Mad Hedge Technology Letter

June 12, 2024

Fiat Lux

Featured Trade:

(WHAT WILL DROPPING INFLATION DO TO TECH STOCKS?)

($COMPQ), ($TNX), (CPI)

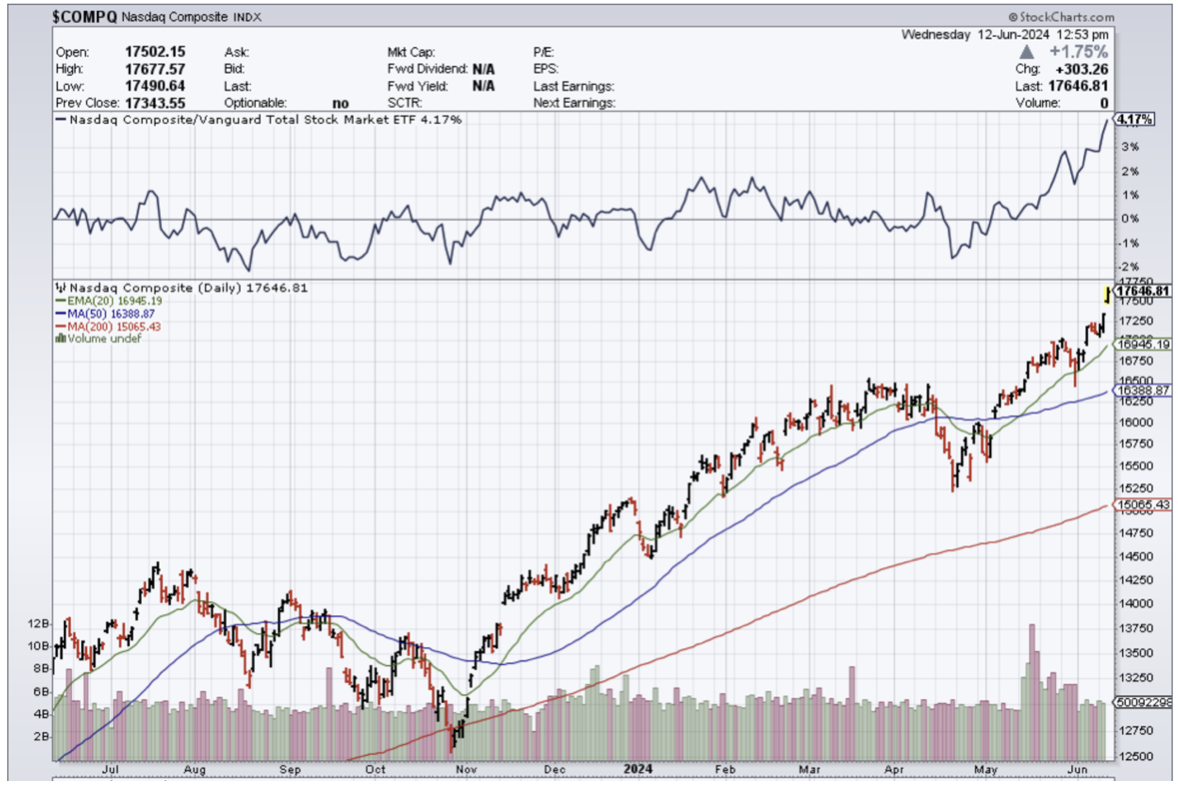

It’s “all systems go” for tech stocks ($COMPQ) as the latest inflation report offers us juicy morsels of data laying out a more attractive backdrop for tech companies in the short term.

The Mad Hedge Tech portfolio has benefited from this “bet on the Fed pivot” trend to great effect and I took profits on my Micron June bull call spread.

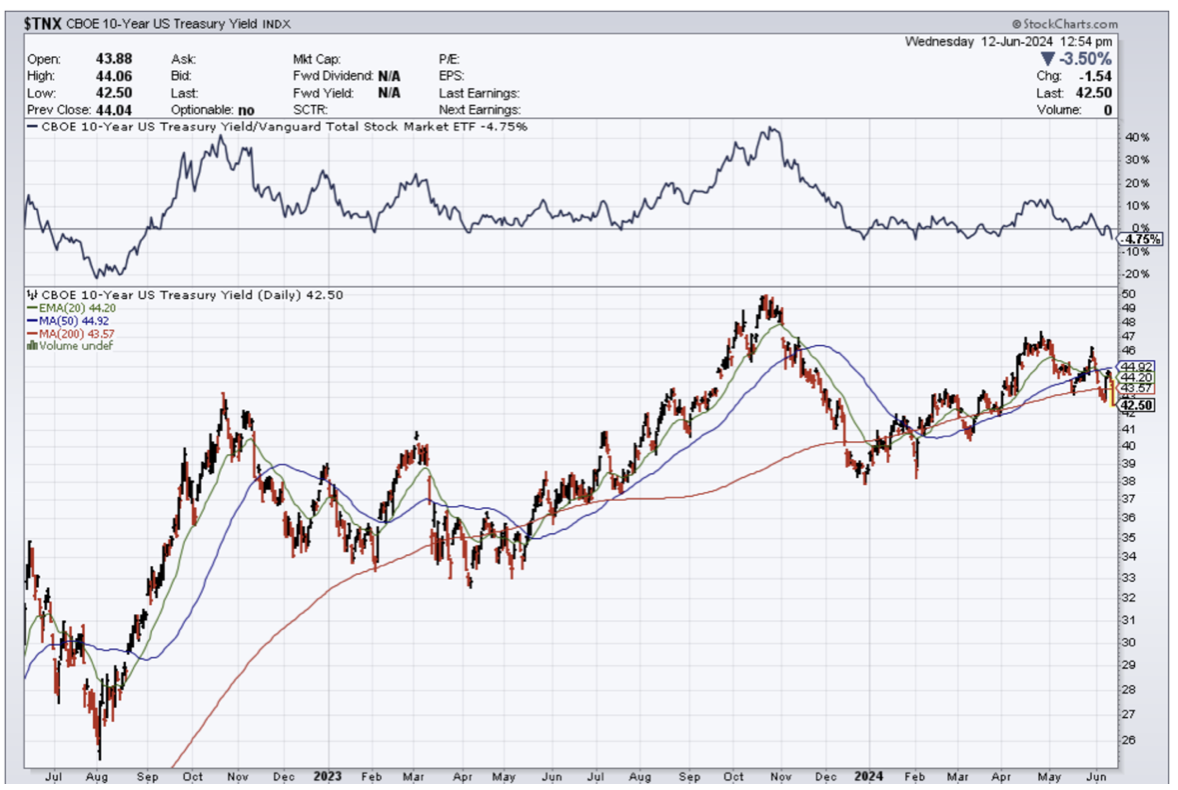

Remember that short-term rates ($TNX) are the most important variable to whether certain stocks go up and down in the short term.

Long term, the story could be very much different.

A higher-than-consensus report would have resulted in a red day for tech stocks, a pullback of commodities, bond yields spiking, and the dollar launching into the orbit.

We got the inverse of that and this is a strong signal that tech stocks will be like a stallion bolting out the back of the stable because tech stocks are the biggest winners of a lower rate environment.

The Consumer Price Index (CPI) remained flat over the previous month and rose 3.3% over the prior year in May — a deceleration from April's 0.3% month-over-month increase and 3.4% annual gain in prices.

Inflation has remained stubbornly above the Federal Reserve's 2% target on an annual basis.

Fed officials have categorized the path down to 2% as "bumpy," while other recent economic data has fueled the Fed's higher-for-longer narrative on the path of interest rates.

On Friday, the Bureau of Labor Statistics showed the labor market added 272,000 nonfarm payroll jobs last month, significantly more additions than the 180,000 expected by economists. Wages also came in ahead of estimates at 4.1%, although the unemployment rate rose slightly to 4% from 3.9%.

Notably, the Fed's preferred inflation gauge, the so-called core PCE price index, has remained particularly high. The year-over-year change in core PCE, closely watched by the Fed, held steady at 2.8% for the month of April, matching March.

The Fed has been unbelievably late in controlling inflation, but that market doesn’t care and tech stocks care less as the AI narrative has been able to supersede anything and everything.

The market is controlled and dictated to by a bunch of algorithms.

Food up 2% after a double is in fact a “victory” to the algorithms even if the middle class in the United States has felt the heavy brunt of it.

It is probably accurate to say that tech stocks are in a world of their own and the price action certainly behaves as if this is the case.

What does this all mean?

Get ready for higher-tech share prices.

Lower rates will help emerging tech companies tap the debt market to fund operations.

Many smaller tech firms don’t have the privilege to tap a multi-trillion dollar balance sheet for cash whenever they want.

In the short-term, except the AI stocks to gap up yet another leg as the market prices at lower rates for companies that hardly need it.

Talk about having your cake and eating it too – this would be it!

For the best of the rest, it helps but won’t move the needle in terms of catching up to big tech, but this should stimulate the investors on the sidelines nudging them to handpick certain stocks that have been ignored during the time of high rates.

Either way, the Fed has really put itself in a box here and without even killing inflation to the 2% mandate.

The markets fully expect the Fed to cut once or twice by the end of the year.

Whether this decision is political or not, the new developments have put a floor under many high-quality tech names.

Consequently, the second half of the year should see some ample returns in tech stocks that preside over good business models.

“Never spend your money before you have earned it.” – Said Thomas Jefferson

Mad Hedge Technology Letter

June 10, 2024

Fiat Lux

Featured Trade:

(OIL, THE US DOLLAR, AND SILICON VALLEY)

($COMPQ)

The dollar, tech stocks, and Saudi Arabian investment are inextricably linked almost like a web of nodes that shouldn’t be messed with.

The Saudis are a financial heavyweight and I would never dismiss their capital flows as it relates to tech stocks.

It is definitely not a drop in a bucket and we should take notice when Saudi Arabia creates a $100 billion fund this year to invest in AI and other technology.

That is just pocket change for one year.

It is in talks with Andreessen Horowitz, the Silicon Valley venture capital firm, and other investors to put an additional $40 billion into A.I. companies.

In March, the government said it would invest $1 billion in a Silicon Valley-inspired start-up accelerator to lure A.I. entrepreneurs to the kingdom.

Saudi wants to invest in tech and to do that they need dollars. Tech and its value are almost always entirely priced using dollars and not any other currency.

So I will address the conspiracy theory that we are about to go completely off the dollar as the global reserve currency.

The behavior of foreign investors suggests that the dollar’s role in global currencies is increasing and not the other way around.

Some even suggest that the Chinese yuan is about to replace the dollar as the world’s most important currency.

I strongly disagree with that opinion.

A place still using capital controls for trillions worth in tech seems like lunacy.

It flat-out does not happen.

Middle East oil-producing nations have other reasons to stick to the dollar.

A crucial one is that most of their currencies are pegged to the greenback, requiring a constant influx of dollars to support the arrangement. Those savings are held in dollar accounts, so Middle East countries have an interest in keeping the dollar strong.

There is not much traction in practical terms of the much-hyped idea of using the yuan to price oil.

American investor Ray Dalio likes to describe America as a weakening power that is succumbing to China. I strongly disagree with that hot take from Dalio. China is in fact faltering at an accelerating pace and its internal problems are piling up like a stray dog locked in a strangers back yard.

If you believe in conspiracy theories, the introduction of a petroyuan, and the ensuing collapse of the petrodollar, would be a first domino, potentially weakening the whole US financial system.

Redraw the global economic map amid a backdrop of crisis and wars.

Astonishing as it is, the narrative is a mirage.

The appetite among OPEC producers to price oil in yuan using a Chinese exchange is basically zero.

Middle Eastern national oil companies closely watch how Beijing tries to manipulate local commodity prices such as iron ore, cotton, coal, or grains every time prices rise above its pain threshold. Having spent 60 years building a formidable cartel, why would Middle East nations cede pricing power to China using a whacked-out currency?

The Saudis need to put their money somewhere and the anointed place has been technology and many times Silicon Valley technology.

They have already invested in many of the most high-profile tech companies in the US and will continue to do that.

Saudi and other foreign money is another reason why this tech market can’t and won’t get sideswiped.

Any dip is viewed as a prime buying opportunity as other industries give way to the freight train that is the AI narrative.

Anyone would be crazy to short the AI trade with unlimited petro-dollars from the Middle East.

Pump the black gold from the ground and dump the profits into volatile tech stocks.

Wait for them to explode to the moon – rinse and repeat.

I am bullish on tech in the short term.

“The man who reads nothing at all is better educated than the man who reads nothing but the newspapers.” – Thomas Jefferson

Mad Hedge Technology Letter

June 7, 2024

Fiat Lux

Featured Trade:

(HEWLETT PACKARD – REMEMBER THEM?)

(HPE), (SMCI), (NVDA), (ORCL), (DELL)

Artificial intelligence is not always the golden ticket, but some legacy companies, they are using this trend to springboard themselves back to relevancy.

Look at companies like Dell (DELL) or Oracle (ORCL) – they epitomize what I am talking about.

For years, these certain legacy tech firms were crowbarred into this narrow definition of some aging enterprise software company that was from yesteryear.

It was true back then but some have changed.

Hewlett Packard (HPE) is another Silicon Valley brand name that has reinvented itself for artificial intelligence and its stock price has reaped the dividends.

The stock has exploded to the $20 per share range after languishing in the teens for years.

HPE latest report was topped up with its better-than-expected revenue fueled by sales of servers built for artificial intelligence work.

The strong performance was due to the company’s server business, which generated revenue of $3.87 billion.

Sales of AI-oriented systems doubled from the first quarter to more than $900 million.

Increased demand and better availability of high-powered semiconductors from Nvidia (NVDA) led to an increase in AI systems sales.

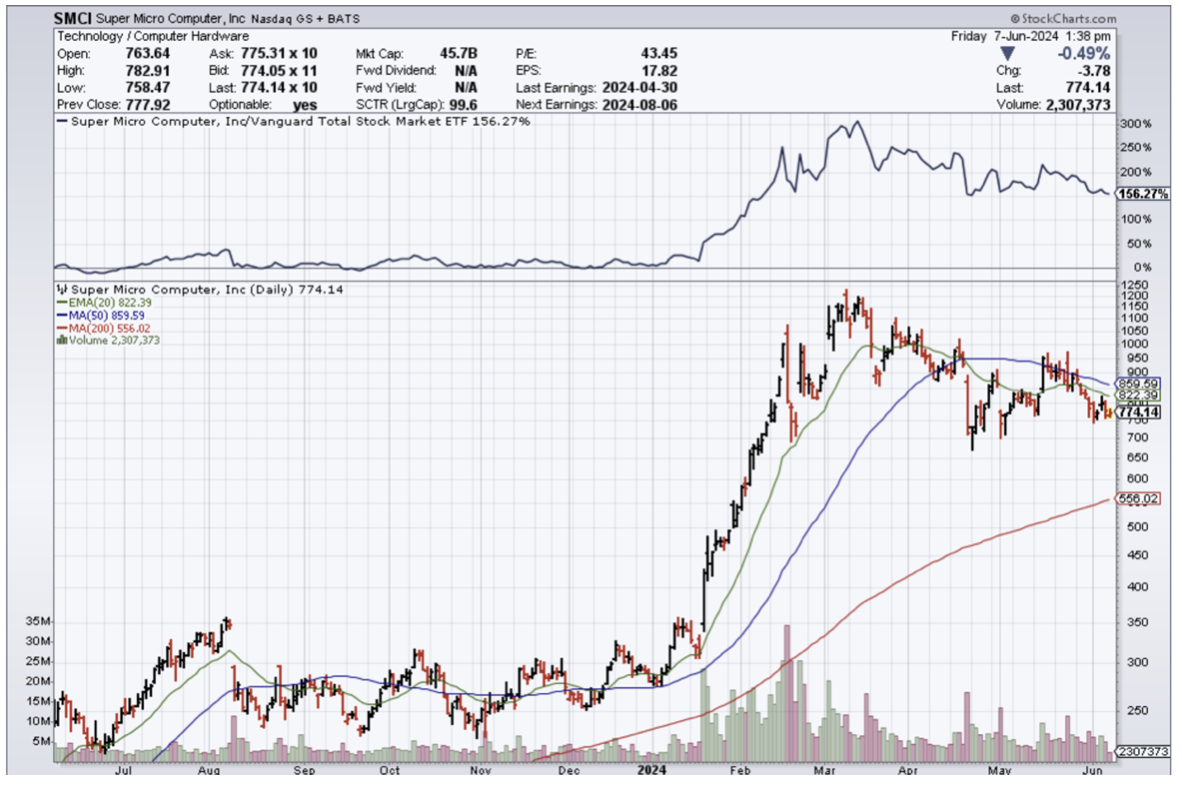

HPE would be a good way to play the catch-up trade in AI servers compared with its peers in the server space, including Dell Technologies (DELL) and Super Micro Computer (SMCI).

HPE’s current backlog for AI systems is now $3.1 billion.

This is the first quarter HPE has broken out AI server revenue and investors likely welcome the increased disclosure.

The AI-server ramp-up is finally materializing.

The full-year forecast is underwhelming given the increased AI business, suggesting other business lines, such as networking, are dragging down the results.

I am not saying that HPE is the finished article right now and is a pure AI play. I am not. They have a lot to work on and that might be a generous statement to even say that.

There is still plenty to dislike about HPE who are saddled with legacy businesses that barely move the needle.

However, if HPE smartly harnesses resources right, I do believe they could eventually turn into an above-average AI play.

At this point, many tech companies view the participation of AI or not as an existential matter.

Many companies will get left behind and swept into the dustbin of history.

When the biggest tech companies in the world talk about AI constantly on their earnings call, it is not a head fake. This is the real deal so get with the program.

There are many different types of semiconductors with different levels of sophistication, from simple chips in kitchen appliances to cutting-edge graphics processing units (GPUs) used in artificial intelligence (AI) applications, as well as cryptocurrency mining.

In many of these use cases, semiconductor chips will need an AI server to act as storage for the data or some other similar function.

The data produced is substantially greater than analog chips and of higher quality.

We are still in the early innings of the AI revolution, so it is important to know which stocks possess an upward trajectory in terms of business models and sub-sectors.

In 2024, semiconductor chips and AI server stocks have made their stamp in the tech world and aren’t going away.

Remember that the trend is your friend and I wouldn’t fight this one. It’s a massive trend to fight and be on the wrong end.

Moving forward, I believe HPE will make meaningful optimization decisions to amplify its AI server business while minimizing its legacy divisions to the benefit of the future share price.

If they can somewhat achieve these results, the stock should easily rise by 3X.

“Life is fragile. We're not guaranteed a tomorrow so give it everything you've got.” – Said CEO of Apple Tim Cook

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.