The Best in the Business

Scale works, and Amazon (AMZN) is proving it.

Jeff Bezos' company is hyper-charging its levers and pumping out growth to the tune of $2.5 billion in net profit as of last quarter.

This is a big deal for a company that has largely been considered using the AWS engine to fund the e-commerce business.

The topline growth is mind-boggling for a company poised to seize 50% of U.S. e-commerce sales by the end of 2018, up from the current 44%.

It's truly an Amazon stock market in 2018.

The razor-thin e-commerce margins are what Amazon is most renowned for, but it's high margin divisions are creating a higher quality company.

Investors are willing to pay a higher multiple for this version of Amazon in the future.

That is a very bullish sign going forward.

Tech shares sold off last Friday because the Amazon fireworks came to an end and no other company will be able to compare with its earnings.

This is another knock off effect from Amazon existing.

Of the vaunted FANG group, only Alphabet and Amazon impressed during this crunch earnings season at a pivotal time in the market that has looked short on ideas.

FANGs are not created equal and Amazon is by far the creme de la creme of this cohort.

The AWS cloud unit and its digital advertising division are the fodder allowing Amazon to take risks elsewhere.

Amazon is the most efficient business in America. In the past quarter it experienced more fluid data centers and warehouse operations.

If you do this for as long as Amazon has, you eventually learn all the tricks to the trade.

Hyper-accelerating technology offers Amazon a new way to implement new efficiencies, non-existent even a quarter ago boosting operational margins.

AWS surged 48.9% YOY to $6.11 billion improving on 48.7% last quarter.

AWS is also comprising a larger stake of the business than before.

This quarter AWS attributed 11.5% to total revenue compared to 10.8% last year.

The topline growth is staggering for a company duking it out with Apple (AAPL) to be the first trillion-dollar company.

The narrow breadth of the nine-year bull market is becoming even narrower, raising risk levels in the short term.

AWS is expected to grow into a $42 billion business by 2020, a nice double of what it is today.

Jeff Bezos does not need to respond to the administration's digital criticism of him because he doesn't need to. Taking the high road is the solution. If he wants to say something, he can publish it through a proxy via the Washington Post, which he owns.

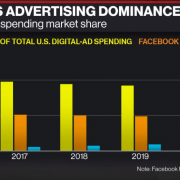

Amazon's digital ad business has been a revelation.

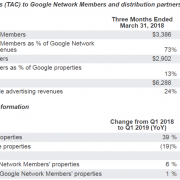

The bad news is that Alphabet (GOOGL) and Facebook (FB) have cornered the global digital ad market taking in 73%, a nice bump from the 63% in 2015.

And of the global digital ad growth, they are collecting 83% of that growth.

That hasn't stopped Amazon from taking a stab at the digital ad market itself which is the logical move with the number of eyeballs attracted to its platform.

The ad business did $2.2 billion in sales last quarter, a nice increase of 132% YOY.

Even though in its infancy, this super-charged digital ad division could eventually give Alphabet and Facebook a run for its money - another reason Facebook is trading in bear market territory.

Facebook's platform quality is far inferior than Amazon, which uses it for e-commerce rather than posting free user content.

Facebook is still pocketing tons of cash but it's growth narrative has been exhausted shown by the dismal guidance for the second half of the year.

Amazon is incrementally raising the quality of the company in all facets, evident in the topline growth and jump in profitability.

Amazon absolutely does care about the bottom line. Watch for the net profits to surge past $3 billion in the third quarter in its resurgent digital ad business.

And with the ad tech quality floating out there, Amazon will be able to invest in poaching top dogs from Facebook and Google to build this division swiftly into tens of billions of dollars in revenue per year.

It could crescendo into another AWS-esque monster.

In Q2 2017, Amazon posted total revenue of $37.96 billion. Fast forward to 2018 and revenue raced ahead to $52.9, a robust $14.94 billion improvement.

The $14.94 billion in one quarter year-over-year improvement in Amazon total revenue is more than many tech companies earn in one year including outstanding companies such as Salesforce (CRM) and Nvidia (NVDA).

It is important for tech companies to have many irons in the fire and Amazon proves this theory correct.

The competition is cutthroat to the point that large tech companies are morphing into each other then abruptly diverging.

The brilliant ideas are copied, then the next set of ideas filter in to be copied again.

Luckily, these ideas are coming from Amazon, which is one of the most innovative companies in the world with top-level management.

This all adds up to why Amazon posted its third straight profitable quarter of more than $1 billion in profits.

Prime members didn't flinch with the price increase of an annual Amazon prime subscription showing management understands the true pulse of its customers.

Under-promise and overdeliver time and time again and a customer will be stuck with you for life.

In the past, investors only bought this company for topline growth. Now, we have a different animal on our hands turning into a model company with bottom line growth flourishing.

Management has proved that strategically investing in the right businesses bear fruit.

It takes time for these businesses to develop but when they do they turn into cash cows.

Investors will take delight in seeing Amazon's brand as just a topline growth company slowly fading away.

Increasing profits offers more opportunities and funds to create new drivers as well.

Increasing profits also adds more opportunities to reallocate capital to shareholders opening up a new investor base.

The network effect is truly alive and well, and the Mad Hedge Technology Letter has routinely identified this company as the best in the tech industry.

________________________________________________________________________________________________

Quote of the Day

"Technological progress has merely provided us with more efficient means for going backwards," said British writer Aldous Huxley.