Students hoping to become bankers shouldn’t study finance, they should dive into programming.

This is the big takeaway from how investment banks are run these days.

Gone are the moments when finance degrees were the hottest commodity; now it is all about generative AI.

Artificial intelligence (AI) could replace the equivalent of 300 million full-time jobs, a report by investment bank Goldman Sachs says.

It could replace a quarter of work tasks in the US and Europe, but may also mean new jobs and a productivity boom.

And it could eventually increase the total annual value of goods and services produced globally by 7%.

Generative AI, able to create content indistinguishable from human work, is "a major advancement", the report says.

Silicon Valley is keen to promote investment in AI not only in the United States but in a way that will ultimately drive productivity gains across the global economy.

The report notes AI's impact will vary across different sectors - 46% of tasks in administrative and 44% in legal professions could be automated, but only 6% in construction and 4% in maintenance, it says.

Journalists will therefore face more competition, which would drive down wages unless we see a very significant increase in the demand for such work.

Consider the introduction of GPS technology and platforms like Uber (UBER). Suddenly, knowing all the streets in London had much less value - and so incumbent drivers experienced large wage cuts in response, of around 10% according to our research.

The result was lower wages, not fewer drivers.

Over the next few years, generative AI is likely to have similar effects on a broader set of creative tasks.

According to research cited by the report, 60% of workers are in occupations that did not exist in 1940.

However, other research suggests technological change since the 1980s has displaced workers faster than it has created jobs.

Nobody understands how the technology will evolve or how firms will integrate it into how they work.

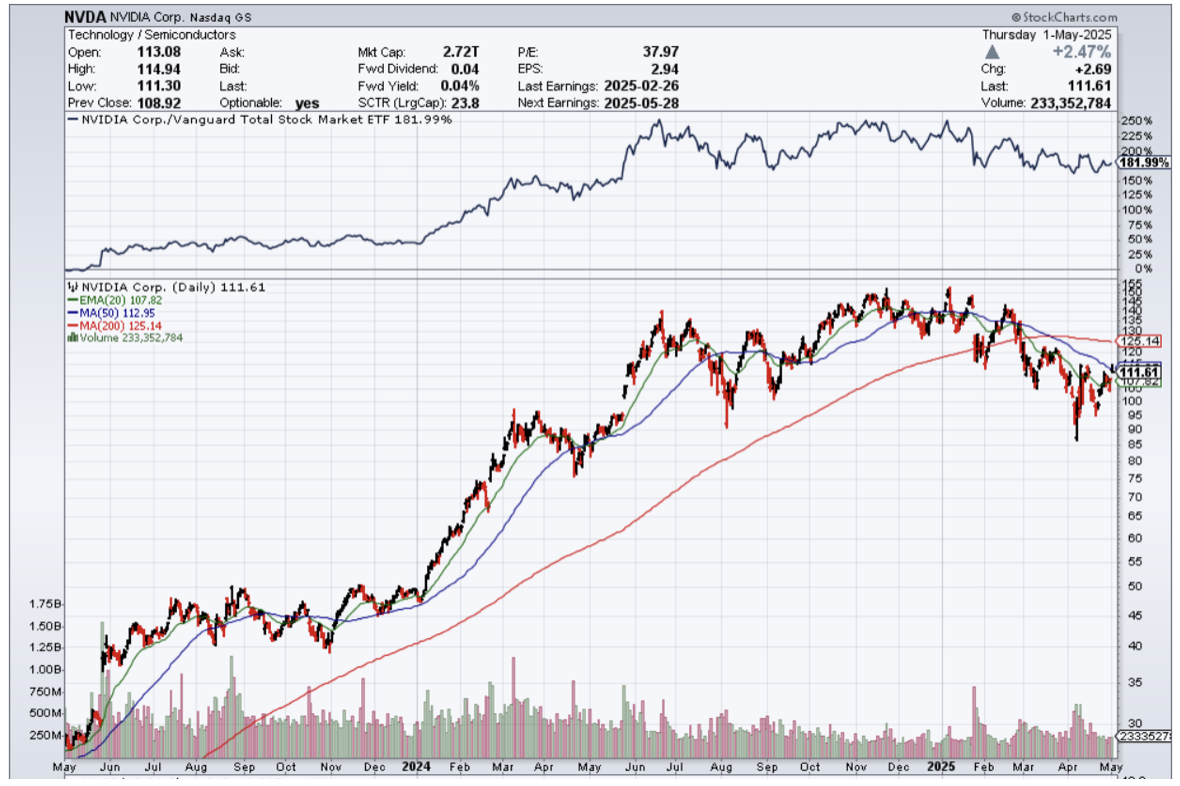

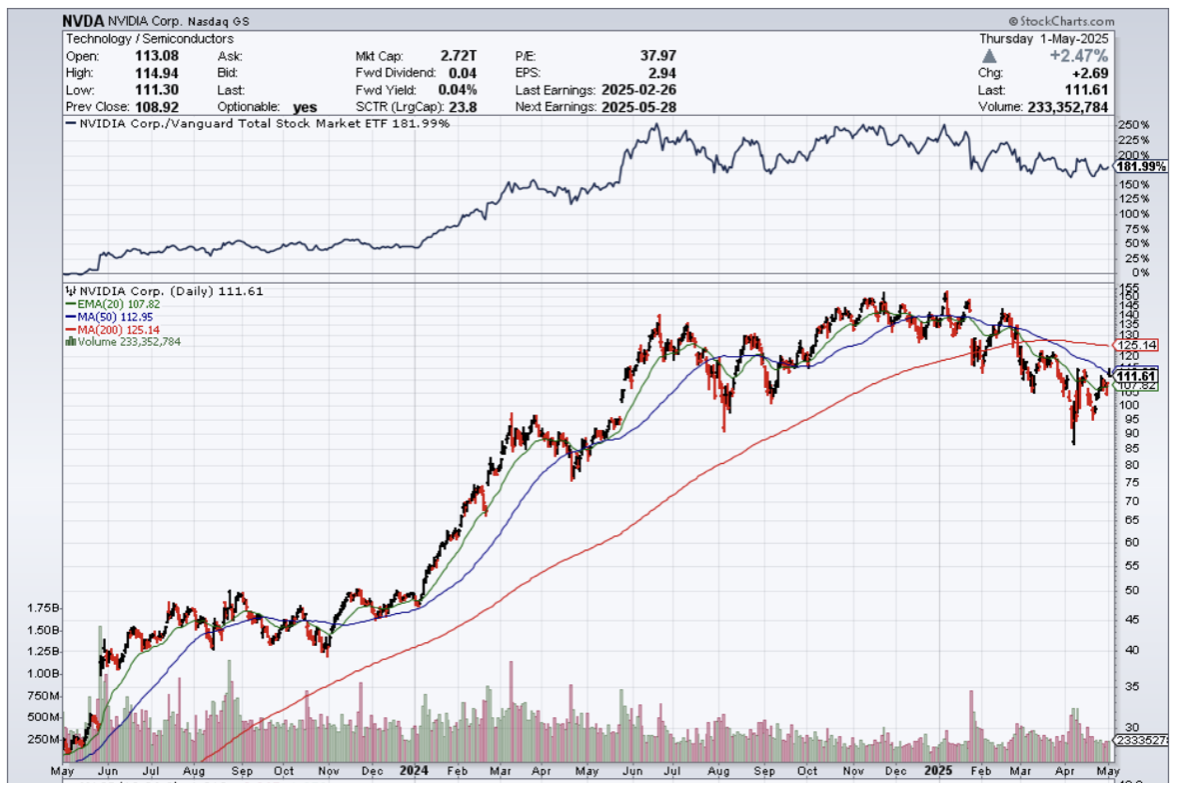

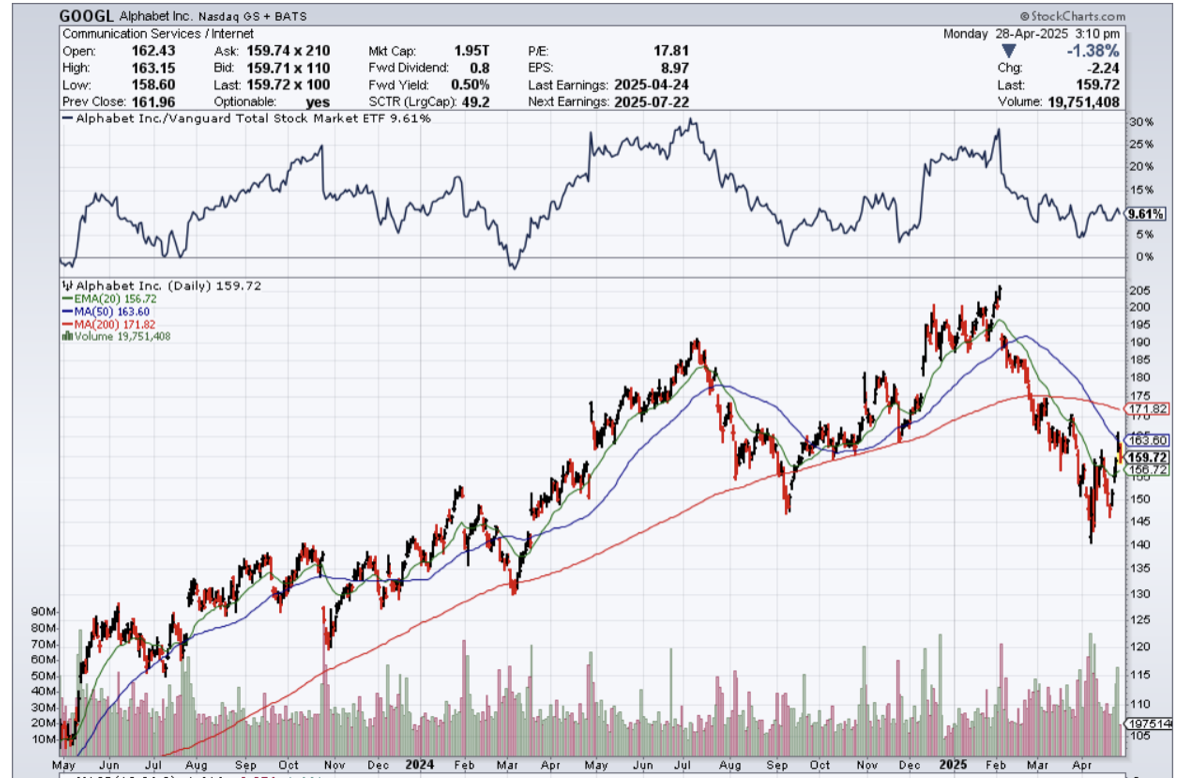

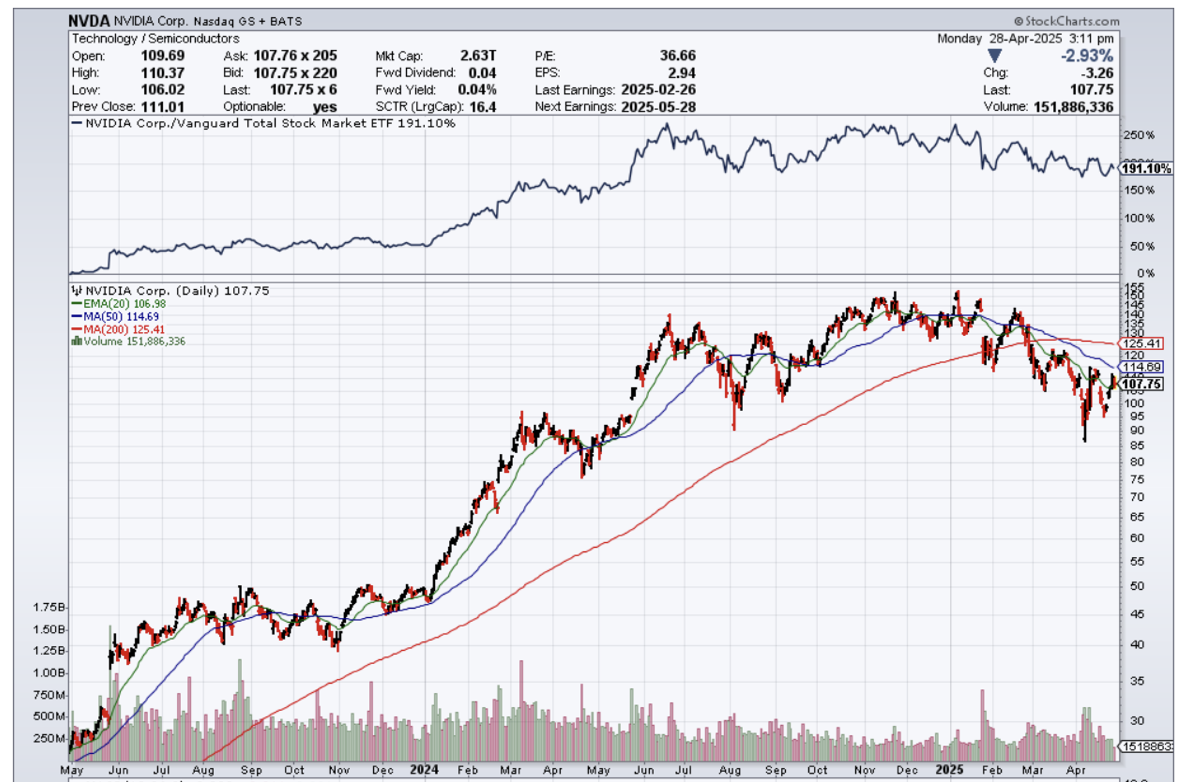

Lower wages and higher output is a perfect recipe for higher technology share prices, and that is exactly what we will get.

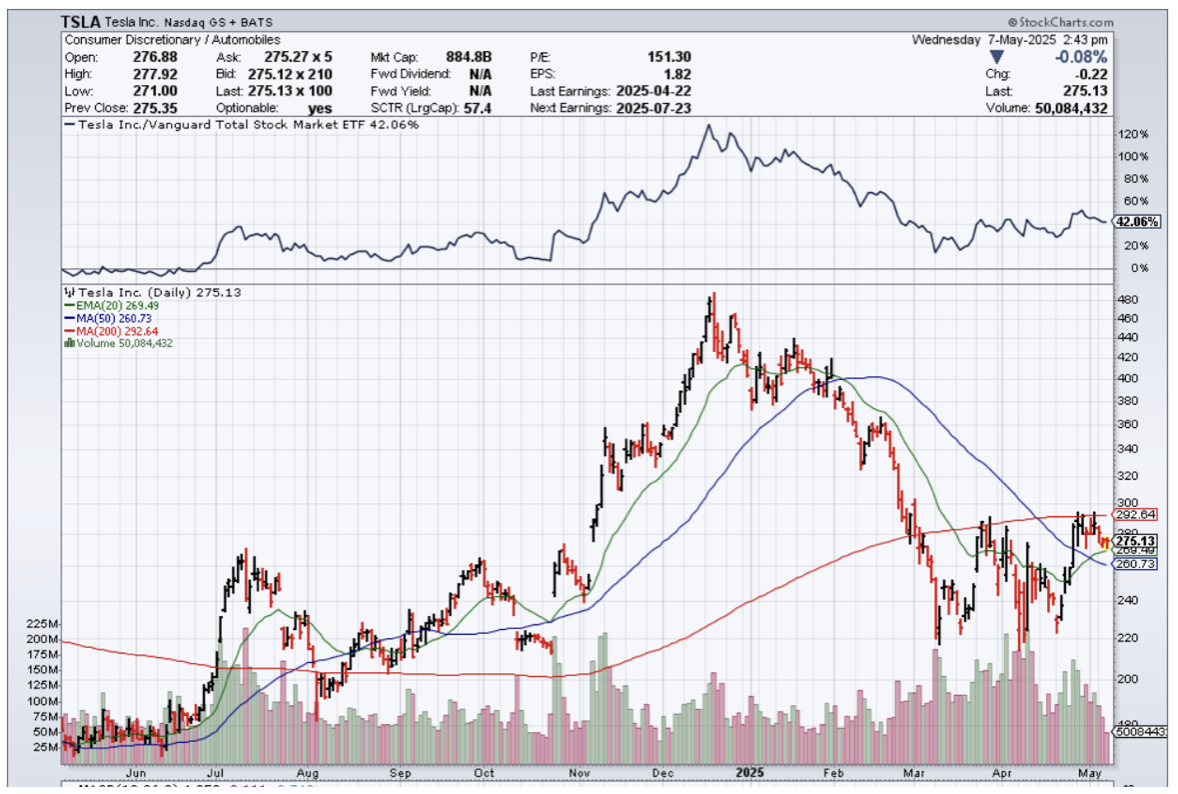

Currently, we are experiencing a mild pullback from the AI mania, but that is simply because it got too far ahead of its skis.

Tesla is also in a prime position to apply AI to power robot-taxis, which would create a windfall.

Tesla’s self-driving tech needs high volumes of AI chips to outfit their EV cars, but they have signaled to investors that they are experiencing trouble reaching that “2nd wave” of incremental buyers for their car.

Why buy a Tesla when a robo-taxi Tesla is around the corner?

Tech as a whole is not in trouble, but individual companies will find an imbalance treatment to their stock.

The AI pixie dust might have leveled off in the short term, and the broader tech market is being dragged down by a confluence of headwinds like spiking interest rates, geopolitical strife, beaten-up consumers, and diminishing addressable market revenue.

I do believe in the AI hype, but these trends don’t go up in a straight line and need time to digest, which often results in short-term pullbacks.