The Market Outlook for the Week Ahead, or The Fork in the Road

I usually don’t pay attention to technical analysis. It is the last refuge of the inexperienced and the uneducated.

However, I don’t ignore it either.

And that sets of a quandary for investors today. For on the one hand, the economic data couldn’t be worse, pointing to a certain trade war-induced recession sometime in 2020.

On the other hand, look at the chart for the S&P 500 (SPY) below and you can see that stocks have been in a clear uptrend for 2 ½ months. Another few weeks, and we might see a breakout to new all-time highs. Or, we might get a false breakout driven by algorithms only and then collapse to new 2019 lows.

Welcome to my world.

While my recent track record may say otherwise, I actually don’t know what markets are going to do every day of every week. And when I don’t know what to do, I do nothing. That’s especially easy to do now with my Mad Hedge Market Timing Index at a dead on neutral position of 50.

Of course, the elevated level of share prices could be the result of ultra-low interest rates and a complete lack of viable alternatives. At 11.9% dividend yield, US stock are among the highest yielding financial instruments in the world. At this year’s 15% capital gain and they are especially compelling, particularly to the many foreigners earning negative interest rates.

In the meantime, I wait for the markets to tell me what to do. I’m basically looking for a higher high to sell into, or a lower low to buy.

The IMF Downgraded Global Growth, from 3.2% to 3% and trade gets the blame. At 2.5% growth, many major economies will be in recessions. Risks are to the downside. More than 90% of the Global Economy is Slowing. It's the worst forecast since 2008.

Bank earnings were mixed, with JP Morgan taking the lead with record revenues and credit card revenues the big winners. Goldman Sachs (GS) looks awful due to failing mergers and acquisitions. Wells Fargo is worse. Trading revenues are the drag.

Retail Sales dove off a surprising 0.3% in September when a 0.3% jump was expected. The individual shopper has been the sole support of the economy this year and when they bail the stock market will hate it.

A Brexit deal is finally on the table, but will Parliament vote for it? I doubt it. If they do, it will be a huge “RISK ON” development. This just could be like Trump announcing another China trade deal. If Brexit lives, Scotland will almost certainly vote to leave the United Kingdom and join Europe.

US Housing Starts fell in September from a 12-year high, down 9.4% to 1.256 million units. The mid-Atlantic gets the blame. Land and labor shortages are a problem.

The GM Strike (GM) is settled and the union probably will vote for it. The strike has definitely been a drag on the US economy. Part of the deal involved closing three old high cost US plants. It’s tough to vote against economic reality.

China’s Economy (FXI) slowed to a 6% growth rate as the trade war drags on business there. That’s a 30-year low. Export demand for US products is plunging. Almost every economic indicator is in decline. Not only is China one of America’s largest customers, it is also Europe’s. The data definitely put the kibosh on the week’s rally.

Netflix soared on an earnings beat, soaring 9%. It looks like it is too early to write off the inventor of movie streaming. I guess a 20-year head start still counts for something. But I am staying away anyway.

I hate to be boring, but my Mad Hedge Trader Alert Service has scored yet another new all-time high. In fact, I have hit new highs almost every day for the last three months. Worse yet, my thesaurus is running out of metaphors for “new high.”

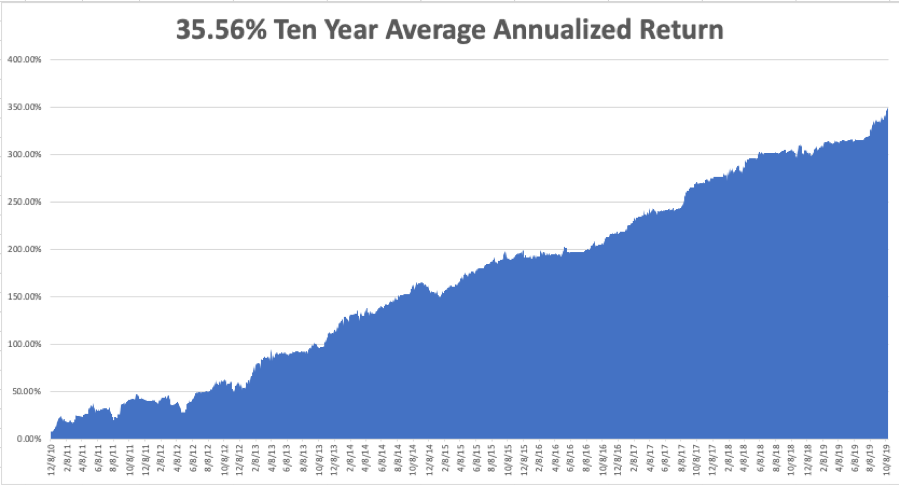

My Global Trading Dispatch reached new pinnacle of +349.64% for the past ten years and my 2019 year-to-date accelerated to +49.50%. The notoriously volatile month of October stands at a blockbuster +12.08%. My ten-year average annualized profit clawed its way up to +35.56%. If I make any more than this, no one will believe it, a frequent problem during my hedge fund days.

Some 28 out of the last 29 trade alerts have made money, a success rate of a stunning 96.55%! Under promise and over deliver, that is the business I have been in all my life. It works. This is rapidly turning into the best year of the decade for me. It is all the result of me writing three newsletters a day, and doing research for 12.

With my Mad Hedge Market Timing Index sitting around the neutral 50 level, there was very little to do this week but take profits on existing positions. Nothing like watching the money roll in. It’s like having a rich uncle write you a check once a month.

All I am left with after the October 18 option expiration is 80% cash and short positions in Wal-Mart (WMT) and the S&P 500 (SPY).

The coming week is pretty non-eventful of the data front. Maybe the stock market will be non-eventful as well.

On Monday, October 21 at 2:00 PM, the US monthly Budget Statement for September comes out, most likely showing a horrific $200 billion deficit.

On Tuesday, October 22 at 10:00 AM, Existing Home Sales are out for September.

On Wednesday, October 23 at 10:30 AM, EIA Energy Stocks are published.

On Thursday, October 24 at 8:30 AM, US Durable Goods are out. Weekly jobless claims are out at the same time.

On Friday, October 25 at 10:00 AM, the University of Michigan Consumer Sentiment is announced. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I'll be driving up to Lake Tahoe to start organizing my October 25-26 conference, briefly stopping at Vacaville for breakfast at Mel’s Drive In and a top up charge for my Tesla Model X to make the climb over Donner Pass. First on the list is to unload there my five cases of vintage wine so it can adjust to the altitude.

Oh, and I haven’t had time for a haircut since I left for Australia four months ago. My kids are starting to call me a hippie.

The Mad Hedge Lake Tahoe Conference begins that night. Tickets are available by clicking here.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader