Apple didn’t release a new iPad model in 2023 which speaks volumes to the short-term trajectory of the tech firm that Steve Jobs built.

The current CEO Tim Cook is still living off of Jobs’ past creativity.

I believe the new Apple VR headset named the Vision Pro is still a speculative product that won’t result in any meaningful revenue for at least the next few years if at all.

Part of the blame for Apple’s underperformance stems from the poor macro environment for pure multinational corporations as deglobalization accelerates.

Apple also took their lineup of smartwatches off the display cases minutes before last Christmas signaling a continued malaise for big tech companies that are finding it rough to move the needle along.

Many behemoth tech companies are feeling the pressure to squeeze that incremental revenue out of the consumer and Apple is no different from a company like Tesla which is under attack from Chinese EV maker BYD.

Competition is real and it’s only getting worse.

The proverbial low-hanging fruit has been plucked dry.

Luckily, the lack of expansion didn’t mean that Apple’s stock went down in 2023.

It was very much the opposite with Apple marauded over 40% higher because of the ultra-lucrative tailwind of the “Fed pivot.”

More minutely, Apple managed to underperform other big tech which is where the blips in the operating and creative spheres start to show up.

In 2023, which ended in September, Apple’s iPad revenue dropped 3.4% to $28.3 billion. On a unit basis, iPad sales were even worse, falling 15%.

Even for Apple’s new products, like Mac computers, consumers showed less desire for devices with minor upgrades. Sales of Mac PCs and laptops fell nearly 27% to $10.2 billion in fiscal 2023. Unit sales declined 11%.

In order to return to revenue growth and support its $3 trillion market cap, Apple needs to strike it rich with some new products and global demand for smartphones and laptops to recover.

Despite less-than-stellar performance, Apple is no slouch. The company recorded $383 billion in total revenue in 2023 and earned nearly $97 billion in net income.

Last November, Apple CFO Luca Maestri said the company’s December quarter will experience no growth compared with last year. He warned that Macs, Wearables, and iPads would see a sales drop.

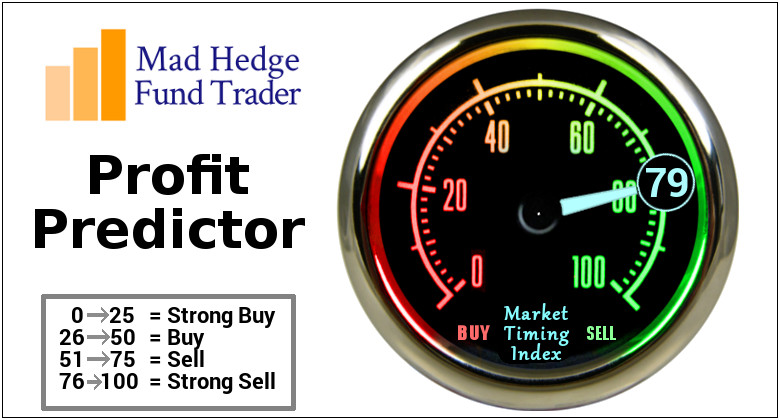

Much of this weakness will eventually drop shares lower, but it is highly likely that a dip will be a garden variety.

Yesterday’s downgrade was a little surprising, but I do believe analysts are prone to issue a downgrade as a reversion to the mean play.

Many might argue that Apple doesn’t deserve as high of a stock price, because its recent near-term ceiling is relatively sagging compared to the past.

That said, its $2.85 billion market cap isn’t too shabby and just a shallow pullback will allow bulls to coalesce around another optimal entry point.

A drawdown will certainly result in a rip-your-face-up move.

Betting against Apple has traditionally been the worst strategy of modern stock trading.

Bears will smartly take profits and run for the hills to get out of the way of the next wave of buy orders.

Wait for the dip to buy Apple.