Taking out long-term leases and turning around to rent short-term i.e. Airbnb style for corporate offices ended with a thud as office sharing tech company WeWork filed for bankruptcy.

The idea never made sense and felt more like a gimmick.

Surprisingly, this bankruptcy didn’t happen much earlier as the “work from home” pivot during 2020-2022 made this business model go from bad to worse.

It’s safe to say that we are far passed the peak “sharing economy” and investors are licking their wounds on this one.

WeWork filed for bankruptcy, capping a dramatic period that saw the once high-flying startup navigate a failed initial public offering, forced government lockdowns, a blank-check merger, and a stubborn avoidance of return-to-office trends.

The company at its 2019 peak commanded a $47 billion valuation with the likes of SoftBank losing more than $14 billion on just this one investment.

The firm’s death spiral arguably started in 2019. In a matter of months, the company went from planning an IPO to firing thousands and procuring a multi-billion-dollar bailout.

WeWork was almost a scam from the beginning with its main business mission explained as to “elevate the world’s consciousness.”

The former CEO of WeWork Adam Neuman operated the business almost as a cult.

The company eventually went public in 2021 through a special purpose acquisition company, two years after its initially planned IPO. But that didn’t stop WeWork from hemorrhaging cash.

While WeWork reached a sweeping debt restructuring deal in early 2023, it quickly signaled desperation soon after.

High-interest rates are starting to knock out the low-quality business ideas that never should have gotten off the ground in the first place.

These developments are a godsend for the tech economy that needs a complete flushing out of the bad ideas that were fueled by 0% interest rates.

Cheap money attracts larger-than-life ideas and personalities that can’t really back up the chutzpah.

Raising the bar for quality in tech has also caused the unintended consequence of raising the top tech companies or magnificent seven even higher up than before.

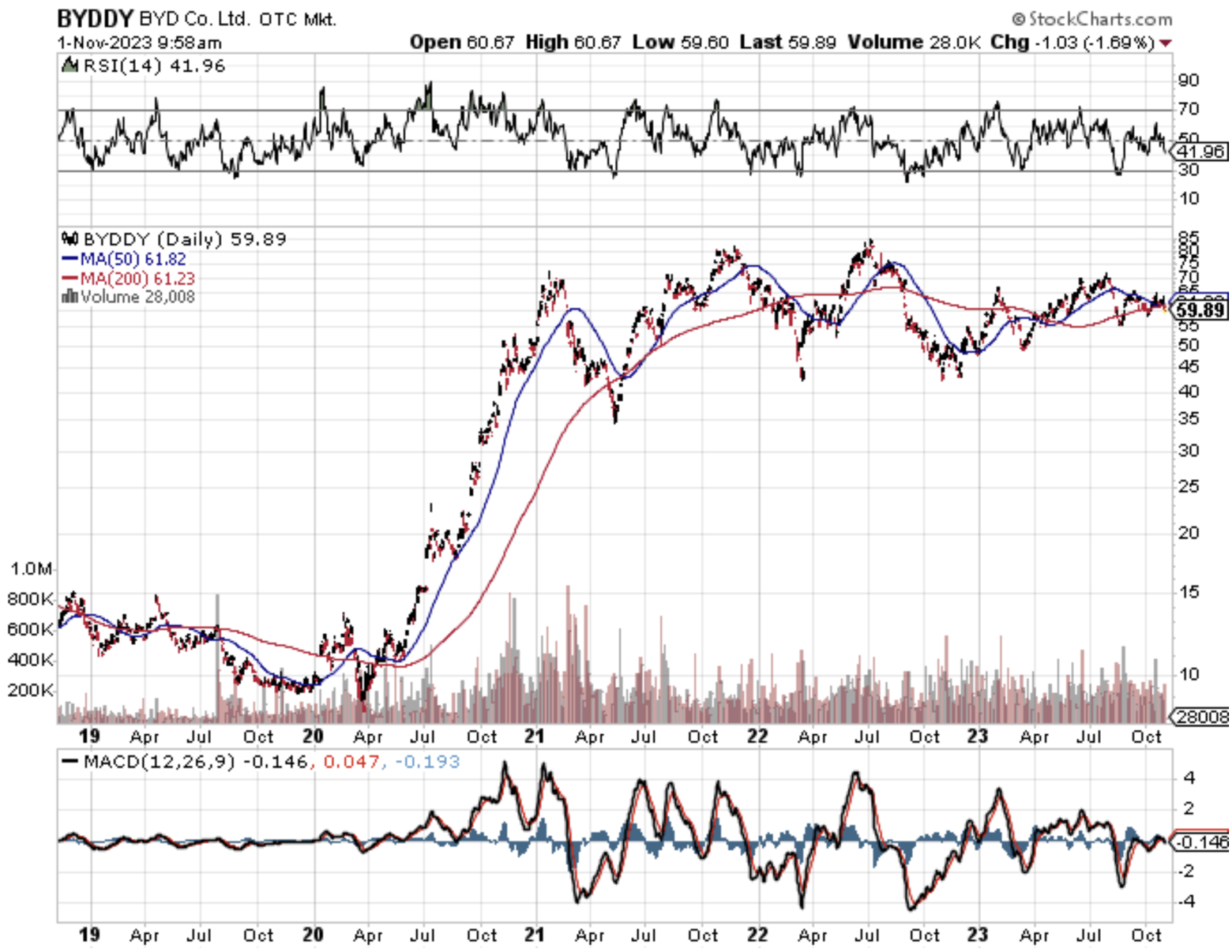

This trend can easily be seen in the EV sector where incumbent Tesla is putting their foot on the scruff of smaller EV company’s necks that simply can’t keep up with the higher material costs and headache of developing a global manufacturing presence amid deglobalization.

In simple terms, it is substantially harder to build an above-average tech company, or any tech company for that matter in 2023.

The former is an issue with the lofty competition that wields powerful balance sheets and the latter is an issue with draconian funding terms.

Waving goodbye to lemons like WeWork is only healthy for the tech sector in the long term and shortly we should see other junk-status companies be thrown by the wayside as well.

Cryptocurrency mogul Sam Bankman Fried’s fall from grace with a guilty verdict of fraud is another signal that the tech’s excesses are quickly normalizing.

We are in the middle of setting ourselves up for the new bull market in technology stocks which will be kicked into gear if interest rates sniff out the next recession.