The Cost of Your Tesla is Going Up

Inflation is everywhere — at your grocer, coffee shop and the bad news is — it’s likely to stay transitory for quite a while as it transits into even higher prices.

This isn’t the Mad Hedge Agricultural Letter so I will stay in my lane — this letter is about one of the building blocks of technology and specifically Electric Vehicles (EVs) — Lithium Batteries.

Lithium-ion batteries are the most popular type of batteries used in electric cars.

This kind of battery may sound familiar — these batteries are also used in most portable electronics, including cell phones and computers. Lithium-ion batteries have a high power-to-weight ratio, high energy efficiency and good high-temperature performance.

In practice, this means that the batteries hold a lot of energy for their weight, which is vital for electric cars — less weight means the car can travel further on a single charge.

The cost of Lithium-ion batteries is critical to EVs because it comprises about 50% of the total cost of producing an EV.

So what’s the deal with Lithium-ion batteries?

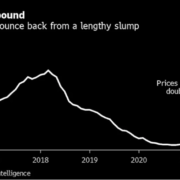

Prices have more than doubled in the past year because demand for the materials used in electric cars and renewable-energy storage has gone bonkers.

Miners cannot issue the supply to satisfy the current demand.

Instead of getting more into the weeds — I will tell you that your new Tesla (TSLA) you’re about to buy will become more expensive, so start budgeting wisely!

Increased costs will be passed onto electric vehicle (EV) manufacturers and not necessarily battery cell manufacturers, thereby potentially leading to a cost increase in EVs in the near future.

The price inflation from lithium is actually derailing a decades-long trend of a fall in lithium-ion battery prices.

Then coupled with a persisting semiconductor shortage (impacting microchip availability) — supply shortages could lead to EV demand destruction as EVs simply fail to come to market in significant quantities or do so at higher prices in limited availability.

Demand destruction is highly likely to accelerate if new lithium projects do not come to market relatively quickly, or miners might simply choose to collude together to keep prices high.

On the supply side, it’s just not guaranteed that miners can keep their costs of exploration, mining, engineering, and executing as low as they did before.

Hiring the proper talent to execute a new mine is facing headwinds like many other businesses in terms of spiking salary costs and lack of engineering talent.

For the EV industry, price points are a sore point because many consumers are on the fence about whether to buy an EV or not.

Simply put, if EVs are too expensive, consumers will just go with a gas guzzler because that’s what they know and they don’t need to deal with waiting hours at a charging station to charge their EV with a gas station across the street.

It’s true that the quality of EVs from Tesla to Mercedes has improved leaps and bounds in the past few years so the quality issue is a non-issue today.

To have a circular and sustainable bull market, EV uptake would need to surpass 50%. Until then, it’s a war of price points.

There’s also a strong possibility that not enough lithium can be mined, and this will keep EV prices high.

Battery makers are also facing higher prices for other key inputs like cobalt and copper.

Instead of doing risky things like short Tesla, which is a dangerous strategy, I would buy a lithium ETF.

The one I recommend is Global X Lithium & Battery Tech ETF (LIT).

The stock is up over 300% in the last 2 years and if this lithium inflation narrative persists, which I highly believe it will, then any substantial drawdowns should be bought.