“Over the next 10 years, we’ll reach a point where nearly everything has become digitized.” – Said Current CEO of Microsoft Satya Nadella

“Over the next 10 years, we’ll reach a point where nearly everything has become digitized.” – Said Current CEO of Microsoft Satya Nadella

Mad Hedge Technology Letter

October 26, 2022

Fiat Lux

Featured Trade:

(THE SHINE HAS BEEN WIPED OFF FOR NOW)

(GOOGL)

Google – it’s not what it used to be.

The sacred Silicon Valley behemoth of technology is finally showing weakness.

Crazier things have happened.

In fact, Google recorded the lowest growth since 2013 and that goes well back when the US economy was picking up steam after the Great Recession.

Revenue growth slowed to 6% from 41% a year earlier as the company suffers from a continued downdraft in online ad spending.

The ramifications are quite large as it essentially means that in the short-term, the digital ad industry is impotent as we head straight for a 2023 recession.

I would say the most surprising part of the whole report was to see Google’s “growth” asset, YouTube, floundering at just 2% growth.

It’s still a $7 billion standalone business but to see that much of a decline was somewhat surprising.

Philipp Schindler, chief business officer for Google, said the company saw a pullback in spend on search ads from certain areas such as insurance, loans, mortgage, and cryptocurrencies.

The underperformance in numbers is yet another bad omen for ad tech companies and Snap was the canary of the coal mine when the stock dropped 28%.

Considering the disappointing tone of the industry now, it’s not shocking to see the CEO of Meta Mark Zuckerberg just ignore his entire Facebook business for the metaverse.

It’s that bad selling digital ads now.

Google’s earnings per share (EPS) dropped by 24% year over year highlighting the challenges of running a large tech company during times of high interest rates and high inflation.

It’s a recipe for underperformance and we are seeing it in every part of Google’s business.

Maybe one of the only bright spots was the Google Cloud surging by 38%.

The cloud is one of the few growth drivers still left at Google.

The problem I have with Google is one that I have with many other big Silicon Valley tech firms.

They have become stagnated and too corporate.

They aren’t the leaders of innovation they once were and have pretty much juiced out the cash cow business they possess whether it be Apple’s iPhone or Google’s search engine or Meta’s Facebook.

The Silicon Valley bros aren’t immune from the rough times.

Long term, it’s hard to see Google becoming the growth engine they once were – a firm that consistently expanded 30% each quarter.

In fact, what I see clearer now than before is the cannibalization of Silicon Valley.

These big firms are starting to behave in a way an investor can understand as a scarcity mindset.

When the pie is perceived as shrinking, companies will step on their toes to get that extra piece of the pie.

Many of these moves illustrate this new entrenched mentality whether it be Apple’s sensitivity to others using the Apple store or the inability to offer stock-based compensation to new employees.

And that’s if a company is still hiring, last time I checked, many tech firms have either frozen hiring or are deleting big swaths of employees.

The new acquirer of Twitter also plans to fire 75% of Twitter’s staff on Day 1 removing the Chief Diversity Officer and many of the frothy positions that don’t add much value.

Big tech needs a reset and this is just more confirmation that restructuring is needed badly.

Mad Hedge Technology Letter

October 24, 2022

Fiat Lux

Featured Trade:

(GET WITH THE TIMES)

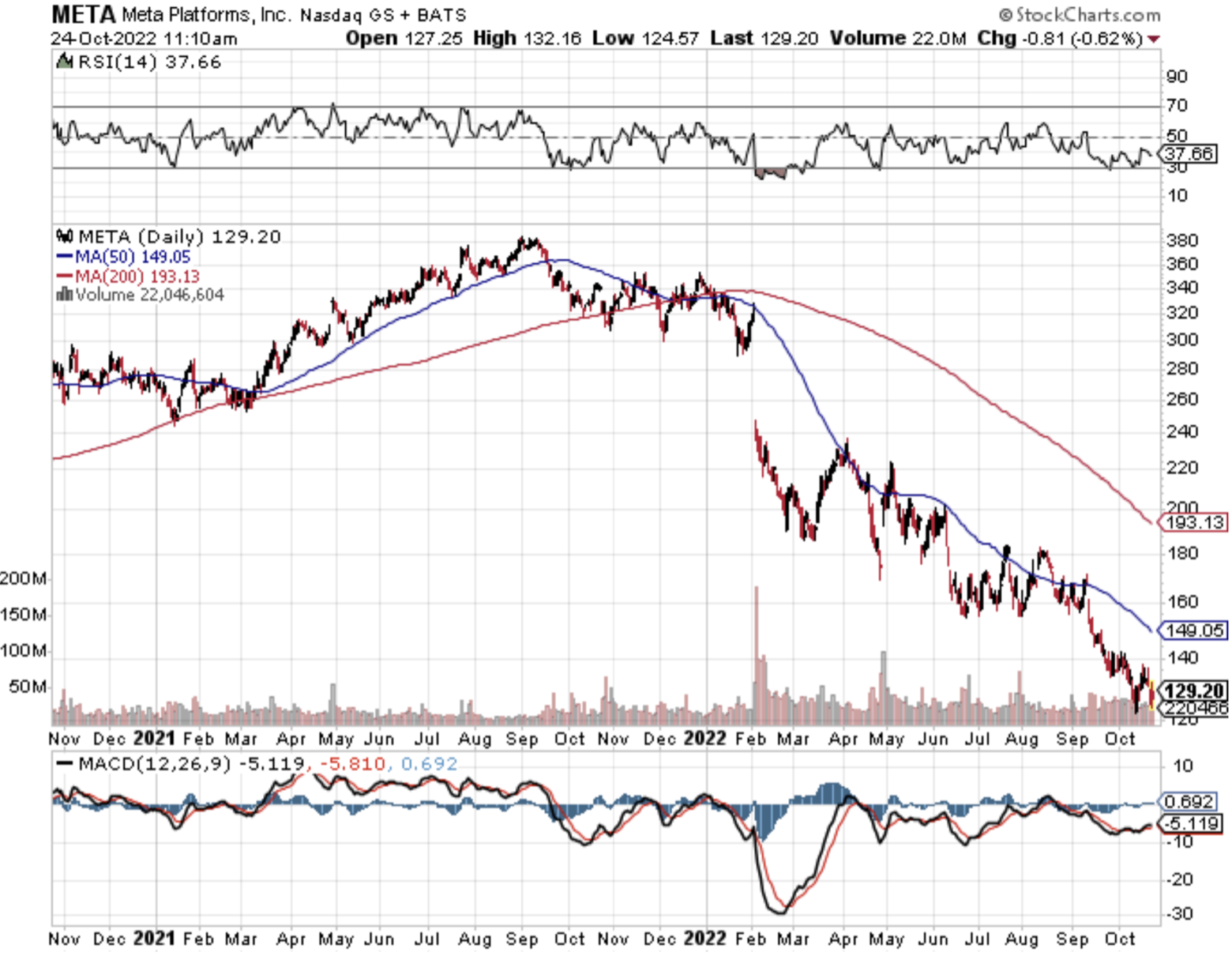

(META)

Brad Gerstner is the Founder and CEO of Altimeter Capital, a tech investment firm based in Silicon Valley and a big shareholder of Meta or Facebook.

On Monday morning, Gerstner wrote an “open letter” to the CEO of Meta Mark Zuckerberg essentially telling him that he has no idea what he’s doing and to get with the program.

Of course, the letter used a polite and courteous tone, but the content was damaging to say the least.

Some of his thoughts also back up exactly what I’ve been preaching.

Innovation in Silicon Valley has come to a screeching halt, and many of these incremental projects aren’t looking too attractive, like Metaverse.

Zuckerberg is also wildly out of step with the current times as bond yields have exploded, and tech stocks have been crushed. Yet the CEO has ramped up spending and getting very little bang for his buck.

He seems oblivious to all of it.

Gerstner wants juicing up of free cash flow through the existing platforms which focus mainly on digital ads, because they are still highly profitable.

He also criticized the amount of money used to develop the Metaverse and called for an imminent reduction in costs.

He later complains that META has increased its headcount from 25,000 to 75,000 heads in the past three years, but META is not squeezing out more productivity by this.

Gerstner recommends cutting the staff budget by 20% which would bring down staff costs to last year’s levels.

He didn’t say that the extra $40 billion in savings would go to shareholder returns, but one might conclude that he is lobbying for that decision that would benefit his wallet.

Essentially, “recommending” to invest $1-$2 billion is a direct show across the bow to Facebook management signaling not good enough at the top level.

Investors believe this technology is not only akin to a pet project, but also a failure of long-term strategic significance.

Remember that Zuckerberg is investing $30 billion in the metaverse in 2022 and wants to ramp up in 2023,.

My guess is that Zuckerberg adopts a defiant stance since he believes he’s the smartest guy in the room at all times.

He hates to be doubted and has an impulse to prove people wrong.

Even if the metaverse is the future, Zuckerberg is wildly early and investors want him to milk profits now from the ad business before he goes full steam into monetizing the metaverse.

Zuckerberg has super voting rights and is unable to get fired from the company he co-founded and investors gave him a pass for this situation for quite some time.

Now, moving forward, it appears as if Zuckerberg doesn’t care about Meta’s stock price anymore and will do anything to make this metaverse project work even if it doesn’t mesh with the balance sheet or the current cost of capital.

He doesn’t care because he views his legacy as intertwined with the prospects of the metaverse which is a dangerous path to choose.

It’s irresponsible for a CEO to crowbar a public company into a binary decision on a speculative technology when there’s no need for it.

Volunteering for high risk is a sign of bad leadership.

A CEO that cannot get fired is dangerous and it is coming back to haunt investors.

My guess is that Zuckerberg will double hiring, double investments and capital spending, double artificial intelligence engineers and triple down on this metaverse project because he views it as an existential proposition.

From an individual investor's point of view, reckless leadership means avoiding the stock.

I believe META’s stock is due for a terrible earnings report, poor forward guidance and I would sell any rally in META stock.

“The best entrepreneurs know this: every great business is built around a secret that's hidden from the outside.” – Said Venture Capital Peter Thiel

Mad Hedge Technology Letter

October 21, 2022

Fiat Lux

Featured Trade:

(A SMART WAY OUT)

(TWTR), (TSLA), (SNAP)

In a crazy turn of events, the US government is considering a national security review of Elon Musk’s Twitter (TWTR) takeover deal.

The review could potentially block the deal, saving Musk $44 billion.

I would say that Musk has been playing up this angle for quite some time.

It’s no coincidence that he started meddling in the Russian-Ukraine dialogue just recently.

Hatching a plan to tick off the US government enough for them to decide a perceived pro-Putin supporter cannot control the reigns of the biggest public discourse forum in the world would signify a massive victory for Musk.

We know Twitter isn’t worth $44 billion.

Snap issued terrible earnings which meant the new valuation of SNAP went from $19 billion to $13 billion company in one day.

Things are so bad at SNAP that they chose to not offer guidance for the 2nd straight quarter.

Musk has also voiced how he plans to reinstate former US President Donald Trump and fire 75% of the Twitter staff on the first day on the job.

He is doing his best to “achieve” a national security review which is executed by the Committee on Foreign Investment in the US (CFIUS).

CFIUS carries out security reviews if a "transaction threatens to impair the national security of the United States," according to federal regulations.

It’s also not a shocker that Musk recently threatened to stop supplying the Starlink satellite service to Ukraine.

If Musk is perceived to not be working for Ukraine, in the political world today, this means he can be labeled a pro-Russian, pro-Putin, anti-democratic, anti-American figure worthy of tech deals getting banned.

Ironically enough, he does the dirty work for the Chinese Communist Party because he operates a gigafactory in Shanghai which produces the most Tesla’s per factory.

Musk later backed down from his threat to stop deploying Starlink and agreed to continue to suffer losses operating the service.

Musk has been providing the service for free but has said SpaceX loses $20 million a month servicing Ukraine.

I must say that Musk has a serious pathway to wriggle himself out of this $44 billion deal.

If the deal is blocked, Twitter would be valued at around $15 billion-$20 billion range, possibly $25 billion is a stretch.

It would be a devastating blow for the Twitter management and shareholders.

Management would need to change instantly because of the brand damage and loss of credibility. Musk has attacked the management and staff at Twitter non-stop throughout this process.

A major restructuring is in the cards no matter what.

Job morale at the firm is at an all-time low as Twitter employees experience depression through a threat of possible termination upon Musk’s purchase.

The fiasco is essentially what Musk wanted in the first place and I could argue that the free PR he is receiving is worth at least $100 billion from start to finish.

Musk understands the more digital footprints he plants all around the internet, the richest man in the world will get many articles published about him. Just do a Google search of Musk and he’s everywhere.

Whether it is about spaceships or social media, Musk has launched himself front and center into almost every discourse including sensitive geopolitics to solving world hunger. He even said one time he wants to buy soccer club Manchester United.

About social media tech stocks, this is highly negative news for the valuations of other social media stocks like Meta (META), but this is great news for Tesla stock if Musk doesn’t need to sell Tesla stock to pay for the Twitter deal.

Musk still needs another $10 billion in financing to cover the balance of the deal to finish the deal.

“Virtual reality, all the A.I. work we do, all the robotics work we do - we're as close to realizing science fiction as it gets.” – Said CEO of Nvidia Jensen Huang

Mad Hedge Technology Letter

October 19, 2022

Fiat Lux

Featured Trade:

(IGNORE THE APOCALYPSE RUMORS)

(NFLX), (FED)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.