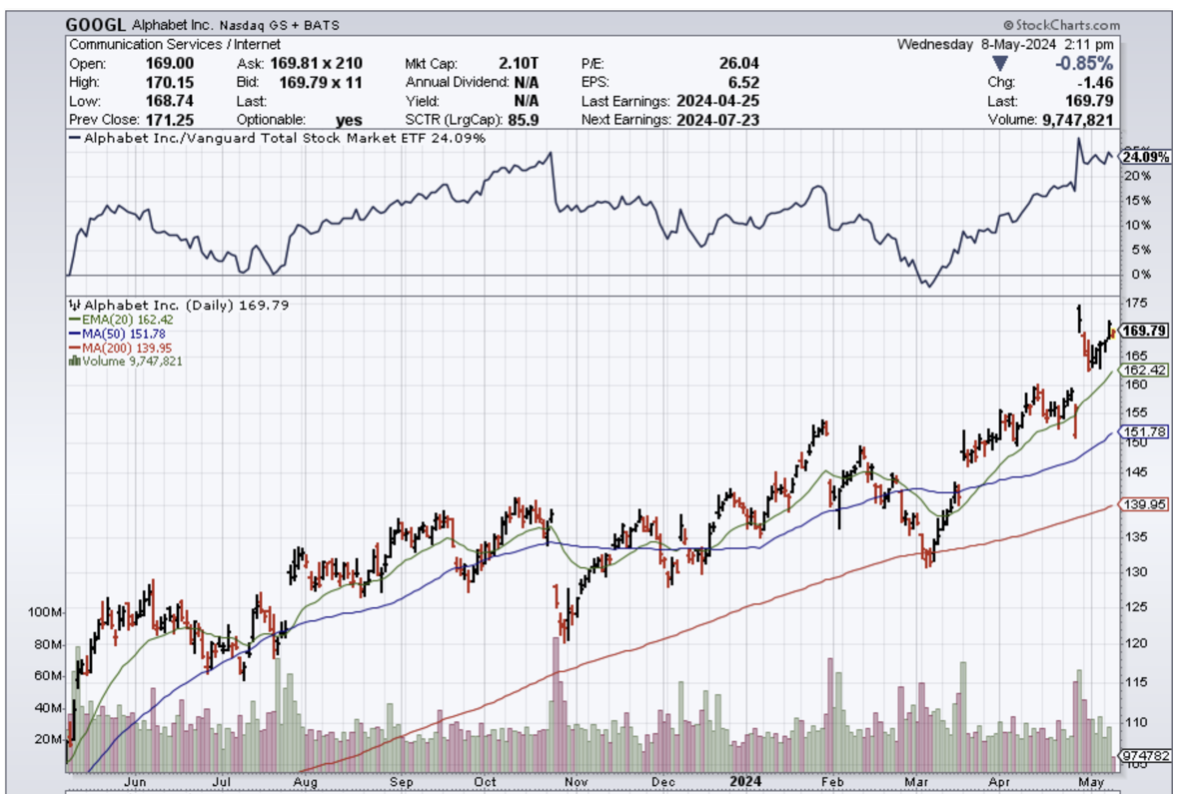

GameStop (GME) and AMC (AMC) shares taking off like a bandit from a bank heist is highly advantageous for tech stocks.

Everyone who owns tech stocks maybe doesn’t know that but won’t complain when their shares go up.

This aggressive price action clearly signals to the rest of the stock market that monetary policy is way too loose.

Yes, and I am saying that at Fed Fund rate sitting at 5% today.

It’s a tough job to reign in the inflationary genie after it’s out of the bottle, and the liquidity sloshing around that overflows into a high inflation backdrop means that prices trend up.

That also goes for tech stocks.

Much of that liquidity has found its way into growth tech stocks like Nvidia (NVDA) and Super Micro Computers (SMCI).

It’s also found its way into marginal tech companies like Gamestop and meme movie cinema stock AMC.

Capital wouldn’t be allocated this poorly into mediocre stocks if there was a tighter cap on liquidity which there isn’t.

It was only just the other week in which the US Central Bank slowed the pace of asset run off to their balance sheet which equated to yet another injection of quantitative easing for tech stocks.

What does that mean?

In the short-term, tech stocks are off to the races.

This is a side effect to the easy money policies resulting in 100% moves in AMC and GME.

It’s almost laughable but that is the world we live in.

The moves higher in both stocks, which have since been followed by several trading halts and subsequent paring of gains Tuesday, came after the reemergence of Keith Gill, also known as "Roaring Kitty," whose bull case on GameStop ignited the meme stock rally back in 2021.

Every bull market has its share of excess and mini bubbles, but this only becomes dangerous when it becomes widespread.

Even if interest in ‘meme’ stocks rebounds following a renewed surge in GameStop’s share price, it doesn’t mean that we are at the end of the tech sector’s Bull Run.

It does mean we are very late in the tech cycle, but honestly speaking, we have been late cycle since 2019.

It’s so late that tech companies now have to issue dividends to keep investors onboard.

They used not have to do that because they were growing so fast.

Sometimes tech stocks don’t sell themselves and this is a period when that is so.

The almost 5 year late cycle action has meant that tech stocks are a good bet in the short-run and the underpinnings to this rally has been fortified due to AI mania that has engulfed many of the best and brightest of tech.

Stocks like GME and AMC shouldn’t be experiencing 100% gains in days in this part of the late cycle, not because I don’t like these companies, but because their business models don’t support such price action.

Gamestop sells video games at the mall.

AMC has a failing movie theatre business.

My take from it is that the tech Bull Run is alive and well in the short-term and there is definitely enough capital to stage a summer tech rally.

Hold on to your hat cowboy!