The Kennedy-Era Stock That's Still Paying My Dinner Bills

The other day, while sorting through my oldest trading records (yes, I keep everything), I found my first Johnson & Johnson (JNJ) dividend check from decades ago. It wasn't much—just enough for a nice dinner back then.

But here's the kicker: that dividend has grown every single year since, weathering oil shocks, dot-com bubbles, financial crises, and even pandemics. It got me thinking about what truly makes a fortress stock in today's market.

While everyone's chasing the latest biotech and healthcare moonshot, JNJ has been quietly building an empire.

With a market cap of $375 billion and revenue growing at an impressive 7.55% annual clip since the 1980s, this company has accomplished something few others have—long-term, consistent growth while raising dividends for over six decades. And then there's the balance sheet.

JNJ is sitting on $25 billion in cash against $38 billion in total debt, resulting in a covered ratio of 29.4. That means they could pay their debt service with spare change found in their corporate couch cushions.

Some investors dismiss JNJ as just another mature healthcare stock, but that perspective overlooks the quiet revolution happening within the company.

In the first two months of 2025 alone, JNJ secured multiple FDA approvals. The most notable? SPRAVATO, the first and only monotherapy for treatment-resistant depression. And they're not stopping there.

JNJ recently announced a $14.6 billion acquisition of Intra-Cellular (ITCI), securing CAPLYTA, a blockbuster drug for bipolar disorder and schizophrenia.

With the global Central Nervous System therapeutics market projected to grow at a 10.5% CAGR through 2034, JNJ is strategically positioning itself for future expansion.

What's particularly impressive is how JNJ has transformed its research and development approach. They're not just throwing money at problems—they're getting smarter about their investments.

Their R&D success rate has been climbing, with a higher percentage of late-stage trials making it to market compared to industry averages. This isn't by accident.

JNJ has been leveraging artificial intelligence and machine learning to better predict which compounds are most likely to succeed, potentially saving billions in development costs. It's like having a crystal ball in the lab, and it's giving them a significant edge over competitors who are still using traditional development methods.

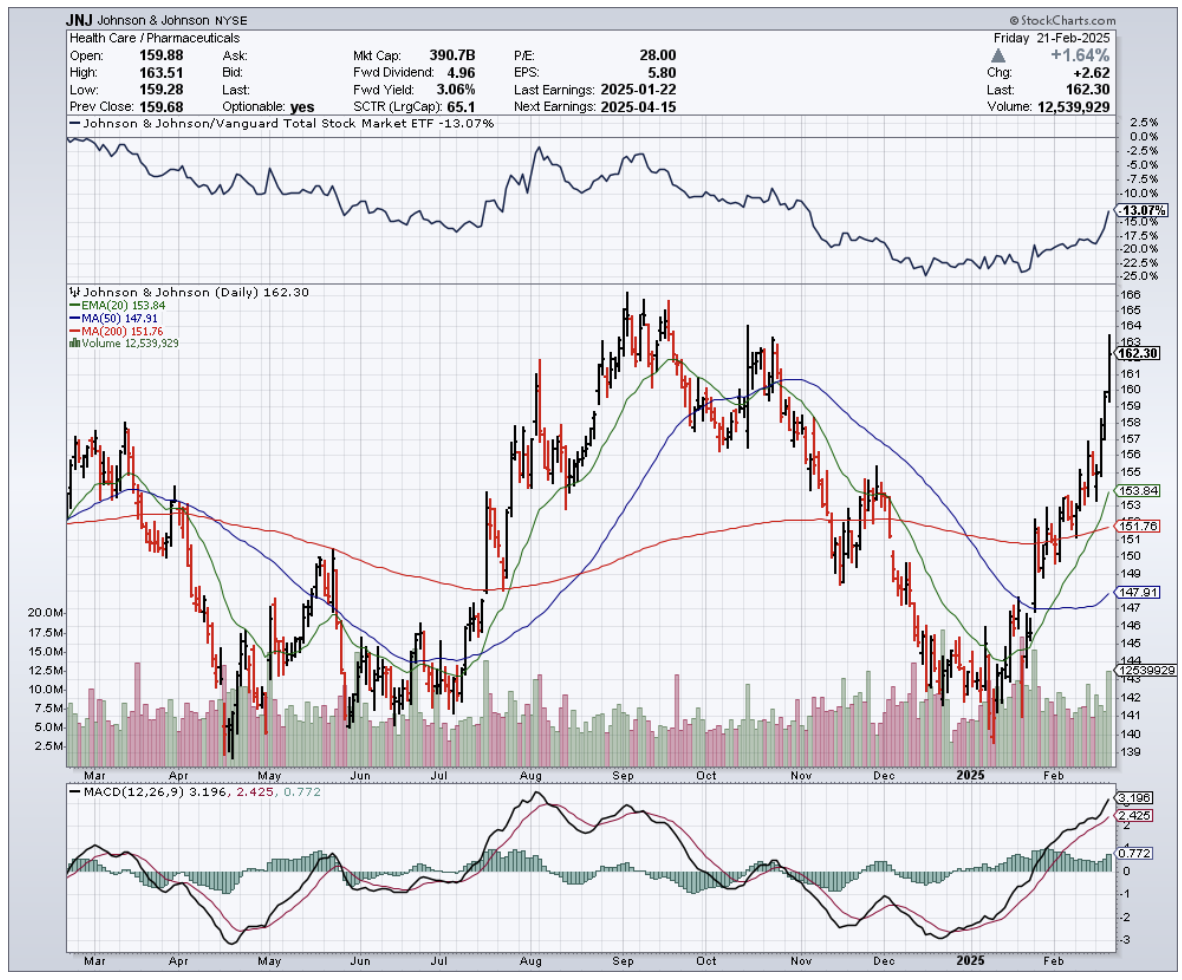

Despite its fortress balance sheet and track record of reliability, JNJ is currently trading at a discount to historical averages.

Its forward P/E ratio sits at 15.8, compared to a five-year average of 17.9. The dividend yield is at 3.18%, higher than its 10-year average of 2.7%. Its price-to-sales (P/S) ratio stands at 4.4, below its five-year average of 4.8.

These numbers suggest the market is underpricing JNJ's resilience and growth potential.

Of course, no investment is risk-free. JNJ is facing looming patent expirations on key drugs, including Stelara, which generated $10.3 billion in 2024 sales, and Xarelto, which brought in $2.3 billion.

However, history suggests that patent cliffs aren't a new challenge for JNJ—they've successfully navigated them for decades. Their strong drug pipeline, along with strategic acquisitions, should help offset any revenue declines.

Beyond pharmaceuticals, JNJ's business diversification is a major advantage.

With roughly two-thirds of revenue coming from Innovative Medicine and the remainder from MedTech, and with 43% of total revenue sourced outside the U.S., this diversified revenue mix helps mitigate risks tied to any single product or market.

What many investors miss is how JNJ's MedTech division is quietly becoming a powerhouse in its own right.

The division has been making strategic moves in robotics and AI-enabled surgical tools, positioning itself at the intersection of healthcare and technology.

This isn't just about selling more medical devices—it's about creating entirely new categories of treatment options. In an aging global population, this kind of innovation could be worth billions in future revenue streams.

With a 16.7% return on invested capital (ROIC) over the last decade and a modest 49% payout ratio, JNJ's dividend isn't just stable—it's poised for growth. The market's current pessimism has created a 24% discount on a company that has delivered for generations.

That's the kind of opportunity that made me start buying JNJ decades ago—and why I'm still adding to my position today.

In a world where even tech giants stumble, owning a company that's been raising its dividend since the Kennedy administration isn't just smart—it's common sense.

The question isn't whether JNJ is a buy. The real question is whether you'll regret not buying the dip.