“Freedom is never more than one generation away from extinction. We didn't pass it to our children in the bloodstream. It must be fought for, protected, and handed on for them to do the same.” – Said Former US President Ronald Reagan

“Freedom is never more than one generation away from extinction. We didn't pass it to our children in the bloodstream. It must be fought for, protected, and handed on for them to do the same.” – Said Former US President Ronald Reagan

Mad Hedge Technology Letter

July 1, 2024

Fiat Lux

Featured Trade:

(SOFTBANK BETS THE RANCH ON AI)

(SFTBY), (NVDA)

SoftBank Group raised about $1.86 billion via dollar and euro bond sales in one of the biggest foreign-currency deals by a Japanese company this year.

This is big news.

Softbank is one of the most prominent venture capitalist funds in the world and they plan on deploying the capital solely into generative artificial intelligence.

Many of these heavyweights from Asia, and the Middle East, and other billionaires around the finance world are chomping at the bit to get a piece of American AI firms.

This trend is in the early innings and won’t slow down.

It’s interesting that Softbank raised the currency in dollars and euros which is another bet on the Japanese yen strengthening and the Fed cutting rates.

The Yen has been one of the worst-performing currencies in the past few years and there is a chance this move could blow up in Softbank’s face.

The dollar is strong and has been increasingly strong lately as the Fed stays higher for longer.

However, if the dollar does get stronger, it will mean that Softbank will need to pay higher costs. Even that said, they will still dive head-first into AI.

My belief is that their CEO Masayoshi Son, who I know very well, will bet the ranch on AI considering he sold out of his Nvidia shares in 2022 and calls it the “fish that got away.”

He rues leaving hundreds of billions of dollars in profits on the table and I don’t believe he is willing to allow that to happen again.

So he will approach these new investments as an “all or nothing” all guns blazing type of strategy.

In its first non-yen debt offering since 2021, billionaire Masayoshi Son’s company priced two dollar tranches totaling $900 million and two euro tranches raising €900 million ($964 million).

It’s not only Softbank, it’s also other Japanese companies looking for ample liquidity.

SoftBank joins a bond bonanza by issuers from Asia and elsewhere including even bigger deals from fellow Japanese borrowers such as Takeda Pharmaceutical and Rakuten.

The Japanese firm this year directly invested $200 million into Tempus AI, a startup that analyzes medical data for doctors and patients to come up with better treatments. More recently, it backed Perplexity AI at a $3 billion valuation, betting on a firm that aims to use AI to compete with Alphabet’s Google search.

Longer term, SoftBank is working on a plan to deploy some $100 billion into AI-related chips in a project dubbed Izanagi, Bloomberg News reported in February.

My belief here is that Softbank and other Japanese companies are on the verge of deploying over $1 trillion of new money into generative artificial companies in America.

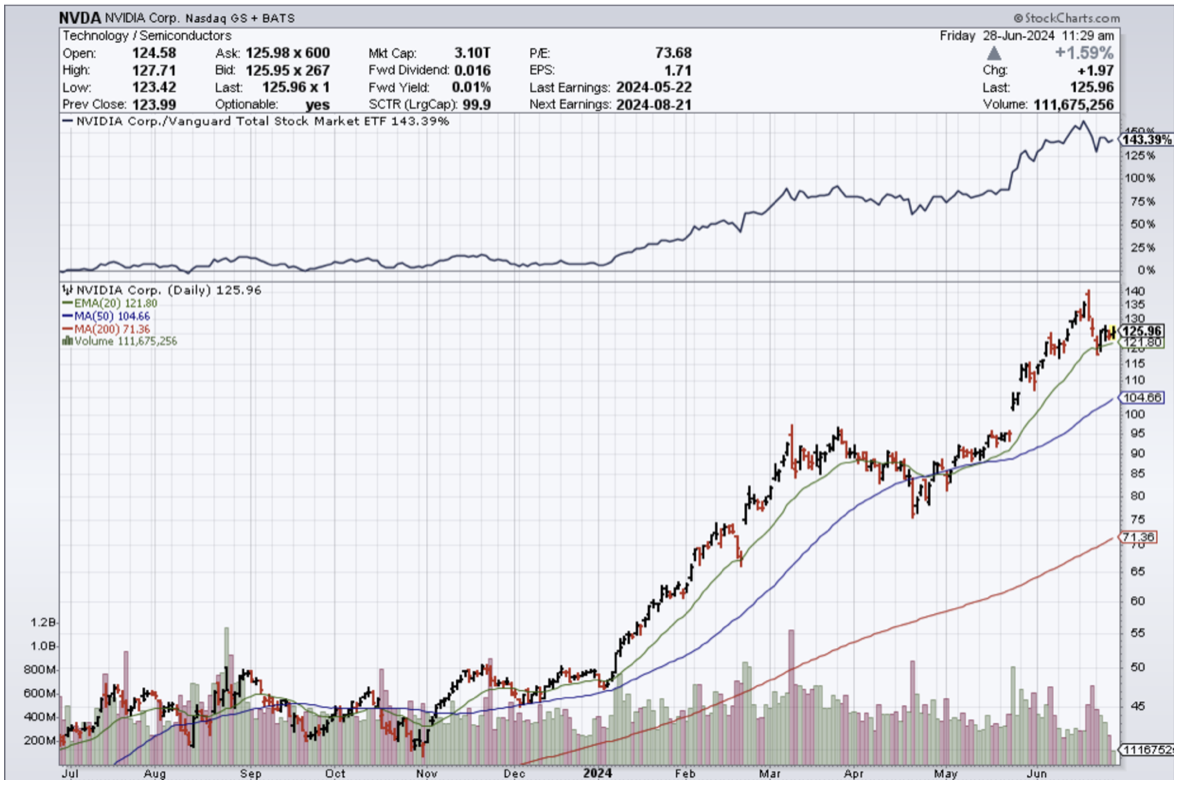

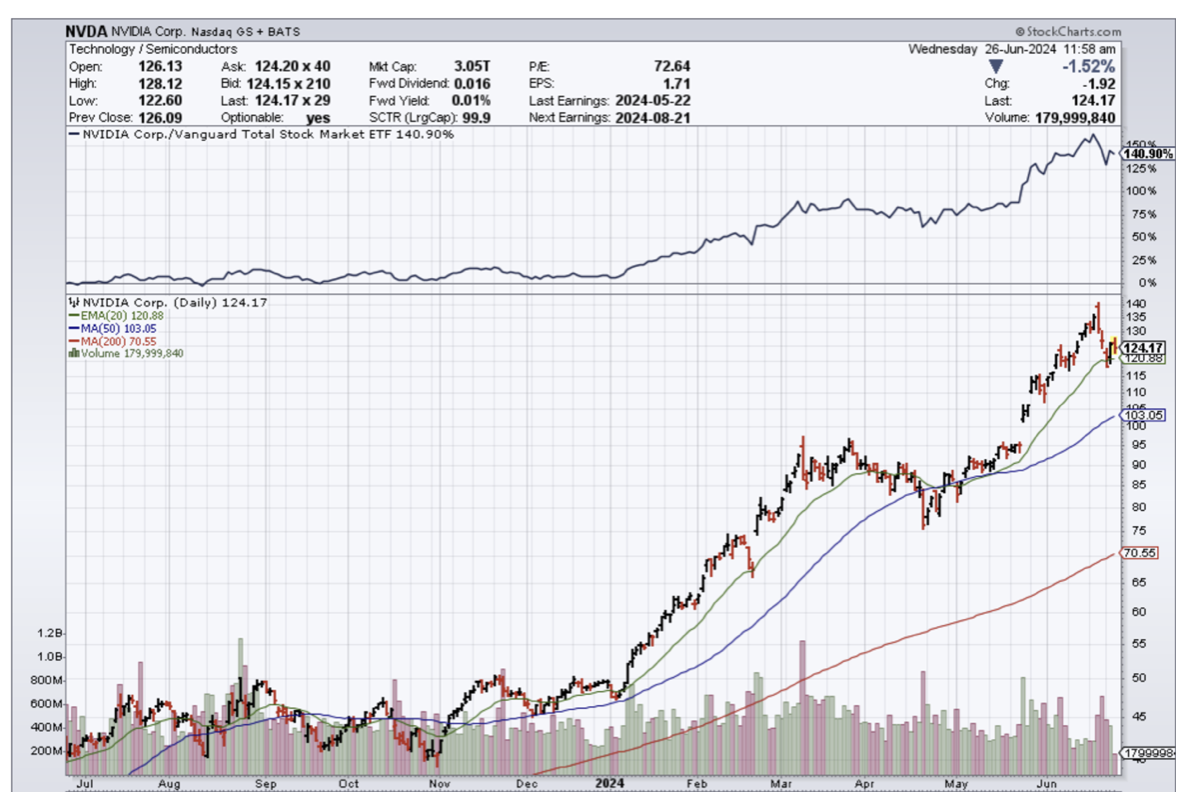

There is a reason why leading AI companies like Nvidia (NVDA) have surged to the skies and a lot of it is foreign money coming chasing the new hot trend.

I don’t believe this trend will stop will money from all corners of the globe from flooding the US markets chasing the few quality AI companies.

The ultimate takeaway is that the best companies connected the generative artificial intelligence are at the beginning of a huge run in share price that will extend years into the future.

Don’t fight the trend – especially the biggest ones in the world.

“The most important thing to do if you find yourself in a hole is to stop digging.” – Said American Investor Warren Buffett

Mad Hedge Technology Letter

June 28, 2024

Fiat Lux

Featured Trade:

(THE NEW AI PLAY THAT YOU MIGHT WANT TO KNOW ABOUT)

(VRT)

This new artificial intelligence stock could be a keep.

As an insider, let me fill you in on the details.

Readers need to look at a company that is literally collaborating with Nvidia to position themselves closest to Nvidia’s business model.

Aligning themselves with the hottest stock in the best sub-sector in the industry that grows the fastest isn’t a bad idea.

That’s why readers should take a peek at Vertiv (VRT) shares which has gone absolutely ballistic over the past year.

VRT is a provider of coolant distribution infrastructure for data centers.

IT cooling challenges continue escalating as new server-accelerated compute technologies, machine learning, artificial intelligence, and high-performance computing drive higher heat densities in the data center environment. Liquid cooling is rapidly emerging as the technology for efficiently handling power-dense hot spots.

These massive data centers require significantly more electricity to operate.

That offers upside to industrials, utilities, and commodities, according to the firm.

GPUs need 2-2.5x more power than CPUs, and expected power usage for US data centers under construction is equivalent to more than 50% of the power currently used by US data centers.

Here is how Vertiv aids the technological revolution:

High-Density Power and Cooling Solutions: The ever-growing processing power of AI requires robust power and cooling infrastructure.

Vertiv's data center solutions are designed to handle the intense heat generated by AI workloads, ensuring optimal performance and preventing overheating.

Technical Partnerships: Vertiv actively collaborates with leading AI chipmakers like Nvidia. These partnerships ensure their solutions are specifically tailored to meet the unique power and cooling demands of cutting-edge AI hardware.

End-to-End Expertise: Vertiv doesn't just provide individual components. They offer comprehensive solutions that manage power delivery and heat rejection from the power grid all the way to the individual chip. This holistic approach streamlines AI infrastructure deployment and optimizes performance.

Their scalable solutions can adapt to the ever-increasing power and cooling needs of AI applications.

Organic orders increased by 60% compared to the same period last year and net sales reached $6.82 billion.

Operating profit for the quarter was $203 million, while adjusted operating profit stood at $249 million, reflecting a significant year-over-year growth of 42%.

The company also began returning cash to shareholders, repurchasing approximately 9.1 million shares at an average price of $66 per share.

Its strong performance is due to robust demand, particularly in AI-driven deployments and liquid cooling technologies, positioning VRT for continued growth and operational improvement in the evolving digital infrastructure landscape.

The necessity of power usage also makes these GPUs considerably hotter, putting pressure on firms such as VRT to improve cooling systems in data centers.

VRT shares have essentially gone up in a straight line in the past 1.5 years from $12 per share to $86.

That type of return has been entirely justified.

Moving forward, I believe the stock will behave in a similar fashion as the demand for its products grows strongly.

Under no scenario do I find a way that its cooling technology will go by the wayside.

In fact, they could have such a great product that it might fuel speculation of getting acquired which would fuel an even higher share price.

I am bullish VRT.

“The best customer service is if the customer doesn't need to call you, doesn't need to talk to you. It just works.” – Said Founder and CEO of Amazon Jeff Bezos

Mad Hedge Technology Letter

June 26, 2024

Fiat Lux

Featured Trade:

(FISKER BLOWS UP)

(FSRNQ), (NVDA), (TSLA)

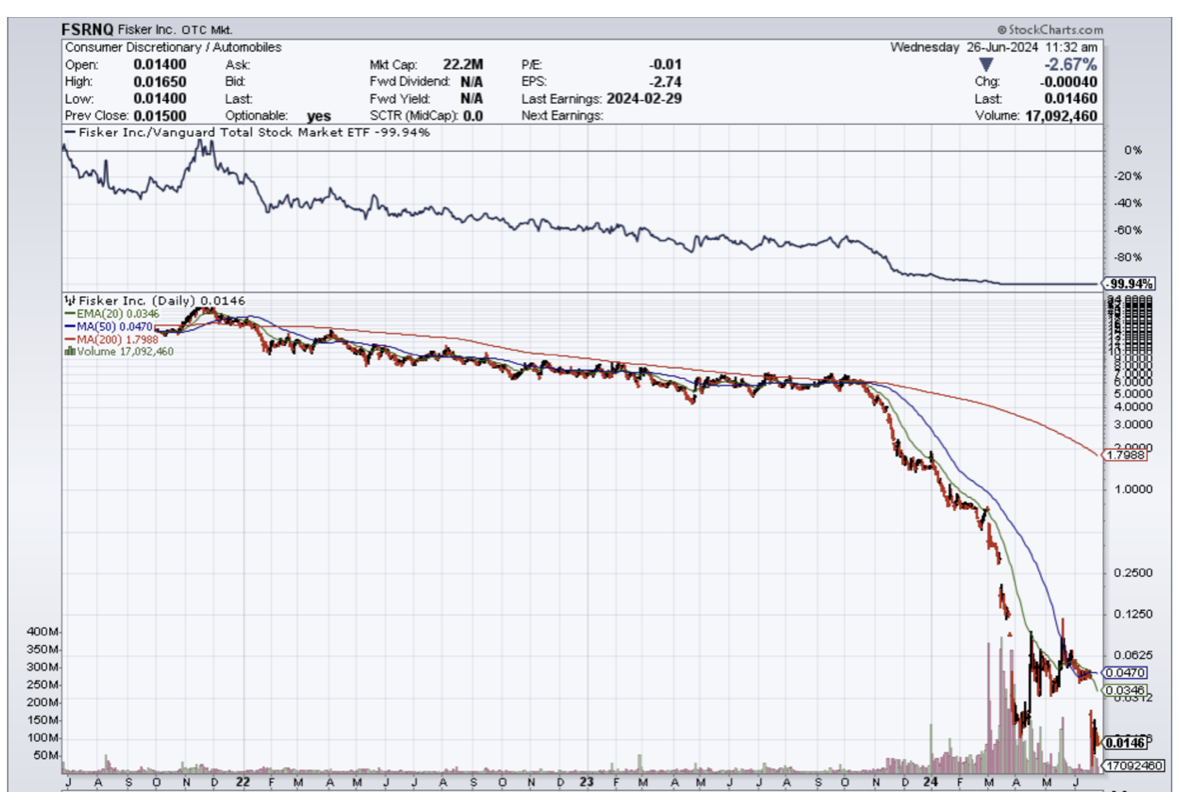

Fisker (FSRNQ) is bankrupt and I can tell you that I am not surprised.

The sushi has hit the fan.

The non-Nvidia (NVDA) tech firms minus big tech are really having a tough time staying liquid and dare I might say profitable.

Many already knew Fisker was in trouble.

They also have a terrible car which doesn’t help its case.

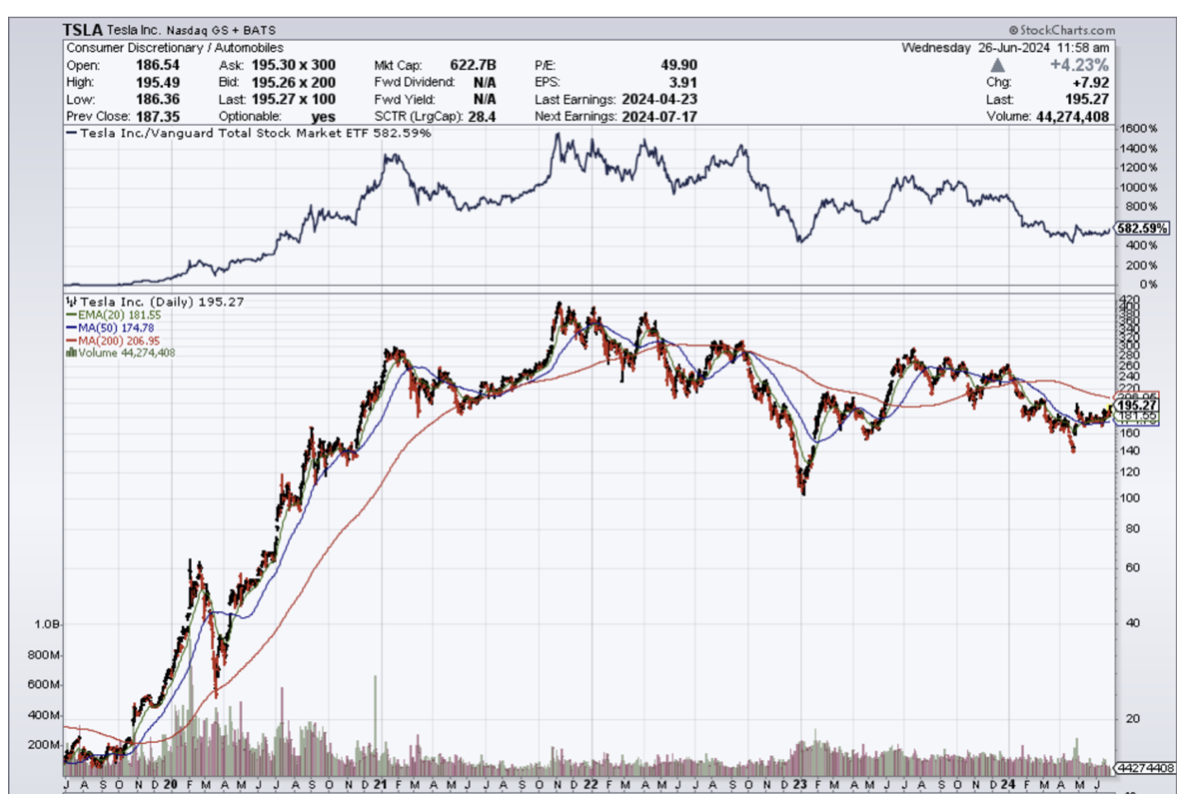

If Tesla (TSLA) is having a hard time selling EVs then imagine what it is like for Fisker to sell an utter clunker.

FSRNQ’s car has been coined as the worst EV on the market by many prominent bloggers.

Fisker management told us they might run out of cash before 2024 is over.

Definitely not shareholders like to hear in an industry that is looking more like a race to zero than an industry able to price itself at a premium.

I believe many car executives are ruing the fact of the multi-decade knowledge transfer to the Chinese about building quality cars.

How do we take tabs of the situation at Fisker?

It only sells one car called the Fisker Ocean electric SUV. Last year, around 10,000 of the SUVs were made but only about half had been delivered to customers.

In a recent interview with Automotive News, the company’s founder and CEO Henrik Fisker admitted that the Ocean had quality problems. He blamed the issues on software from different suppliers that worked poorly together and said they were being addressed through updates.

Worldwide sales of plug-in vehicles could rise 21% this year, which represents a smaller rise than the 35% increase in 2023.

The company listed between $500 million and $1 billion of assets, and between $100 million and $500 million of liabilities, in its petition filed in Delaware. The filing protects Fisker from creditors while it works out a plan to repay them.

While Fisker Ocean sport utility vehicle production started on schedule in November 2022, the first SUVs lacked basic features including cruise control. The California-based company told customers it would deploy capabilities it had promised them the following year, via over-the-air software updates.

Fisker produced 10,193 Oceans last year but delivered only 4,929 vehicles to customers.

Fisker follows a handful of other EV startups into bankruptcy, including Charge Enterprises, the installer of EV charging stations that filed for Chapter 11 protection in March. Other EV makers that have filed for bankruptcy include Lordstown Motors, Proterra and Electric Last Mile Solutions.

Anecdotally, EVs didn’t calculate properly how difficult it is to convince the 2nd wave of buyers.

For example, everyone in my family that will buy an EV has already bought one.

One Gen Z relative of mine swears he will never buy an EV because it doesn’t amount to more than a “toy car” with a battery that needs to be plugged in. He prefers a Ferrari or a Maserati where he can hear the engine roar. There is a high chance he will never be persuaded to buy an EV or if he does get persuaded, it will take 10-20 years for him to come around.

That is what EV makers face in bringing forward the next buyer.

Therefore, look at the bottom of the barrel EV production, they are all facing Chapter 11 and this is just the beginning.

Fisker’s share price peaked at around $30 per share in 2021 and now shares trade at $.02 per share. I would not buy the stock even at these levels.

Tesla’s halving of its share price also most likely means it is fairly priced for right now as we wait for a catalyst to send us either up or down.

The walls are closing in on the EV industry in the short-term and I advise readers to head to higher ground, let’s say the chip industry for a better crack at tech stocks.

“Only when the tide goes out do you discover who's been swimming naked.” – Said American Investor Warren Buffett

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.