Technology's Upside in the Trade War

After watching the performance of technology stocks over the past two weeks, you may be on the verge of slitting your wrist, overdosing on drugs, and then jumping off the Golden Gate Bridge.

However, the results reported by tech companies this week say you should be doing otherwise.

As tech companies confront upcoming regulation and an overseas trade war, it has felt like a death by a thousand cuts.

It almost is starting to feel as if being a technology company is akin to drinking from a poisoned chalice.

I beg to differ.

I will tell you why the destiny of tech is quite positive.

The long-term secular growth drivers will prevail of accelerated earnings amid a backdrop of global economic synchronized expansion.

Assiduous capital reallocation programs will attract investors instead of detract from them.

The ironic angle to the precarious diplomatic tumult is that regulation will ultimately benefit the current pacesetters and culprits of technology because the barriers of entry become insurmountable.

The trade war has the same effect as the data regulation because it is ultimately for the betterment and protection of domestic, made-in-USA technology.

Washington knows the FANGs all too well, and the bull market will cease to exist if Beijing buys out our technological expertise.

Short-term pain for long-term gain. That's it in a nutshell.

The White House further understands that it's better to start a trade war now when it holds a stronger hand. No doubt after 20 more years of an ascending China, the Middle Kingdom will leverage its economic clout for diplomatic power dictating the outcome more ruthlessly.

Effectively, Trump's trade fracas is a one step back and two steps forward policy. During the one step back phase simply seems as if the economy is taking a nosedive into the ocean floor.

Love it or hate it, technology is becoming more (and not less) ubiquitous. However, it's gone too far too fast, and society and public officials require time to absorb the new environment or you risk the current backlash.

Simultaneously, America is in the one step back phase of data regulation, trade laws, and society's backlash of encroaching tech.

Bad timing.

The teething problems will gradually subside, the stock market will re-ignite, and tech will advance further into regular life.

The market even has seen some green shoots with the blockbuster Dropbox (DBX) IPO up over 40% intraday on the first day of trading.

In the S-1 filing required for IPOs, (DBX) stated that it may "not be able to achieve or maintain profitability" because of increasing expenses. The disclosure also prefaced its "history of net losses" to justify the business direction.

(DBX) lost $111.7 million in 2017, on revenues of just over $1 billion.

Technology must be doing something right if loss-making firms are treated with a 40% gain on IPO day; and, Spotify, an even bigger money loser, will go public next week.

If investors are smitten with loss-making tech companies, I imagine they feel quite comfortable with the ones earning billions in quarterly profits and growing at a pace where analysts cannot hike their price targets quick enough, making them look foolish.

The outstanding gains by (DBX) was for one reason and one reason only.

It's a pure cloud play, and pure cloud plays have been rewarded in spades.

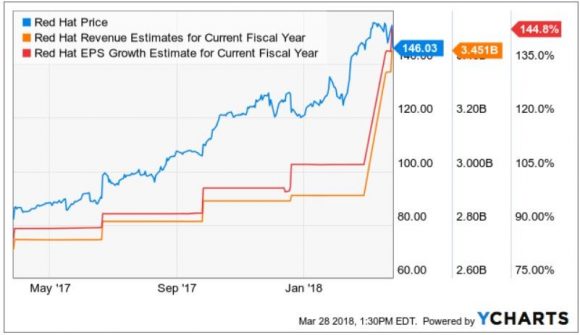

Red Hat's (RHT) stellar earnings were on the heels of the (DBX) IPO success.

Red Hat is a medium-size unadulterated cloud play that lacks the financial resources of the FANGs but is still turning a profit.

It is the poster boy for enterprise cloud companies flourishing in an unrelenting fierce environment.

If the world is going to hell in a handbasket, then how did Red Hat achieve aggregate billings growth of 25%?

Everyone and their uncle expect tech companies to start floundering, but the opposite is true. They overpromise then over deliver to the upside every quarter.

Red Hat booked the most deals over $1 million in Q4 2017 in its history.

Cross-selling cloud applications was especially strong with 81% of deals over $1 million spending on multiple software services.

The critical subscription revenue comprised 88% of Q4 revenue and is up 15% YOY. Application development-related subscriptions were up 42% YOY, higher than the infrastructure-related subscription revenue growing 17% YOY.

Companies are churning out innovation on top of their existing platforms using various software solutions. And every company in the world is migrating toward cloud software and infrastructure. There has never been a better time to be a pure cloud company.

The most poignant telltale sign was that Red Hat renewed 99 out of 100 of its top deals and disclosed that multiyear deals were healthy.

Ansible, its software for automating data center operations, OpenShift, its software for container-based deployment and management, and OpenStack, an infrastructure-as-a-service (IaaS) for cloud computing are the underpinnings to Red Hat's supreme business.

The reoccurring revenue salted away is legion.

The FY 2018 guidance was even more impressive than the quarterly earnings report. Red Hat expects a revenue range between $800 million and $810 million, up from the $748 million last quarter and expects quarterly EPS at $0.81, up from $0.70 last quarter.

Toward the end of the earnings call, Red Hat CEO Jim Whitehurst described the cloud growth environment as "very, very, very fast growth."

Market conditions and heightened volatility could stay irrational for longer than expected but leadership stocks are always the last to fall.

If (DBX) can catch a bid, and headway is made on political issues, then jump back into the cloud names that perform like Red Hat and about which I have been beating the drum.

And don't forget that these regulatory and political hindrances all point toward giving big cap tech cozier conditions and an elevated runway from which to operate.

__________________________________________________________________________________________________

Quote of the Day

"We know where you are. We know where you've been. We can more or less know what you're thinking about." - said Eric Schmidt in 2010, the former executive chairman of Google from 2001-2017