Mad Hedge Technology Letter

May 24, 2018

Fiat Lux

Featured Trade:

(MICRON'S BLOCKBUSTER SHARE BUYBACK)

(MU), (AMZN), (NFLX), (AAPL), (SWKS), (QRVO), (CRUS), (NVDA), (AMD)

The Amazon (AMZN) and Netflix (NFLX) model is not the only technology business model out there.

Micron (MU) has amply proved that.

Bulls were dancing in the streets when Micron announced a blockbuster share buyback of $10 billion starting in September.

This is all from a company that lost $276 million in 2016.

The buyback is an overwhelmingly bullish premonition for the chip sector that should be the lynchpin to any serious portfolio.

The news keeps getting better.

Micron struck a deal with Intel to produce chips used in flash drives and cameras. Every additional contract is a feather in its cap.

The share repurchase adds up to about 16% of its market value and meshes nicely with its choreographed road map to return 50% of free cash flow to shareholders.

Tech's weighting in the S&P has increased 3X in the past 10 years.

To put tech's strength into perspective, I will roll off a few numbers for you.

The whole American technology sector is worth $7.3 trillion, and emerging markets and European stocks are worth $5 trillion each.

Tech is not going away anytime soon and will command a higher percentage of the S&P moving forward and a higher multiple.

The $5 billion in profit Micron earned in 2017 was just the start and sequential earnings beats are part of their secret sauce and a big reason why this name has been one of the cornerstones of the Mad Hedge Technology Letter portfolio since its inception as well as the first recommendation at $41 on February 1.

Did I mention the stock is dirt cheap at a forward PE multiple of just 6 and that is after a 35% rise in the share price so far this year?

What's more, putting ZTE back into business is a de-facto green light for chip companies to continue sales to Chinese tech companies.

China consumed 38% of semiconductor chips in 2017 and is building 19 new semiconductor fabrication plants (FAB) in an attempt to become self-sufficient.

This is part of its 2025 plan to jack up chip production from less than 20% of global share in 2015 to 70% in 2025.

This is unlikely to happen.

If it was up to them, China would dump cheap chips to every corner of the globe, but the problem is the lack of innovation.

This is hugely bullish for Micron, which extracts half of its revenue from China. It is on cruise control as long as China's nascent chip industry trails miles behind them.

At Micron's investor day, CFO David Zinsner elaborated that the mammoth buyback was because the stock price is "attractive" now and further appreciation is imminent.

Apparently, management was in two camps on the capital allocation program.

The two choices were offering shareholders a dividend or buying back shares.

Management chose share repurchases but continued to say dividends will be "phased in."

This is a company that is not short on cash.

The free cash flow generation capabilities will result in a meaningful dividend sooner than later for Micron, which is executing at optimal levels while its end markets are extrapolating by the day.

As it stands today, Micron is in the midst of taking its 2017 total revenue of about $20 billion and turning it into a $30 billion business by the end of 2018.

Growth - Check. Accelerating Revenue - Check. Margins - Check. Earnings beat - Check. Guidance hike - Check.

The overall chips market is as healthy as ever and data from IDC shows total revenues should grow 7.7% in 2018 after a torrid 2017, which saw a 24% bump in revenues.

The road map for 2019 is murkier with signs of a slowdown because of the nature of semi-conductor production cycles. However, these marginal prognostications have proved to be red herrings time and time again.

Each red herring has offered a glorious buying opportunity and there will be more to come.

Consolidation has been rampant in the chip industry and shows no signs of abating.

Almost two-thirds of total chip revenue comes from the largest 10 chip companies.

This trend has been inching up from 2015 when the top 10 comprised 53% in 2016 and 56% in 2017.

If your gut can't tell you what to buy, go with the bigger chip company with a diversified revenue stream.

The smaller players simply do not have the cash to splurge on cutting-edge R&D to keep up with the jump in innovation.

The leading innovator in the tech space is Nvidia, which has traded back up to the $250 resistance level and has fierce support at $200.

Nvidia is head and shoulders the most innovative chip company in the world.

The innovation is occurring amid a big push into autonomous vehicle technology.

Some of the new generation products from Nvidia have been worked on diligently for the past 10 years, and billions and billions of dollars have been thrown at it.

Chips used for this technology are forecasted to grow 9.6% per year from 2017-2022.

Another death knell for the legacy computer industry sees chips for computers declining 4% during 2017-2022, which is why investors need to avoid legacy companies like the plague, such as IBM and Oracle because the secular declines will result in nasty headlines down the road.

Half way into 2018, and there is still a dire shortage of DRAM chips.

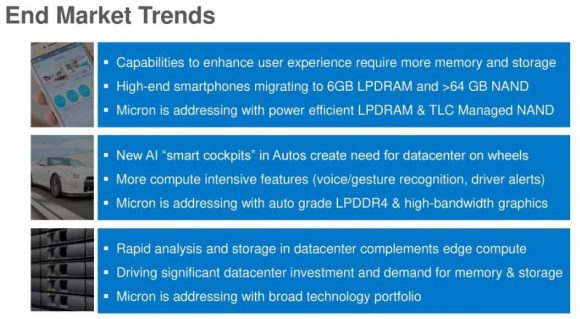

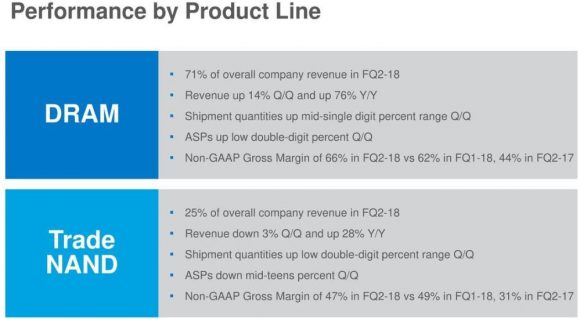

Micron's DRAM segments make up 71% of its total revenue, and the 76% YOY increase in sales underscores the relentless fascination for DRAM chips.

Another superstar, Advanced Micro Devices (AMD), has been drinking the innovation Kool-Aid with Nvidia (NVDA).

Reviews of its next-generation Epyc and Ryzen technology have been positive; the Epyc processors have been found to outperform Intel's chips.

The enhanced products on offer at AMD are some of the reasons revenue is growing 40% per year.

AMD and Nvidia have happily cornered the GPU market and are led by two game-changing CEOs.

It is smart for investors to focus on the highest quality chip names with the best innovation because this setup is most conducive to winning the most lucrative chip contracts.

Smaller players are more reliant on just a few contracts. Therefore, the threat of losing half of revenue on one announcement exposes smaller chip companies to brutal sell-offs.

The smaller chip companies that supply chips to Apple (AAPL) accept this as a time-honored tradition.

Avoid these companies whose share prices suffer most from poor analyst downgrades of the end product.

Cirrus Logic (CRUS), Skyworks Solutions (SWKS), and Qorvo Inc. (QRVO) are small cap chip companies entirely reliant on Apple come hell or high water.

Let the next guy buy them.

Stick with the tried and tested likes of Nvidia, AMD, and Micron because John Thomas told you so.

_________________________________________________________________________________________________

Quote of the Day

"Bitcoin will do to banks what email did to the postal industry." - said Swedish IT entrepreneur and founder of the Swedish Pirate Party Rick Falkvinge.

Mad Hedge Technology Letter

May 23, 2018

Fiat Lux

Featured Trade:

(WHY THE BIG DEAL OVER ZTE?),

(MU), (QCOM), (INTC), (AAPL), (SWKS), (TXN), (BIDU), (BABA)

Here's the conundrum.

Beyond cutting-edge technology, there's nothing that China WANTS OR NEEDS to buy from the U.S. China's largest imports are in energy and foodstuffs, both globally traded commodities.

China is playing the long game because it can.

Earlier this year, China altered its constitution to remove term limits and any obstacle that would hinder Chairman Xi to serve indefinitely.

If it's two, four, eight or 10 years, no problem, China will wait it out.

As it stands, China is enjoying the status quo, which is a robust economic trajectory of 6.7% economic growth YOY and at that rate will leapfrog America as the biggest economy in the world by 2030.

China does not need handouts.

It already has its mooncake and is eating it.

The Chinese are also betting that Donald Trump fades away with the passage of time, possibly soon, and that a vastly different administration will enter the fray with an entirely different strategy.

The indefinite "hold" pattern is a polite way to say we surrender.

ZTE Corporation is a Chinese telecommunications equipment manufacturer and low-end smartphone maker based in Shenzhen, China.

This seemingly innocuous company is ground zero for the U.S. vs China trade practice dispute.

The U.S. Department of Commerce banned American tech companies from selling components to ZTE for seven years, crippling its supply chain after violating sanctions against Iran and North Korea.

ZTE uses about 30% of American components to produce its smorgasbord of telecom equipment and down-market cell phones.

What most people do not know is that ZTE is the fourth most prevalent smartphone in America, only behind Apple, Samsung, and LG, commanding a 12.2% market share, and its phones require an array of American made silicon parts.

In 2017, the company shipped more than 20 million phones to the United States.

The ruling effectively put ZTE out of business because the lack of components shelved production.

Low-end smartphones account for almost one-third of total revenue.

ZTE could very well have survived with a direct hit to its consumer phone business, but the decision to ban components made the telecom equipment division inoperable.

This segment accounts for a heavy 58.2% of revenue. Therefore, disrupting ZTE's supply chain would effectively take down more than 91% of its business for a company that employs 75,000 employees in over 160 countries.

Upon news of ZTE's imminent demise, the administration made a U-turn on its initial decision stating "too many jobs in China lost."

The reversal made America look bad.

It shows that America is being dictated to and not the other way around.

When did it become the responsibility of the American administration to fill Chinese jobs for a company that is a threat to national security?

The Chinese refused to continue talks with the visiting delegation until the ZTE situation was addressed.

Treasury Secretary Steve Mnuchin and company were able to "continue" the talks then were politely shown the door.

Bending the rules for ZTE should have never been a prerequisite for talks, stressing the lack of firepower in the administration's holster.

However, stranding the delegation in Chinese hotel rooms for days waiting in limbo, without offering an audience, would have caused even more humiliation and anguish for the administration.

China is not interested in buying much from America, but one thing it needs -- and needs in droves -- are chips.

Long term, this ZTE ban is great for China.

I believe China will use this episode to rile up the nationalistic rhetoric and make it a point to wean itself from American chips.

However, for the time being, American chips are the most valuable import America can offer China, and that won't change for the foreseeable future.

The numbers back me up.

Micron (MU) earns more than $10 billion in revenue from China, which makes up over 51% of its total revenue.

Qualcomm (QCOM), mainly through its lucrative licensing division, makes more than $14.5 billion from its Chinese revenue, which comprises over 65% of revenue.

Texas Instruments (TXN) earns more than 44% of revenue from China, and almost a quarter of Intel's (INTC) revenue is derived from its China operations.

The biggest name embedded in China is Apple (AAPL), which earned almost $45 billion in sales last year. Its China revenue is three times larger than any other American company.

In less than a decade, China has caught up.

China now has adequate local smartphone substitutes through Huawei, Oppo, Vivo, and Xiaomi phones.

Skyworks Solutions (SWKS), a chip company reliant on iPhone contracts, is most levered toward the Chinese market capturing almost 83% of revenue from China.

You would think these chips would be the first on the chopping block in a trade war. However, you are wrong.

China needs all the chips it can get because there is no alternative.

Stopping the inflow of chips is another way of stopping China from doing business and developing technology.

The Chinese economy has been led by the powerful BATs of Baidu (BIDU), Tencent, and Alibaba (BABA) occupying the same prominent role the American FANGs hold in the American economy.

They are not interested in digging their own grave.

To execute the 2025 plan to become the world leaders in advanced technology, they need chips that power all modern electronic devices.

The most likely scenario is that China maintains development using American chips for the time being and slowly pivots to the Korean chip sector, which is vulnerable to Chinese political pressure.

Remember that South Koreans have two of the three biggest chip companies in the world in Samsung and SK Hynix. China has used economic coercion to get what it wants from Korea in the past or to prove a point.

Korean multinational companies, shortly after the Terminal High Altitude Area Defense (THAAD) installation on the Korean peninsula, were penalized by the Chinese government shutting down mainland Korean stores, temporarily banning Chinese tourism in South Korea, and blocking K-pop stars from performing in the lucrative Chinese market.

The Chinese communist government can turn the screws when it wants and how it wants.

Therefore, the next battleground for tech could migrate to South Korean chip companies as China is on a mission to suck up as much high-grade tech ingenuity as possible while it can.

China has some easy targets to whack down if the administration forces it into a corner with a knife to its throat.

Non-tech companies are ripe for massacre because they do not produce chips.

Companies such as Procter & Gamble, Starbucks, McDonald's, and Nike could be replaced by a Chinese imitation in a jiffy.

Apple is the 800-pound gorilla in the room.

An attack on Apple would hyper-accelerate tension between two leaders to the highest it's ever been and would be the straw that breaks the camel's back.

Technology has transformed the world.

Technology also has been adopted by nations as a critical component to national security.

Nothing has changed fundamentally, and nothing will.

China will become the biggest economy in the world by 2030.

China will kick the proverbial can down the road because it can. It never has to cooperate with America again.

Contrary to expectations, American chip companies are untouchable, and investors won't see Micron suddenly losing half its revenue over this trade war.

Until China can produce higher quality chips, it will lap up as much of Uncle Sam's chips until it can force transfer the chip technology from the Koreans.

American chip companies can breathe a sigh of relief.

_________________________________________________________________________________________________

Quote of the Day

"If we go to work at 8 a.m. and go home at 5 p.m., this is not a high-tech company and Alibaba will never be successful. If we have that kind of 8-to-5 spirit, then we should just go and do something else." - said Alibaba founder and executive chairman Jack Ma.

Mad Hedge Technology Letter

May 22, 2018

Fiat Lux

Featured Trade:

(THE BIG WINNERS IN THE SPORTS BETTING DECISION),

(LSE:PPB), (LSE:WMH), (LSE:888), (BYD), (IGT), (SGMS)

Up to my elbows in the market for the past 50 years, I have seen my share of paradigm shifts transforming the world and markets with it.

The Supreme Court delivered another momentous decision overturning the 1992 decision to ban sports betting in most states.

The aftermath is decisively pro-business with a profusion of domestic and international winners that can bask in the glow of a future windfall swelling the industry coffers to the tune of $150 billion per year.

The estimated amount of illicit sports gambling activity that goes unreported is $150 billion, and that will migrate to official channels, but I bet the sum is vastly higher.

Sports betting is as American as apple pie.

This is highly evident each year with the NCAA men's basketball tournament sucking in eyeballs resulting in more than $5 billion in lost worker productivity.

The annual Super Bowl is practically an institution in this country as well as quarterback Tom Brady's starting spot on Super Bowl Sunday.

Not only is this ruling pro-business, but the verdict is another overwhelming win for technology and the state of Nevada.

Nevada was one of the few states to receive an exemption from the 1992 ruling, and its sports betting books have developed uninterrupted for the past 26 years.

The 26-year head start will mirror Amazon's seven-year head start in the cloud catapulting existing operations to the top of the food chain.

Sports team owners from all the major sports leagues are jumping with joy as the team valuations of each franchise received another boost with fresh capital pouring in like an overflowing dam.

This development effectively creates a digital sports industry operating parallel to the official leagues and will have business synergies galore.

Sports leagues are about to welcome a new tidal wave of viewer interest that seeks to capitalize on the new synergies.

Options derivative contracts on sports games could be another product down the road for this budding industry.

The two best tech companies in position to take the court ruling and turn it into material business are the leading fantasy sports providers DraftKings and FanDuel, which are both private companies.

In 2016, these two companies attempted a merger that would have given the company a 90% monopolistic market share and more than 5 million customers.

The following year, the Supreme Court blocked the merger as DraftKings continued to grow in excess of 8 million users.

Fantasy sports and the entire e-sports genre is experiencing skyrocketing popularity with youth (physical) sports participation falling off a cliff.

New York-based FanDuel and Boston-based DraftKings have a wide-reaching digital footprint in fantasy sports that is supported by rich tech architecture.

The abundance of tech capabilities will make the crossover into sport wagering seamless.

NumberFire, a sports big data company, was bought up by FanDuel in 2015, and has close to 1 million subscribers parsing through its analytics.

The sports big data movement was christened by Bill James who coined the study of statistics in baseball as sabermetrics. That was the platform used by the Oakland Athletics' General Manager Billy Beane that later developed into a movie and book called Moneyball written by Michael Lewis starring Brad Pitt.

FanDuel was able to poach an entire team of sports tech developers when Zynga 365 Sports went bust after a few sports titles failed to stick and FanDuel picked up 38 of the 42 leftover developers in 2015.

DraftKings has pounced its increasing headcount from 425 to 700 at its Boston headquarters taking advantage of the new legislation to ramp up the required staff.

Plundering talent across the pond, too, leaving no stone unturned is a statement of intent.

DraftKings anointed Sean Hurley, who cut his teeth as head of U.K. B2B sports betting technology supplier Amelco and niche online sports book Whale Global, as its new head of sportsbook.

Tapping the U.K. for sports tech talent makes sense.

The U.K. legalized sports betting in 1961. The Brits bet more than $20 billion last year.

There is an affluence of sports betting tech know-how for hire in Europe. American companies would be naive not to pursue staff reinforcements at a time when companies are fortifying talent levels.

Thus, opening up an extensive market full of sports-crazed fans gives U.K. firms a tasty new opportunity to pursue with existing foundations in place.

Upon the announcement, online sports book outfit 888 Holdings (LSE:888) exploded 15% on the London Stock Exchange.

It's subsidiary 888sport was the first foreign company to receive a license to operate by the Nevada Gaming Commission in 2013.

Paddy Power Betfair (LSE:PPB), based in Dublin, is another company poised to benefit and has launched a takeover bid for FanDuel to seize further gains in market share.

Discussions are ongoing.

This all comes after buying U.S. headquartered Draft, a fantasy sports rival, for $48 million.

There are obvious synergies between fantasy sports and sports betting as they both process ample amounts of data that help set the odds for each game.

Online sports betting is another industry that is waiting for Artificial Intelligence (A.I.) to enhance the betting products, creating a plethora of new business opportunities.

British firms use the same in-game add-on product strategy that is popular with e-gaming franchises such as Fortnite.

In-game bets allow gamblers to wager on specific events within a game such as the first scorer of a soccer match or the first player to receive a yellow card.

Niche betting has proved hugely popular.

Paddy Power has already made inroads in America with a horseracing and greyhound racing TV channel and sportsbook called TVG and an online casino in the state of New Jersey.

Cross-border talent poaching will heat up as premium dollars are up for grabs favoring the first movers that can retain business.

The last clear-cut U.K. winner is William Hill (LSE:WMH), which already has an outsized presence in America by way of its purchase of three Nevadan sports books: Lucky, Leroy's, and Club Cal Neva, for a grand total of $53 million.

The deal gave William Hill an 11% market share of sports book revenues in Nevada. The British bookmaker's sports book can be seen dotted all over Las Vegas and Reno thoroughfares.

CEO of William Hill, Philip Bowcock chimed in saying America will benefit with an injection of "100,000 new jobs" stateside, and consumer safety will increase with the need to bet under the table swept into the dustbin of history.

The U.S.-based fantasy sports powerhouses, U.K.-based sports betting sites, and the State of Nevada are the unwavering victors.

The last stratum of indirect winners are the companies that manufacture sports betting equipment.

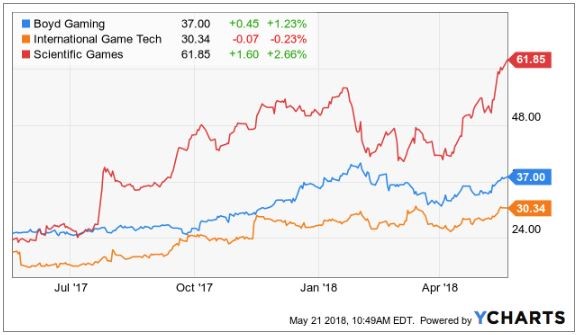

No doubt that states will likely set up brick-and-mortar sports betting establishments. Companies such as Boyd Gaming (BYD), Scientific Games Corporation (SGMS), and International Game Technology (IGT) could see a nice revenue bump stemming from the equipment they manufacture.

_________________________________________________________________________________________________

Quote of the Day

"Cybersecurity is not only a question of developing defensive technologies but offensive technologies, as well," said President of the United States Donald J. Trump.

Mad Hedge Technology Letter

May 21, 2018

Fiat Lux

Featured Trade:

(HERE'S THE BIGGEST TECHNOLOGY CONTRACT IN HISTORY)

(AMZN), (MSFT), (ORCL), (IBM), (GOOGL)

The return of the Jedi is coming.

Luke Skywalker and Obi-Wan Kenobi will enter the cloud and use the force.

Not the Jedi of the famous George Lucas films, but JEDI - Joint Enterprise Defense Infrastructure commissioned by the Department of Defense.

This large contract is up for grabs.

Rumor has it that Amazon is in the driver's seat to become the government's right-hand man.

The purpose of this broad-based upgrade is to enhance communication channels among military branches by loading up operations into the cloud.

Artificial Intelligence (A.I.) and machine learning will be integrated as well.

One task slated for modernization includes the heaps of documents waiting to be translated from Arabic, Farsi, Chinese and other foreign languages into English.

A.I. will organize which documents have priority over others as well as aiding in raw translation. This will save the Department of Defense's overworked linguists thousands of hours in brute translation work.

As it stands, the government is grappling with an overlapping fractious system with legacy software up to 20 years old.

These legacy systems of yore are poor at keeping out the cyber criminals looking for a smash-and-data grab.

One instance where massive inefficiencies rear its ugly head is in the Department of Agriculture.

This department has 22 chief information officers that require seven more personal assistants inflating the IT budget.

The government could become the best turnaround story in the tech industry in years.

This turnaround could eventually become bigger than Microsoft and Cisco, which are the poster children for extreme cosmetic surgery in Silicon Valley.

The government burns $90 billion per year servicing IT operations, and JEDI is slated to offer an attractive sum of $100 billion over 10 years to a private company.

Not only will the Department of Defense modernize, but every part of the government will adopt new technologies.

Security is a priority for this administration after its legitimacy was questioned due to alleged nefarious Russian involvement.

The Committee on Foreign Investment in the United States (CFIUS) has buckled down rejecting a myriad of attempted foreign takeovers of cutting-edge tech companies stressing the need to properly harness local tech companies' ingenuity to the benefit of the country.

These new opportunities do not affect the already $1 billion per quarter that Alphabet (GOOGL) takes in from government servicing.

The $1 billion contract was given to Alphabet to develop the Algorithmic Warfare Cross-Functional Team industrially working on Project Maven.

Project Maven is the Department of Defense's attempt to integrate A.I. and machine learning into motion detector technology applied to surveillance drones using the Google cloud.

Project Maven received an additional boost to its objectives with an additional $100 million cash injection recently underlining the government's efforts to make warfare more efficient and less expensive.

Amazon Web Services (AWS) has also carved out a nice $5 billion per quarter business thanks to the power brokers in Washington.

Another side deal consummated recently has thrust Microsoft into the frame as well.

Microsoft (MSFT) agreed with the Office of the Director of National Intelligence to service 17 intelligence agencies with the Microsoft Azure cloud platform.

The deal was reported to be valued at "hundreds of million" of dollars.

Another separate deal agreed by both parties has Microsoft migrating another 3.4 million users and 4 million devices from the Department of Defense into the cloud.

All told, Microsoft has pulled in more than $1.3 billion of orders from the government in the past five years.

Bill Gates's old company was rewarded certification to supply the government with computers, operating systems, Microsoft Office, and the cloud services bolstering their credentials to potentially extract more government business.

The administration has adopted a winner takes all approach to the JEDI contract preferring one cloud provider to maintain the infrastructure.

Companies are scratching and clawing to get within a shout of winning this valuable revenue stream that could extrapolate down the road.

JEDI accounts for just 20% of the cloud possibilities for the tech companies in the government system.

The further 80% of digitization will happen down the road.

Firms are up in arms about the single platform solution and believe branching out to multiple platforms will come in use if part of the operation goes down.

Hybrid solutions are the norm for 80% of Fortune 500 companies.

As it is, International Business Machines Corp. (IBM), Oracle (ORCL), Alphabet, Amazon (AMZN), and Microsoft have been adamant that they are the best candidates for the job.

Amazon has been on a one-man mission mobilizing its all-star team of lobbyists to gain an edge.

Amazon has been part of the government's purse strings for quite some time.

It was awarded a $600 million contract in 2013.

Secretary of Defense James Mattis spoke about the relationship with Amazon in glowing terms characterizing Amazon's performance as "impressive" in terms of securing data and functionality.

The positive Amazon feedback has given AWS a head start. It hopes to capitalize on the biggest transfer of data to the cloud in modern history.

Once completed, departments will at last be able to access files from different branches on the same platform. This process is currently done manually.

Quickening the pace of modernization is a prerogative for the new administration.

President Donald Trump signed an executive order to spur on the process of getting rid of the decaying system.

Son-in-law Jared Kushner has also been an advocate of the agonizing overhaul.

This bold initiative ties in well with enhancing cybersecurity inside Washington at a time when hackers have penetrated legacy systems with ease.

Getting the White House up and running will improve the operation of the government. From an investor's point of view, it will add materially to the bottom line of companies that start to win more contracts.

This underscores the reliance of our government and economy on the large cap tech companies that are single-handedly propping up the current bull market.

The White House will wake up one day and understand that technology innovation is more powerful than ever, and even the mayhem inside the White House can't stop the digitization of politics.

Going forward Amazon and Microsoft should get a healthy boost to their overflowing coffers. Legacy companies such as IBM and Oracle could be punished by the government as well as investors for being legacy companies, which could lead the government to pass over IBM and Oracle.

Yes Mr. President ... An Upgrade Is Needed

_________________________________________________________________________________________________

Quote of the Day

"What would I do? I'd shut it down and give the money back to the shareholders." - said Michael Dell in 1997, the founder of Dell Technologies, when asked what he would do if he was in charge of Apple.

Mad Hedge Technology Letter

May 18, 2018

Fiat Lux

Featured Trade:

(THE HISTORY OF TECHNOLOGY),

(COME MEET JOHN THOMAS AT HIS GLOBAL STRATEGY LUNCHEONS)

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Updates, which I will be conducting in and around the U.S. during the week of June 11-15, 2018. For exact dates, please look at the listing calendar below.

Each luncheon will include an excellent meal followed by a wide-ranging discussion and an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there, too.

I'll be arriving at 11:30 AM, and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

Each lunch will be held at an exclusive downtown private club. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for the luncheons, click on our online store.

LUNCHEONS:

MONDAY, JUNE 11, 2018, FORT WORTH, TX, GLOBAL STRATEGY LUNCHEON

TUESDAY, JUNE 12, 2018, NEW ORLEANS, LA, GLOBAL STRATEGY LUNCHEON

WEDNESDAY, JUNE 13, 2018, PHILADELPHIA, PA, GLOBAL STRATEGY LUNCHEON

THURSDAY, JUNE 14, 2018, NEW YORK, NY, GLOBAL STRATEGY LUNCHEON

FRIDAY, JUNE 15, 2018, DENVER, CO, GLOBAL STRATEGY LUNCHEON

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.