reportedly looking for burgeoning podcast talent to fuse with its smart speaker assets.

No doubt the big boys are readying the bazookas.

I believe we are about to see the cornering of all popular podcast shows and the data backs up this strategy for big tech who will most likely become buyers because of their deep pockets.

Over 37% of the U.S. population devour podcasts at least once a month, or 104 million people.

Popular podcasts are ad revenue bell cows.

For instance, Rogan advertises directly to his audience and has brands backing him such as 23andme, Blue Apron, Square’s Cash App, Casper, Dollar Shave Club, Postmates, and Quibi.

The number of monthly podcast listeners jumped 16% in the last year and has doubled since 2015.

Over 55% of monthly podcast listeners are between ages 12 and 34 meaning the content is influential to the daily discourse of popular culture and an incubator of trend formation.

Barstool Sports has more than 30 podcasts and is a top 10 U.S. podcast publisher, with more monthly podcast listeners than sports channel distributor ESPN.

Podcasts are here to stay and the industry’s best will gravitate towards the most lucrative offers.

It doesn’t matter what platforms want to host them because their giant audiences will follow.

After Spotify’s buy of Rogan’s podcast, Apple, Facebook, Google, and Amazon must be contemplating their next move.

The reason we promulgate trades in big tech is because of their nimbleness in adapting their revenue models to the revenues drop off points.

The acceleration of entrenched trends like cord-cutting and digital media adoption offers a great boost to digital products like podcasts.

In the past quarter, legacy media has lost another 2 million subscribers representing a 6% loss.

Keeping tabs on who scoops up the best podcasts will be a lead indicator in who is harnessing funds to secure the best digital content.

My guess is that it is big tech and they will only become more diverse and powerful.

“Computers are useless. They can only give you answers.” – Said Artist Pablo Picasso

Mad Hedge Technology Letter

May 22, 2020

Fiat Lux

Featured Trade:

(WHY DATA HAS BECOME THE OXYGEN OF MODERN COMMERCE),

(BIG DATA)

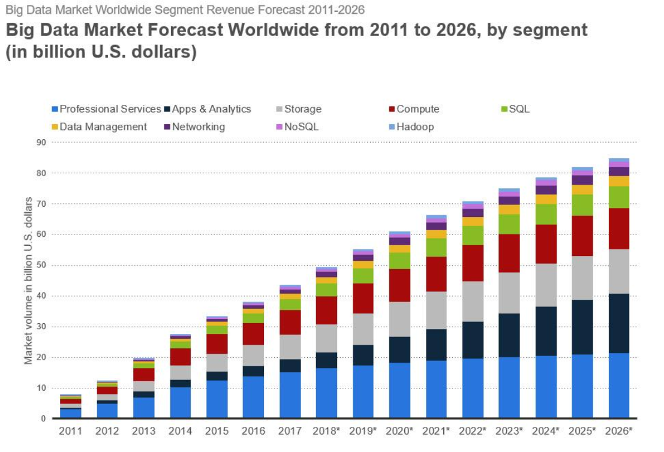

What does it mean for companies to apply data to gain an edge?

Let me explain.

Data is best described as the oxygen that is provided to the lungs.

Competition is based on the business intelligence excavated from vast troves of data.

These insights enable companies to target proper growth drivers, migrate to revenue hotspots and add appropriate employee talent.

The data also delves into how to create product stickiness, customer loyalty, promote up-selling, and optimize operations.

It’s not me just saying this to hype up the phenomenon, and I can vouch that data-driven decisions have worked wonders for the Mad Hedge Technology Letter.

Other companies have reported robust performance in productivity and profitability margins up to 10% higher than analog companies.

A recent report showed that margins would expand wider after the first year to 10% and hit a roaring 15% after operations are further refined.

It's a world of data supremacy; it doubles in size every two years and will reach 70 zettabytes by next year.

Data is connected to every part of the model from marketing campaigns, to website traffic flow and activity engagement, to operational procedures.

Can you believe that only 10% of global data is currently being acted on?

It’s hard to digest that most companies are winging it without any rhyme or reason.

The world is way too complex to bring a knife to a gunfight.

Predictive insights used to be only reserved for Fortune 500 companies who could afford the high expense of applying these high-powered tools.

But after the recent wave of automation and cloud software, even individual proprietors can participate in this once-taboo management exercise because the costs have come down.

Going on gut instinct and best estimates can only get you so far in a rapidly digitizing world and the coronavirus has only made the volume of data explode and required insights into business that are much more important.

I would also say that companies must be vigilant in harnessing the data because the skyrocketing number of nefarious elements out there have corrupted many data forms.

Just recently, the Mad Hedge website was overpowered by a tsunami of bots scouring our website for data.

The bots overloaded our email distributer service with new subscriptions by registering 1000s of emails into our database which muddied our underlying data and our ability to glean salient insights into it.

Bots find the data needed to answer a question or solve a problem and the Mad Hedge Fund Trader website has been a target to find the best financial content in the English-speaking world.

Once the requisite data is in hand, bots identify what toolsets are needed to organize the data and produce predictive and prescriptive business insights.

Many of these bots use content to create trading algorithms based on stand-alone content from the Mad Hedge Fund Trader that acts as a direct input into the database.

This new form of business intelligence deploys machine learning software as a question or problem and generate actionable solutions.

They can categorize base cases, outliers, marginal cases, and errors that require further data cleaning, additional reporting, and queries.

Ultimately, these bots are the vehicles in which a final answer is populated such as whether or not to buy Amazon stock today or tomorrow and so on.

As we push into the 5G era, this same technology will be repurposed for the internet of things (IoT) translating into another wave of products being groomed and fine-tuned by machine learning.

Internet of Things (IoT) is the fastest-growing segment of data and already comprises 15% of total global data.

Physical products will need embedded sensors that will monitor the performance and send terabytes of data back to the data servers for data analysts to pick apart.

One example is a Geared Turbo Fan engine which requires 5,000 sensors that generate up to 10 GB of data per second.

Now you can understand why the volume of data is literally about to mushroom as 5G takes hold and why Amazon has been so hellbent in penetrating the smart home market.

Bots facilitate conversations between systems and data silos and allow your decision-makers to have the keys to the Ferrari.

Bots enable an easy view of displaying key performance indicators (KPIs) and alerts on the run with simple charts and graphs.

As the coronavirus offers us glimpses into the world tomorrow, data analysts embedded all over the world will be harnessing bots to maintain your home thermostat or upgrade software in the rear of your smart microwave.

As we speak, the Mad Hedge Fund Trader website is gearing up for the next wave of data supremacy and I advise everyone else to get with the program.

This is the world of the future and for companies who don’t adapt, they will be swept into the dustbin of history.

“The sidelines are not where you want to live your life. The world needs you in the arena.” – Said CEO of Apple Tim Cook

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.