“Try never to be the smartest person in the room. And if you are, I suggest you invite smarter people…or find a different room.” – Said Founder and CEO of Dell Technologies Michael Dell

Global Market Comments

March 1, 2019

Fiat Lux

SPECIAL FRIDAY TECH EDITION

Featured Trade:

(ABOUT THE TRADE ALERT DROUGHT),

(SPY), (GLD), (TLT), (MSFT),

Long term subscribers are well aware that I sent out a flurry of Trade Alerts at the beginning of the year, almost all of which turned out to be profitable.

Unfortunately, if you came in any time after January 17 you watched us merrily take profits on position after position, whetting your appetite for more.

However, there was nary a new Trade Alert to be had, nothing, nada, and even bupkiss. This has been particularly true with particular in technology stocks.

There is a method to my madness.

I was willing to bet big that the Christmas Eve massacre on December 24 was the final capitulation bottom of the whole Q4 move down, and might even comprise the grand finale for an entire bear market.

So when the calendar turned the page, I went super aggressive, piling into a 60% leverage long positions in technology stocks. My theory was that the stocks that had the biggest falls would lead the recovery with the largest rises. That is exactly how things turned out.

As the market rose, I steadily fed my long positions into it. As of today we are 80% cash and are up a ballistic 13.51% in 2019. My only remaining positions are a long in gold (GLD) and a short in US Treasury bonds (TLT), both of which are making money.

So, you’re asking yourself, “Where’s my freakin' Trade Alert?

To quote my late friend, Chinese premier Deng Xiaoping, “There is a time to fish, and there is time to mend the nets.” This is now time to mend the nets.

Stocks have just enjoyed one of their most prolific straight line moves in history, up some 20% in nine weeks. Indexes are now more overbought than at any time in history. We have gone from the best time on record to buy shares to the worst time in little more than two months.

My own Mad Hedge Market Timing Index is now reading a nosebleed 72. Not to put too fine a point on it, but you would be out of your mind to buy stocks here. It would be trading malpractice and professional negligent to rush you into stocks at these high priced level.

Yes, I know the competition is pounding you with trade alerts every day. If they work, it is by accident as these are entirely generated by young marketing people. Notice that none of them publish their performance, let alone on a daily basis like I do.

You can’t sell short either because the “I’s” have not yet been dotted nor the “T’s” crossed on the China trade deal. It is impossible to quantify greed in rising markets, nor to measure the limit of the insanity of buyers.

When I sold you this service I promised to show you the “sweet spots” for market entry points. Sweet spots don’t occur every day, and there are certainly none now. If you get a couple dozen a year, you are lucky.

What do you buy at market highs? Cheap stuff. That would include all the weak dollar plays, including commodities, oil, gold, silver, copper, platinum, emerging markets, and yes, China, all of which are just coming out of seven-year BEAR markets.

After all, you have to trade the market you have in front of you, not the one you wish you had.

So, now is the time to engage in deep research on countries, sectors, and individual names so when a sweet spot doesn’t arrive, you can jump in with confidence and size. In other words, mend your net.

Sweet spots come and sweet spots go. Suffice it to say that there are plenty ahead of us. But if you lose all your money first chasing margin trades, you won’t be able to participate.

By the way, if you did buy my service recently, you received an immediate Trade Alert to by Microsoft (MSFT). Let’s see how those did.

In December, you received a Trade Alert to buy the Microsoft (MSFT) January 2019 $90-$95 in-the-money vertical BULL CALL spread at $4.40 or best.

That expired at a maximum profit point of $1,380. If you bought the stock it rose by 10%.

In January, you received a Trade Alert to buy the Microsoft (MSFT) February 2019 $85-$90 in-the-money vertical BULL CALL spread at $4.00 or best.

That expired last week at a maximum profit point of $1,380. If you bought the stock it rose by 12%.

So, as promised, you made enough on your first Trade Alert to cover the entire cost of your one-year subscription ON THE FIRST TRADE!

The most important thing you can do now is to maintain discipline. Preventing people from doing the wrong thing is often more valuable than encouraging them to do the right thing.

That is what I am attempting to accomplish today with this letter.

Mad Hedge Technology Letter

February 28, 2019

Fiat Lux

Featured Trade:

(WHY ETSY KNOCKED IT OUT OF THE PARK),

(ETSY), (AMZN), (WMT), (TGT), (JCP), (M)

I wrote to readers that I expected online commerce company Etsy to “smash all estimates” in my newsletter Online Commerce is Taking Over the World last holiday season, and that is exactly what they did as they just announced quarterly earnings.

To read that article, click here.

I saw the earnings beat a million miles away and I will duly take the credit for calling this one.

Shares of Etsy have skyrocketed since that newsletter when it was hovering at a cheap $48.

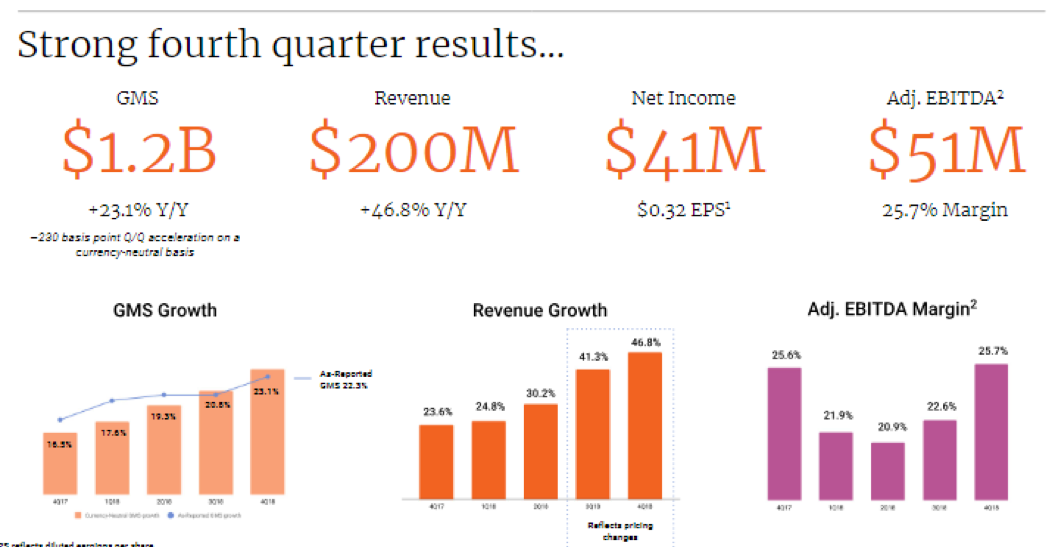

The massive earnings beat spawned a rip-roaring rally to over $71 - the highest level since the IPO in 2015.

Three catalysts serving as Etsy’s engine are sales growth, strength in their core business, and high margin expansion.

Sales growth was nothing short of breathtaking elevating 46.8% YOY – the number sprints by the 3-year sales growth rate of 27% signaling a firm reacceleration of the business.

The company has proven they can handily deal with the Amazon (AMZN) threat by focusing on a line-up of personalized crafts.

Some examples of products are stickers or coffee mugs that have personalized stylized prints.

This navigates around the Amazon business model because Amazon is biased towards high volume, more likely commoditized goods.

Clearly, the personalized aspect of the business model makes the business a totally different animal and they have flourished because of it.

Active sellers have grown by 10% while active buying accounts have risen by 20% speaking volumes to the broad-based popularity of the platform.

On a sequential basis, EPS grew 113% QOQ demonstrating its overall profitability.

Estimates called for the company to post EPS of 21 cents and the 32 cents were a firm nod to the management team who have been working wonders.

Margins were healthy posting a robust 25.7%.

The holiday season of 2018 was one to reminisce with Amazon, Target (TGT), and Walmart (WMT) setting online records.

Pivoting to digital isn’t just a fad or catchy marketing ploy, online businesses harvested the benefits of being an online business in full-effect during this past winter season.

Etsy’s management has been laser-like focusing on key initiatives such as developing the overall product experience for both sellers and buyers, enhancing customer support and infrastructure, and tested new marketing channels.

Context-specific search ranking, signals and nudges, personalized recommendations, and a host of other product launches were built using machine learning technology that aided towards the improved customer experience.

New incremental buyers were led to the site and returning customers were happy enough to buy on Etsy’s platform multiple times voting with their wallet.

The net effect of the deep customization of products results in unique inventory you locate anywhere else, differentiating itself from other e-commerce platforms that scale too wide to include this level of personalization.

Backing up my theory of a hot holiday season giving online retailers a sharp tailwind were impressive Cyber Monday numbers with Etsy totaling nearly $19,000 in Gross Merchandise Sales (GMS) per minute marking it the best single-day performance in the company’s history.

Logistics played a helping hand with 33% of items on Etsy capable to ship for free domestically during the holidays which is a great success for a company its size.

This wrinkle drove meaningful improvements in conversion rate which is evidence that product initiatives, seller education, and incentives are paying dividends.

Overall, Etsy had a fantastic holiday season with sellers’ holiday GMS, the five days from Thanksgiving through Cyber Monday, up 30% YOY.

Forecasts for 2019 did not disappoint which calls for sustained growth and expanding margins with GMS growth in the range of 17% to 20% and revenue growth of 29% to 32%.

Execution is hitting on all cylinders and combined with the backdrop of a strong domestic economy, consumers are likely to gravitate towards this e-commerce platform.

Expanding its marketing initiatives is part of the business Josh Silverman explained during the conference call with Etsy dabbling in TV marketing for the first time in the back half of 2018, and finding it positively impacting the brand health metrics particularly around things like intending to purchase.

However, Etsy has a more predictable set of marketing investments through Google that offers higher conversion rates and the firm can optimize to see how they can shift the ROI curve up.

Etsy can invest more at the same return or get better returns at the existing spend from Google, it is absolutely the firm's bread and butter for marketing, particularly in Google Shopping, and some Google product listing ads.

With all the creativity and reinvestment, it’s easy to see why Etsy is doing so well.

Online commerce has effectively splintered off into the haves and have-nots.

Those pouring resources into innovating their e-commerce platform, customer experience, marketing, and social media are likely to be doing quite well.

Retailers such as JCPenney (JCP) and Macy’s (M) have borne the brunt of the e-commerce migration wrath and will go down without a fight.

Basing a retail model on mostly physical stores is a death knell and the models that lean feverishly on an online presence are thriving.

At the end of the day, the right management team with flawless execution skills must be in place too and that is what we have with Etsy CEO Josh Silverman and Etsy CFO Rachel Glaser.

Buy this great e-commerce story Etsy on the next pullback - shares are overbought.

“Well, if you can buy 1,000 of anything, it doesn't belong on Etsy” – Said CEO of Etsy Josh Silverman

Mad Hedge Technology Letter

February 27, 2019

Fiat Lux

Featured Trade:

(HOW AUTONOMOUS DRIVING WILL CHANGE THE WORLD),

(TSLA), (GM), (GOOGL)

The car insurance industry will grapple with a massive existential crisis of epic proportions unless they evolve.

The looming threat is caused by technology and autonomous driving.

This is why parents usher their children into industries that won’t be blown up by technological disruption.

Removing the driver from the automobile industry could be the single most societal shift in our lifetimes.

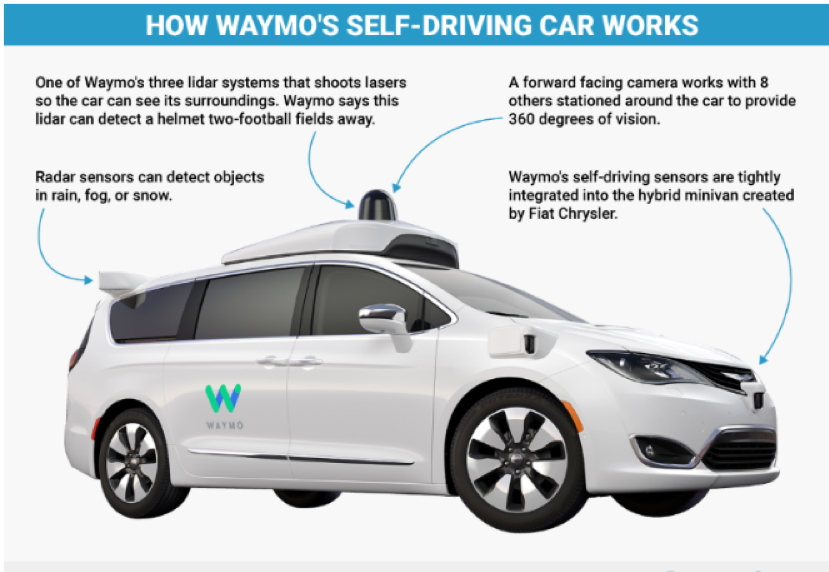

This technology is getting ramped up as we speak and Waymo is the clear leader that is already collecting money for commercial rides in the state of Arizona.

Car insurers must wonder if they will be able to charge the same amount if there are no drivers?

The answer is that the liability will head from the driver to the manufacturer with companies like General Motors (GM) Tesla (TSLA) likely footing the bill while the passenger is likely to pay minimally.

We are headed towards another data war with insurers incentivized to dismiss the relevance of data in self-driving cars and devaluing it will cause the car companies’ bills to go higher.

Car insurance companies are also heavily investing in data analytics teams to see which part of the pie and how big of it they can get from self-driving technology.

This is uncharted territory.

Consensus has it that by 2035, 23 million autonomous vehicles or around 10 percent of today’s total will grace our roads and highways.

But I believe this number is understating the underlying series of generational factors at play.

It’s no secret that the majority of Millennials and Generation Z want to live in coastal urban cores participating in the heart of downtown activities mainly because of the chance to find a high-paying job.

This has exacerbated the migration from rural to metro areas around the country and sapping the need to drive or buy a car when Uber can become an almost perfect substitute.

And don’t forget that according to the latest data, cars are stationary 92% of the time signaling consumers’ intentions to stop purchasing and instead rent cars by the minute, hour, and day.

That is the beauty of the sharing economy and how self-driving cars will fit in.

This avant-garde model will emerge between 2035 and 2050 effectively reducing the value of owning a car, the self-driving car that will be bought, probably by the self-driving tech company itself, could constitute 50% of all vehicles sold globally.

The sum of the parts could mushroom into a $3 trillion addressable market, not only made up of the physical cars but the assortment of ancillary technology needed to fuel these cutting-edge machines.

Alphabet’s (GOOGL) self-driving unit named Waymo run an onboard computer that processes images in real time using its machine learnings algorithm built by the industries’ best machine learning engineers.

However, not only do these firms need an army of artificial intelligence engineers to build the algorithms that are at the fulcrum of what they do, they also need other parts that fit into the puzzle such as lidar radar technology.

Lidar is an acronym for light detection and ranging, and the physical manifestation of this technology has so far been a cone-shaped object on top of the car's roof emitting laser pulses that bounce off objects allowing the car to recreate a 3D image of its surroundings.

The advancement of this technology and the potential production of scale will cut the cost of manufacturing this technology to less than $10 per sensor.

A full-blown lidar unit costs $75,000 at current market prices, but luckily the phenomenon of deflationary technology always drives the prices down to bare bones.

Cameras, sensors, cooling systems, and GPU chips are other products that must be heavily developed to accommodate self-driving technology.

GM is another prominent player in this field, and they have already outfitted close to 200 cars for testing.

The firm transformed its Orion Assembly plant in Michigan to accommodate cameras, lidar, and other sensors to its Chevrolet Bolt.

Whoever masters the lidar technology the quickest will have an inside edge to grab market share once this industry explodes and a lower insurance bill.

Waymo won’t be the only player usurping market share even though they are the brightest name out there, and there is room for others to crash the party.

GM invested $500 million into Lyft which could act as a gateway path into outfitting Lyft cars with GM’s proprietary technology.

Whoever specializes in the art of licensing self-driving technology to companies will ring in the register as well and the opportunities abroad are endless because emerging economies aren’t players in this industry.

GM’s Cruise AV has opened eyes with GM removing pedals or a steering wheel for this electric car.

It’s under testing in select cities and GM plans to integrate it into its ride-sharing program.

Investors are still waiting for companies to telegraph meaningful revenue to the top line, and this teething phase could cause the impatient to bolt for greener pastures.

Waymo has claimed it will be able to deliver up to 1 million trips per day by 2022 signaling that real top line revenue appears a few years off at the earliest.

This trade isn’t for the smash-and-grab type, but this is the future and it will be a slow crawl to broad-based adoption and material revenue.

The death of the car insurance industry is still years away and insurers still have time to save their bacon.

Data at the Association for Safe International Road Travel (ASIRT) shows that nearly 1.25 million people die in road crashes each year, on average 3,287 deaths a day and another 20-50 million are injured or disabled.

Technology is on the move and will try to correct this awful trend in road safety and human fatalities.

These years could be the high-water mark for car insurance and as self-driving technology continues to seep deeper into the public consciousness, it could snatch revenue from the coffers of the insurance companies.

But if these legacy companies become nimble and embrace the changes, they could potentially be at the vanguard of a highly lucrative industry charging the likes of GM and Tesla to ferry around humans.

“Incentive structures work, so you have to be very careful about what you incent people to do because various incentive structures create all sorts of consequences which you can’t anticipate,” said Apple founder Steve Jobs.

Mad Hedge Technology Letter

February 26, 2019

Fiat Lux

Featured Trade:

(WHY THE BIG PLAY IS IN SOFTWARE),

(AMZN), (WMT), (ZEN), (FB), (TWLO)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.