The Incredible Disappearing US Stock Market

Now you see it, now you don't.

If you think this was some kind of magic show, you'd be right. For what has been disappearing is the US stock market.

American companies have been buying their own shares back at a frenetic pace, some $5 trillion worth in the last six years. And since the beginning of 2018, that buy back rate has doubled, thanks to the machination of the new tax bill.

If you own stocks, you should feel like you just landed in Heaven.

Mergers and acquisitions have vaporized another $2 trillion of equity.

Some 35% of the American equity markets have gone poof, gonzo, and bye-bye in a mere half a decade

This all compares to a total remain stock marketing capitalization today of $25 billion.

The laws of supply and demand are really quite simple. The fewer shares that are out there, the more valuable the remaining ones become.

It's not like shares go to money heaven when they are bought back.

Companies are not allowed to keep them. Instead, they retire them, increasing the relative ownership of the company for the remaining shareholders, like you and me.

This means there are fewer claims on earnings, and a greater say in the future of the company through increased voting power at shareholder meetings and proxy fights.

The net effect is to improve the firm's financial ratios and boost return on equity and the return on assets. These are all excellent reasons for the shares to trade at higher price earnings multiples and rise in value.

You can't blame corporate America for falling into a narcissistic love affair with its own shares.

For a start, because the S&P 500 (SPY) up 400% from its March, 2009 bottom, they have been fantastic investments.

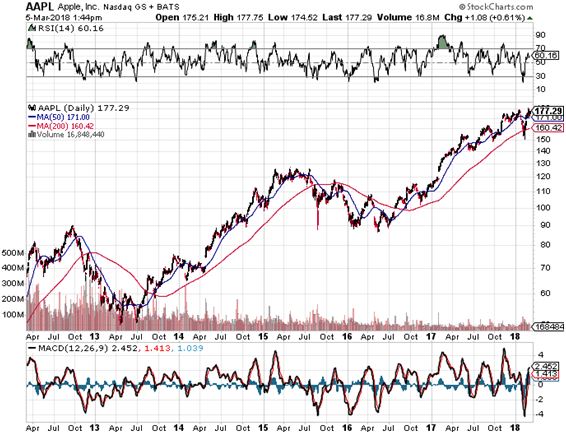

Take a look at Apple (AAPL), with the largest buyback program in absolute dollar terms by miles. Since it announced its share repurchase plan in late 2012 the value of its stock has skyrocketed some 262%.

According to their latest announcement, the firm is committed to buying back another $170 billion worth of stock, or 68% of its current $250 billion cash hoard.

Anyone who thinks this money is coming home to create new jobs is smoking California largest export crop.

The same is true for most other big names.

The bottom line here, ironically, is that companies can make more money buying back their own shares than investing in their own core businesses, even with technology firms.

Expect this to continue. Looking in the only in the rear-view mirror with your foot firmly on the accelerator has proved a successful management strategy for decades.

It not like senior management solely have the interests of shareholders at heart either. The bulk of their personal compensation is usually tied to stock options in their own firms' stocks.

More aggressive corporate share buybacks pave the path to high prices and personal enrichment beyond the dreams of Croesus.

That has enabled a continuously rising stock market to mint more billionaires than you can count, even though the beneficiaries had no idea what markets were going to do.

It's like the cock taking credit for the rising sun.

No wonder I have such a tough time chartering a personal jet these days!

Take a look at the share prices of some of the most ambitious buyers of their own stock.

Bed Bath & Beyond (BBBY) has purchased 50% of its outstanding float, at one point delivering a 400% gain in its shares, even though its core retail business sucked.

The Travelers Company (TRV) has removed a mind boggling 60% of its shares from the market, delivering another 400% gain in the shares.

Gap, Inc., a member of another dying industry, which bought back some 55% of its shares, saw prices jump some 800% at the top.

Wasn't it Calvin Coolidge who, our 30th president, who said that, "The business of America is business."

The reality is that the business of America is buying shares.

You can also blame interest rates, which have stayed at ultra-low levels for the past nine years, thanks to the Federal Reserve's aggressive quantitative easing programs.

Back in the day, when overnight interest rates were at 6%, large companies maintained substantial cash management divisions to administer their excess funds.

No more. It doesn't take a lot of talent to bring in a zero return. And cutting a few green eyeshades was always a popular cost cutting measure.

It's not like shares go to money heaven when they are retired.

Largest Share Repurchase Programs 2010-2017

Industrials

Northrop Grumman (NOC) - 50%

CSX Corp. (CSX) - 29%

3M Co. (MMM) - 25%

United Technologies (UTX) - 25%

Technology

Microsoft (MSFT) - 30%

Intel (INTC) - 30%

Cisco (CSCO) - 32%

Consumers

Travelers (TRV) - 60%

Gap (GPS) - 55% (GPS)

Bed Bath & Beyond (BBBY) - 50%

McDonald's (MCD) - 36%