The Market Outlook for the Week Ahead, or the Canaries in the Coal Mine are Dying

Well, that was some week!

After moving up in a straight line for ten weeks, markets are now doing their best impression of a Q4 repeat.

The transports Index (XTN), the most important leading indicator for markets, has been down for 11 straight days, the worst run in 40 years.

And now for the bad news.

Look at a long term chart for the S&P 500 (SPY) and the head and shoulder top practically leaps at you and grabs you by the lapels (that is, if you are one of the few who still wears a suit).

It makes you want to slit your wrist, jump off the nearest bridge, or binge watch all nine seasons of The Walking Dead. It neatly has the next bear market starting around say May 10 at 4:00 PM EST, a rollover point I put out two years ago.

However, hold that move! As long as we have a free Fed put under the market in the form of Jay Powell’s “patience’ policy, we are not going to have a major crash any time soon. That is 2021 business.

It's more likely we trade in a long sideways range until the economy finally rolls over and dies. So when we hit my first (SPY) downside target at the 50-day moving average at $269, which is a very convenient 5% down from the recent top, could well bounce hard and I might add some longs in the best quality names. It all sets of my dreaded flatline of death scenario for the rest of 2019.

Last week saw an unremitting onslaught of bad news from the economy.

The February Nonfarm Payroll report came in at a horrific 200,000 when 210,000 was expected, sending traders to man the lifeboats. The headline Unemployment Rate dropped 0.2% to 3.8%. Average Hourly Earnings spiked 11 cents to $27.66, a 3.4% YOY gain and the biggest pop since 2009.

Construction lost 31,000 jobs, while leisure and Hospitality added no jobs at all. The stunner is that the U6 long term structural “discouraged worker” unemployment rate dropped an amazing 0.8% to 7.4%, the sharpest drop on record. Fewer jobs, but at higher wages is the takeaway here, the exact opposite of what markets want to hear.

US Construction Spending fell off a cliff, down 0.6% in December. It seems that nobody wants to invest ahead of a recession.

The dollar soared (UUP), and gold (GLD) got hammered. You can blame the slightly stronger GDP print on Thursday the week before, which came in at 2.2% instead of 1.8%. As long as Jay doesn’t raise interest rates this is just a brief short covering rally for the buck.

China cut its growth forecast from 6.5% to 6.0% GDP growth for 2019. The trade war with the US and the stimulus hasn’t kicked in yet. The last time they did this, the market fell 1,000 points. Buy (FXI) on the dip.

US Trade Deficit hit ten-year high at $59.8 billion for December, and a staggering $419 billion for the year. It’s funny how foreigners stop buying your goods when you declare war on them. Even Teslas (TSLA) are being stopped at the border in China. Who knew?

New trade tariffs hit US consumers the hardest adding $69 billion to their annual bill. Falling real earnings and rising costs is hardly a sustainable model. Will someone please tell the president?

US growth is fading, says the Fed Beige Book, slowing to a “slight to moderate rate”. The government shutdown is the cause. With Europe already in recession, I’ll be using rallies to increase my shorts. Sell (SPY) and (IWM).

The European Central Bank axed its growth forecast sharply, from 1.7% to 1.1%. Stimulus to renew on all front, including more quantitative easing. It’s just a matter of time before their recession pulls the US down. Sell the Euro (FXE).

You lost $3.7 trillion in Q4, or so says the Fed about the decline of national personal net worth during the stock market crash, the sharpest decline in a decade. You’re now only worth $104.3 trillion.

The Mad Hedge Fund Trader actually gained ground last week, thanks to profits on our short positions rising more than our offsetting losses on our longs.

I have doubled up my overall positions, finally taking advantage of the rollover in all risk assets from a historic ten-week run to the upside. I added shorts in the S&P 500 (SPY) and the Russell 2000 (IWM) against a very deep in-the-money long in Freeport McMoRan (FCX) the world’s largest copper producer.

The thinking here is that with China the only economy in the world that is stimulating its economy and the planet’s largest copper consumer, copper makes a nice long side hedge against my short positions.

The Mad Hedge Technology Letter is happily running a short position is Apple (AAPL) which is now almost at its maximum profit point. We only have four days to run to expiration when the position we bought for $4.60 will be worth $5.00.

February came in at a hot +4.16% for the Mad Hedge Fund Trader. March started out negative, down -0.84%, thanks to a wicked stop loss on Gold (GLD). We had 80% of the maximum potential profit at one point but left the money on the table at the highs.

My 2019 year to date return ratcheted up to +12.84%, a new all-time high and boosting my trailing one-year return back up to +29.92%.

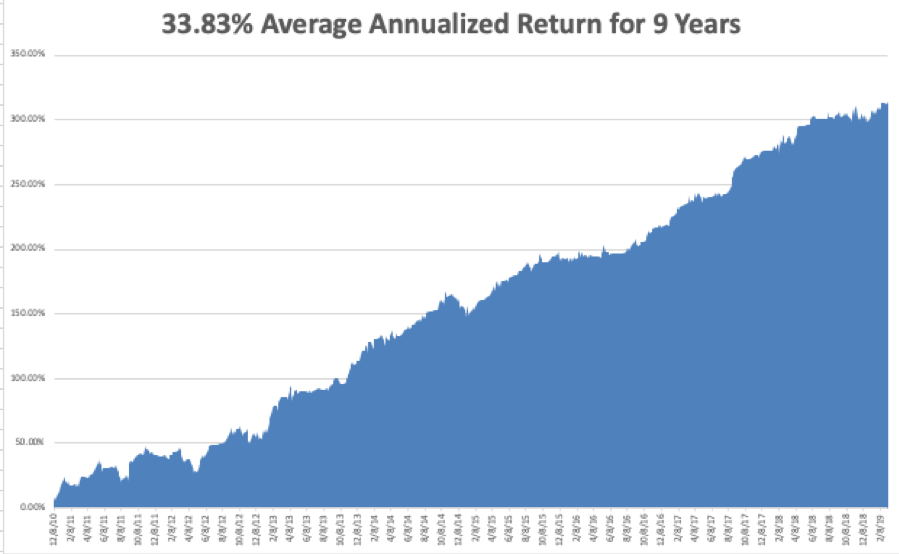

My nine-year return clawed its way up to +312.94%, another new high. The average annualized return appreciated to +33.83%.

I am now 50% in cash, 20% long Freeport McMoRan (FCX), and 10% short bonds (TLT), 10% short the S&P 500, and 10% short the Russell 2000.

We have managed to catch every major market trend this year, loading the boat with technology stocks at the beginning of January, selling short bonds, and buying gold (GLD). I am trying to avoid stocks until the China situation resolves itself one way or the other.

As for the Mad Hedge Technology Letter, it is short Apple (AAPL).

Q4 earnings reports are pretty much done, so the coming week will be pretty boring on the data front after last week's fireworks.

On Monday, March 11, at 8:30 AM EST, January Retail Sales is ut.

On Tuesday, March 12, 8:30 AM EST, the February Consumer Price Index is published.

On Wednesday, March 13 at 8:30 AM EST, the February Durable Goods is updated.

On Thursday, March 14 at 8:30 AM EST, we get Weekly Jobless Claims. These are followed by January New Home Sales.

On Friday, March 15 at 9:15 AM EST, February Industrial Production comes out. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’ll be headed to the De Young Museum of fine art in San Francisco to catch the twin exhibitions for Monet and Gaugin. When it rains every day of the week, there isn’t much to do but go cultural.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader