The Largest Risk to Tech Growth Shares

The U.S. Central Bank has chosen to be as accommodative as possible in order to put a floor under the stock market with near-zero interest rates and large-scale asset purchases.

This will have an inordinate effect on tech stocks moving forward because the rhetoric from the Fed is as close as one can get to admitting that tech stocks should be bought in droves.

Fed policy won’t kill the rally and talk up higher interest rates until “substantial further progress (to unemployment numbers) has been made,” and “is likely to take some time” to achieve said Fed Governor Jerome Powell.

Yes, it’s possible to attribute some of the bullishness to the “reopening” trade and the massive migration to digital, but the loose monetary policy is overwhelmingly the predominant catalyst to higher tech shares.

As Powell spoke, the Nasdaq did a wicked U-turn in real-time after being in the red almost 4% and sprinted higher to finish up the trading day only ½ of a percent down on the day.

What does this mean for the broader tech market and Nasdaq index?

We started seeing all sorts of wonky moves like Tesla (TSLA) making a $1.5 billion bitcoin (BTC) investment earlier this month.

Fintech player Square (SQ) bought Bitcoin on the dip pouring $170 million into it.

Yes, this isn’t a joke.

Corporations are becoming the dip buyers in bitcoin which would have never been fathomable a year ago from today.

The risk-taking has literally gone into hyper-acceleration in the tech world and is transforming into a fantasy world of corporations swimming knee-deep in capital trying to outdo one another with fresh bitcoin orders of millions upon billions.

That’s where we are at right now in the tech markets.

Treasury Secretary Janet Yellen has also gotten into the bitcoin story condemning the digital gold by saying that bitcoin is an “extremely inefficient” way to conduct monetary transactions.

But because of the extreme low-rate nature of debt, this just gives investors another entry point into the digital gold.

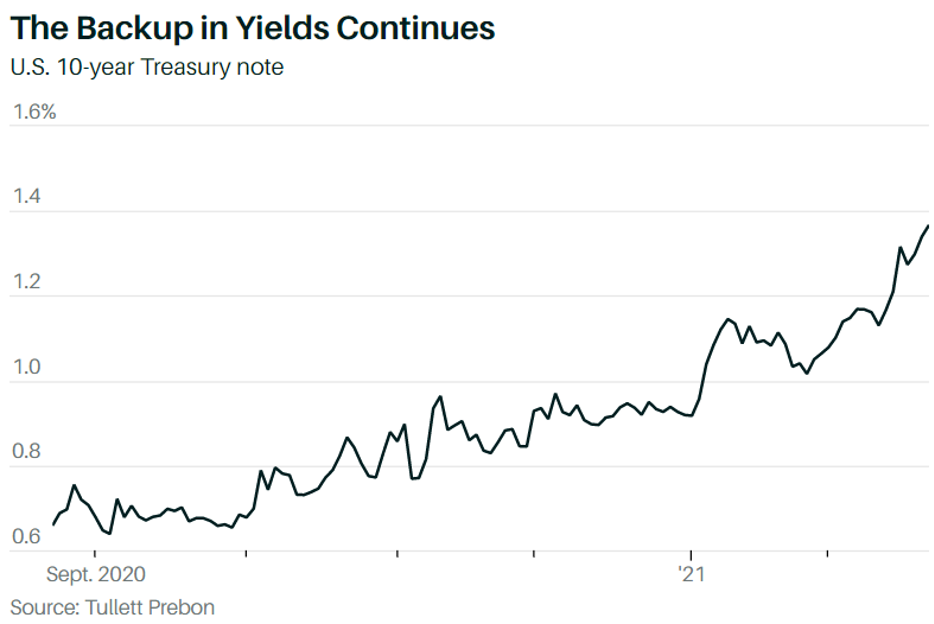

This sets the stage for a correction in tech stocks and the likely reason for it would possibly be higher interest rates or even negative lockdown news or some combination of both.

On the technical side of things, a result of this magnitude would be set off by first, cascading sell orders at one time, eerily similar to what got us the March 2020 low.

This could happen in either biotechnology stocks or Tesla shares and cause performance to deteriorate which could trigger net outflow and that would trigger a violent feedback loop.

Catherine D. Wood is the Founder, CEO, and CIO of ARK Invest and has been hyping up the super-growth tech assets like she was betting her life on it.

The only way she can get away with this chutzpah is in an anemic rate environment that pushes investors to search for yield.

Her reaction to yesterday’s market action wasn’t to buy bitcoin on the dip but go into a safer asset that actually produces something, and she bought another big chunk of Tesla.

Risk-taking and leverage in tech shares have gone up the wazoo which means that any incremental rising of rates is harder for the overall tech market to absorb.

Bitcoin is now being viewed as just one risk point higher on the risk curve than Tesla and that is a dangerous concept.

Technology often promises investors that they are paying for future cash flows of tomorrow and that story doesn’t work if the margins are turning against the management.

The low rates offer the impetus for characters like Wood to boast that she was surprised by how fast companies are adopting bitcoin and that her “confidence in Tesla has grown.”

It is just a sign of the times and even more money has been injected into zombie companies that have no hope of improving margins ala the retail sector.

Awash in liquidity has the ultimate effect of making tech growth stocks even more attractive than the rest of the crowd which is why we have been seeing sharp upward moves in second derivative plays to bitcoin like PayPal (PYPL), Square while the FANGs, aside from Google (GOOGL), have treaded sideways.

Markets tend to overshoot on the upside and downside and as the sell-off was met with shares that came roaring back in a speculative frenzy, we are now in a situation with many markets, even the foreign ones, hitting fresh records, even as the nations they were based in suffered their sharpest recessions since at least the Great Depression.

The overshooting tends to come from the fear of missing out (FOMO) amongst other reasons.

Ultimately, as the corporate list of characters and billionaire hedge fund community load up on tech growth stocks, just a small movement to higher yield could cause a Jenga-like toppling of their strategy and profits.

This could snowball into a massive unwind of positions to meet margin calls after margin calls.

If we can avoid this indiscriminate fire sale, then, like Bank of America recently just said, it’s hard to make a different analysis aside from being overly bullish as the treasury, Fed, and macroeconomic factors have made a major sell-off less likely.

I am bullish technology and would advise readers to go back into growth names as volatility subsides, but keep an eye out for rates creeping higher because, at the end of the day, it’s clearly the biggest risk to the tech sector.