The Future of Consumer Spending?

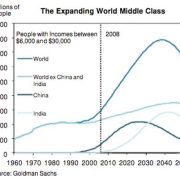

As part of my never ending campaign to get you to move more money into emerging markets, please take a look at the chart below from Goldman Sachs. It shows that the global middle class will rise from 1.8 billion today to 4 billion by 2040, with the overwhelming portion of the increase occurring in emerging markets.

The chart defines middle class as those earning between $6,000 and $30,000 a year. Adding 2.2 billion new consumers in these countries is creating immense new demand for all things and the commodities needed to produce them. This explains why these countries will account for 90% of GDP growth for at least the next ten years. It's all a great argument for using this dip to boost your presence in ETF's for emerging markets (EEM), China (FXI), Brazil (EWZ), and India (PIN).

Of course, you don't want to rush out and buy these things today. Emerging markets have been one of the worst performing asset classes of the year. But the selloff off is creating a once in a generation opportunity to get into the highest growing sector of the global economy on the cheap. I'll let you know when it is time to pull the trigger.

In the meantime, store this chart in your data base so when people ask why your portfolio is packed with Mandarin, Portuguese, and Hindi names, you can just whip it out.