“A brand for a company is like a reputation for a person. You earn reputation by trying to do hard things well.” – Said CEO and Founder of Amazon Jeff Bezos

Mad Hedge Technology Letter

October 23, 2019

Fiat Lux

Featured Trade:

(WILL A.I. SAVE US?),

(TSLA), (AMZN), (FB)

Anti-A.I. physicist Professor Stephen Hawking was a staunch supporter of preserving human interests against the future existential threat from machines and artificial intelligence (A.I.).

He was diagnosed with motor neuron disease, more commonly known as Lou Gehrig's disease in 1963 at the age of 21 and sadly passed away March 14, 2018 at the age of 76.

Famed for his work on black holes, Professor Hawking represented the human quest to maintain its superiority against quickly advancing artificial acculturation.

His passing was a huge loss for mankind as his voice was a deterrent to A.I.'s relentless march to supremacy. He was one of the few who had the authority to opine on these issues.

Gone is a voice of reason.

Critics have argued that living with A.I. poses a red alert threat to privacy, security, and society as a whole. Unfortunately, those most credible and knowledgeable about A.I. are tech firms.

They have shown that policing themselves on this front is remarkably unproductive.

Mark Zuckerberg, CEO of Facebook (FB), has labeled naysayers as "irresponsible" and dismissed the threat. After failing to prevent Russian interference in the last election, he is exhibiting the same defensive posture translating into a de facto admission of guilt. His track record of shirking accountability is becoming a trend leading him to allow politicians to post untrue marketing material for the 2020 U.S. election.

Share prices will materially nosedive if A.I. is stonewalled and development stunted. Many CEOs who stake careers on doubling or tripling down on A.I. cannot see it die out. There is too much money to lose – even for Mark.

The world will see major improvements in the quality of life in the next 10 years. But there is another side to the coin which Zuckerberg and company refuse to delve into...the dark side of technology.

Tesla's (TSLA) CEO Elon Musk has shared his anxiety about robots flipping the script on humans. Elon acknowledges that A.I. and autonomous vehicles are important factors in the battle for new technology. The winner is yet to be determined as China has bet the ranch with unlimited resources from the help of Chairman Xi and state sponsored institutions.

The quagmire with China has been squarely centered around the great race for technological supremacy.

A.I. is the ultimate X factor in this race and whoever can harness and develop the fastest will win.

Musk has hinted that robots and humans could merge into one species in the future. Is this the next point of competition among tech companies? The future is murky at best.

Hawking's premise that evolution has inbuilt greed can be found in the underpinnings of America's economic miracle.

Wall Street has bred a culture that is entirely self-serving regardless of the bigger system in which it finds itself.

Most of us are participating in this perpetual money game chase because our system treats it as a natural part of life. A.I. will help a select few do well in this paper chase to the detriment of the majority.

Quarterly earnings performance is paramount for CEOs. Return value back to shareholders or face the sack in the morning. It's impossible to convince anyone that America's capitalist model is deteriorating in the greatest bull market of all time.

Wall Street has an insatiable hunger for cutting-edge technology from companies that sequentially beat earnings and raise guidance. Flourishing technology companies enrich the participants creating a Teflon-like resistance to downside market risk.

The issue with Professor Hawking's work is that his timeframe is too far in the future. Professor Hawking was probably correct, but it will take 25 years to prove it.

The world is quickly changing as science fiction becomes reality.

People on Wall Street are a product of the system in place and earn a tremendous amount of money because they proficiently execute a specialized job. Traders are busy focusing on how to move ahead of the next guy.

Firms building autonomous cars are free to operate as is. Hyper-accelerating technology spurs on the development of A.I., machine learning, and enhanced algorithms. Record profits will topple and investors will funnel investments back into an even narrower grouping of technology stocks after the weak hands are flushed out.

Professor Hawking said we need to explore our technological capabilities to the fullest in order to avoid extinction. In 2018, exploring these new capabilities still equals monetizing through the medium of products and services.

This is all bullish for equities as the leading companies associated with A.I. to reap the benefits.

And let me remind you that technology is still the least regulated industry on the planet even with all the recent hoopla.

It is having its cake and is eating it too. Hence, technology is starting to cross over into other industries demonstrating the powerful footprint tech has extracted in economics and the stock market.

The only solution is keeping companies accountable by a function of law or creating a third-party task force to regulate A.I.

In 2019, the thought of overseeing robots sounds crazy.

The future will be here sooner than you think.

"The greatest enemy of knowledge is not ignorance, it is the illusion of knowledge," said the late Professor Stephen Hawking.

Mad Hedge Technology Letter

October 21, 2019

Fiat Lux

Featured Trade:

(THE CLOUD BASICS)

(AMZN), (MSFT), (GOOGL), (AAPL), (CRM), (ZS)

If you've been living under a rock the past few years, the cloud phenomenon hasn't passed you by and you still have time to cash in.

You want to hitch your wagon to cloud-based investments in any way, shape or form.

Microsoft's (MSFT) pivot to its Azure enterprise business has sent its stock skyward, and it is poised to rake in more than $100 billion in cloud revenue over the next 10 years.

Microsoft's share of the cloud market rose and is catching up to Amazon Web Services (AWS).

Amazon leads the cloud industry and still maintains more than 30% of the cloud market. Microsoft would need to gain a lot of ground to even come close to this jewel of a business.

Amazon (AMZN) relies on AWS to underpin the rest of its businesses and that is why AWS contributes 73% to Amazon's total operating income.

Total revenue for just the AWS division is an annual $5.5 billion business and would operate as a healthy stand-alone tech company if need be.

Cloud revenue is even starting to account for a noticeable share of Apple's (AAPL) earnings, which has previously bet the ranch on hardware products.

The future is about the cloud.

These days, the average investor probably hears about the cloud a dozen times a day. If you work in Silicon Valley, you can triple that figure.

So, before we get deep into the weeds with this letter on cloud services, cloud fundamentals, cloud plays, and cloud Trade Alerts, let's get into the basics of what the cloud actually is.

Think of this as a cloud primer.

It's important to understand the cloud, both its strengths and limitations. Giant companies that have it figured out, such as Salesforce (CRM) and Zscaler (ZS), are some of the fastest growing companies in the world.

Understand the cloud and you will readily identify its bottlenecks and bulges that can lead to extreme investment opportunities. And that's where I come in.

Cloud storage refers to the online space where you can store data. It resides across multiple remote servers housed inside massive data centers all over the country, some as large as football fields, often in rural areas where land, labor, and electricity are cheap.

They are built using virtualization technology, which means that storage space spans across many different servers and multiple locations. If this sounds crazy, remember that the original Department of Defense packet-switching design was intended to make the system atomic bomb-proof.

As a user, you can access any single server at any one time anywhere in the world. These servers are owned, maintained and operated by giant third-party companies such as Amazon, Microsoft, and Alphabet (GOOGL), which may or may not charge a fee for using them.

The most important features of cloud storage are:

1) It is a service provided by an external provider.

2) All data is stored outside your computer residing inside an in-house network.

3) A simple Internet connection will allow you to access your data at anytime from anywhere.

4) Because of all these features, sharing data with others is vastly easier, and you can even work with multiple people online at the same time, making it the perfect, collaborative vehicle for our globalized world.

Once you start using the cloud to store a company's data, the benefits are many.

- No Maintenance

Many companies regardless of their size prefer to store data inside in-house servers and data centers.

However, these require constant 24-hour-a-day maintenance, so the company has to employ a large in-house IT staff to manage them - a costly proposition.

Thanks to cloud storage, businesses can save costs on maintenance since their servers are now the headache of third-party providers.

Instead, they can focus resources on the core aspects of their business where they can add the most value without worrying about managing IT staff of prima donnas.

- Greater Flexibility

Today's employees want to have a better work/life balance and this goal can be best achieved by letting them telecommute. Increasingly, workers are bending their jobs to fit their lifestyles, and that is certainly the case here at Mad Hedge Fund Trader.

How else can I send off a Trade Alert while hanging from the face of a Swiss Alp?

Cloud storage services, such as Google Drive, offer exactly this kind of flexibility for employees. According to a recent survey, 79% of respondents already work outside of their office some of the time, while another 60% would switch jobs if offered this flexibility.

With data stored online, it's easy for employees to log into a cloud portal, work on the data they need to, and then log off when they're done. This way a single project can be worked on by a global team, the work handed off from time zone to time zone until it's done.

It also makes them work more efficiently, saving money for penny-pinching entrepreneurs.

- Better Collaboration and Communication

In today's business environment, it's common practice for employees to collaborate and communicate with co-workers located around the world.

For example, they may have to work on the same client proposal together or provide feedback on training documents. Cloud-based tools from DocuSign, Dropbox, and Google Drive make collaboration and document management a piece of cake.

These products, which all offer free entry-level versions, allow users to access the latest versions of any document so they can stay on top of real-time changes which can help businesses to better manage workflow, regardless of geographical location.

- Data Protection

Another important reason to move to the cloud is for better protection of your data, especially in the event of a natural disaster. Hurricane Sandy wreaked havoc on local data centers in New York City, forcing many websites to shut down their operations for days.

The cloud simply routes traffic around problem areas as if, yes, they have just been destroyed by a nuclear attack.

It's best to move data to the cloud to avoid such disruptions because there your data will be stored in multiple locations.

This redundancy makes it so that even if one area is affected, your operations don't have to capitulate, and data remains accessible no matter what happens. It's a system called deduplication.

- Lower Overhead

The cloud can save businesses a lot of money.

By outsourcing data storage to cloud providers, businesses save on capital and maintenance costs, money that in turn can be used to expand the business. Setting up an in-house data center requires tens of thousands of dollars in investment, and that's not to mention the maintenance costs it carries.

Plus, considering the security, reduced lag, up-time and controlled environments that providers such as Amazon's AWS have, creating an in-house data center seems about as contemporary as a buggy whip, a corset, or a Model T.

"Life is not fair; get used to it," said the founder of Microsoft Bill Gates.

Mad Hedge Technology Letter

October 18, 2019

Fiat Lux

Featured Trade:

(THE ROAD OUT OF SILICON VALLEY),

(AAPL), (CRM), (MSFT), (FB), (AMZN), (GOOGL)

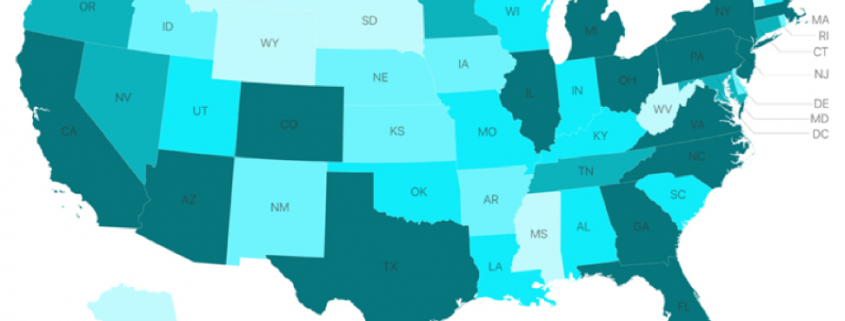

In a new study, 44% of Millennials plan to move out of the Bay Area in the “next few years.”

In the same study, 8% of Millennials will move out of the Californian tech peninsula within the next 365 days.

Tech companies are in serious danger of stagnating because they won’t be able to hire the talent needed to keep their companies afloat while the number of foreign HB-1 visas has dried up.

All of this could come home to roost and early cracks can be found in the local housing migratory trends.

The robust housing demand, lack of housing supply, mixed with the avalanche of inquisitive tech money has made living with a roof over your head a tall order.

The area has also become squalid like some third world countries due to the homeless problem that is growing faster than any software company.

Salesforce Founder and CEO Marc Benioff has lamented that San Francisco, where ironically he is from, is a diabolical “train wreck” and urged fellow tech CEOs to “walk down the street” and see it with their own eyes to observe the numerous homeless encampments dotted around the city limits.

The leader of Salesforce doesn’t mince his words when he talks and beelines to the heart of the issues.

In condemning large swaths of the beneficiaries of the Silicon Valley ethos, he has signaled that it won’t be smooth sailing forever.

He has also urged companies to transform their business model if they are irresponsible with user data.

The tech lash could get messier this year because companies that go rogue with personal data will face a cringeworthy reckoning as government policy stiffens.

I have walked around the streets of San Francisco myself.

Places around Powell Bart station close to the Tenderloin district are eyesores littered with used syringes that lay in the gutter.

South of Market Street (SoMa) isn’t a place I would want to barbecue on a terrace either.

Summing it up, the unlimited tech talent reservoir that Silicon Valley gorged on isn’t flowing anymore because people don’t want to live there anymore.

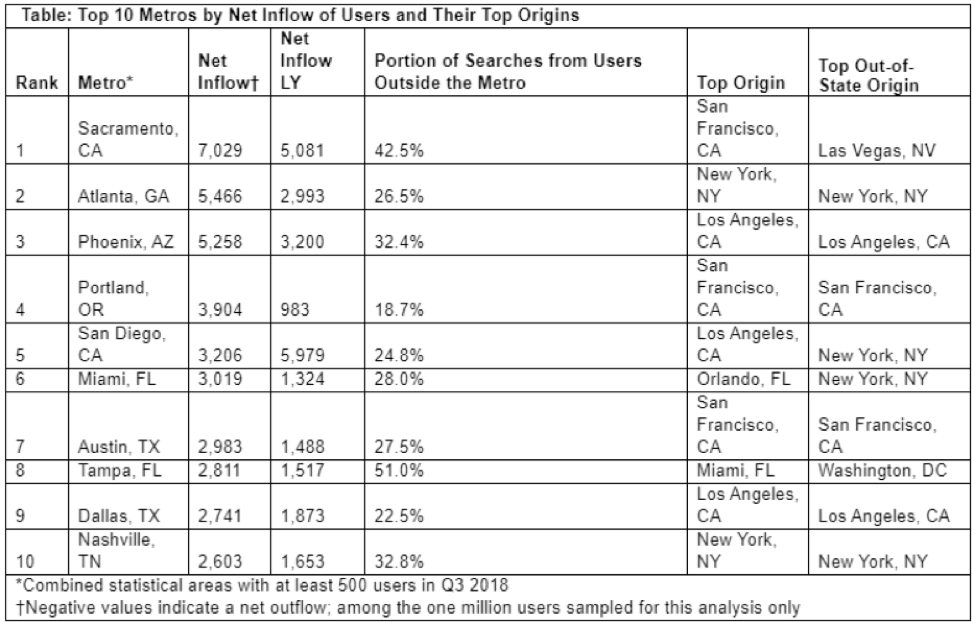

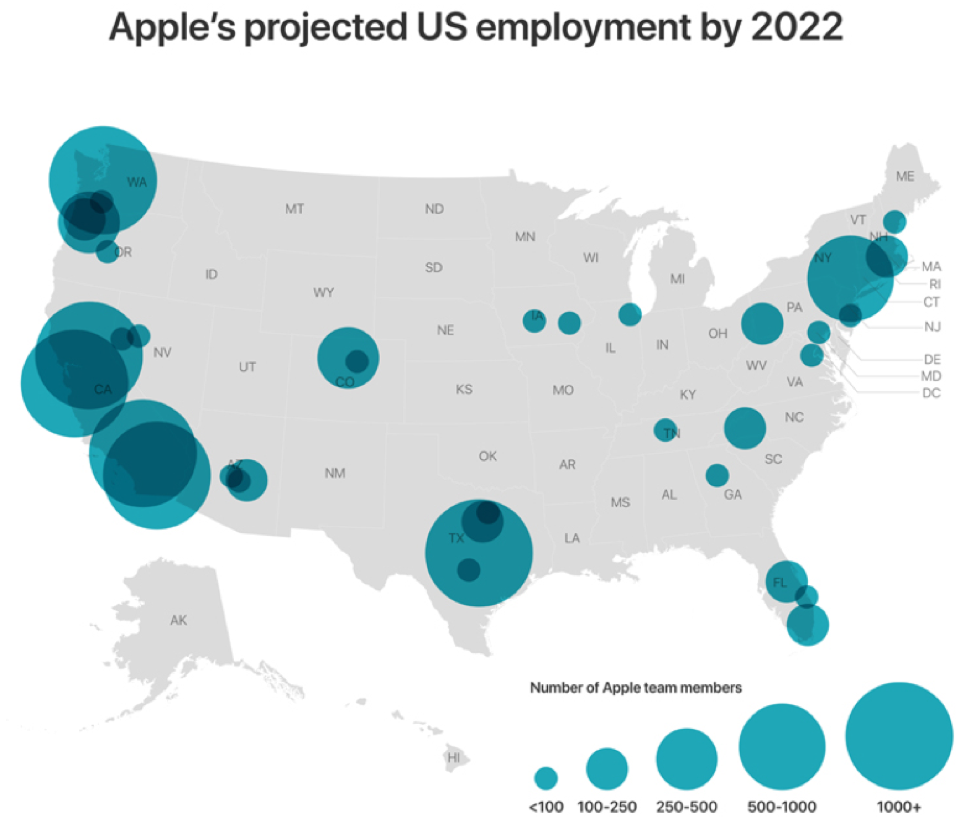

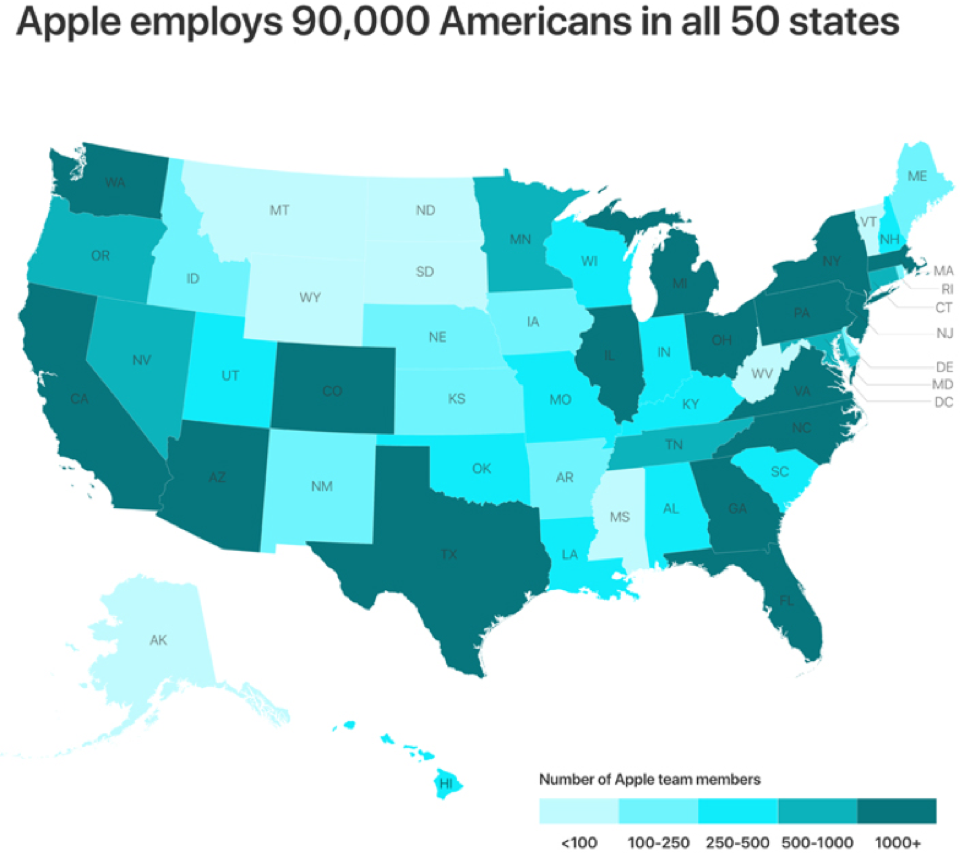

This is exactly what Apple’s $1 billion investment into a new tech campus in Austin, Texas, and Amazon adding 500 employees in Nashville, Tennessee are all about.

Apple also added numbers in San Diego, Atlanta, Culver City, and Boulder just to name a few.

Apple currently employs 90,000 people in 50 states and is in the works to create 20,000 more jobs in the US by 2023.

Most of these new jobs won’t be in Silicon Valley.

Jobs simply flock to where the talent is.

The tables have turned but that is what happens when the heart of western tech becomes unlivable to the average tech worker earning $150,000 per year.

Sacramento has experienced a dizzying rise of newcomers from the Bay Area escaping the sky-high housing.

Millennials are reaching that age of family formation and they are fleeing to places that are affordable and possible to take the first step onto the property ladder.

These are some of the practical issues that tech has failed to address, and part of the problem with unfettered capitalism which doesn’t consider quality of life.

No wonder why Silicon Valley real estate has dropped in the past year, people and their paychecks are on the way out.

Mad Hedge Technology Letter

October 16, 2019

Fiat Lux

Featured Trade:

(IS 3D PRINTING A WASTE OF SPACE?)

(SSYS), (ETSY), (MSFT), (BA), (NFLX), (GE), (LMT)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.