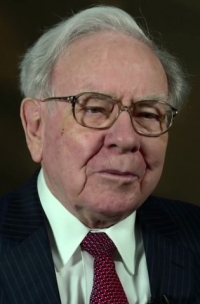

Warren Buffett preaches searching among your “circle of competence” to find those gems of companies that will offer abundant value in the far future.

His time horizon has always been long – 10, 20, 30 years where a company has sufficient time to execute its business strategy.

The celebrated investor’s track record is unrivaled.

Another critical rule to his playbook of uncanny success is to invest in companies within your area of expertise to avoid erroneous investment decisions.

If an investor is uncertain if a company is within its “circle of competence,” then it is likely outside the circle and best to skip investing in the company for now.

The Oracle of Omaha has taken his investment playbook to the chicken tikka masala-loving country of India, dropping a few Benjamín’s on One97 Communications Ltd., the parent company of Paytm, an Indian fin-tech firm.

This disrupting digital payments company based in Noida, India, is the nation’s largest mobile-payments firm and quite an achievement in a country that loves paper cash.

It boasts a popular smartphone app used in daily lives, and mirrors digital payment businesses of the likes of China’s Alipay or Tencent’s WeChat payment platform.

When the Indian government laid down the heavy hand of fiscal regulation on the paper currency market with an eye toward the digital currency market, an outsized winner was Paytm.

The cost of printing paper money in India per year is more than $90 million by itself.

I am not saying that the Indian government is going into overdrive adopting bitcoin tomorrow, but its pivot toward fin-tech mobile payments and Buffett’s vote of approval show where all the deep lying tech value is marinating in the world.

It is not Silicon Valley that gets more expensive by the day.

Silicon Valley is largely saturated with venture capitalist firms cherry-picking the best firms before they go public and making many times their investment once they hit the New York public markets.

Well, we are still in the early stages of India’s rapidly developing tech scene. And 2018 has seen some blockbuster cash injections such as Walmart’s investment in e-commerce juggernaut Flipkart.

Buffett has championed investing into companies with a “margin of safety,” allowing him to buy stakes at levels he believes that are well below market value.

This allows him to sleep at night because even if the company tanks short-term, he knows that eventually it will pull it together.

India can now lay claim to more than 390 Internet users, and 300 million of those use Paytm.

When 77% of a country’s population is using an app, you know there is some staying power, as the first mover advantage in the tech world has a powerful and long-term network effect such as the AWS’s foray into the cloud business.

Paytm does have a crowded lineup of heavyweights breathing capital into its company in the form of investments from Masayoshi Son’s SoftBank Vision Fund and Jack Ma’s Alibaba (BABA).

China’s presence in the Indian tech scene is strong, but it has not doubled down there as it has in Southeast Asia, where it enjoys a healthier political connection that is largely void of border skirmishes.

India is the largest democracy in Asia and a strong ally of the United States. Although American tech companies won’t be welcomed with a pristine red carpet, they do have ample opportunity to invest in the burgeoning Indian tech scene.

Buffett’s stake amounts to a 3% to 4% stake in Paytm, and the valuation has spiked to more than $10 billion.

This comes on the heels of Buffett’s adding to his position in Apple (AAPL) that sees him now own 5%.

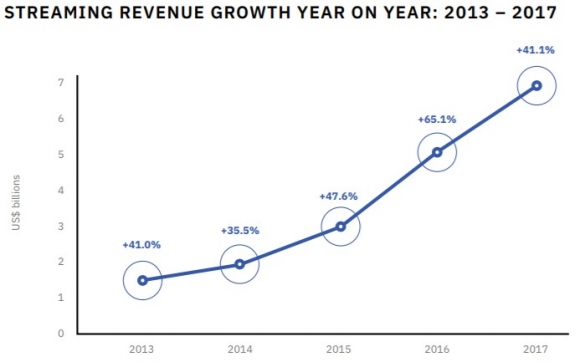

Apple’s services division is its new cash cow and is on track to eclipse $50 billion in annual revenue next year.

Apple’s services division surpassed $30 billion in the first three quarters of 2018. Its evolution comes at a timely period where smartphone growth has peaked while invaded by low-quality Chinese substitutes.

After sliding to annual low’s in April 2018 of $160, Apple has literally gone ballistic, powering past the $1 trillion valuation mark and is trading at all-time highs around $230.

Apple is another example of why this bull market is predominantly propped up by tech companies that continue to grow earnings at an insane pace.

Only a few companies have fallen into booby traps set forth by the regulatory hurdles first set by the Europeans and General Data Protection Regulation (GDPR).

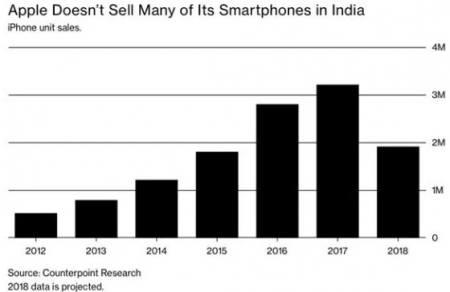

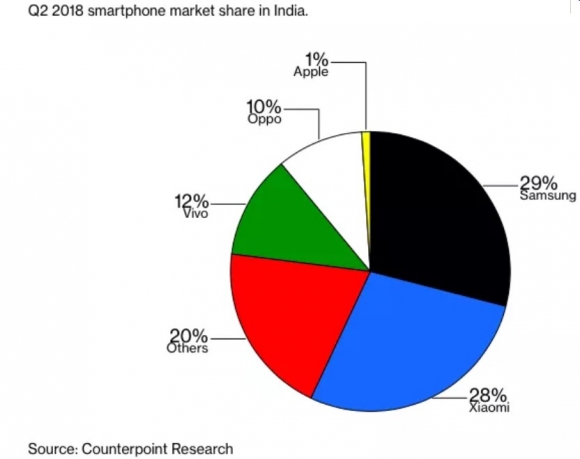

Apple is losing its smartphone battle in India, but Indians can’t afford iPhones yet and even Netflix (NFLX) is seen as an expensive streaming service.

The average Indian does not possess the purchasing power that North America and Europe have.

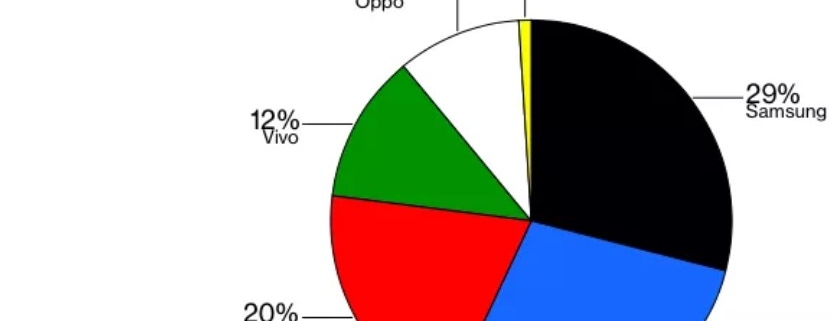

Apple has only extracted 1% of smartphone sales in India compared to leader Xiaomi, which leads the market with a 28% share. Further down-market Chinese phone maker Oppo lags with 10% and Vivo with 12%.

It doesn’t matter for Apple.

Apple continues to milk the North American and European markets to great effect padding profits with its high-quality services business.

China was the undeveloped market that launched Apple’s profits sky high. And American tech companies are ostensibly using this same strategy in India and hoping to cement the best strategy for revenue down the road.

Buffett’s investment is finally a green light for India if there ever was one, and every Silicon venture capitalist has to be licking their chops to squeeze value out of India.

The value is deep lying, but it will pay dividends within five to 10 years as India’s economy rises with its citizen’s discretionary income.

With every Tom, Dick, and Harry lusting after the India market, it will drive valuations firmly higher for the foreseeable future.

The fear of missing out (FOMO) will expedite the pivot toward India where many of the most conservative investors could ironically end up.

The tech relationship between America and India is demonstrably synergistic with Indian born CEOs heading Google (GOOGL) and Microsoft (MSFT) among other influential tech companies.

Berkshire’s (BRK/B) funds join the Chinese, Japanese, and Silicon Valley venture capitalist’s capital queuing at India’s front door awaiting to unlock value.

Buffett even opted out of investing in ride-sharing behemoth Uber, because apparently the “margin of safety” was not sufficient enough in the proposal.

Buffett was even quoted on a local Indian television station gushing about the country saying, “If you’ll tell me a wonderful company in India that might be available for sale, I’ll be there tomorrow.” That day has surfaced in the form of his investment in Paytm.

Apparently, Buffett’s expertise lies in India now and Indian-born Ajit Jain is one of four Berkshire executives running the company on a day-to-day basis.

This will pave the way for more tech investments in the swiftly evolving Indian tech scene, and Berkshire will ring in the profits of these Indian assets down the road.

________________________________________________________________________________________________

Quote of the Day

“Our favorite holding period is forever,” – said legendary American investor Warren Buffett.