Why ETSY Knocked it Out of the Park

I wrote to readers that I expected online commerce company Etsy to “smash all estimates” in my newsletter Online Commerce is Taking Over the World last holiday season, and that is exactly what they did as they just announced quarterly earnings.

To read that article, click here.

I saw the earnings beat a million miles away and I will duly take the credit for calling this one.

Shares of Etsy have skyrocketed since that newsletter when it was hovering at a cheap $48.

The massive earnings beat spawned a rip-roaring rally to over $71 - the highest level since the IPO in 2015.

Three catalysts serving as Etsy’s engine are sales growth, strength in their core business, and high margin expansion.

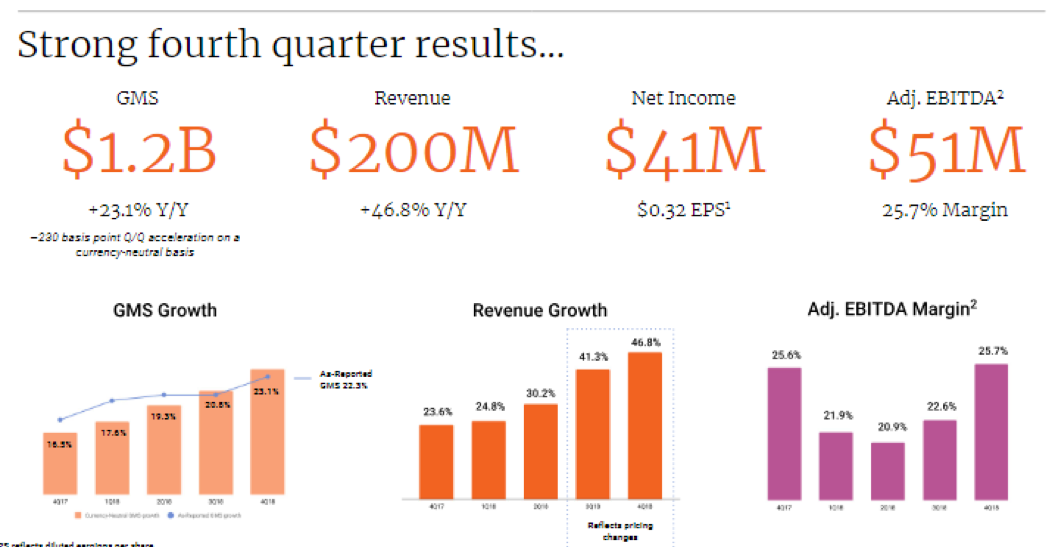

Sales growth was nothing short of breathtaking elevating 46.8% YOY – the number sprints by the 3-year sales growth rate of 27% signaling a firm reacceleration of the business.

The company has proven they can handily deal with the Amazon (AMZN) threat by focusing on a line-up of personalized crafts.

Some examples of products are stickers or coffee mugs that have personalized stylized prints.

This navigates around the Amazon business model because Amazon is biased towards high volume, more likely commoditized goods.

Clearly, the personalized aspect of the business model makes the business a totally different animal and they have flourished because of it.

Active sellers have grown by 10% while active buying accounts have risen by 20% speaking volumes to the broad-based popularity of the platform.

On a sequential basis, EPS grew 113% QOQ demonstrating its overall profitability.

Estimates called for the company to post EPS of 21 cents and the 32 cents were a firm nod to the management team who have been working wonders.

Margins were healthy posting a robust 25.7%.

The holiday season of 2018 was one to reminisce with Amazon, Target (TGT), and Walmart (WMT) setting online records.

Pivoting to digital isn’t just a fad or catchy marketing ploy, online businesses harvested the benefits of being an online business in full-effect during this past winter season.

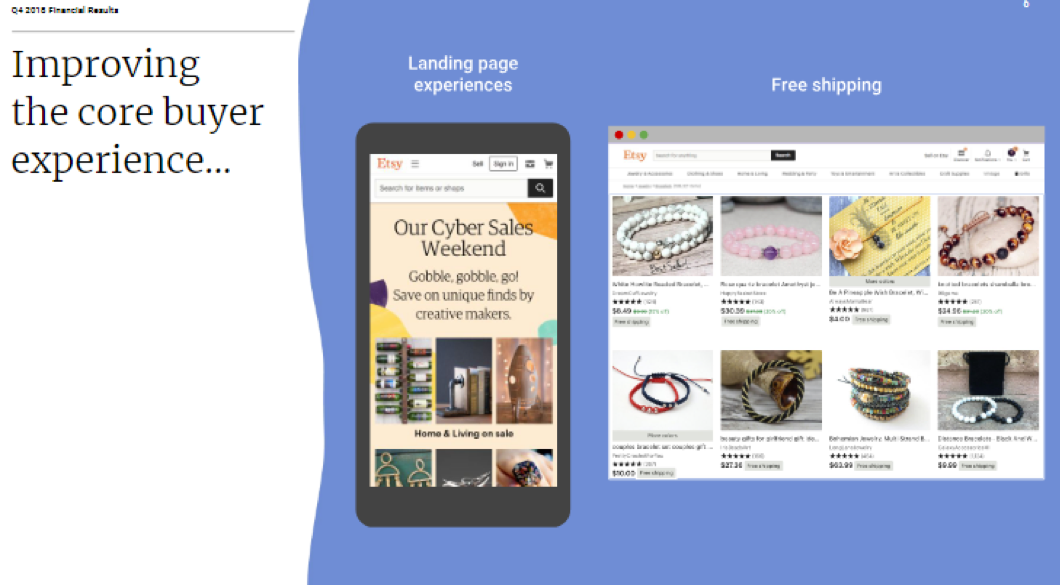

Etsy’s management has been laser-like focusing on key initiatives such as developing the overall product experience for both sellers and buyers, enhancing customer support and infrastructure, and tested new marketing channels.

Context-specific search ranking, signals and nudges, personalized recommendations, and a host of other product launches were built using machine learning technology that aided towards the improved customer experience.

New incremental buyers were led to the site and returning customers were happy enough to buy on Etsy’s platform multiple times voting with their wallet.

The net effect of the deep customization of products results in unique inventory you locate anywhere else, differentiating itself from other e-commerce platforms that scale too wide to include this level of personalization.

Backing up my theory of a hot holiday season giving online retailers a sharp tailwind were impressive Cyber Monday numbers with Etsy totaling nearly $19,000 in Gross Merchandise Sales (GMS) per minute marking it the best single-day performance in the company’s history.

Logistics played a helping hand with 33% of items on Etsy capable to ship for free domestically during the holidays which is a great success for a company its size.

This wrinkle drove meaningful improvements in conversion rate which is evidence that product initiatives, seller education, and incentives are paying dividends.

Overall, Etsy had a fantastic holiday season with sellers’ holiday GMS, the five days from Thanksgiving through Cyber Monday, up 30% YOY.

Forecasts for 2019 did not disappoint which calls for sustained growth and expanding margins with GMS growth in the range of 17% to 20% and revenue growth of 29% to 32%.

Execution is hitting on all cylinders and combined with the backdrop of a strong domestic economy, consumers are likely to gravitate towards this e-commerce platform.

Expanding its marketing initiatives is part of the business Josh Silverman explained during the conference call with Etsy dabbling in TV marketing for the first time in the back half of 2018, and finding it positively impacting the brand health metrics particularly around things like intending to purchase.

However, Etsy has a more predictable set of marketing investments through Google that offers higher conversion rates and the firm can optimize to see how they can shift the ROI curve up.

Etsy can invest more at the same return or get better returns at the existing spend from Google, it is absolutely the firm's bread and butter for marketing, particularly in Google Shopping, and some Google product listing ads.

With all the creativity and reinvestment, it’s easy to see why Etsy is doing so well.

Online commerce has effectively splintered off into the haves and have-nots.

Those pouring resources into innovating their e-commerce platform, customer experience, marketing, and social media are likely to be doing quite well.

Retailers such as JCPenney (JCP) and Macy’s (M) have borne the brunt of the e-commerce migration wrath and will go down without a fight.

Basing a retail model on mostly physical stores is a death knell and the models that lean feverishly on an online presence are thriving.

At the end of the day, the right management team with flawless execution skills must be in place too and that is what we have with Etsy CEO Josh Silverman and Etsy CFO Rachel Glaser.

Buy this great e-commerce story Etsy on the next pullback - shares are overbought.