Don’t get caught up in the cesspool of digital ads inundating your life.

I’ll teach you how to take back control of your life and even mess with these data thieves.

No need to thank me.

One of the most frequented complaints I hear today is the overflowing number of digital ads people are faced with that make you want to pull your hair out.

If you want to play your part in taking back your internet freedom, then read on.

The internet ad business is a world that borders subterfuge.

The high stakes environment is perpetuated by none other than Silicon Valley and specifically the tech heavyweights that wield capital dominating the data sphere.

Even though it sounds remarkably cliché, data is truly the new oil.

You would be surprised how many internet operations are based on the back of you, the user, and the data you generate.

Take Lyft (LYFT).

They are forced to tap the digital marketing world to attract qualified drivers.

Not only does Lyft spend ad dollars on driver recruitment, but they must spend to grow the number of passengers.

The rider base, as a result, synthetically grows which is directly attributable to paid marketing initiatives.

Lyft lays out on a platter the ways they attempt to generate new passengers and drivers, essentially becoming market makers, and it’s a mind-boggling long list including:

“referrals, affiliate programs, free or discount trials, partnerships, display advertising, television, billboards, radio, video, content, direct mail, social media, email, hiring and classified advertisement websites, mobile “push” communications, search engine optimization and keyword search campaigns.”

Even if there is only a 20% chance of breaking even, these unicorns are incentivized to lose others' money translating into poor quality growth or initiate high-risk strategies or carry out a combination of the two.

Sales and marketing costs in the year ending Dec 2018 came in at $296.6 million, meaning that over 37% of overall costs to Lyft were attributed to this one segment.

If that wasn’t bad enough, Alphabet affiliated company CapitalG took in $41.4 million, $74.4 million, and $92.4 million of ad-related services in 2016, 2017, 2018 laughing all the way to the bank.

Not only do Alphabet have a 5% stake in Lyft, but they are incentivized to bump up Lyft’s search engine optimization ranking to the top because they’ll benefit through asset appreciation if the company flourishes.

The process is rigged so what can we do about it?

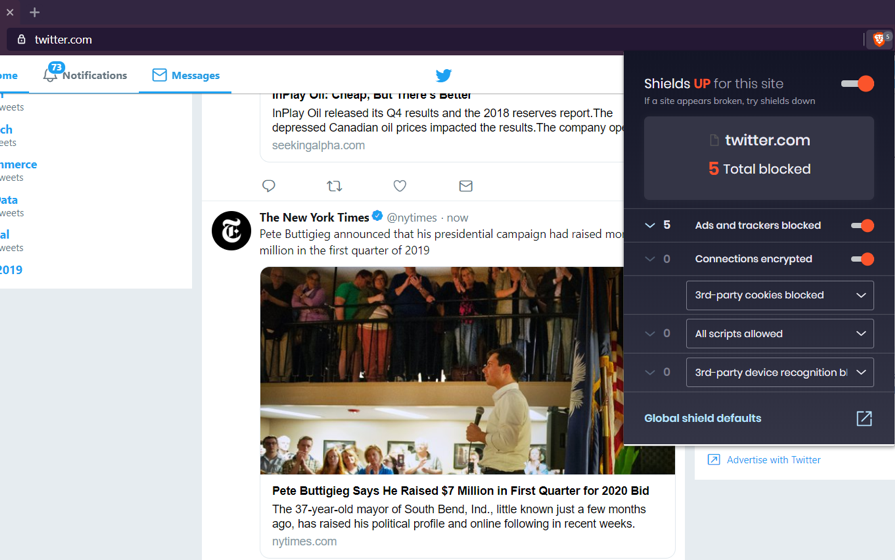

Seizing control of your life and personal data first centers on installing a different browser other than a Google-based product to diversify the data out of Alphabet’s (GOOGL) iron grip.

I have chosen to use the browser called Brave, based on the Chromium web browser, it comes preinstalled with an ad blocker and disables web trackers, and most importantly, works well.

To visit their website, click here.

Make sure to import your passwords and bookmarks from your prior browser to ensure a smooth transition.

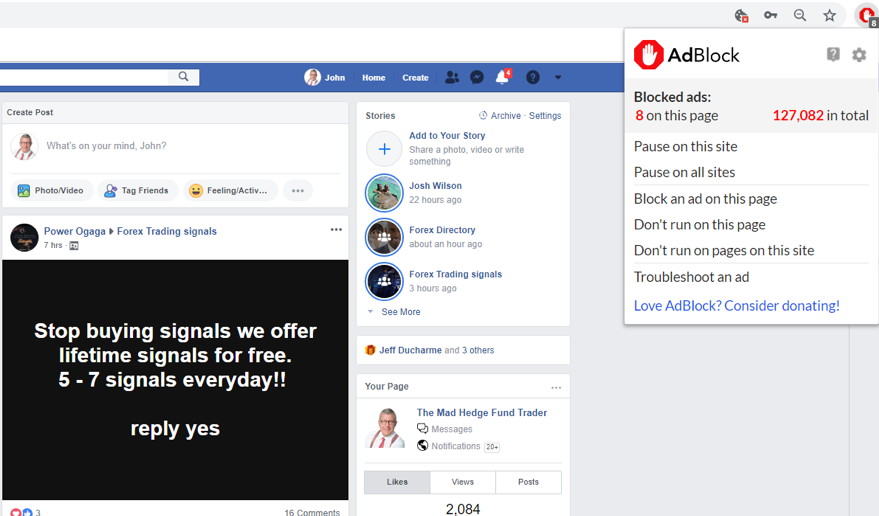

Once you are armed with a browser with a functioning ad-blocker, notice how the ad-less experience enhances your browser experience.

Try out YouTube.com, notice that ads don’t pop up in the beginning or middle of your viewing session and they do not even prompt you to disable them.

To understand which websites are hellbent on grabbing your digital ad dollar, then you will visit the odd website such as CNBC’s live TV feed which forces the user to disable the ad blocker which can be done at the top.

As much as CEO of Facebook (FB) Mark Zuckerberg has been vilified for his ad practices, he does not force users to disable ad blockers to use his platform to his credit which indicates that most users really have no idea about this stuff.

Seeking Alpha, the internet financial new site, is one of the worst eggs in the dozen, full out blocking users from even viewing the main homepage if you are accessing it with a VPN (virtual private network).

If you do access Seeking Alpha with an ad blocker, every page you click prompts an annoying reminder to “white list” the site which is polite verbiage for don’t block us or we will prevent you from using us.

Awareness and actionable methods to take back your internet freedom and personal data are vital to the health and longevity of the internet.

Instead of enriching these few Silicon Valley bullies, change your browser to an independent service, install an ad-blocker, and lastly buy a VPN.

A VPN is a software that circumvents geographical restrictions by connecting to servers in different countries effectively masking your computer’s IP address location.

This can have many different applications such as during my summer vacations in Switzerland, I can access all the US-based internet services that would require my IP address to originate from a domestic American location.

A VPN is also important in minimizing the chances of cyber threats and offers extra layers of security.

Chinese internet users often access international websites that are habitually censored through VPN software getting access to the west’s treasure trove of professional knowledge.

In many cases, a small Chinese company wielding a VPN is the difference between success and failure.

VPN software is the Chinese communist party’s worst enemy which is why they forced Apple to remove them from Apple’s app store recently.

My go-to VPN is Astrill. To visit their website, please click here.

Knowledge is power.

The masking of a computer’s geographical location will stymy digital ad crawlers diluting ad data forcing them to revalue the digital ad tools they use to charge exorbitant amounts to analog companies to digitally advertise destroying ad revenue.

I see this as a positive development as the unintended consequences of these digital ad creatures have toxified the internet for the naive user with many digital companies resorting to perverse tactics that beget even more perverse marketing tactics.

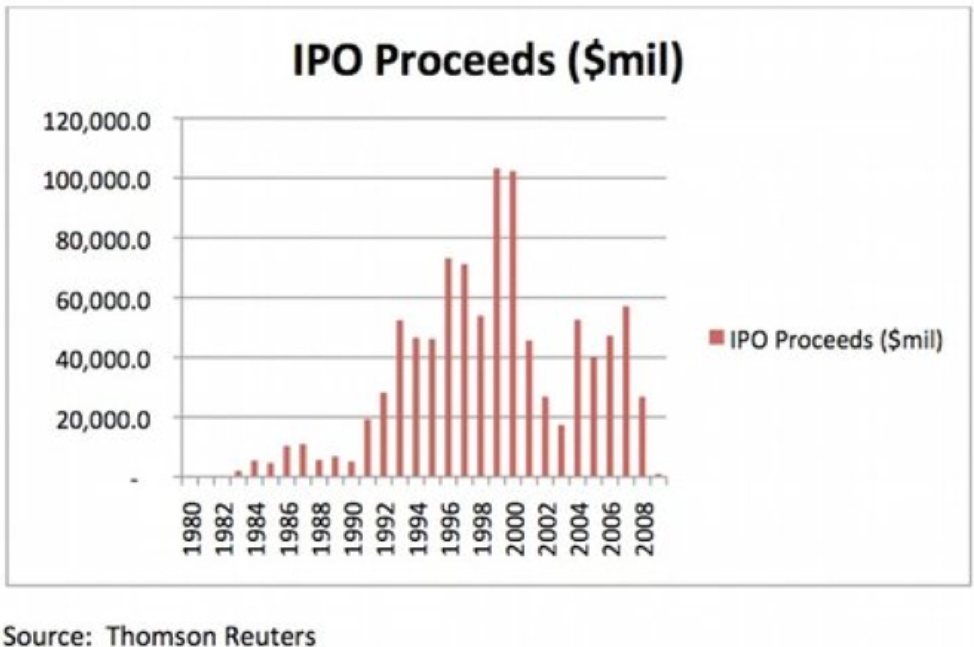

The slew of new tech IPOs is offering us inside knowledge into how enslaved tech companies are to the likes of Alphabet and Facebook digital ad apparatus.

To shake them off our tails, users on mass need to alter how they use the internet to protect from being pickpocketed in broad daylight.

Once revenue begins to suffer, they will have to act more reasonably to the betterment of the internet which we all share as a communal good.