“When we launch a product, we're already working on the next one. And possibly even the next, next one.” – Said CEO of Apple Tim Cook

Mad Hedge Technology Letter

October 11, 2018

Fiat Lux

Featured Trade:

(WHY SNAPCHAT SNAPPED),

(SNAP), (FB), (AMZN), (NFLX)

To the dismay of tech shares, the tech industry doesn’t operate in a bubble.

The broader landscape is experiencing a dose of volatility triggered by the ratcheting up in interest rates.

There’s not much tech can do to change the narrative.

The back and forth political saber rattling isn’t helping either.

Tech is experiencing a swift rotation out of hyper-growth names such as Amazon (AMZN) and Netflix (NFLX) with investors taking profits on these names that have gone up in a straight line this year.

This does not mean you should fling these stocks into tech heaven yet.

The hardest hit names will be the marginal tech firms in the marginal tech spaces headed by dreadful management.

This narrow criterion conveniently perfectly fits one company I have written about extensively.

Enter Snapchat.

It’s been a year to forget or remember - depending on how you look at it for CEO of Snapchat Evan Spiegel.

Snapchat was one of my first recommendations of The Mad Hedge Technology Letter when I told readers to run for the hills.

To read my story on Snapchat, please click here.

At that time, the stock was trading at a luxurious $19.

Lionizing this shoddy company would be a stretch as shares have parachuted down to the $6.60 level.

The latest word is that Snapchat is burning money fast.

The cash crunch will quickly force them to raise some capital and this is just one of the many litanies of spectacular misfortunes that have beset this Venice, California social media starlet.

Maybe management is spending too much time ripping the bong on Venice Beach because the decisions being made are of that ilk.

The first catastrophic move out of many was the botched redesign alienating the core base who were dazed and confused by the new interface and functionality.

Social media works poorly when you can’t find your friends on it.

Spiegel admitted the redesign was “rushed” and it behooves me to let readers know that the redesign was the worst redesign I have ever seen in my life as I tested it out in my office.

Snapchat quickly restored the previous interface calming their shrinking core audience.

The self-inflicted wound was deep, and earnings reflected the quicksand Snapchat quickly found itself in.

Snapchat announced that global daily active users (DAUs) shrank from 191 million to 188 million.

A company at this early stage in the growth cycle should be reeling in the users non-stop.

This is far from a mature company and if executed properly the company should have the ability to cast their net far and wide scooping up new users left and right.

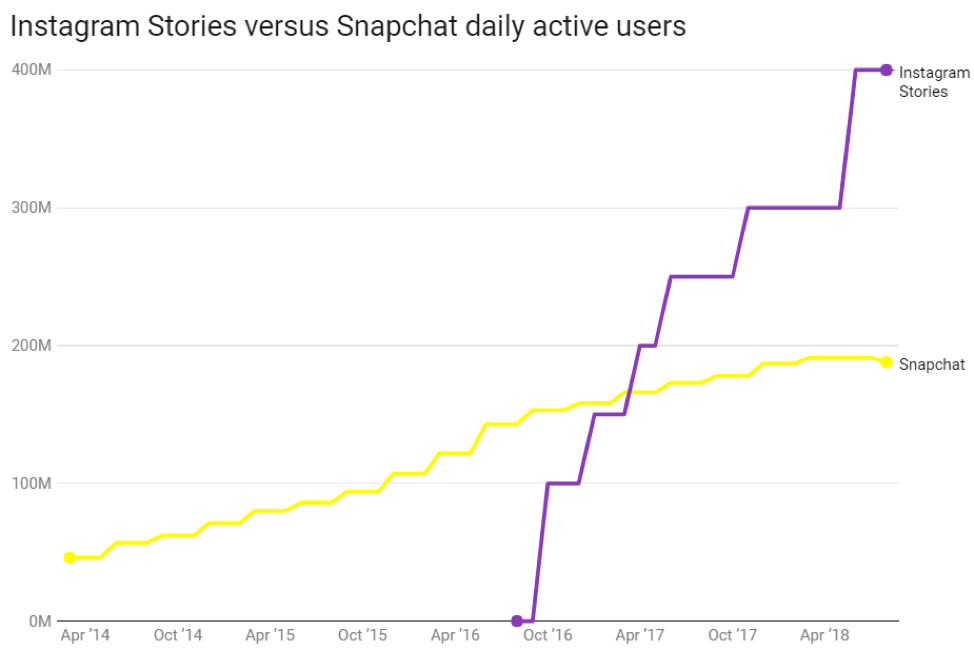

Let’s remember that Instagram, the Facebook (FB) owned direct competitor, is growing their user base parabolically.

Simply put, Snapchat has had no answer to Instagram’s rapid rise to fame, and that was the center of my thesis to turn my back to this rapidly deteriorating company.

Snapchat has offered no meaningful innovation to combat the terrorizing force of Instagram.

The dearth of innovation has caused the average time spent on the platform to dip from 33 minutes to 31 minutes per session.

Instagram has stretched the lead on Snapchat. In fact, it was Instagram that cleverly borrowed Snapchat’s best features and integrated them into their platform.

Sentiment has turned rotten as the stock sold off when Spiegel announced that he wants the company to turn profitable in 2019.

Investors don’t believe this one iota.

Snapchat is expected to burn through $1.5 billion in 2019, and Spiegel’s pipedream of scratching out a profit is implausible.

Snapchat is not executing on the digital ad front.

It was a year and a half ago when consensus believed Snapchat was able to churn out revenue of $540 million this quarter, but it looks more likely that Snapchat is set for revenue of just a shade over $280 million.

The severe underperformance is due to a lack of advertisers causing the eventual price of digital ads to fetch a lower price in an auction-based model.

Stinging as it might be, the lower costs of ads is also caused by the average age group of Snapchat’s core base.

Snapchatters are usually teenagers and have low purchasing power.

Targeting an older user base would improve margins significantly.

However, the conundrum is that the core user base might jump ship like they did to Facebook and shifted over to Facebook-owned Instagram.

Snap doesn’t have a Facebook posing an acute problem that could likely backfire.

General Data Protection Regulation (GDPR) in the European Union made the issue of securing personal data a national issue.

Facebook poured fuel on the fire when they disclosed several breaches clobbering their share price.

Mark Zuckerberg’s company is still reeling from the series of mishaps.

Ironically, Facebook debuted a smart speaker with prime access to user’s home when trust is at its lowest ebb around Facebook’s data collection practices.

Investors really need to ask themselves if Facebook’s management has any common sense at all.

Any decent company would have halted this project and I expect it to be a complete disaster.

Part of Snapchat’s turnaround strategy involves releasing scripted shows as short as five minutes long.

Entering into the original content wars is a tough sell. The competition is becoming fiercer and this move hardly will differentiate itself from ad buyers who already avoid Snapchat. In fact, it smells of desperation.

Snapchat has seen a brutal brain drain with management leaving in droves.

They have voted with their feet.

Chief Strategy Officer Imran Khan was the latest to announce his upcoming departure.

Others to jettison are the VP of product, VP of sales, VP of engineering, and its general counsel.

The high turnover rate will make it more complicated to execute a drastic reversal of fortune.

The only silver lining is if Zuckerberg manages to screw up Instagram after forcing the creators out with his behind-the-scenes meddling, giving a glimmer of hope to Snapchat.

A stellar performance from the execution team along with a Facebook mess of Instagram could resuscitate the user base if users start to flee Instagram in droves.

There aren’t many alternatives unless a user is inclined to quit social media.

Snapchat badly needs to build up its user base or else digital ad buyers will stay away.

I am still bearish on this stock and it would take a small miracle to spruce up the share price again.

“Google's not a real company. It's a house of cards.” – Said Former CEO of Microsoft Steve Ballmer

Mad Hedge Technology Letter

October 10, 2018

Fiat Lux

Featured Trade:

(DON’T BUY SURVEYMONKEY ON THE DIP),

(SVMK), (GOOGL), (CRM)

If a company takes almost 20 years and still isn’t profitable - it probably never will.

Granted, tech firms are given a Rapunzel-length leash to collect users, scale out the product, refine algorithms to industry standard, and build up the engineering team.

I know this takes time – it doesn’t happen in one day.

After whipping up a frenzy of momentum and venture capitalists claiming stakes, tech stocks usually go public.

This is the common process of what it takes to construct a Silicon Valley tech firm, and there are no shortcuts to this long hard slog.

And if after almost 20 years, amid a nine-year bull market, a tech firm in the most dominating sector in the world cannot figure how to be in the black, investors should stay away from this company in droves.

SurveyMonkey (SVMK), who recently achieved a blockbuster IPO, were the rock stars of the tech world for one day and one day only.

The stock peaking after the first trading day is a ghastly signal and ominous sign.

Their fifteen minutes of fame is all they will get because this practically ex-growth company has no indicators of a rosier future.

The company went public at $12 per share and even that was too generous.

The stock took off like a banshee, on the verge of overshooting the $20 level before falling back to grace.

The stock is now trolling around $13, and on the verge of heading to the purgatory of single digits.

What caused such a swan dive after such a promising start?

On the surface, everything looks like peaches and daffodils – a growing Silicon Valley cloud company even with Facebook spin doctor Sheryl Sandberg on the board.

The optics pass all the marks.

But wait a second, looking at the nuts and bolts, it’s crystal clear why this stock has been throttled back.

The first half of 2018, SurveyMonkey presided over a tepid 3% of paid user growth.

Yes, SurveyMonkey is growing, but not by much.

In this same period, the company lost $27.2 million and this was after an annual 2017 loss of $24 million.

Profitability isn’t exactly their forte.

The 14% of revenue growth the company secured was done after taking a machete and gutting margins to appear pretty for the IPO.

And it’s painfully obvious that SurveyMonkey is failing at converting the freemium users into paid converts.

The online survey doesn’t exactly have the highest barriers of entry.

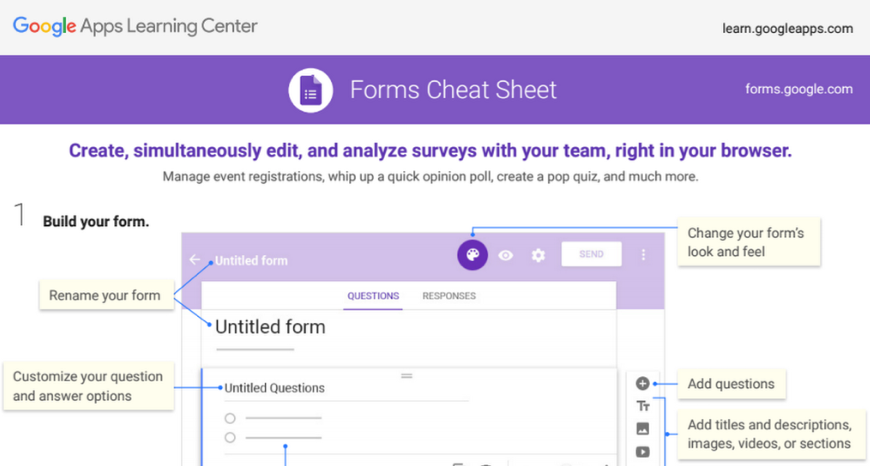

Google (GOOGL) Forms is the competitor in this space offering straightforward free surveys with basic analysis.

The tool is highly functional.

The pricing structure to SurveyMonkey’s individual membership is presented as a luxury service like the US postal service.

The individual service costs $384 per year and rises all the way up to the bloated price of $1,188 per year.

Any individual paying $1,188 per year for this needs to check themselves into a mental hospital.

Google Forms could easily undercut this pricing model by offering survey tool packages for a fraction of this amount.

The “team plan” is also laughable by charging $75 per month for up to three users, and this type of plan is capped at an exorbitant $225 per month.

Let’s remember that Microsoft offers Microsoft Office 365 Personal for an annual total of $59.99 and is million times more useful.

This annual subscription comes with premium versions of Word, Excel, PowerPoint, OneDrive, OneNote, Outlook, Publisher, and Access.

The OneDrive cloud service includes 1 terabyte (TB) of cloud storage.

Just by this simple comparison, it is easy to see which service is of value and which service is building castles in the sky.

With the explosion of service-as-a-software (SaaS) apps flooding desktops, I imagine the paid version of SurveyMonkey would be first on the chopping block due to its overly ambitious pricing.

In this strategy, the company is more concerned about milking as much as they can from each existing paid user instead of juicing up the core user base.

Effectively, this is a poor management decision, and the company is harming the growth of the potential paid usership base by robbing all incentive to convert to the paid version.

As Netflix masterfully proved, draw in the eyeballs at a lower price, build up the service to an optimum quality level, and subscribers never leave.

The opposite strategy is an indirect way of management believing the product is not good enough or the niche is too small to perpetualize a solid relationship.

And since growth numbers aren’t accelerating, there is infinitesimal reason to even consider investing in this fading company.

SurveyMoney has also racked up the debt - $317 million of it to be precise putting its debt $100 million over total revenue in 2017.

They were burning cash quickly and only had $43 million left in the coffers.

Part of the rationale for going public was a way to pay down debt.

Another chunk of proceeds from the IPO will be used to pay taxes.

The company has no innovative roadmap going forward and using the cash to pay down existing obligations shows the anemic level of intent from this company.

The silver lining in this company is that the losses of $76.4 million in 2016 were pared back in 2017.

In the IPO prospectus, SurveyMonkey noted that most unpaid customers do not become paid customers.

Even though the product is useful and it’s a long-time favorite of mine, the stock is a different animal.

There was not much meat in the prospectus and most of it were dry bones.

The IPO day was buoyed by the $40 million in stock venture-capital arm of Salesforce (CRM) pocketed, but that short-term boost has faded quickly as investors have dissected this company in every which way.

Use their free survey tools but avoid paying for the paid version and don’t buy the stock.

There are many other fishes in the sea.

NO IPO FOR GOOGLE FORMS

“Will the social networking phenomenon lessen? I don't think so.” - Said Former CEO of Yahoo Marissa Mayer

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

October 9, 2018

Fiat Lux

Featured Trade:

(LIVING ON THE EDGE),

(AMZN), (MSFT), (HPE), (GOOGL)

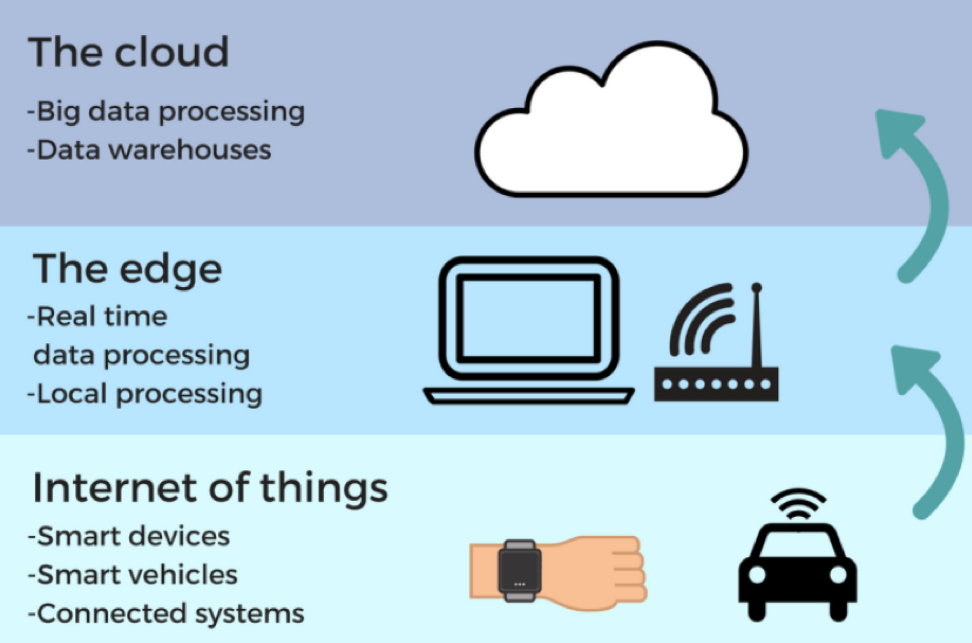

What is Edge Computing?

Edge computing is processing data at the edge of your network.

The data being generated will not only occur in a centralized data-processing storage server anymore, but at different decentralized locations closer to the point of data generation.

This is what everyone is talking about and is an epochal development for tech companies and the businesses they run.

The last generation of IT saw a massive migration to the cloud as centralized servers stored the sudden hoard of data that never existed before.

Edge computing bolsters data performance, boosts reliability, and cuts the costs of operating apps by curtailing the distance data must flow which effectively reduces latency and bandwidth headaches.

Edge computing is revolutionizing IT infrastructure as we know it.

No longer will we be forced to use these monolith-like giant server farms for all our data needs.

Epitomizing the Silicon Valley culture of becoming faster and more agile to disrupt, tech infrastructure is getting the same potent cocktail of performance enhancers underlying the same characteristics.

According to research firm Gartner, around 80% of enterprises will shutter legacy data servers by 2025, compared to 10% in 2018.

Keeping the data near the points of data creation is the logical step to enhance and optimize data processes.

Cloud computing depends on superior bandwidth to handle the data load.

This can create a severe bottleneck if bombarded with a heavy dose of devises all communicating with the centralized servers.

The edge computing industry already in the initial stages of ramping up will be worth $6.72 billion by 2022, up from $1.47 billion in 2017.

Underpinning this crucial IT is the imminent inauguration of 5G networks powering IoT devices.

Simply put, the amount of raw data which will need swift processing is about to explode. Relying on a slower, centralized servers is not the solution, and the edge offers a suitable solution to accommodate the new generation of technology.

And as technology starts to permeate every corner of the globe, data will need to be instantaneously processed locally in cutting-edge technology such as self-driving cars.

Waiting on communicating with a centralized server in another continent is just not plausible.

A self-driving car only has milliseconds to react in hazardous conditions.

Other critical and data heavy operations such as wind turbines, medical robots, airplanes, oil rigs, mining vehicles, and logistics infrastructure only function if operated at peak levels and an interruption to connectivity could be fatal.

Telecom companies and IT firms will experience the biggest sea of changes from edge computing in the next five years.

These two sectors are confronting a significant ramp up in network load and will find it challenging to deliver the results to operate the apps and services they are responsible to run.

This new IT technology is the answer.

The industry adopting edge computing the fastest is retail because of the troves of data collected by IoT sensors and cameras.

Companies will be able to analyze the performance of products and edge computing is the technology that will capture the data.

The adoption of edge computing will perfectly take advantage of the boom in IoT devices and uptick of internet speeds through 5G.

Sales of PC’s, tablets, and smartphones have matured, and aren’t seeing the same pop in growth rates like before.

However, the IoT industry will expand by 30% in the next five years boding well for the broad-based integration of edge computing.

In total, the number of connected devices in the next five years will balloon from 17.5 billion in 2017 to over 31 billion in 2023.

The first iteration of 5G IoT devices will be on the market in 2020 deploying industrial process monitoring and control.

This is not a flash in the plan technology and many firms already or are about to roll-out an edge computing strategy.

In a recent report, 72.7% of tech firms already possess a solid edge computing plan or it is in the works.

If you include all the tech firms who expect to invest in edge computing in the next year, the number catapults to 93.3%.

The same survey continued to delve into the mindset of edge computing for tech management by asking about the importance of the technology.

Over 70% of firms characterized edge computing as important, bifurcated into two categories with the first being “critically important” which 22.2% of respondent agreed with.

Another 49.6% of respondent described edge computing as “very important.”

Firms cited that improved application performance is the largest benefit of edge computing followed by real time data analytics and data streaming.

It is not the death of cloud computing yet.

Even though centralized, slower, and negatively affected by long distance, cloud computing still has a place in the future of IT.

About two-thirds of tech firms plan to utilize a hybrid centralized cloud – edge computing strategy.

Even if they did not combine this strategy, companies would most likely separate the operations responsible for two distinct set of tasks filtered by the level of time sensitivity.

The overwhelming and imminent adoption of IoT devices means IT departments are crafting a substantially higher budget for edge computing to satisfy their operational needs.

Large recipients of this technology will turn out to be companies related to manufacturing, smart cities and transportation as well as energy and healthcare.

This technology really cuts across the entire spectrum of global industries.

Data usually does not discriminate, and applications of new tech is fueling a rapid rise of performance optimization that no other sectors can claim.

Let’s do a quick rundown of the edge computing players.

The three cloud behemoths of Amazon Web Services (AWS), Microsoft (MSFT) Azure, and Google (GOOGL) Cloud are constructing edge gateways and edge analytics into their IoT offerings aiding workload distribution across edge and cloud services.

Microsoft has over 300 edge computing patents and launched its Azure IoT Edge service integrating container modules, an edge runtime, and a cloud-based management interface.

Amazon Web Services offers AWS CloudFront content delivery infrastructure and AWS Greengrass IoT service building on the momentum of pioneering centralized cloud technology.

Dell’s IoT division invested $1 billion in R&D to help drive Edge Gateways and VMware's Pulse IoT Center.

Hewlett Packard Enterprise (HPE) devoted $4 billion to its edge network portfolio. HPE operates edge services, mini-data centers, and smart routers.

These are just some of the initiatives from some of the main players in the field.

Expect companies to become a lot more connected while possessing the speed, high performance, and agility to optimally entertain this new-found connectivity.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.