“Technology is the knack of so arranging the world that we do not experience it.” – Said American existential psychologist Rollo May

Mad Hedge Technology Letter

March 30, 2020

Fiat Lux

Featured Trade:

(THE NEW CROWN JEWELS OF SOCIAL DISTANCING)

(DOCU), (SIRI), (ZNGA), (NOK), (AMZN), (WORK), (MSFT), (ZM)

The second tier of social distancing tech stocks will do well in this brave new world in which digital lives have superseded physical ones.

Sure, most of you already know that Amazon (AMZN), Slack (WORK), Microsoft (MSFT), Zoom Communications (ZM), and Teladoc Health (TDOC) are the crown jewels of current social distancing tech stocks, but there is another group that should also outperform.

Here are 4 that you should take a look at with DocuSign being the best of the bunch:

DocuSign (DOCU)

Teleconferencing and other niches have come front and center and consummating deals have migrated to one place since people cannot physically sign their name from pen to paper.

Electronic signatures were basically a cottage industry when it came out, but it is here to stay and this company has investors buzzing. Although the volume of business agreements being signed globally may temporarily slip, those that are continuing to work are enabled by DocuSign to close agreements without meeting eye to eye.

I expect resiliency in the type of products DocuSign provides and the remote implementation options.

DocuSign is well-positioned within the defensive category of digital transformation spend. Their recent acquisition of Seal Software will help boost DocuSign’s ability to leverage the power of artificial intelligence in the domain of contract analytics.

The opportunity to mitigate time spent on manual workflows through the addition of Seal to the portfolio can bolster the value proposition and drive ROI (return on investment) for customers.

The trajectory of the company was validated by DocuSign’s strong fourth-quarter earnings results with adjusted earnings increasing 12 cents per share which is a 100% increase year over year.

Just as impressive, DocuSign posted quarterly revenue of $274.9 million, an increase of 38%. As the data suggests, the signals all point to this company continuing its outperformance.

The e-document market has been monopolized by DocuSign with competition shut out, and as business goes 100% virtual in the current environment, this should have a positive network effect that will resonate when the world opens back up.

The next 3 stocks aren’t growth companies like DocuSign but are cheap stocks under $10 that might be worth a look.

Sirius XM Holdings (SIRI)

With all the extra time at home, satellite radio has hit the jackpot, making their services much more appealing.

Since Sirius and XM Radio merged in 2008, the combined Sirius XM Holdings has enjoyed a near-monopoly on satellite radio.

Sirius built on that with the 2018 acquisition of Pandora, the music streaming product, helping to fill the sails again with rapid revenue growth; its audio products now reach more than 100 million people.

Sirius' situation is appearing healthy and added a further 1.1 million subscribers in 2019 alone, bringing its total paying subscribers to roughly 30 million. The company's audacious strategy of partnering with auto manufacturers to pre-install SiriusXM in new models should help steadily grow the business.

Zynga (ZNGA)

This video game stock is cheap and could be a beneficiary of the stay at home revolution.

Zynga's portfolio of popular games, combined with hyper-charged growth, makes it one of the best cheap stocks to buy under $10.

Last quarter, the social gaming developer behind franchises like Words With Friends, Zynga Poker, CSR Racing, and FarmVille set new company revenue records up 48%.

While growth is likely to decelerate quickly from such temporary coronavirus catalysts, I expect double-digit revenue growth in 2020.

Still, Zynga is holding up remarkably well, especially in the COVID-19 era, as people increasingly turn to mobile devices for entertainment.

Nokia Corp. (NOK)

Nokia's expected earnings growth is impressive with Wall Street looking for an 8% bump in 2020 and roughly 30% profit growth in 2021.

Cheap stocks to invest in under $10 don't often come in the form of well-oiled global corporations valued at $15 billion.

The Finnish communication equipment telecom is one of the rare exceptions against the rule.

Sales have grown 14% annually for the last five years. Nokia may end up one of the 5G stocks to watch in the coming years because of the stigma of Huawei forcing many Europeans to go with brands closer to home.

Nokia pays a hefty 8% dividend as well and will never need a last-second bailout.

“Every technological revolution takes about 50 years.” – Said Founder of Alibaba Jack Ma

Mad Hedge Technology Letter

March 27, 2020

Fiat Lux

Featured Trade:

(THE COMING AD HIT FOR GOOGLE AND FACEBOOK)

(FB), (GOOGL), (TWTR), (SNAP)

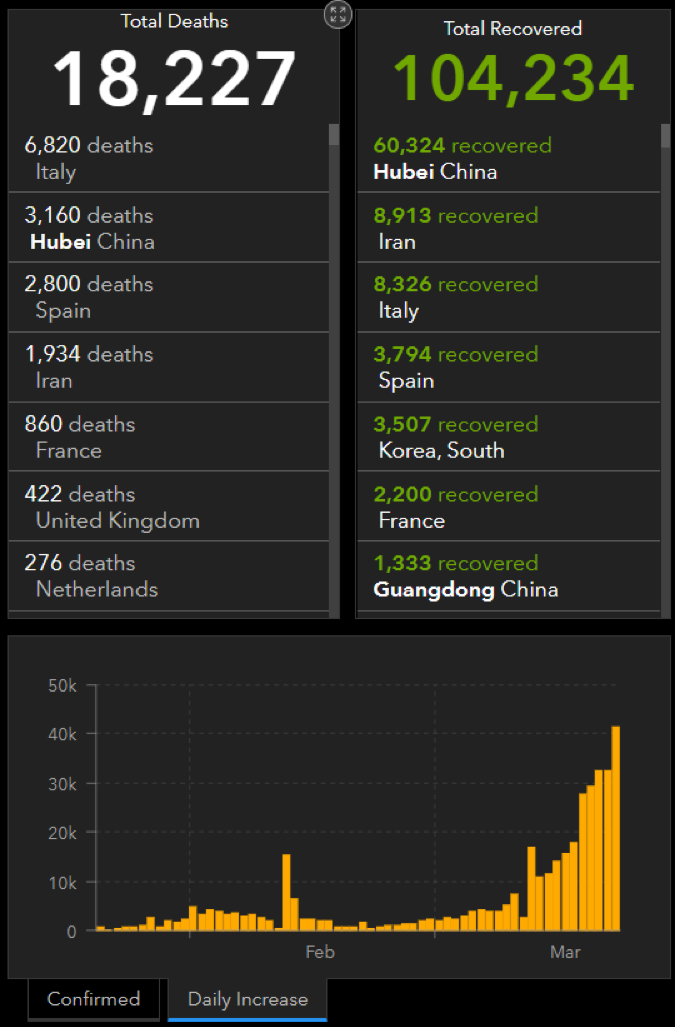

Expect lower revenues from Facebook (FB) and Google (GOOGL) because ad revenue has taken a hit.

It makes no sense to spend ad money on Facebook and Google ads for restaurants and hotels during times like this and that’s if they even still exist today.

The accumulative effect of the bankruptcies in other parts of the economy will shrink Google and Facebook’s ad dollar coffers.

The two internet giants together could see more than $44 billion in worldwide ad revenue evaporate in 2020, but that doesn’t mean these companies won’t be profitable.

For 2020, Google's total net revenue is now projected to be about $127.5 billion, down $28.6 billion for the year.

Facebook’s management said there was “a weakening in the ads business in countries taking aggressive actions to reduce the spread of COVID-19.”

Facebook’s overall usage has increased during the pandemic, with data up more than 50% over the last month in countries hit hardest by the virus, but the spike in volume isn’t in a form in which they can monetize it.

In 2021, Facebook’s advertising business is projected to recover growing 23% year-over-year to $83 billion.

I now expect Google to generate $54.3 billion in operating income (43% adjusted EBITDA margin) and Facebook will make $33.7 billion (49% margin), in 2020.

Digital platforms have felt the abrupt halt in spending, given the relative ease of stopping ad spend.

Secondary ad companies are also performing worse than expected with forecasted revenue for Twitter (TWTR) down by 18% (to expected revenue of $3.2 billion) while Snap (SNAP) ad revenue is expected at $1.66 billion, 30% lower.

Amazon’s ad business boasts a fortified moat because their revenue comes from product searches and those have experienced a surge in demand because of the coronavirus.

Facebook-owned WhatsApp has increased by 50% and that number is up 70% in Italy as the Italians go through a severe outbreak and lockdown.

Another side effect from the virus is the reduction of video streaming quality to ease the strain on internet networks, as YouTube and Netflix (NFLX) have also done.

Facebook is monitoring usage patterns in order to make the system more efficient, and add further capacity as required.

To help ameliorate potential network congestion, they temporarily reduced bit rates for videos on Facebook and Instagram in certain regions.

Facebook is conducting tests and further preparing to respond to any problems that might arise with network services.

Facebook and Google’s weakness proves that even the largest of Silicon Valley tech companies are battling with revenue restructuring while waiting for the U.S. economy to open up.

Although this is terrible news for Facebook and Google, the Nasdaq index is in the process of bottoming out.

The 3.28 million U.S. jobless claims were unprecedented but could very well represent a flushing out of the horrible news as the Nasdaq index spiked by 4% intraday.

Tech shares have had this job claim number baked into the share price for quite a while and we knew it was going to drop like an atomic bomb.

Some estimates had 4 million unemployed and the pain on main street is real, just search on Twitter – hashtag #lostmyjob.

The anecdotes stream down about individuals coming to grips with a sudden sacking and new reality of zero income.

This is just the first phase of job removals and the silver lining is that tech companies largely avoided the worst of the firings partly because many tech jobs can be moved remotely unlike many hospitality jobs.

The other silver lining is that the health scare is supercharging the digital ecosystem as society has effectively been moved online.

Any short-term weakness in tech companies will only be brief as tech stock will lead the recovery as the economy starts to open up again and the record amount of fiscal stimulus breathes life into hobbled companies.

Tech investors should prepare to pull the trigger.

“The thing that we are trying to do at Facebook is just help people connect and communicate more efficiently.” – Said Facebook Co-Founder and CEO Mark Zuckerberg

Mad Hedge Technology Letter

March 25, 2020

Fiat Lux

Featured Trade:

(ALGORITHMS RUN WILD)

($COMPQ), (TWTR)

Don’t underestimate trading algorithms.

The “Buy the Dip” psychology is broken and computerized trading has completely flooded the market with its personality.

That is exactly the dynamic of the current tech market, and it will mountain of generous offerings to reverse the trend in the form of monstrous stimulus and cash handouts.

As we entered 2020, the sentiment was sky-high, geopolitical tensions relatively calmed and three recent interest-rate cuts from the Federal Reserve drove tech stocks to record levels.

For 10 years, traders and the algorithms they harnessed were handsomely rewarded by aggressively betting against elevated volatility.

Cogent chart trends are the algorithms’ lustful partner in bed and now that every single short-term model is flashing sell, sell, sell - there isn't much bulls can do to fight back.

Many tech hedge funds have settled on similar conclusions - the best defense right now is unwinding portfolios to return to cash.

Incessant margin calls roiling any logical strategy has struck fear into many traders who levered up 10X.

What you could possibly see is the Minsky moment: That stability ultimately breeds instability because the only input in which becomes the difference make is volatility producing massive violence on upside and downside moves.

The ones who can absorb elevated risk are nibbling and unleveraged hoping to time the turn when stocks finally react positively to good data.

The current battle in the fog of war is that of two different economic scenarios that have direct influence in which ways the algorithms flip – either shutdown the country ala Wuhan, China for an extended period of time or send the troops back to work.

Hedge fund billionaire Bill Ackman gave his 2-cents restating his passionate plea for a 30-day-shutdown to fight the coronavirus pandemic.

Former Goldman Sachs CEO Lloyd Blankfein is in favor of sending back the asymptomatic younger generation workers sooner than later.

Initially, Blankfein gave his backing for “extreme measures” in order to flatten the curve, but promoted healthy workers returning “within a very few weeks.”

Blankfein's argument rests on that if people don’t go back to work, the economy might become too damaged to recover from inciting another crash.

This contrasts starkly with Ackman’s idea of “testing, testing, testing”, which would theoretically dismantle the potency of the virus but take longer for the economy to restart.

U.S. President Donald Trump has relayed his desire to open up business by Easter Sunday.

So as mostly professional politicians hash out a towering aid package of over $2 trillion, firms will get more of an indicator of how and when the business world opens up again.

Trading algorithms are on a knives edge because of the uncertainty – until they are illegal – it is something we are stuck with.

These trading formulas are preset based on biases that start with a series of inputs and the most critical input is volatility or better known as the fear index.

If the lockdowns are extended, the flood of negative news will force algorithms to sell on the extra volatility.

When things go bonkers, many of these preset formulas sell which exacerbates the down move further simply because more than enough people have the same preset algorithm.

Cutting position size when market volatility explodes is not a farfetched theory and is quite a common trading nostrum.

Even if many of these trades would be good long-term bets, many trading algorithms are focused on short-term trades and by this, I mean milliseconds and not days.

Another input into trading algorithms are Twitter feeds.

The platform is scraped for keywords from mass media news sources and synthesized into a specific output that is fed into a computer algorithm.

These headlines offer insight into what the sentiment is for the trading day – negative, positive, or neutral.

This scraping of data is especially relevant in today’s chaotic trading world where 10% moves up or down in one day is the new normal.

Because of Dodd-Frank Wall Street reform, many of the big banks have shuttered trading operations hurting the market’s liquidity situation causing spreads to widen and down moves to accelerate.

But now that the Fed has landed the Sikorsky UH-60 Black Hawk on the helipad and the money is waiting to helicopter down as they have announced “unlimited” asset buying and guaranteeing of corporate bonds to aid financial markets.

How does computerized trading roil markets?

Here is an example. A recent trading day included more than $100 billion of selling, the worst week since the financial crisis and was triggered by a hedging strategy called “vol targeting”—using volatility as a central input in trading decisions—and other systematic tactics.

Funds making decisions based on volatility, including some with names such as volatility-targeting funds and risk-parity funds, have risen in popularity.

Risk-parity funds manage an estimated $300 billion.

Risk parity is an approach focused on allocation of risk, usually defined as volatility, rather than allocation of capital.

That is what we have now – a cesspool of risk parity hedge funds layered by high frequency funds layered by short/long vol funds layered by arbitrage funds all levered 15X.

The take into consideration that they are supercharged by massive volume-based computer algorithms and trying to head for the exit door at the same time.

Ironically, this could be one of catalysts for shares to recalibrate and head back up north as traders start to front-run the peak of the health crisis.

Let’s hope that it happens sooner than later and that the government doesn’t manage to screw up delivering the helicopter money.

“If you can't make it good, at least make it look good.” – Said Co-Founder of Microsoft Bill Gates

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.