The Market Outlook for the Week Ahead, or Here's the Big Call

Well that tears it!

Flamethrowers! Yes, on the list of 125 products that China is imposing new 25% import duties are flamethrowers.

And I was so looking forward to getting a flamethrower of my own with which to singe lazy and errant stock analysts from whom we all are afflicted.

I guess I'll just have to buy American, which I already do with my cars (Teslas).

The real call here is that the NASDAQ has entered a well-defined trading range, from 6,600 to 7,600, where it will remain trapped for six months until the November midterm congressional elections. After that, we will rally 10% in year-end rally.

The deep in-the-money call spread strategy I employ is ideally suited to this kind of go-nowhere market. While other traders are tearing their hair out, you'll be raking in the money every month as if you've just been adopted by a new rich uncle.

The president, absolutely cacophonous about the riches created by a rising stock market, has developed lockjaw in a falling one.

The reason was provided by trade advisor Peter Navarro, who said quite simply that the markets were wrong in their belief that trade wars decimate share prices.

My half century of trading tells that markets are never wrong, only people are.

And while the chief architect of our China trade policy has never been there, I managed to find it in 1974. It's easy. You just head east.

Here are some harsh numbers to show you how quixotic the administration policies are. By imposing $25 billion in import duties to protect dying American industries, investors cut $3 trillion off of US stock market capitalization.

That is a 120:1 risk reward AGAINST us. That's NOT the kind of trade I'm used to strapping on.

I'm sure the Chinese are thinking, "How would you like to lose another $3 trillion?" "How about a recession and bear market?" and "See you $25 billion and raise you $50 billion!"

Here is a number that gets lost in translation of the $1 trillion in two-way trade between the US and China. Some 90% of the profits accrue to the US. It is an issue that officials in Beijing have been complaining to me about for decades, which essentially makes them the low-waged manufacturing colony.

That iPhone X that Foxconn makes for $100 Apple (AAPL) sells for $1,000 in the US.

One then has to ask the cogent question, "If you're winning the game, why change the rules?"

The Chinese are not a nation you want to antagonize. They endured 2 million casualties in Korea just to inflict 50,000 on us. Chosin Reservoir looms large in my family - the best fighting retreat in history carried out by the Marine Corp.

The Chinese can also suffer more pain than Americans, with most only one or two generations out of a $300 annual per capita income.

Will the US November congressional election affect economic fundamentals" I doubt it. The mere fact that the election is out of the way is worth a 10% stock market rally into year-end.

The March Nonfarm Payroll Report was a disappointment for the second month in a row, coming in at a feeble 103,000. The headline unemployment rate remains at a decade low of 4.1%.

The stock market didn't care, with the overwhelming focus now on trade issues.

The really important numbers now, Average Hourly Earnings, were up a slightly inflationary 0.3%, but no one noticed.

The January and February reports we revised downward by a steep 50,000.

Manufacturing gained 22,000 jobs, Health Care was up 22,000, and Professional and Business Services up 33,000. Construction lost 15,000 jobs, thanks to raising interest rates.

The Broader U-6 "Discouraged Worker" unemployment rate dropped 0.2% to 8.0%, a new decade low.

As a stand-alone number, the report is not important. However, look at it in the context of a rising tide of recent, slightly negative economic data reports and one has to start to get concerned. Is it the weather, or the beginning of something larger?

We are only a week off from when the Q1, 2018 earnings season kicks off, which will probably deliver some of the strongest reports in US history.

Until then, the data reports will be relatively benign.

On Monday, April 9, nothing of note is announced.

On Tuesday, April 10, we receive March NFIB Small Business Optimism Index.

On Wednesday, April 11, at 8:30 AM EST, we learn the all-important Consumer Price Index, the most important read on inflation. Bed Bath & Beyond (BBBY) reports.

Thursday, April 12, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a dramatic rise of 24,000 last week (another bad number). BlackRock (BLK) reports.

On Friday, April 13, at 10:00 AM EST, we get the JOLTS Report on private sector job openings. It is the big day for bank earnings, with Citigroup (C), JP Morgan (JPM), and Wells Fargo (WFC) all reporting.

The week ends as usual with the Baker Hughes Rig Count at 1:00 PM EST. Last week brought a drop of 2.

Followers of the Mad Hedge Trade Alert Service enjoyed one of their best weeks in years. Executing on the views above, I nailed the market bottom, hauling in an eye-popping 5.06% in performance in a single day.

I artfully used the huge sell-off days to pile on long positions in Google (GOOGL) and JP Morgan (JPM), and sell short US Treasury bonds and volatility (VXX). On the up days I bought gold (GLD).

It all worked like a charm, and every position is now profitable.

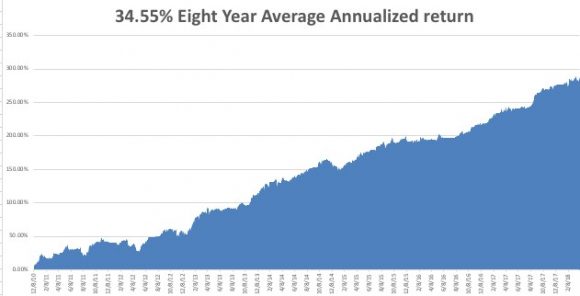

That brings April up to a +4.76% profit, my trailing one-year return to +49.72%, and my eight-year average annualized return up to 34.55%. We are an eyelash short of a new all-time performance high.

As for me, I'll be shutting down my Lake Tahoe estate for a while, not that the snow has turned to rain. The lake level is at a 118-year high, and Reno, NV, is worried about flooding. All the floodgates are open.

What a winter! I barely had time to tear myself away from my screens to visit the slopes.

Good Luck and Good Trading.