The AI war is heating up thanks to the new kid on the block Cognition AI.

They have certainly one-upped the competition.

Cognition AI’s team has a new type of technology called Devin.

Devin is a software development assistant in the vein of Copilot, which was built by GitHub, Microsoft, and OpenAI, but, like, a next-level software development assistant.

Instead of just offering coding suggestions and auto-completing some tasks, Devin can take on and finish an entire software project on its own.

The technology can even create websites within seconds. No coder will ever be able to compete with this.

As it works, Devin shows all the tasks it’s performing and finds and fixes bugs on its own as it tests the code being written.

The founders of Cognition AI are Scott Wu, its chief executive officer; Steven Hao, the chief technology officer; and Walden Yan, the chief product officer.

One of the big breakthroughs claims they can force a computer to reason with stunning efficiency.

Reasoning in AI-speak means that a system can go beyond predicting the next word in a sentence or the next snippet in a line of code, toward something more akin to thinking and rationalizing its way around problems.

It’s possible to give Devin jobs to do with natural language commands, and it will set off and accomplish them.

As Devin works, it tells you about its plan and then displays the commands and code it’s using. If something doesn’t look quite right, you can give the AI a prompt to go fix the issue, and Devin will incorporate the feedback midstream.

Most current AI systems go haywire soon after it veers away from the script. Off-schedule variables usually are hard for current AI to stomach.

What does this mean for the tech sector and the future of work?

A naïve person would say this will free developers from the drudgery of mundane tasks and let them focus on more creative jobs.

However, the smart crowd understands this will be a great excuse to cut staffing costs to the bone.

This will allow many non-coders to join in the game and totally bypass going through software developers who more often than not lack common sense.

Remember when the Chinese consumer went from cash to paying with QR codes via smartphones, they skipped over the credit card and America is still stuck on the plastic card.

People will be able to create 1-man tech companies and do the job of 100 people in no time.

This certainly is a winner-takes-all scenario and the mid-term future is quite bleak for software developers.

It’s looking highly likely and I would say ironic that the software developers creating AI are about to do a disservice to their colleagues and rid the economy of 99% of software developers.

Of course, AI isn’t that good yet, but the path is being laid and the countdown has been initiated.

With a few years of furious development of high-quality AI, this will usher in a golden age of tech stocks, because they will finally be able to fire most of the staff.

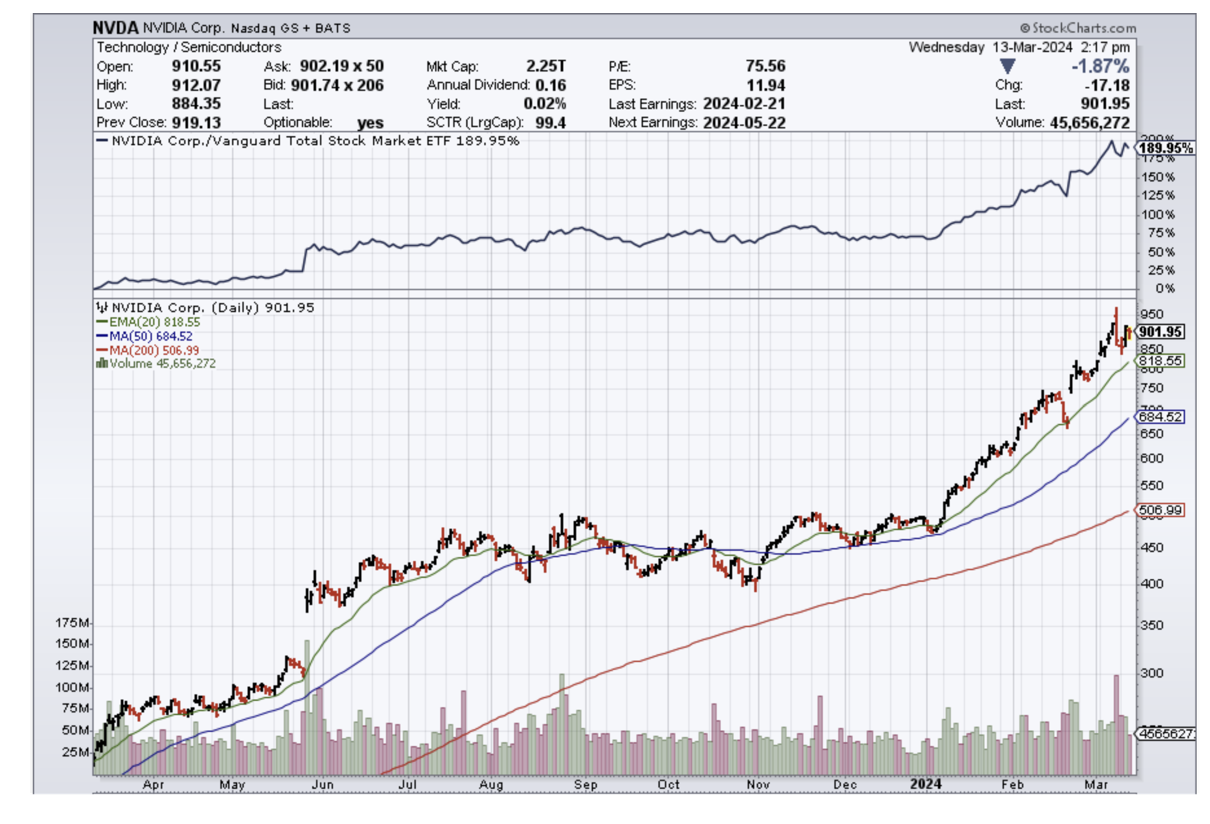

The advancement of AI can guarantee higher tech shares no matter what and many might say stocks like Nvidia are cheap because this trend is still in the early innings.