If trucks drive themselves, what will happen to long-distance drivers?

Self-driving cars are still a little ways off - but I do believe it will happen.

What will become of long-distance drivers?

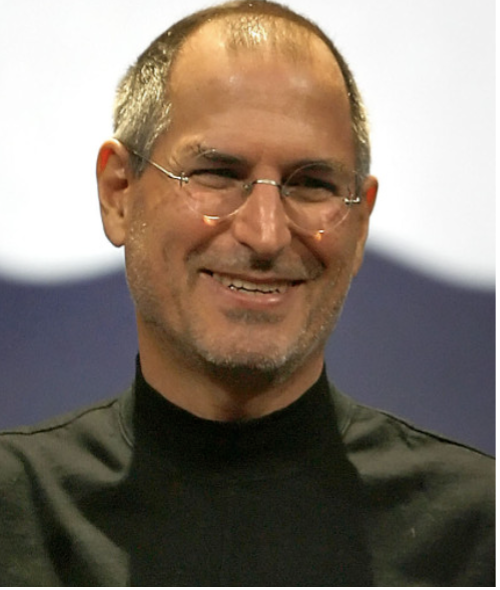

Actually, self-driving cars should have been part of the street scene for a long time, at least according to Twitter CEO Elon Musk's forecasts.

In 2015, the Tesla founder predicted that two years later fully autonomous cars would be driving around.

Not so fast.

Since then, he has adjusted the forecast year after year. Musk recently said that 2023 will finally be the day.

But it's not just Musk who has butchered it when it comes to self-driving cars. Many car producers have announced autonomous cars every year, but they are still a long way off.

Many questions remain unanswered and will still remain unanswered for the foreseeable future.

No wonder, because the technical and social challenges involved in getting fully autonomous cars on the road are enormous.

Then there is the legislation of it – can an industry that is tilted towards benefitting Elon Musk really expect any Democratic legislation that is positive?

The consensus is that anything he will try to do will get delayed and he will need to wait for the Republicans.

What about the technical level?

What happens in unforeseen traffic situations? What if the human has to take the wheel, but his driving skills have long since atrophied? What do autonomous vehicles mean for traffic and urban planning? Who is liable in case of accidents?

Is "platooning" revolutionizing the forwarding business?

In the short term, there are traffic situations that are manageable in their complexity and in which autonomous vehicles could definitely play an important role in the future.

For example, experiments with automated truck convoys have long been carried out on freeways and highways. In this so-called "platooning", several trucks drive behind one another, with only the first vehicle in the column having to be driven by a person.

"Platooning" is intended to save fuel, since the vehicles' slipstream can be used more efficiently. But there is also the suspicion that staff could also be saved because fewer long-distance drivers are needed.

Last but not least, last year’s trucker protests in Canada highlight how governments can quickly turn authoritarian in nature, in this case, by closing truckers’ bank accounts.

Nobody in their right mind can say that’s pro-business and who in their right mind would want to open a new Canadian trucker business after that.

In the U.S., the truck driver is the most common occupation in 26 out of 50 US states. There is a 67% chance of it disappearing completely in the next twenty years because artificial intelligent solutions will deliver us a timely way to replace the driver.

The economist John Maynard Keynes predicted in 1930 that by 2030 we would only be working 15 hours a week. In an essay entitled "Economic Possibilities for our Grandchildren," the Brit didn’t consider that these gains would be pocketed by corporations and not the people.

It’s highly possible that within 10 years, humans won’t be driving groceries or other goods across states and this function will be replaced by an algorithm. If not that, then products will be platooned to a destination headed by one driver followed by a herd of self-driving trucks behind him or her.

Instead of passing on the cost savings to the end consumer, the gains will materialize in increased buybacks, higher dividends, higher stock prices, higher executive compensation, increased operational efficiencies, and decreased wage expenses.

Some of the winners of this A.I. revolution will be public trucking names such as Old Dominion Freight Line (ODFL), Covenant Logistics Group (CVLG), Arcbest (ARCB), Universal Logistics Holdings (ULH), Schneider National (SNDR), Werner Enterprises (WERN).