This is not your father’s Walmart (WMT).

Peel back a layer or two of that thin veneer and in Walmart, you have nothing closely resembling the Walmart you grew up with.

This would have been a coup de grâce for many companies facing the tsunami of tech strength crushing business models left and right.

Yet, Walmart has found a way to turn the tables and flourish when many industry experts thought this once legacy shopping business was careening towards extinction.

Walmart’s outstanding performance of growing e-commerce sales 43% YOY in the winter quarter of 2018 is a proclamation that they are here to stay through hell or high water and it’s the e-commerce segment leading the charge.

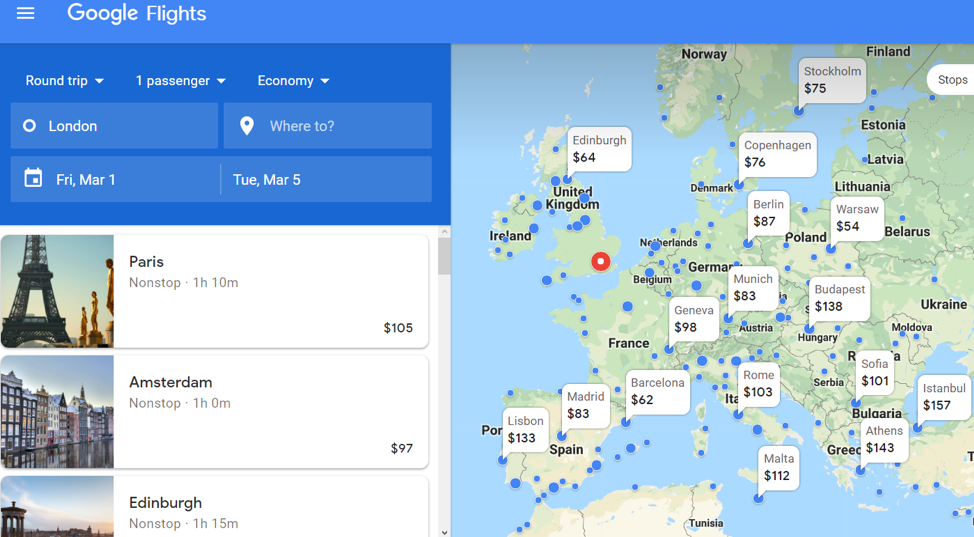

Betting the ranch on e-commerce has them inevitably on a collision course heading directly towards competitor Amazon (AMZN).

Instead of shriveling up and waving the white flag, Walmart’s President and CEO Doug McMillon is acutely aware that the overall pie is growing and there is room for more than just Amazon.

His company’s recent success echoes this trend of the overall marketing growing, and I believe passing the acid test of the 2018 winter shopping season is concrete evidence that Walmart has a prosperous future if they can navigate around four objectives.

First, triple-down on the e-commerce strategy which could translate into being a tad cavalier to operating margins.

This would take a machete to short-term profitability, but I believe Walmart investors are starting to believe in this tech pivot and further margin erosion can be stomached because they are currently conditioned for it.

To capture a larger footprint in the e-commerce market, data analytics specialists will need to be recruited in heavy numbers and convinced of the future vision of Walmart.

The turn of the calendar year means that end of the year bonuses are out and now is the time to capture the horde of tech talent sitting on the open market waiting to be put on Walmart’s books.

Walmart could potentially leap into position to nab some of these tech high flyers who specialize in Python and SQL programming languages. The demand for these wizards is insatiable and the key to any corporate digital migration strategy.

Second, being able to penetrate the target audience a notch above than what Walmart is traditionally accustomed to.

This would correlate into higher average spend per Walmart transaction which would become a feedback loop into Walmart carving out higher-grade product line-ups to compensate increasingly pressured margins.

Third, enhance the logistics and fulfillment strategy by automating more of the business process through robotics and a streamlined IT department.

Walmart has been in the process of scaling out this portion of the business process and they are probably the only one that can pull this off because of the gigantic addressable market and flowing access to capital.

Fourth, originate an educational program coaching up spendthrift customers on how to access its products digitally.

Investors must remember that a large swath of Walmart’s customers aren’t at the top of the socioeconomic ladder and seamlessly culling them into the digital orbit is a responsibility shouldered on upper management.

The goal is to gradually migrate every type of order variant online or through self-checkout means, and self-navigating through these payment and service barriers could be a hindrance as Walmart’s customer base is less tech-savvy than Amazon’s prime subscription customer base.

However, the smaller digital native customer base on a percentage basis is offset by the 4,700 physical stores allowing these partially digital-savvy customers to click and collect.

I view the click and collect distribution channel as a bridge towards becoming fully digital and if Walmart can provide superior customers service, this cohort will likely stick with Walmart’s full-service digital offerings in the future once they upgrade.

In the distant future, it’s almost guaranteed these physical stores end up as fulfillment centers with robotic automation or some type of mix of the two.

Walmart is starting to get serious looks as an e-commerce powerhouse, and I have consistently described Walmart as the next FANG. This latest earnings report reinforces this thesis.

I champion some of the moves to add to product lines such as online brands Art.com and female garment retailer Bare Necessities.

If Walmart could whip up an in-house brand similar to Amazon Basics, that would also be a gamechanger. That step is down the road and Walmart would need to accumulate higher expertise to convert certain products from the 3rd party variety.

Another growth inducer would be establishing a subscription-based service similar to Amazon Prime. Software as a subscription (SaaS) is all the rage in technology and for all the right reasons as this recurring revenue is a boon for the CFO and stabilizes finances.

The Arkansas-based firm forecasted e-commerce annual sales growth of 35% and indicated that huge sums of capital would be allocated into remodeling store units, reinforcing the e-commerce platform, and juicing up its supply chain operations.

Walmart is only scratching the surface and it would take a debacle of epic proportions or a massive recession crimping product demand to knock off Walmart from this high-speed train of positive momentum.

Yes, I agree this company isn’t even close to Amazon now, but the catch-up potential and that path to catch up is clear as daylight.

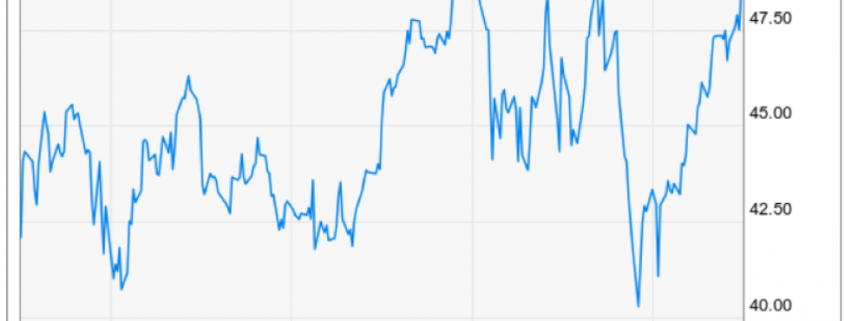

There is no need to chase shares at this price, but I can say that Walmart is on the verge of locking itself up at the $100 price point as an eternal support level moving forward.

If shares sell off to $90 because of the recent buying from oversold conditions, it could be one of the last times ever to secure a price that cheaply for a precious FANG company.

The company is also famous for continuously raising its dividend.

Walmart is an intriguing stock for the rest of 2019, particularly if the momentum snowballs from here.