Tech investors should be migrating towards stocks that have high visibility of an earnings turnaround once a health solution is discovered for the current health scare. One that definitely does not fit the bill is Yelp (YELP) who has experienced negative earnings growth for the past three years.

What’s the deal with Yelp?

The company recently withdrew its first quarter and 2020 financial guidance because the coronavirus has destroyed large parts of its business probably to never return.

If you didn’t know, Yelp provides information through online communities on restaurants, shopping, nightlife, financial, health, and other services, so it’s easy to do the calculus as to why lockdowns and restrictions on public life are affecting these revenue streams.

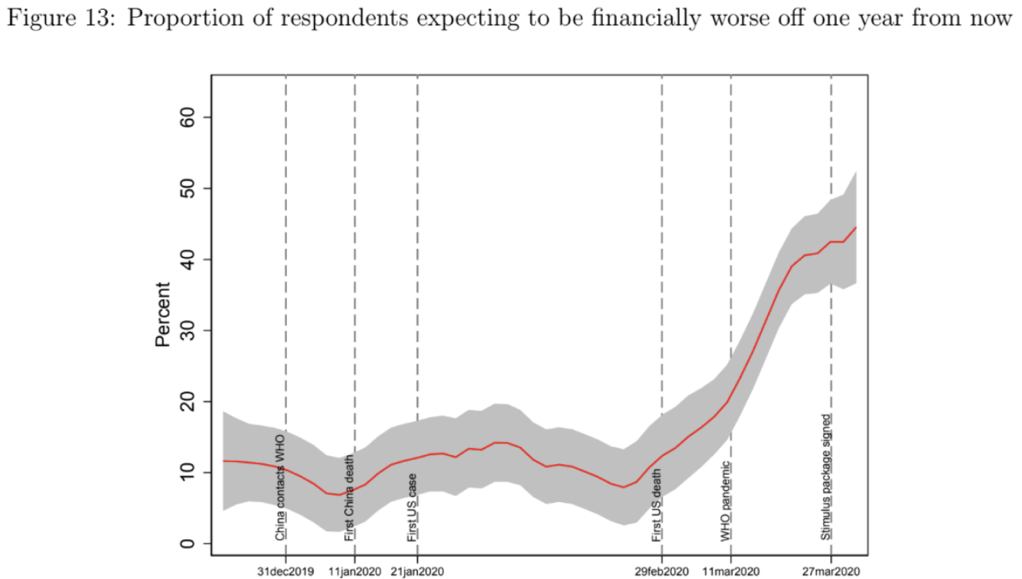

A recent survey reported a higher average likelihood of households missing a debt payment over the next three months, meaning the consumer is in dire straits unless there is a swift 180 in circumstances.

In the longer-term, the New York Fed affirms a “persistent deterioration” in consumers’ expectations to access credit throughout the rest of 2020.

The New York Fed said the sharp decline in consumer expectations cuts across all age, education, and income groups.

Less money for consumer spending means less consumer demand on Yelp translating into lower ad revenue – it’s that simple.

On a conference call on February 13, Yelp mentioned that it expects 2020 revenues to grow between 10% and 12% year over year and adjusted EBITDA by 1 to 2 percentage points. It had also expected margins to expand again in 2020.

What a difference 4 weeks makes!

Now almost every company is in survival mode and Yelp is the weakest link.

Consumer interest in restaurants and nightlife has taken a nosedive in the new coronavirus economy.

Yelp data shows that consumer interest had declined 54% for restaurants and 69% for nightlife venues.

Cafes, French restaurants, and wineries decreased their share of daily consumer actions (down 66%, 47% and 44%, respectively) week over week.

In contrast, the weekly growth numbers favor just a select few - grocery stores interest is up 102%, fruit and vegetable shops are up 102%, fast-food joints are up 64%, and pizzerias round out the bunch up 44%.

Some hard-hit companies come in the form of bowling, yoga and martial arts services which tend to involve groups of people, declined by a respective 43%, 38%, and 33%, and these are all companies that would be spending ad money.

Even worse news on the financial side - mom and pop stores have a short leash with median cash buffer for a small business at just 27 days.

As you would assume, searches on home fitness equipment surged 344%, and interest in parks rose 53%.

Interest was also up 360% for buying guns and 166% up for buying water - breweries were down 61%.

Lawmakers and states, including New York, New Jersey, California, and Pennsylvania, have ordered a temporary closure of restaurants and bars and I can safely say that consumers probably won’t return the next day to barge down the entrance door.

The last earnings report wasn’t all that hot for Yelp who missed on revenue while spending 10% more on advertising to get to that miss.

Earnings per share also missed estimates by sliding 35% year over year validating my thesis that this is a sinking ship headed towards an iceberg.

These propped up numbers were before the coronavirus hit the company and the business model is poorly prepared for this type of phenomenon and the lasting effects.

I expect a material decrease in the growth of the number of paying advertising locations and lower advertising budgets from multi-location customers.

Paying advertising locations should drop by half just this quarter.

Materially lower traffic dropping over 50% is a trend that will perpetuate and even if there is a dead cat bounce because shares are so beaten down, this is an unequivocal “sell on the rally” type of stock.